- Canada

- /

- Metals and Mining

- /

- TSXV:SUP

3 TSX Penny Stocks With Market Caps Under CA$300M

Reviewed by Simply Wall St

As the Canadian economy navigates a period of stabilized yields and moderated inflation, the TSX has seen modest growth, reflecting cautious optimism among investors. In this context, penny stocks—though often considered niche investments—remain relevant for those seeking opportunities in smaller or emerging companies. These stocks can offer unique prospects when backed by strong financials, and we'll explore three that stand out for their potential to combine value with growth.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.76 | CA$174.75M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.81 | CA$444.19M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.51 | CA$14.9M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.72 | CA$641.48M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.16 | CA$29.28M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$4.07M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.82 | CA$379.19M | ★★★★★☆ |

| New Gold (TSX:NGD) | CA$4.03 | CA$3.08B | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$1.94 | CA$189.49M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.07 | CA$201.14M | ★★★★☆☆ |

Click here to see the full list of 937 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

EMX Royalty (TSXV:EMX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: EMX Royalty Corporation, along with its subsidiaries, focuses on exploring and generating royalties from metals and minerals properties, with a market cap of CA$288.35 million.

Operations: The company's revenue primarily comes from the resource industry, totaling $26.82 million.

Market Cap: CA$288.35M

EMX Royalty Corporation, with a market cap of CA$288.35 million, focuses on generating royalties from metals and minerals properties. Despite being unprofitable with negative return on equity, EMX maintains a satisfactory net debt to equity ratio of 5.5% and has sufficient cash runway for over three years due to positive free cash flow growth. Recent strategic moves include a royalty agreement in Peru's copper-rich region and completing a share buyback program worth $8.3 million, enhancing shareholder value by reducing dilution risk. The board is experienced but recently lost member Chris Wright following his appointment as U.S. Secretary of Energy.

- Click here and access our complete financial health analysis report to understand the dynamics of EMX Royalty.

- Review our growth performance report to gain insights into EMX Royalty's future.

Namibia Critical Metals (TSXV:NMI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Namibia Critical Metals Inc. explores and develops critical metals properties in Namibia, with a market cap of CA$7.62 million.

Operations: Namibia Critical Metals Inc. currently does not report any revenue segments.

