- Canada

- /

- Metals and Mining

- /

- TSX:GGD

GoGold Resources And 2 Promising Penny Stocks On The TSX

Reviewed by Simply Wall St

As global markets navigate the complexities of economic policies and interest rate adjustments, Canadian investors are keeping a close eye on how these factors might influence domestic opportunities. Penny stocks, though often seen as relics of past market eras, continue to present intriguing prospects for those interested in smaller or newer companies. With strong financial foundations and growth potential, penny stocks like GoGold Resources offer a unique opportunity for investors seeking value at lower price points.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.74 | CA$173.17M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.73 | CA$286.83M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.28 | CA$116.04M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.64 | CA$584.01M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.46 | CA$325.16M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.16 | CA$5.03M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.75M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.10 | CA$207.81M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.09 | CA$29.28M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

Click here to see the full list of 965 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

GoGold Resources (TSX:GGD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GoGold Resources Inc. is involved in the exploration, development, and production of gold and silver in Mexico with a market cap of CA$431.68 million.

Operations: The company generates revenue from its Metals & Mining segment, specifically focusing on Gold & Other Precious Metals, amounting to $31.79 million.

Market Cap: CA$431.68M

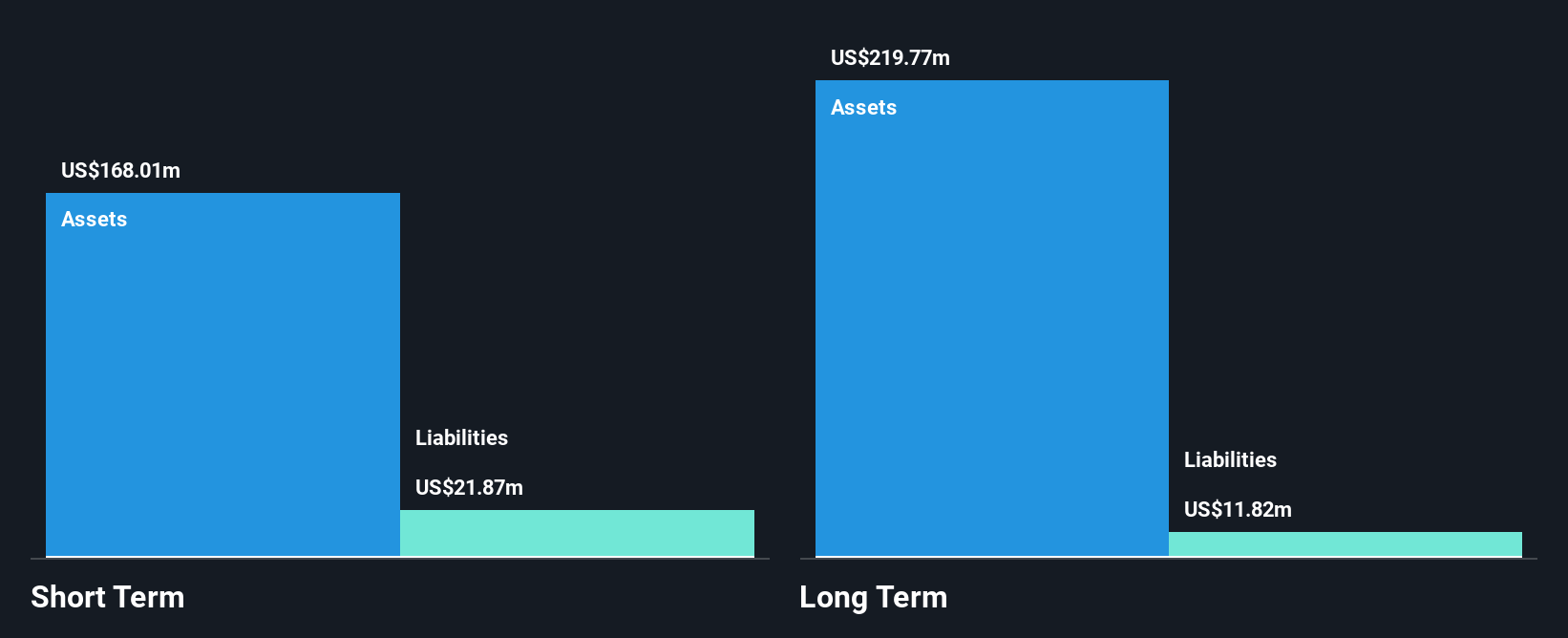

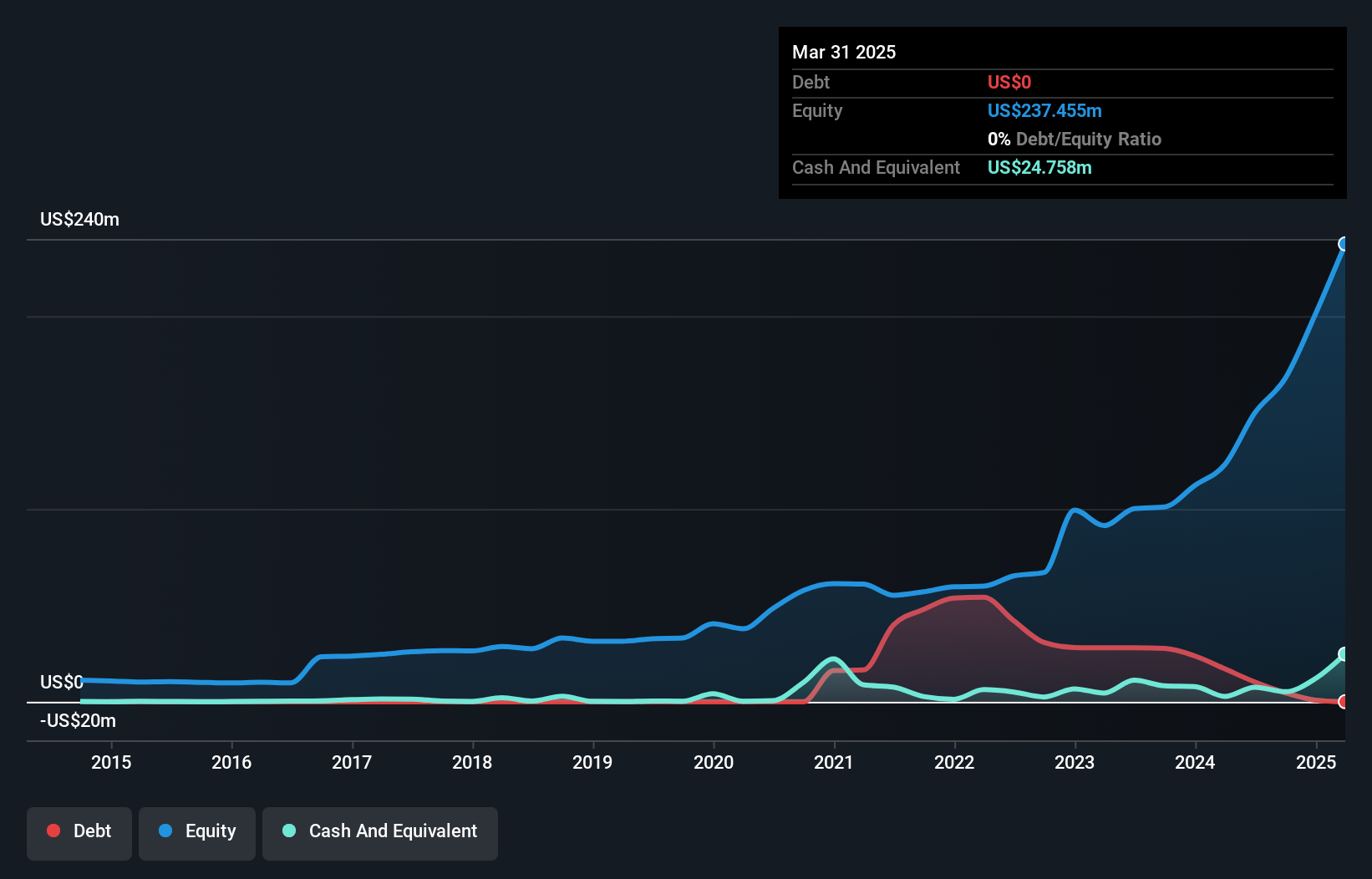

GoGold Resources, with a market cap of CA$431.68 million, focuses on gold and silver production in Mexico. The company recently reported quarterly production of 406,150 silver equivalent ounces and is advancing its Los Ricos South project towards a definitive feasibility study. Despite being unprofitable with increasing losses over the past five years, GoGold has no debt and robust short-term assets exceeding liabilities, providing financial stability. Its management team is experienced with an average tenure of 8.8 years. Future earnings are forecasted to grow significantly, though the company currently faces challenges in profitability and return on equity.

