TSX Penny Stock Spotlight Cannabix Technologies And 2 Other Promising Picks

Reviewed by Simply Wall St

The Canadian market has experienced volatility in 2025, with diversification emerging as a key strategy for investors amid softened growth outlooks and uncertainty surrounding tariffs and government policy. Despite these challenges, certain sectors have demonstrated resilience, highlighting the potential benefits of exploring diverse investment opportunities. Penny stocks, though an older term, continue to represent a niche area where smaller or newer companies can offer growth potential; focusing on those with strong financials may uncover promising opportunities amidst the broader market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| NTG Clarity Networks (TSXV:NCI) | CA$1.82 | CA$78.83M | ✅ 4 ⚠️ 2 View Analysis > |

| NamSys (TSXV:CTZ) | CA$1.09 | CA$30.09M | ✅ 2 ⚠️ 2 View Analysis > |

| Madoro Metals (TSXV:MDM) | CA$0.045 | CA$4.03M | ✅ 2 ⚠️ 5 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$0.93 | CA$457.81M | ✅ 3 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.96 | CA$317.84M | ✅ 2 ⚠️ 1 View Analysis > |

| Alvopetro Energy (TSXV:ALV) | CA$4.97 | CA$176.25M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.69 | CA$632.31M | ✅ 4 ⚠️ 1 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.19 | CA$86.43M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.485 | CA$13.89M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.06 | CA$39.14M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 936 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Cannabix Technologies (CNSX:BLO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cannabix Technologies Inc. is a technology company that develops marijuana and alcohol breathalyzers for employers, law enforcement, workplaces, and laboratories in the United States with a market cap of CA$69.09 million.

Operations: Cannabix Technologies Inc. has not reported any specific revenue segments.