Market Cap: CA$7.62M

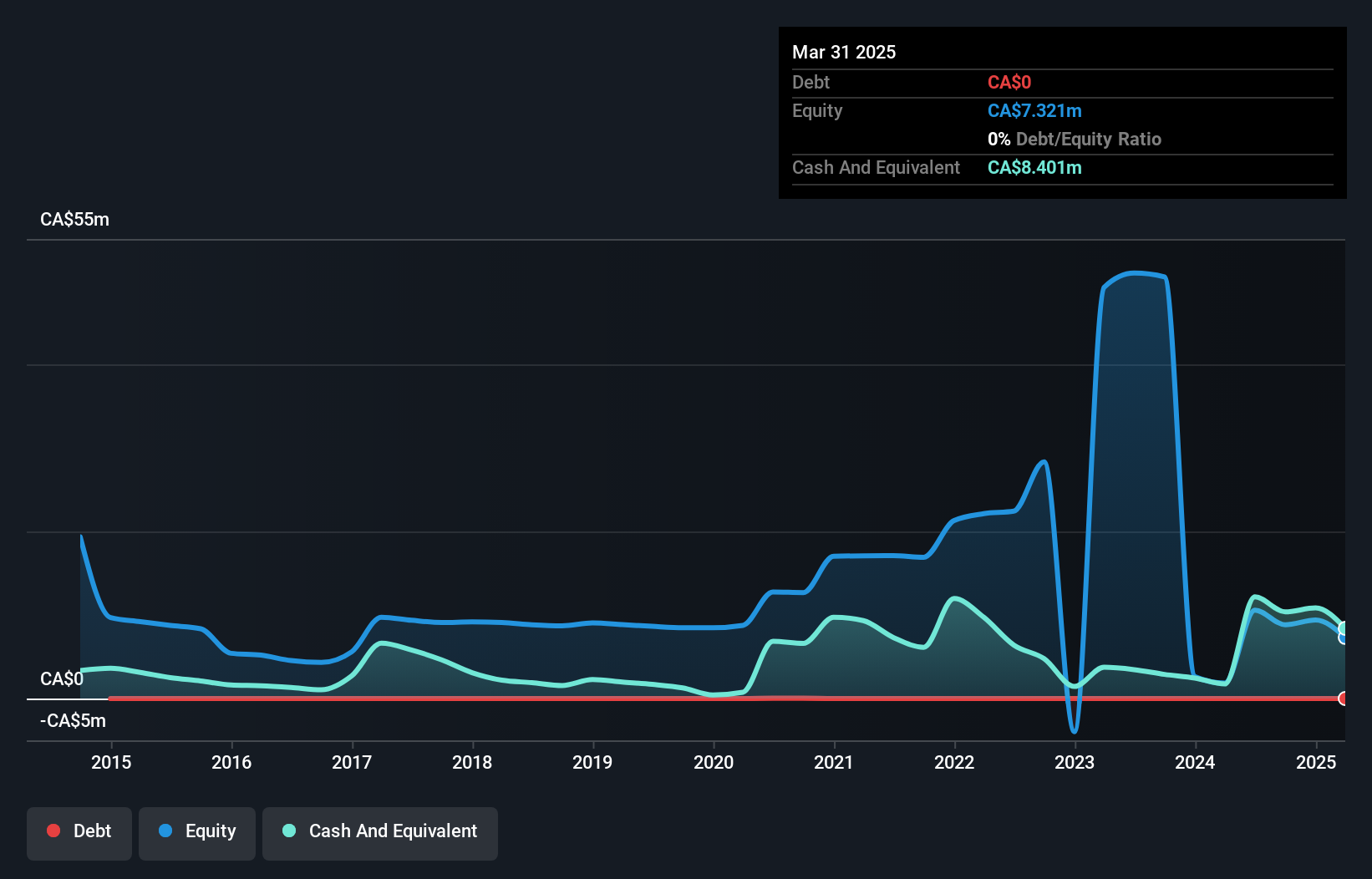

Namibia Critical Metals Inc., with a market cap of CA$7.62 million, is pre-revenue and debt-free, focusing on developing critical metals properties in Namibia. Recent advancements include successful hydrometallurgical test work for high purity rare earth element carbonate production at its Lofdal project, simplifying processes and reducing reagent consumption. The company secured additional funding from joint venture partner JOGMEC, totaling $15.09 million in commitments. While the management team and board are experienced, the company faces challenges with increased losses over five years and highly volatile share prices recently despite having sufficient cash runway after recent capital raises.

- Get an in-depth perspective on Namibia Critical Metals' performance by reading our balance sheet health report here.

- Assess Namibia Critical Metals' previous results with our detailed historical performance reports.

Northern Superior Resources (TSXV:SUP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Northern Superior Resources Inc. is a junior mining company focused on exploring and developing gold properties in Ontario and Québec, Canada, with a market cap of CA$72.68 million.

Operations: Northern Superior Resources Inc. does not report any revenue segments.

