- Canada

- /

- Metals and Mining

- /

- TSXV:TUO

Discover Hidden Opportunities: Amerigo Resources And 2 Other Penny Stocks On The TSX

Reviewed by Simply Wall St

The TSX has been experiencing a robust year, with gains exceeding 17%, reflecting the broader positive trends in the global market. In such a thriving market, investors often look beyond traditional stocks to explore opportunities that might offer significant returns. Penny stocks, despite being an older term, refer to smaller or newer companies that can present unique growth potential when supported by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.67 | CA$620.84M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.42 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.18 | CA$5.18M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.34 | CA$304.56M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.37 | CA$116.65M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.80 | CA$298.44M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.37 | CA$236.62M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.17M | ★★★★★★ |

| Newport Exploration (TSXV:NWX) | CA$0.115 | CA$12.14M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$29.82M | ★★★★★★ |

Click here to see the full list of 948 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Amerigo Resources (TSX:ARG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amerigo Resources Ltd., through its subsidiary Minera Valle Central S.A., produces and sells copper and molybdenum concentrates from Codelco’s El Teniente underground mine in Chile, with a market cap of CA$298.44 million.

Operations: The company's revenue is primarily generated from the production of copper concentrates under a tolling agreement with DET, amounting to $169.30 million.

Market Cap: CA$298.44M

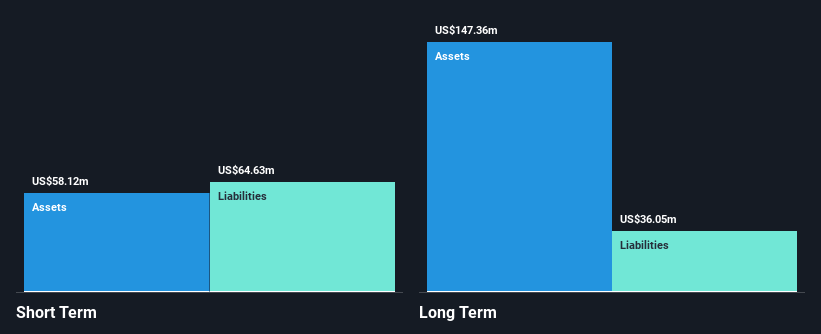

Amerigo Resources has demonstrated strong financial performance, with significant growth in copper production and improved profitability. The company reported a net income of US$9.77 million for Q2 2024, reversing a loss from the previous year, and achieved sales of US$51.6 million for the same period. Despite its low return on equity at 10.8%, Amerigo's debt is well-managed, covered by operating cash flow and short-term assets exceeding long-term liabilities. However, its dividend sustainability remains questionable as it isn't fully covered by earnings despite consistent payouts like the recent CA$0.03 per share dividend declared in July 2024.

- Click here and access our complete financial health analysis report to understand the dynamics of Amerigo Resources.

- Gain insights into Amerigo Resources' outlook and expected performance with our report on the company's earnings estimates.

NEXE Innovations (TSXV:NEXE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NEXE Innovations Inc. manufactures and sells plant-based single-serve coffee pods for use in single-serve coffee machines in Canada, with a market cap of CA$36.97 million.

Operations: The company generates revenue from its Industrial Automation & Controls segment, amounting to CA$0.15 million.

