- Canada

- /

- Metals and Mining

- /

- TSXV:PML

TSX Penny Stocks To Watch In December 2025

Reviewed by Simply Wall St

As the Canadian market navigates through a year marked by policy shifts and global uncertainties, the TSX is poised for its strongest calendar-year return since 2009. This resilience highlights the potential for growth even amidst volatility, offering investors reasons to remain optimistic. Penny stocks, though often seen as niche investments due to their smaller or newer company focus, can still present valuable opportunities when backed by strong financial health. In this article, we explore three penny stocks that may combine balance sheet strength with long-term potential in today's market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.12 | CA$53.09M | ✅ 3 ⚠️ 3 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.11 | CA$21.03M | ✅ 2 ⚠️ 2 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.38 | CA$143.13M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.48 | CA$3.59M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.365 | CA$54.82M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.26 | CA$838.27M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.15 | CA$23.19M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.91 | CA$145.67M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.12 | CA$197.77M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.78 | CA$10.92M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 390 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Nano One Materials (TSX:NANO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nano One Materials Corp. produces and sells cathode active materials for lithium-ion batteries used in electric vehicles, energy storage systems, and consumer electronics, with a market cap of CA$168.61 million.

Operations: Currently, the company does not report any specific revenue segments.

Market Cap: CA$168.61M

Nano One Materials Corp., with a market cap of CA$168.61 million, remains pre-revenue as it develops cathode active materials for lithium-ion batteries. Despite being unprofitable, the company has secured a CAD 5 million non-repayable contribution from Natural Resources Canada to scale its production capabilities and accelerate commercialization efforts. Nano One's strategic collaborations, including partnerships with Sumitomo Metal Mining and Rio Tinto, aim to enhance supply chain resilience and support technology licensing opportunities. The company's financial position is bolstered by more cash than debt and manageable liabilities but faces challenges with less than one year of cash runway if current free cash flow trends continue.

- Get an in-depth perspective on Nano One Materials' performance by reading our balance sheet health report here.

- Learn about Nano One Materials' historical performance here.

Panoro Minerals (TSXV:PML)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Panoro Minerals Ltd. is an exploration-stage company focused on acquiring, exploring, and developing mineral properties in Peru, with a market cap of CA$92.78 million.

Operations: Panoro Minerals Ltd. does not report any revenue segments as it is an exploration-stage company focused on mineral properties in Peru.

Market Cap: CA$92.78M

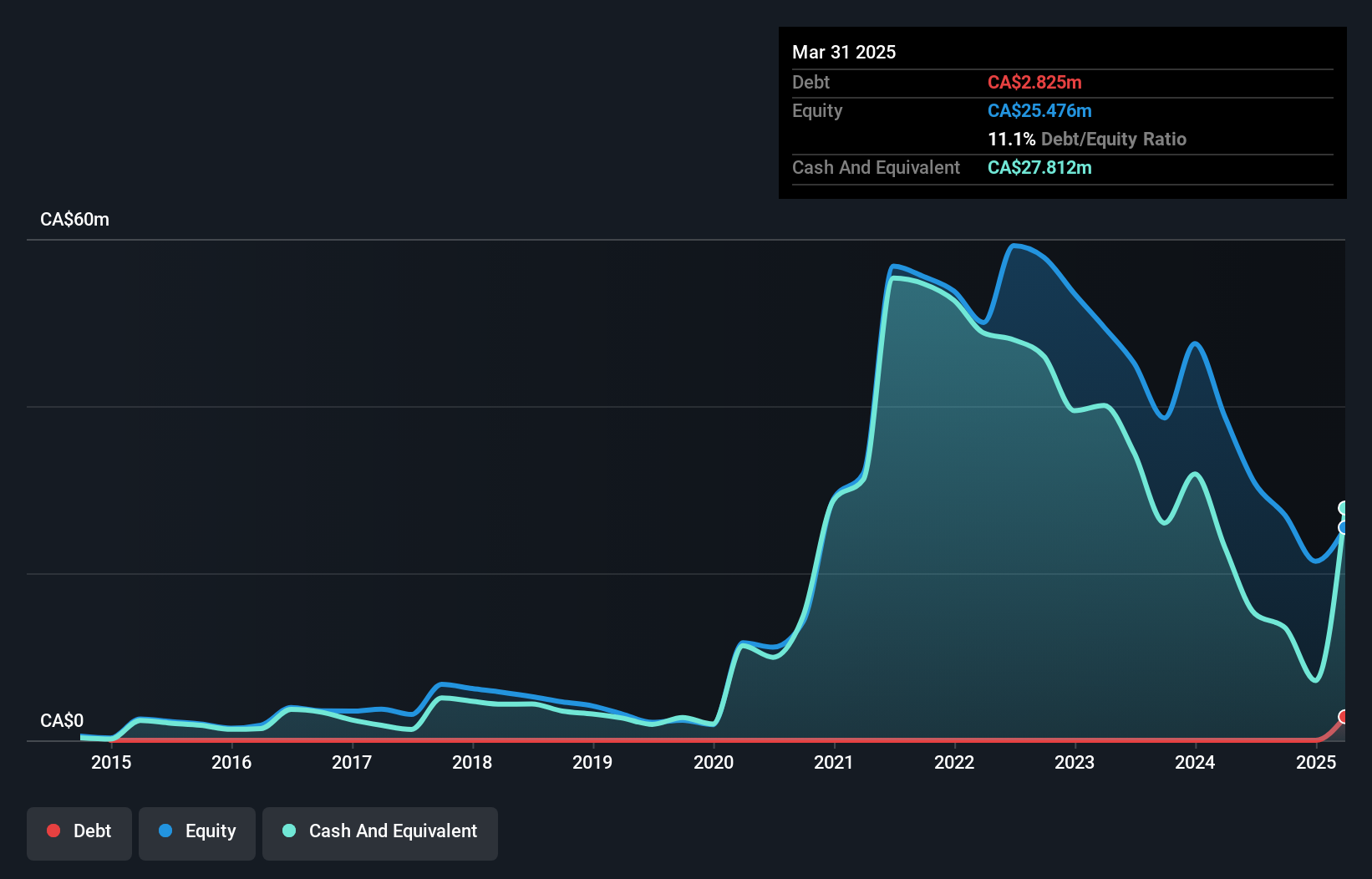

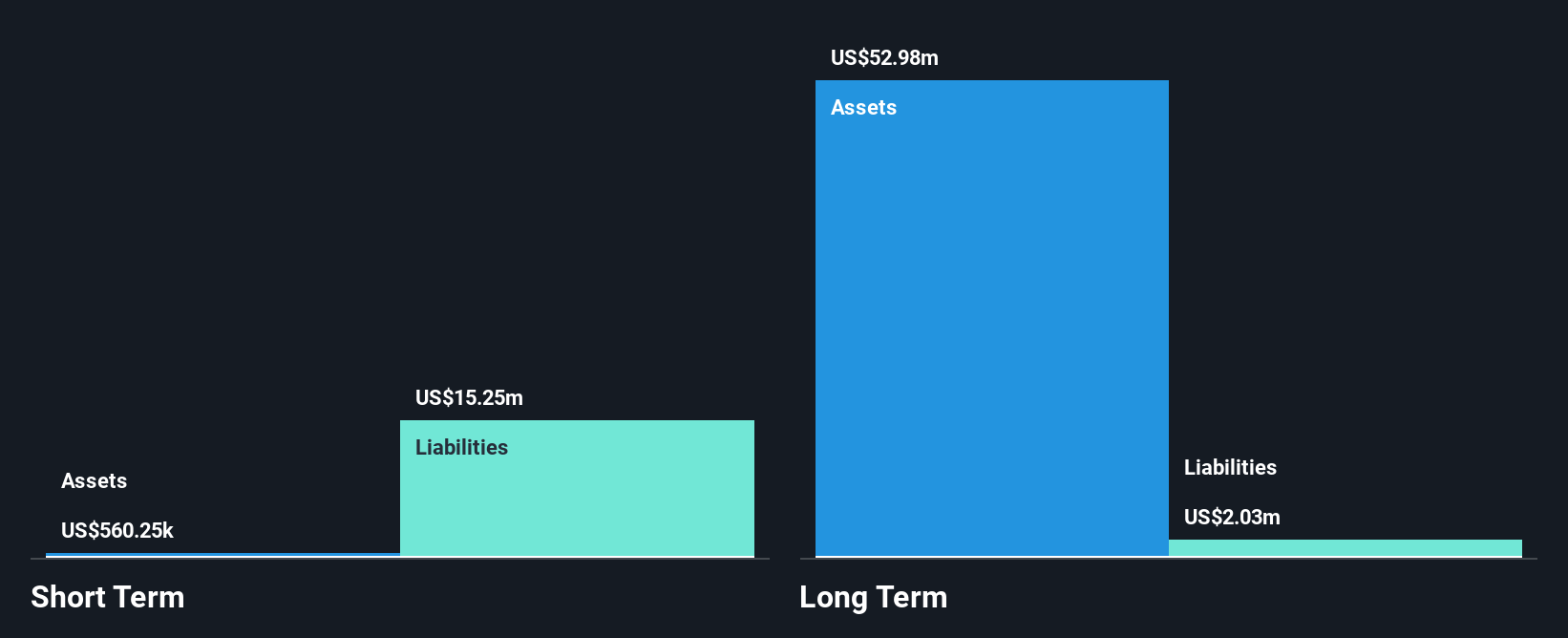

Panoro Minerals Ltd., with a market cap of CA$92.78 million, is pre-revenue and focused on mineral exploration in Peru. The company recently reported a net loss reduction for the third quarter but remains unprofitable overall. A recent private placement aims to raise up to CA$5 million, potentially extending its cash runway. While Panoro's debt-to-equity ratio has improved significantly over five years, short-term assets do not cover liabilities, posing financial challenges. Despite high share price volatility and insider selling, the seasoned management and board bring substantial experience to navigate these uncertainties in the penny stock landscape.

- Click to explore a detailed breakdown of our findings in Panoro Minerals' financial health report.

- Review our historical performance report to gain insights into Panoro Minerals' track record.

Regulus Resources (TSXV:REG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Regulus Resources Inc. is a mineral exploration company operating in Canada and Peru with a market cap of CA$410.53 million.

Operations: Regulus Resources Inc. does not report any specific revenue segments.

Market Cap: CA$410.53M

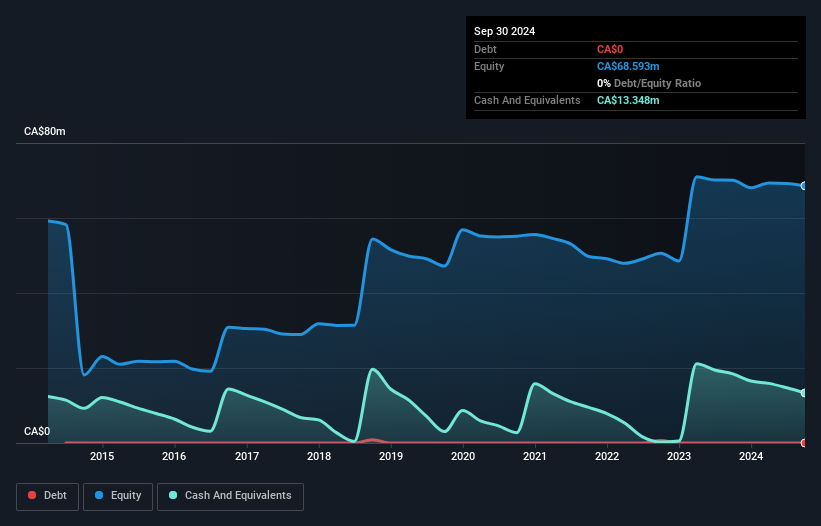

Regulus Resources Inc., with a market cap of CA$410.53 million, is pre-revenue and focused on mineral exploration in Canada and Peru. The company is debt-free, with short-term assets significantly exceeding liabilities, indicating strong financial health for its size. Despite being unprofitable, Regulus has reduced its losses over the past five years by 14.2% annually and maintains a cash runway of 1.7 years if free cash flow growth continues at historical rates. The experienced management team and board are well-positioned to guide the company through the challenges typical of penny stocks in this sector.

- Click here to discover the nuances of Regulus Resources with our detailed analytical financial health report.

- Evaluate Regulus Resources' historical performance by accessing our past performance report.

Where To Now?

- Reveal the 390 hidden gems among our TSX Penny Stocks screener with a single click here.

- Want To Explore Some Alternatives? This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:PML

Panoro Minerals

An exploration-stage company, engages in the acquisition, exploration, and development of mineral properties in Peru.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026