Market Cap: CA$72.68M

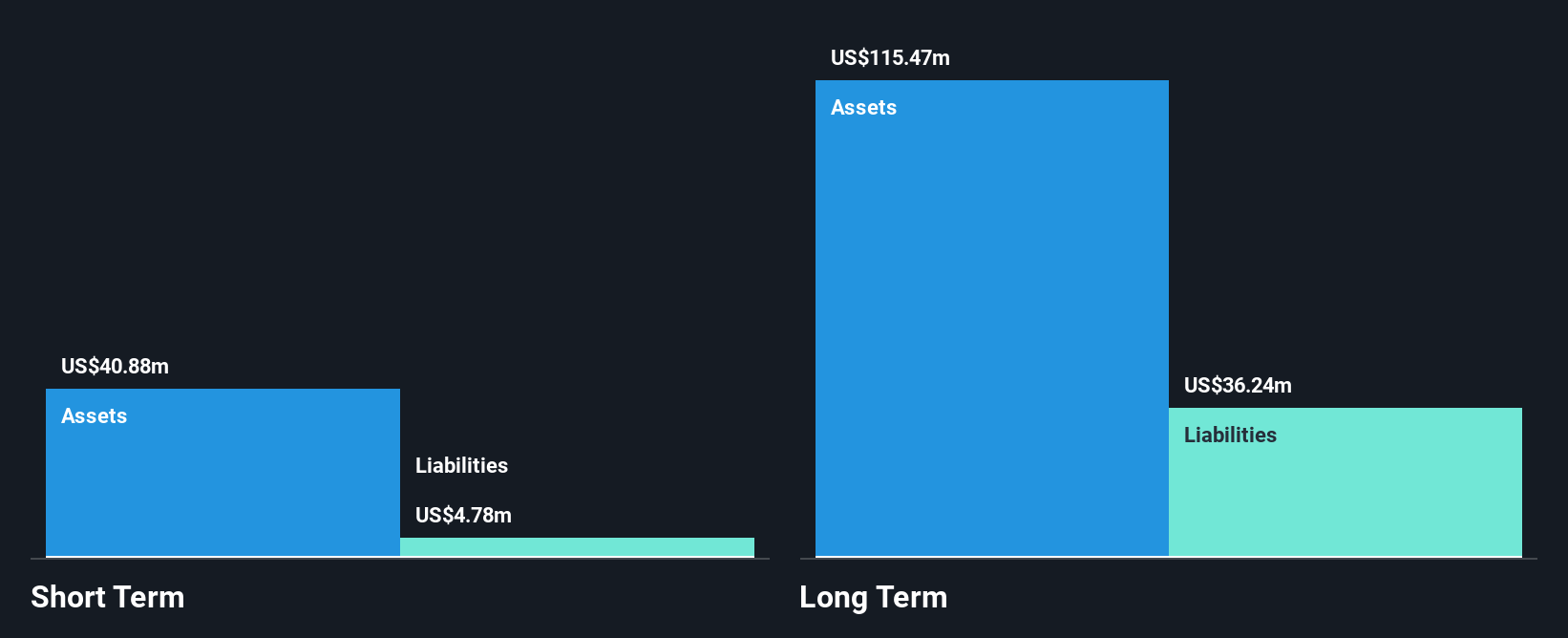

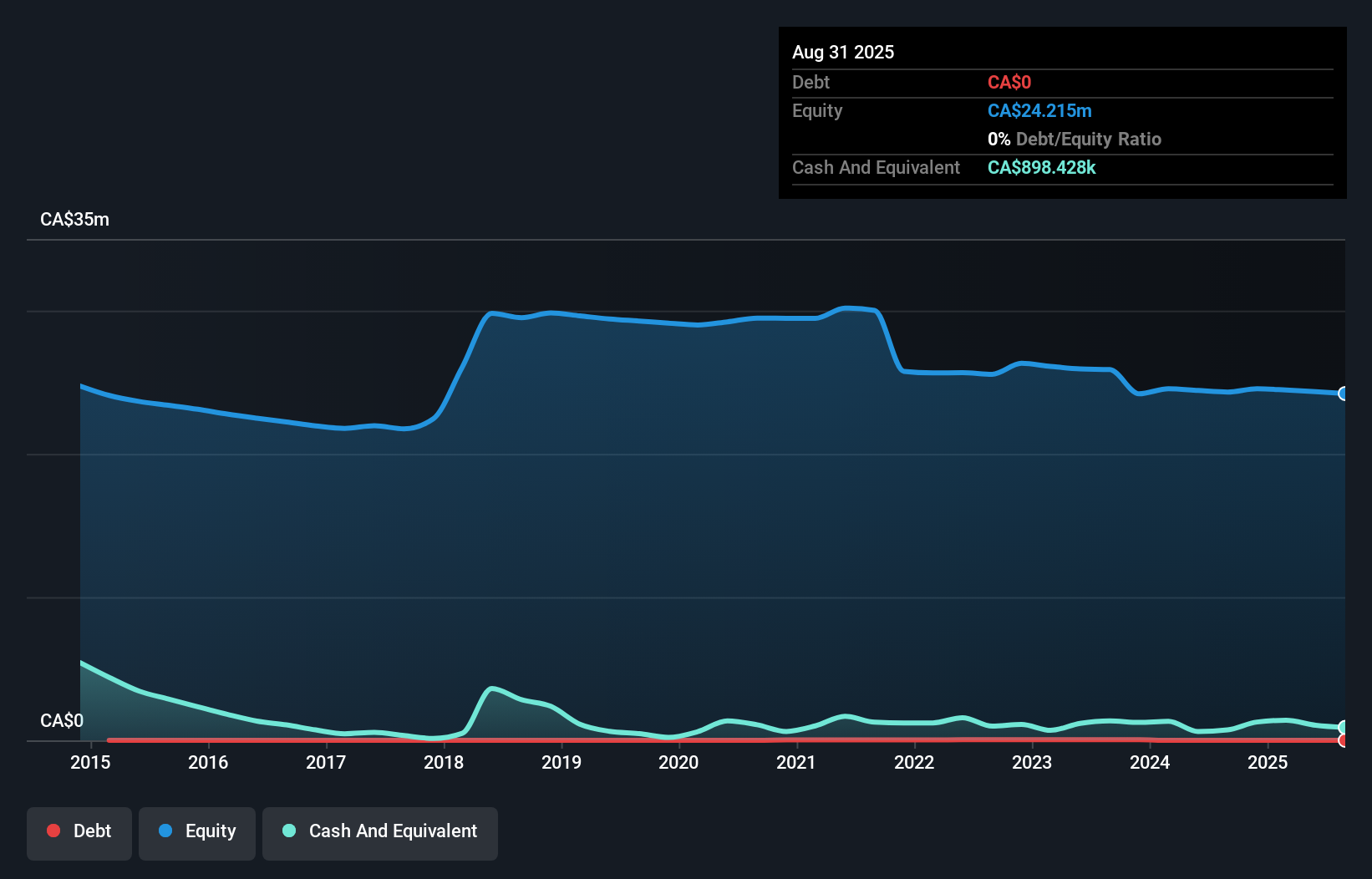

Northern Superior Resources Inc., with a market cap of CA$72.68 million, is pre-revenue and debt-free, focusing on gold exploration in Ontario and Québec. The company has faced increased losses over the past five years at a rate of 48% annually, although it maintains a stable weekly volatility of 6%. Despite being unprofitable, Northern Superior's short-term assets significantly exceed its liabilities, providing financial stability. Recent board changes include the resignation of Mr. Francois Perron and the appointment of Mr. Eric Desaulniers. The management team is relatively experienced with an average tenure of 2.3 years, offering some operational continuity amidst financial challenges.

- Click to explore a detailed breakdown of our findings in Northern Superior Resources' financial health report.

- Gain insights into Northern Superior Resources' historical outcomes by reviewing our past performance report.

Next Steps

- Get an in-depth perspective on all 937 TSX Penny Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Superior Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SUP

Northern Superior Resources

An exploration stage junior mining company, engages in the identification, acquisition, evaluation, and exploration of gold properties in Ontario and Québec, Canada.

Flawless balance sheet low.

Market Insights

Community Narratives