Market Cap: CA$36.97M

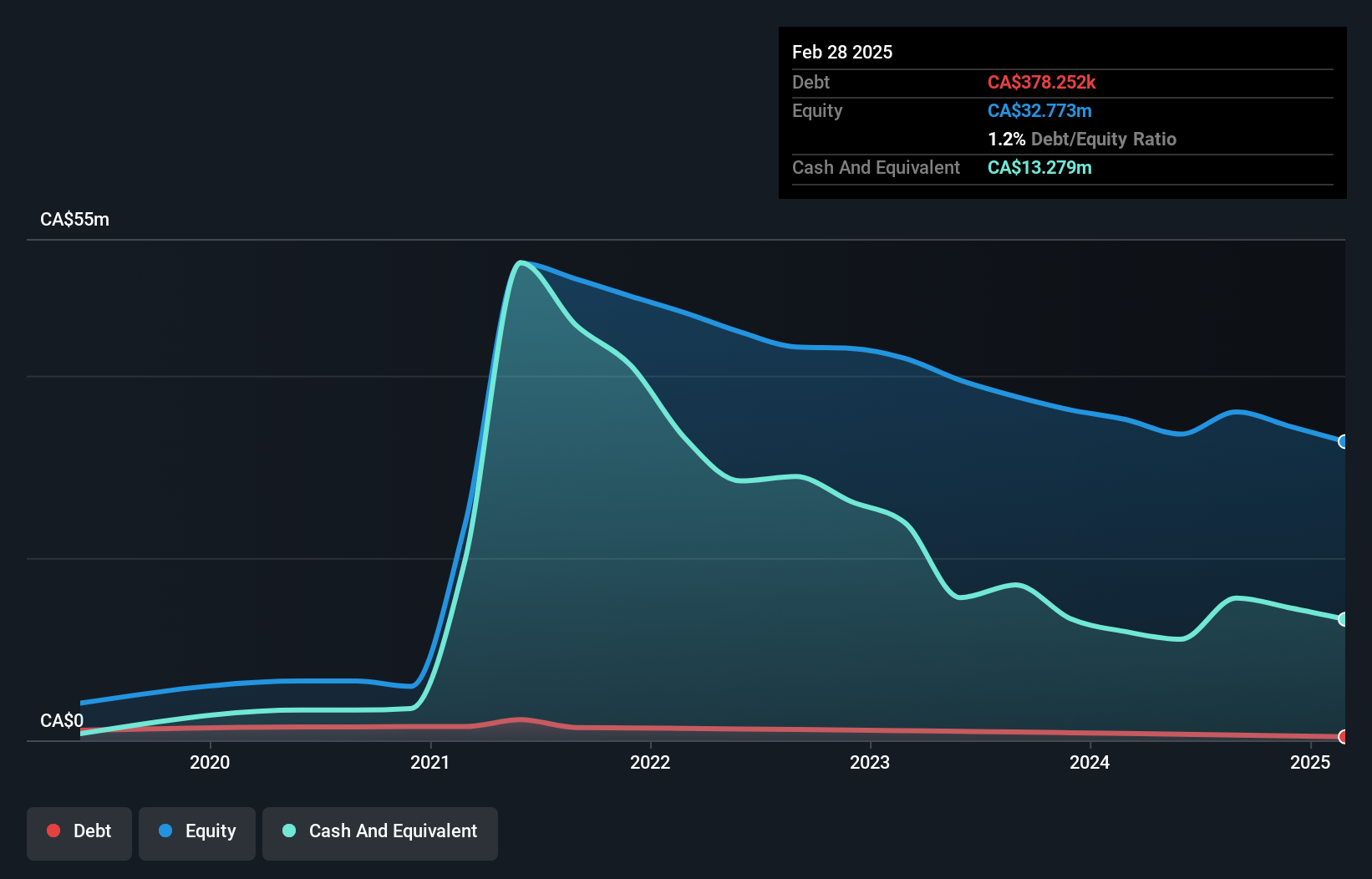

NEXE Innovations, with a market cap of CA$36.97 million, is pre-revenue, generating only CA$0.15 million in sales. The company has more cash than debt and its short-term assets significantly exceed both short and long-term liabilities, indicating a strong financial position despite being unprofitable with increasing losses over five years. NEXE's management and board are experienced, but the company's cash runway is less than a year if current free cash flow trends continue. Its share price remains highly volatile compared to most Canadian stocks, reflecting investor uncertainty about future profitability prospects.

- Get an in-depth perspective on NEXE Innovations' performance by reading our balance sheet health report here.

- Explore historical data to track NEXE Innovations' performance over time in our past results report.

Teuton Resources (TSXV:TUO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Teuton Resources Corp. is an exploration stage company focused on acquiring, exploring, and managing mineral properties in Canada with a market cap of CA$79.11 million.

Operations: Teuton Resources Corp. does not report any revenue segments as it is currently in the exploration stage.

