- Canada

- /

- Metals and Mining

- /

- CNSX:UBQ

3 TSX Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

As the Canadian economy shows signs of cooling, with a potential easing in interest rates on the horizon, investors are keeping a close eye on market developments. In such conditions, penny stocks—often representing smaller or newer companies—can offer intriguing opportunities for growth at lower price points. This article will explore several promising penny stocks that stand out for their financial strength and potential to deliver impressive returns.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.84 | CA$175.73M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.66 | CA$593.32M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.74 | CA$283.52M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.33 | CA$117.08M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.29 | CA$212.76M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.43 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.15 | CA$5.03M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.22 | CA$313.02M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$3.96 | CA$205.89M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.16 | CA$127.98M | ★★★★☆☆ |

Click here to see the full list of 964 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Ubique Minerals (CNSX:UBQ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ubique Minerals Limited is a zinc exploration company focused on acquiring, exploring, and developing mineral properties in Canada and Namibia, with a market cap of CA$1.93 million.

Operations: Currently, there are no reported revenue segments for this zinc exploration company.

Market Cap: CA$1.93M

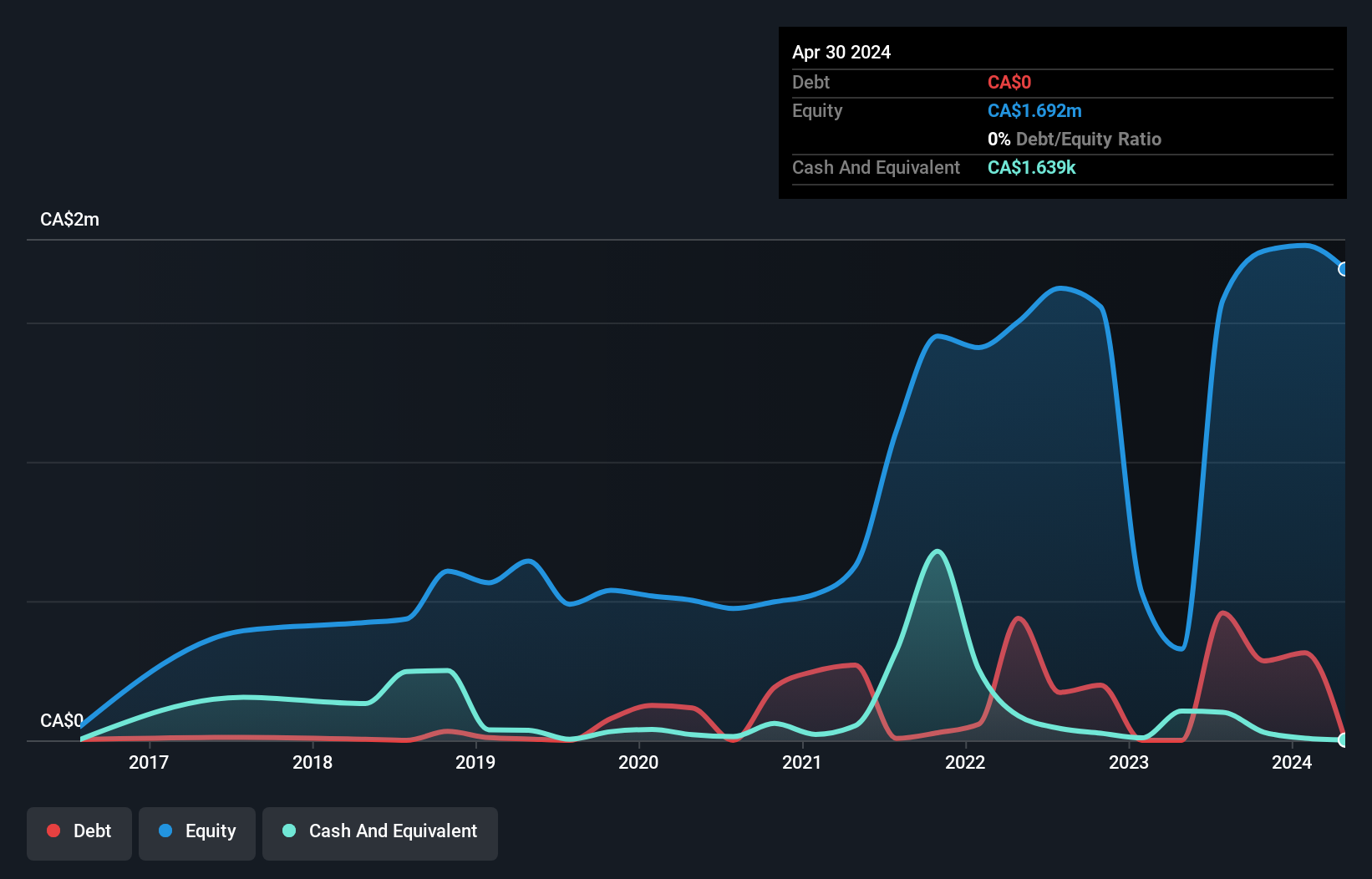

Ubique Minerals has recently transitioned to profitability, marking a significant milestone for this pre-revenue zinc exploration company with a market cap of CA$1.93 million. Despite no debt, its short-term assets of CA$52.8K fall short of covering liabilities, indicating potential liquidity challenges. The company's Price-To-Earnings ratio of 8.7x suggests it may be undervalued compared to the broader Canadian market average of 14.7x, yet shareholder dilution over the past year indicates potential concerns for investors. With an experienced management team and board, Ubique's strategic direction remains critical as it navigates its growth trajectory in the mining sector.

- Click to explore a detailed breakdown of our findings in Ubique Minerals' financial health report.

- Gain insights into Ubique Minerals' past trends and performance with our report on the company's historical track record.

Dynasty Gold (TSXV:DYG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dynasty Gold Corp. is an exploration stage company focused on acquiring, exploring, and developing mineral properties in the United States and Canada, with a market cap of CA$8.25 million.

Operations: There are no reported revenue segments for the company.