- Unlock comprehensive insights into our analysis of GoGold Resources stock in this financial health report.

- Explore GoGold Resources' analyst forecasts in our growth report.

Mandalay Resources (TSX:MND)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mandalay Resources Corporation is involved in the acquisition, exploration, extraction, processing, and reclamation of mineral properties across Canada, Australia, Sweden, and Chile with a market cap of CA$325.16 million.

Operations: The company's revenue is primarily derived from its Metals & Mining segment, specifically focusing on Gold & Other Precious Metals, which generated $224.44 million.

Market Cap: CA$325.16M

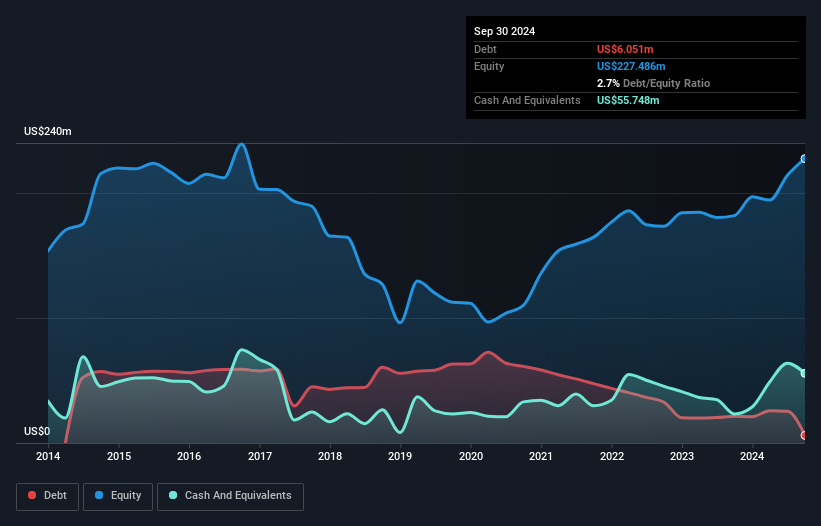

Mandalay Resources, with a market cap of CA$325.16 million, shows promising financial health and growth potential within the penny stock segment. The company reported significant earnings growth of 381.7% over the past year, driven by increased sales in its Metals & Mining segment, with Q3 revenue reaching US$55.29 million. Mandalay's debt is well-managed, covered by operating cash flow at a very large margin, and it has reduced its debt-to-equity ratio significantly over five years. Despite a relatively new management team averaging 1.6 years in tenure, the board brings stability with an average tenure of 6.5 years and recent strategic appointments enhancing governance expertise.

- Navigate through the intricacies of Mandalay Resources with our comprehensive balance sheet health report here.

- Understand Mandalay Resources' earnings outlook by examining our growth report.

Thor Explorations (TSXV:THX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Thor Explorations Ltd., with a market cap of CA$183.70 million, operates as a gold producer and explorer through its subsidiaries.

Operations: The company generates revenue primarily from the Segilola Mine Project, which amounted to $146.78 million.

Market Cap: CA$183.7M

Thor Explorations Ltd., with a market cap of CA$183.70 million, is navigating challenges and opportunities in the penny stock arena. The company reported Q2 2024 sales of US$53.88 million, an increase from the previous year, though recent production guidance was revised downward to 85,000 oz due to operational delays and extreme weather. Despite these hurdles, Thor maintains strong financial health with interest payments well-covered by EBIT (4.1x) and satisfactory net debt levels (1.8%). Recent drilling at Segilola shows promising high-grade gold intersections that could enhance future resource estimates despite current earnings volatility challenges.

- Click here to discover the nuances of Thor Explorations with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Thor Explorations' future.

Make It Happen

- Investigate our full lineup of 965 TSX Penny Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GGD

GoGold Resources

Engages in the exploration, development, and production of silver, gold, and copper primarily in Mexico.

Flawless balance sheet with questionable track record.