- Canada

- /

- Metals and Mining

- /

- TSXV:REG

TSX Penny Stocks To Watch In May 2025

Reviewed by Simply Wall St

The Canadian market has shown resilience, with the TSX only 4% off its record high, buoyed by a strong performance in the materials sector. As investors navigate this period of market recovery and uncertainty, penny stocks—despite their somewhat outdated name—remain an intriguing investment area for those seeking opportunities in smaller or newer companies. When backed by solid financials, these stocks can offer a mix of value and growth potential that might not be as readily available in larger firms.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.73 | CA$73.84M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.62 | CA$69.39M | ✅ 4 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.63 | CA$425.79M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.11 | CA$575.35M | ✅ 4 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.73 | CA$287.16M | ✅ 2 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.59 | CA$530.7M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.61 | CA$129.53M | ✅ 1 ⚠️ 2 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.39 | CA$92.28M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.45 | CA$14.04M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.23 | CA$47.27M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 927 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

American Pacific Mining (CNSX:USGD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: American Pacific Mining Corp. focuses on exploring and developing precious and base metals in the Western United States, with a market cap of CA$44.91 million.

Operations: American Pacific Mining Corp. has not reported any revenue segments.

Market Cap: CA$44.91M

American Pacific Mining Corp., with a market cap of CA$44.91 million, is currently pre-revenue and focuses on precious and base metals exploration in the Western U.S. Recent developments include the commencement of a 3,000-metre drill program at its Madison Copper-Gold Project in Montana, targeting high-impact areas with potential for significant mineralization. The company is debt-free but faces financial constraints with less than a year of cash runway based on current free cash flow. Despite being unprofitable and experiencing increased losses over five years, it leverages experienced management to explore district-scale opportunities at Madison.

- Click here to discover the nuances of American Pacific Mining with our detailed analytical financial health report.

- Learn about American Pacific Mining's historical performance here.

Questerre Energy (TSX:QEC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Questerre Energy Corporation is an energy technology and innovation company focused on acquiring, exploring, and developing non-conventional oil and gas projects in Canada, with a market cap of CA$111.41 million.

Operations: The company's revenue is primarily derived from its Oil & Gas - Exploration & Production segment, which generated CA$34.15 million.