Market Cap: CA$8.25M

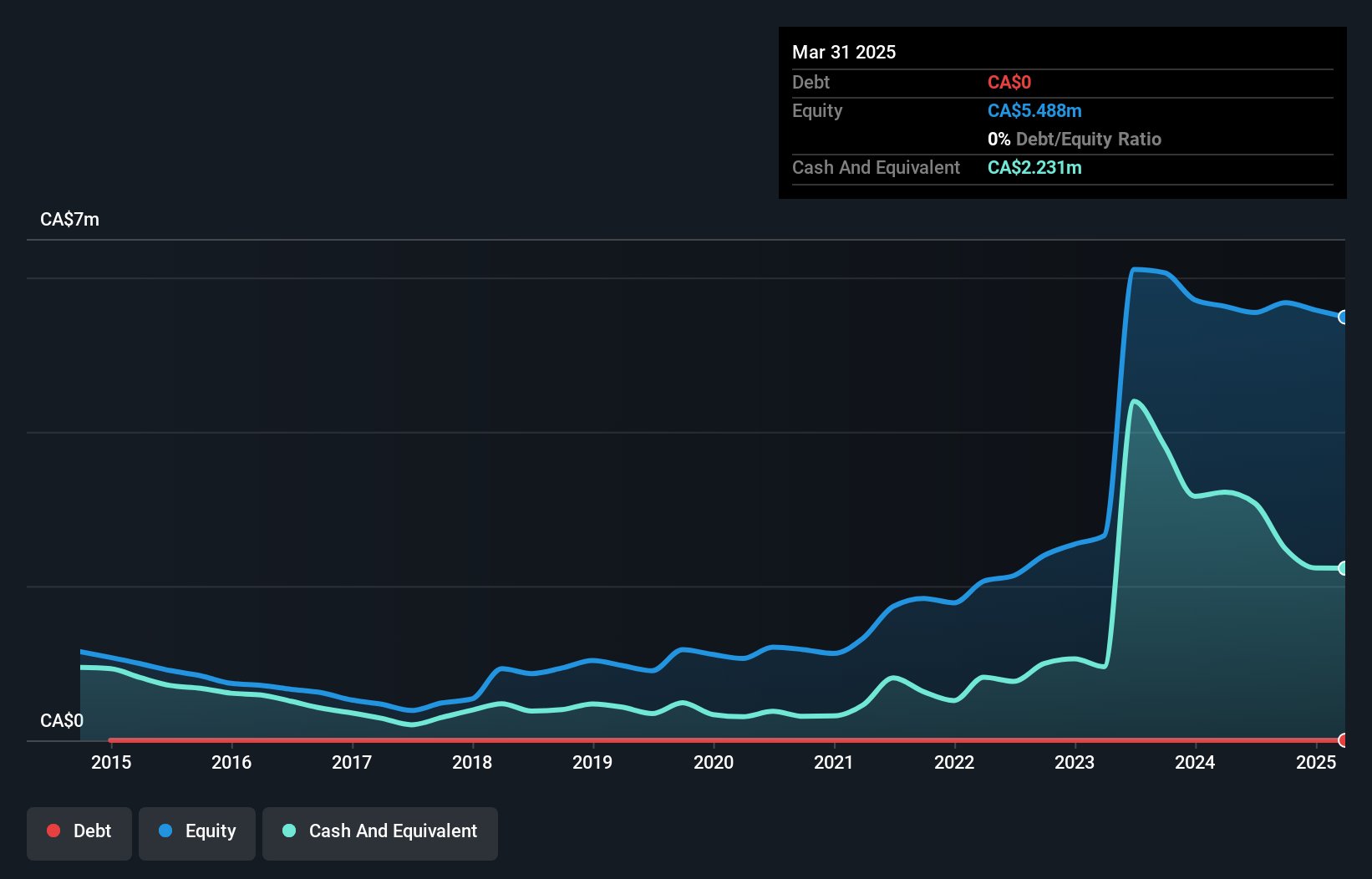

Dynasty Gold Corp., with a market cap of CA$8.25 million, remains pre-revenue and unprofitable, experiencing increased losses over the past five years at 2.6% annually. Despite this, the company is debt-free and boasts a robust cash runway exceeding three years due to positive free cash flow growth of 8.3% per year. Its short-term assets significantly surpass liabilities, ensuring financial stability in the near term. However, its share price has been highly volatile recently, reflecting investor uncertainty in its exploration-focused strategy amidst an experienced board but insufficient management data for tenure assessment.

- Unlock comprehensive insights into our analysis of Dynasty Gold stock in this financial health report.

- Gain insights into Dynasty Gold's historical outcomes by reviewing our past performance report.

Atlas Salt (TSXV:SALT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Atlas Salt Inc. focuses on the valuation, exploration, development, and production of industrial mineral properties in Newfoundland and Labrador, Canada with a market cap of CA$62.54 million.

Operations: No revenue segments are reported for Atlas Salt Inc.