Market Cap: CA$79.11M

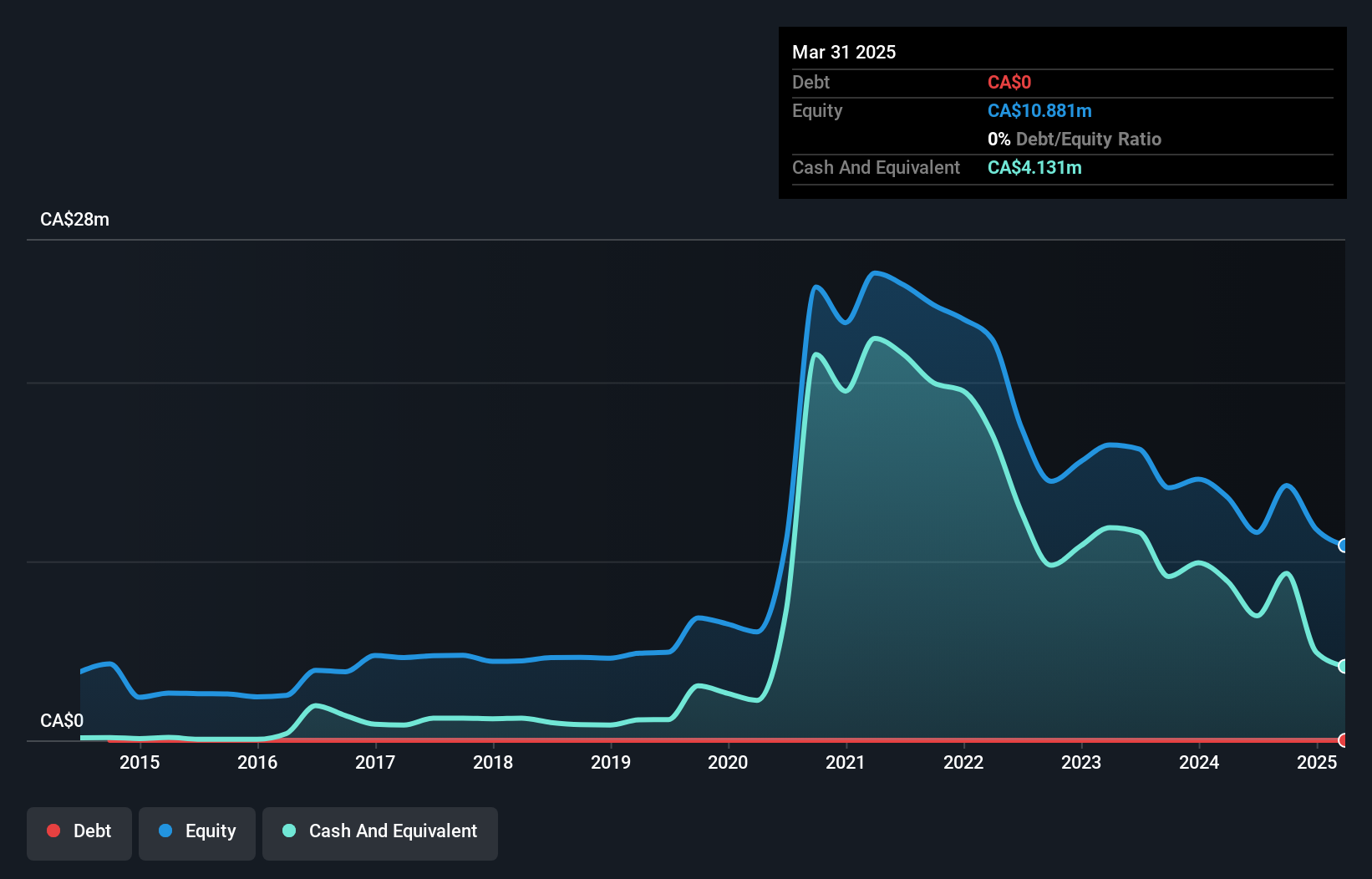

Teuton Resources Corp., with a market cap of CA$79.11 million, is pre-revenue and currently unprofitable, with losses increasing at 43.7% annually over the past five years. Despite this, the company maintains a debt-free status and has no long-term liabilities, offering some financial stability. Its short-term assets of CA$7.1 million comfortably cover its short-term liabilities of CA$146.9K, providing more than three years of cash runway based on current free cash flow trends. Recent earnings reports show increased net losses compared to last year, highlighting ongoing financial challenges as it remains in the exploration stage without significant revenue streams yet established.

- Click here to discover the nuances of Teuton Resources with our detailed analytical financial health report.

- Learn about Teuton Resources' historical performance here.

Summing It All Up

- Get an in-depth perspective on all 948 TSX Penny Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teuton Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:TUO

Teuton Resources

An exploration stage company, engages in the acquisition, exploration, and dealing of mineral properties in Canada.

Flawless balance sheet low.