Market Cap: CA$111.41M

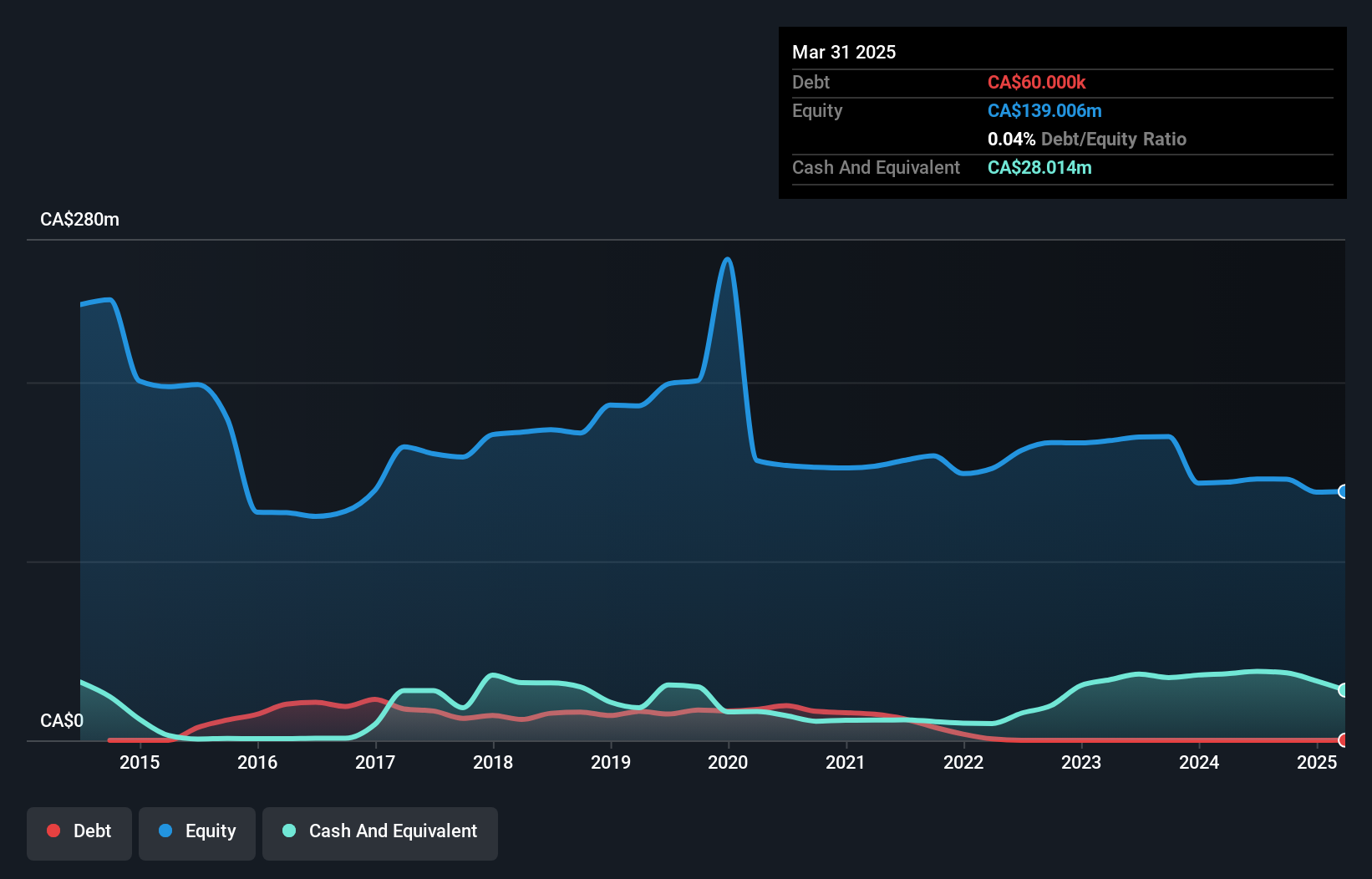

Questerre Energy Corporation, with a market cap of CA$111.41 million, reported revenues of CA$34.15 million for 2024, slightly down from the previous year. Despite being unprofitable with a net loss of CA$7.33 million, it has significantly reduced losses over five years by 10.7% annually and improved its debt-to-equity ratio to 0.04%. The company maintains a cash runway exceeding three years and has more cash than total debt, ensuring financial stability amidst industry challenges like tariffs in Canada. Its experienced board and management team further bolster its strategic direction in the non-conventional oil and gas sector.

- Take a closer look at Questerre Energy's potential here in our financial health report.

- Understand Questerre Energy's track record by examining our performance history report.

Regulus Resources (TSXV:REG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Regulus Resources Inc. is a mineral exploration company with operations in Canada and Peru, and it has a market cap of CA$253.06 million.

Operations: Regulus Resources Inc. has not reported any revenue segments.

Market Cap: CA$253.06M

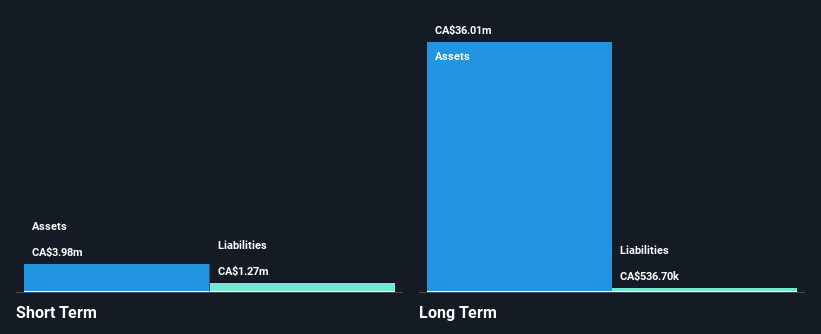

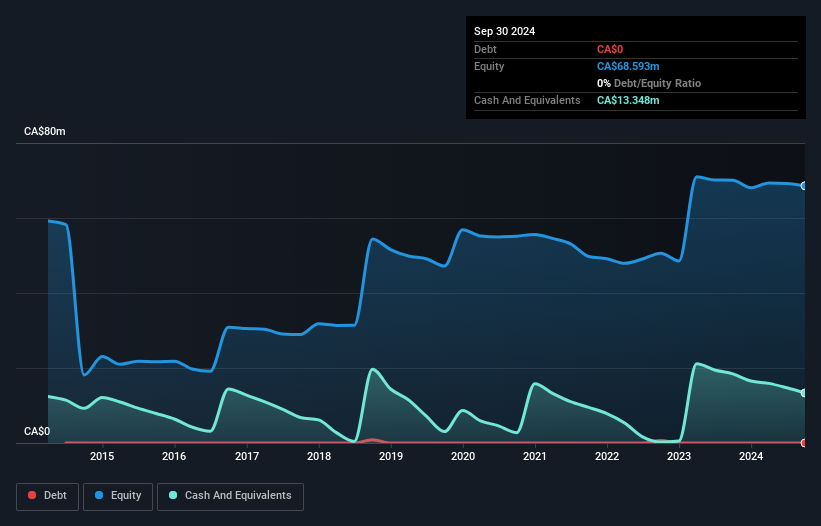

Regulus Resources Inc., with a market cap of CA$253.06 million, operates as a pre-revenue company in the mineral exploration sector. Despite reporting a net loss of CA$0.64 million for Q1 2025, the company has successfully reduced losses over five years by 26.7% annually. It remains debt-free and boasts sufficient cash runway for over two years if free cash flow growth persists at historical rates. The seasoned management team, averaging nearly 12 years of tenure, alongside an experienced board, supports strategic decision-making while maintaining financial stability with short-term assets surpassing liabilities significantly.

- Get an in-depth perspective on Regulus Resources' performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Regulus Resources' track record.

Seize The Opportunity

- Click here to access our complete index of 927 TSX Penny Stocks.

- Searching for a Fresh Perspective? This technology could replace computers: discover the 21 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Regulus Resources, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:REG

Regulus Resources

Operates as a mineral exploration company in Canada and Peru.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives