- Canada

- /

- Metals and Mining

- /

- TSXV:THX

Investors Still Aren't Entirely Convinced By Thor Explorations Ltd.'s (CVE:THX) Earnings Despite 27% Price Jump

Thor Explorations Ltd. (CVE:THX) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

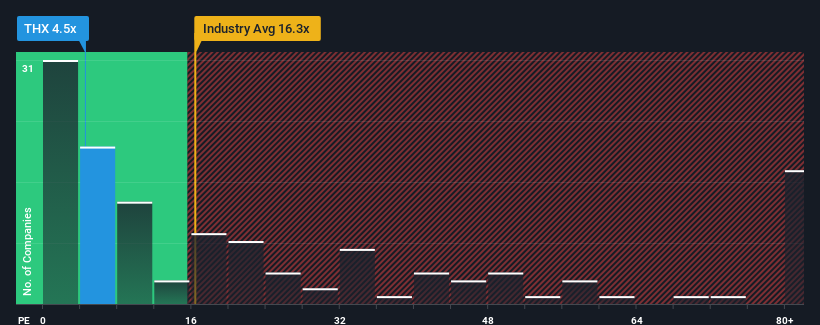

Although its price has surged higher, given about half the companies in Canada have price-to-earnings ratios (or "P/E's") above 16x, you may still consider Thor Explorations as a highly attractive investment with its 4.5x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Thor Explorations as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Thor Explorations

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Thor Explorations would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 28%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 8.9% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 9.0% per annum, which is not materially different.

With this information, we find it odd that Thor Explorations is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Thor Explorations' P/E

Shares in Thor Explorations are going to need a lot more upward momentum to get the company's P/E out of its slump. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Thor Explorations' analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Thor Explorations with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Thor Explorations' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Thor Explorations might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:THX

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.