- Canada

- /

- Metals and Mining

- /

- TSXV:LOD

Stratabound Minerals (CVE:SB) Has Debt But No Earnings; Should You Worry?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Stratabound Minerals Corp. (CVE:SB) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Stratabound Minerals

What Is Stratabound Minerals's Debt?

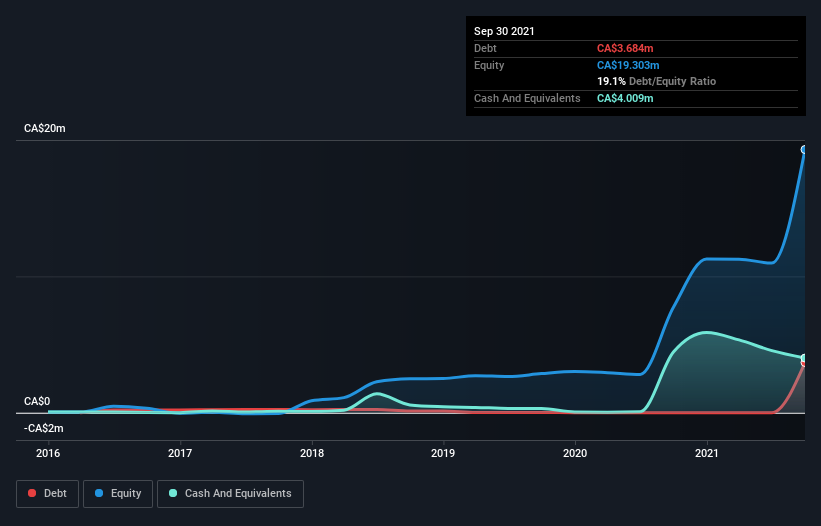

The image below, which you can click on for greater detail, shows that at September 2021 Stratabound Minerals had debt of CA$3.68m, up from none in one year. But on the other hand it also has CA$4.01m in cash, leading to a CA$324.5k net cash position.

How Strong Is Stratabound Minerals' Balance Sheet?

According to the last reported balance sheet, Stratabound Minerals had liabilities of CA$7.14m due within 12 months, and liabilities of CA$13.9k due beyond 12 months. On the other hand, it had cash of CA$4.01m and CA$71.5k worth of receivables due within a year. So its liabilities total CA$3.07m more than the combination of its cash and short-term receivables.

Stratabound Minerals has a market capitalization of CA$12.3m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. While it does have liabilities worth noting, Stratabound Minerals also has more cash than debt, so we're pretty confident it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Stratabound Minerals will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Since Stratabound Minerals has no significant operating revenue, shareholders probably hope it will develop a valuable new mine before too long.

So How Risky Is Stratabound Minerals?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And we do note that Stratabound Minerals had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through CA$4.2m of cash and made a loss of CA$1.6m. With only CA$324.5k on the balance sheet, it would appear that its going to need to raise capital again soon. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 6 warning signs for Stratabound Minerals (5 don't sit too well with us!) that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:LOD

Lode Gold Resources

Engages in the acquisition and exploration of mineral resource properties in North America.

Moderate risk and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026