Market Cap: CA$62.54M

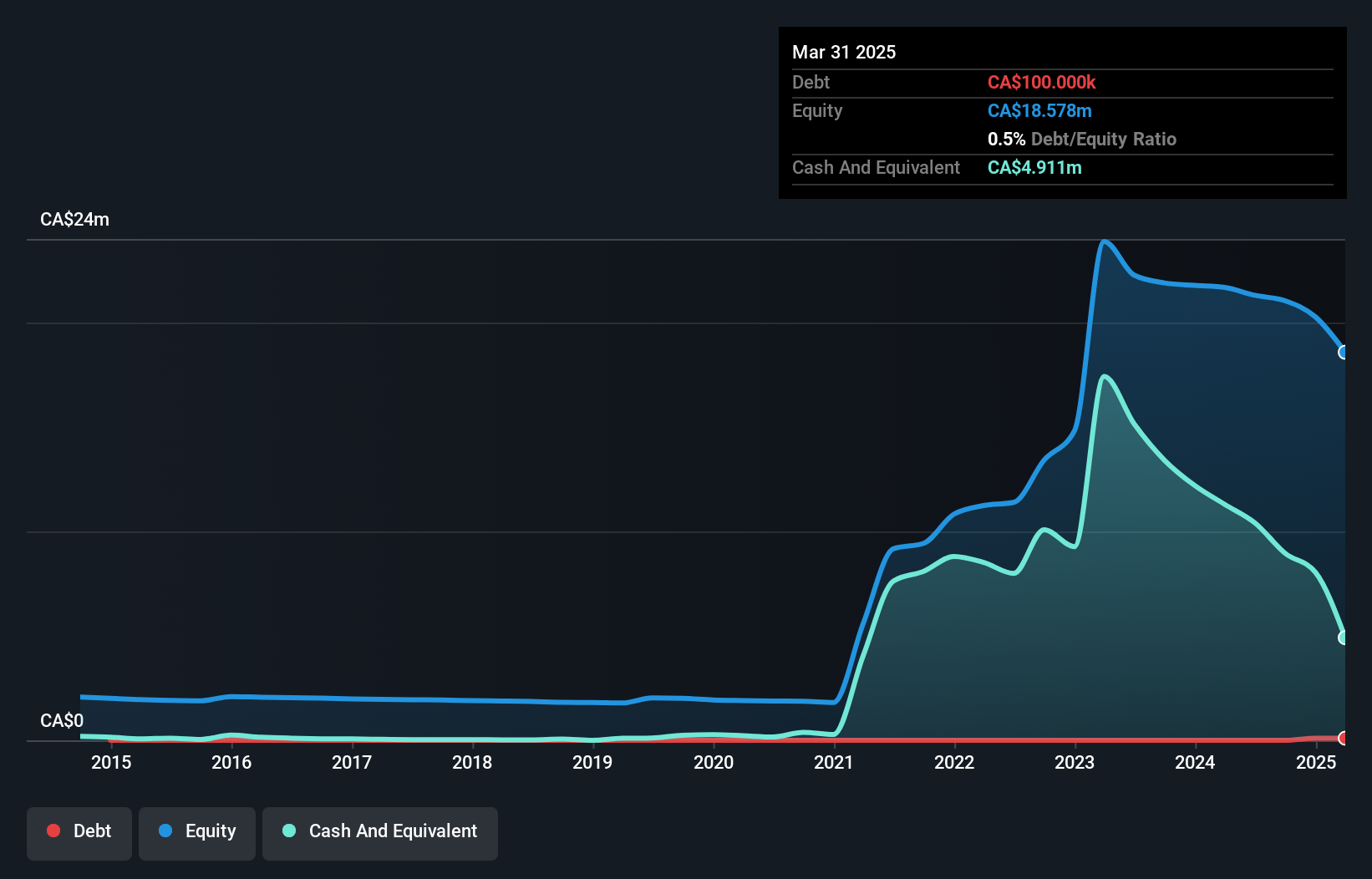

Atlas Salt Inc., with a market cap of CA$62.54 million, is pre-revenue and debt-free, maintaining financial stability as its short-term assets exceed liabilities. The company is advancing the Great Atlantic Salt Project through strategic partnerships and acquisitions, including a mineral lease for 550 hectares and an MOU with Sandvik for advanced mining equipment. Recent developments include geotechnical drilling to de-risk construction phases and executive changes enhancing leadership experience. Despite negative returns on equity due to unprofitability, Atlas Salt's sufficient cash runway supports ongoing project development amidst stable share volatility over the past year.

- Get an in-depth perspective on Atlas Salt's performance by reading our balance sheet health report here.

- Evaluate Atlas Salt's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Click here to access our complete index of 964 TSX Penny Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:UBQ

Ubique Minerals

A zinc exploration company, acquires, explores for, and develops mineral properties in Canada and Namibia.

Moderate with adequate balance sheet.

Market Insights

Community Narratives