- Canada

- /

- Metals and Mining

- /

- TSXV:TUD

How Many Tudor Gold Corp. (CVE:TUD) Shares Did Insiders Buy, In The Last Year?

We often see insiders buying up shares in companies that perform well over the long term. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So we'll take a look at whether insiders have been buying or selling shares in Tudor Gold Corp. (CVE:TUD).

Do Insider Transactions Matter?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, most countries require that the company discloses such transactions to the market.

Insider transactions are not the most important thing when it comes to long-term investing. But equally, we would consider it foolish to ignore insider transactions altogether. For example, a Harvard University study found that 'insider purchases earn abnormal returns of more than 6% per year.

Check out our latest analysis for Tudor Gold

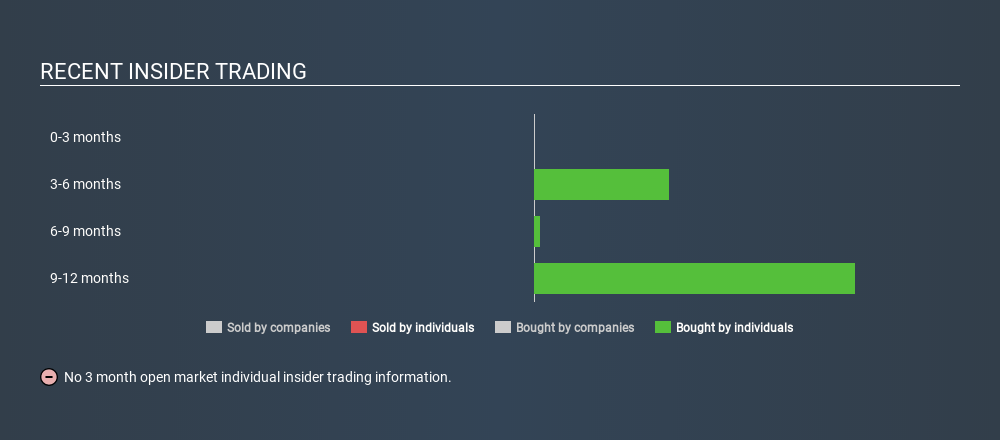

Tudor Gold Insider Transactions Over The Last Year

insider Eric Sprott made the biggest insider purchase in the last 12 months. That single transaction was for CA$3.0m worth of shares at a price of CA$0.45 each. Even though the purchase was made at a significantly lower price than the recent price (CA$0.59), we still think insider buying is a positive. Because it occurred at a lower valuation, it doesn't tell us much about whether insiders might find today's price attractive.

Eric Sprott bought 14.19m shares over the last 12 months at an average price of CA$0.43. You can see a visual depiction of insider transactions (by individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Does Tudor Gold Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. We usually like to see fairly high levels of insider ownership. From our data, it seems that Tudor Gold insiders own 14% of the company, worth about CA$13m. But they may have an indirect interest through a corporate structure that we haven't picked up on. Whilst better than nothing, we're not overly impressed by these holdings.

So What Does This Data Suggest About Tudor Gold Insiders?

There haven't been any insider transactions in the last three months -- that doesn't mean much. On a brighter note, the transactions over the last year are encouraging. Insiders do have a stake in Tudor Gold and their transactions don't cause us concern. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. Our analysis shows 6 warning signs for Tudor Gold (2 are a bit concerning!) and we strongly recommend you look at them before investing.

But note: Tudor Gold may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSXV:TUD

Tudor Gold

A junior resource exploration company, engages in the exploration and development of mineral properties in Canada.

Slight with mediocre balance sheet.

Market Insights

Community Narratives