Market Cap: CA$69.09M

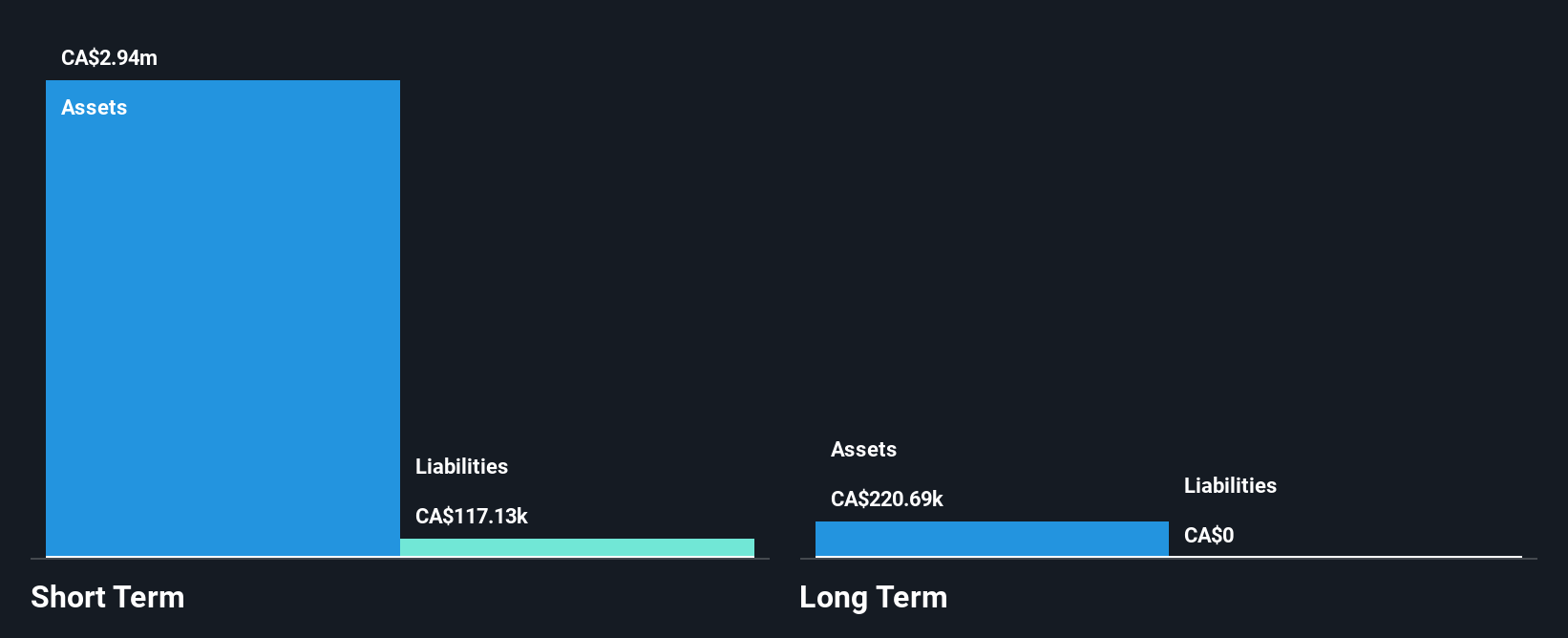

Cannabix Technologies Inc., a pre-revenue company with a market cap of CA$69.09 million, is making strides in marijuana breathalyzer technology. The recent validation of its Breath Collection Unit (BCU) for detecting THC and other cannabinoids marks significant progress towards addressing the challenges posed by cannabis legalization. Collaborating with Omega Laboratories, Cannabix aims to offer precise and rapid detection solutions for law enforcement and workplace safety. Despite being unprofitable, the company benefits from no debt, experienced management, and sufficient cash runway exceeding one year, positioning it well within the volatile landscape of penny stocks in Canada.

- Get an in-depth perspective on Cannabix Technologies' performance by reading our balance sheet health report here.

- Examine Cannabix Technologies' past performance report to understand how it has performed in prior years.

Regulus Resources (TSXV:REG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Regulus Resources Inc. is a mineral exploration company focused on operations in Canada and Peru, with a market cap of CA$265.52 million.

Operations: Regulus Resources Inc. does not report any revenue segments as it is a mineral exploration company focused on operations in Canada and Peru.

Market Cap: CA$265.52M

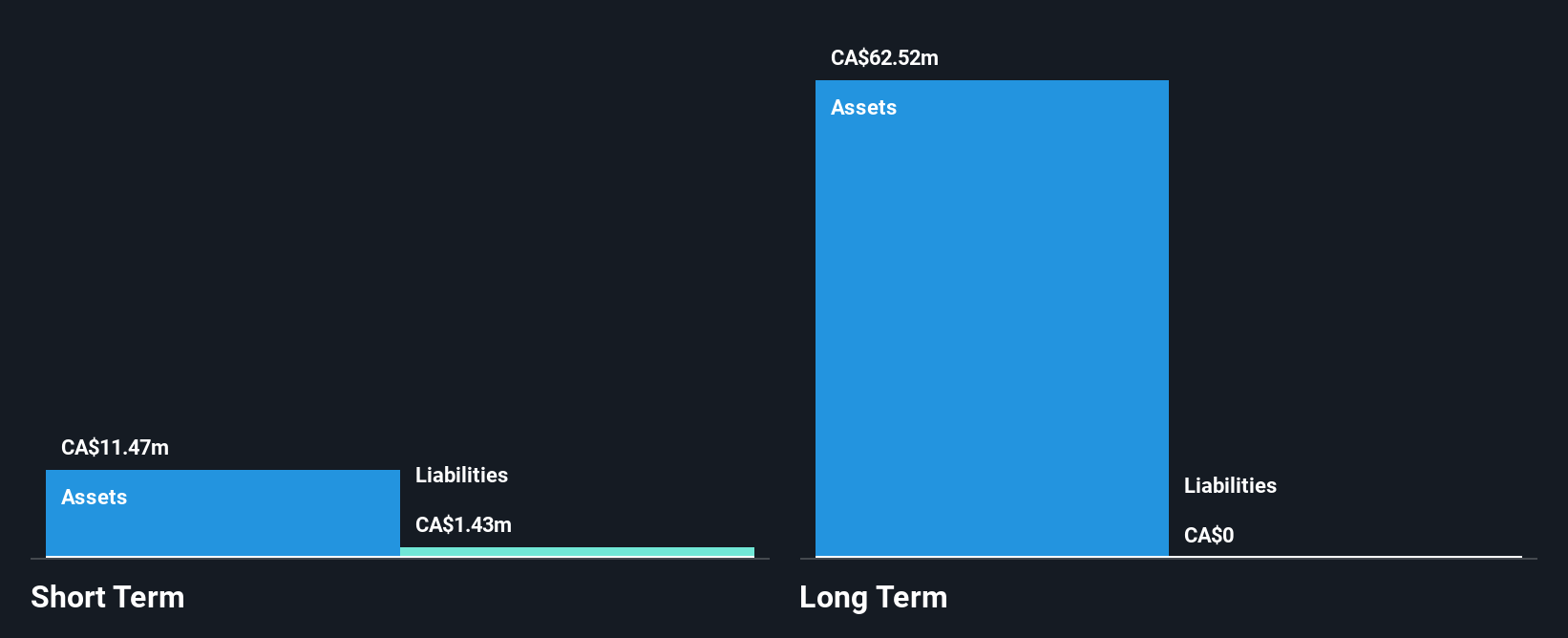

Regulus Resources Inc., with a market cap of CA$265.52 million, is a pre-revenue mineral exploration company focused on Canada and Peru. Despite its unprofitability, the company has been reducing losses over the past five years at a rate of 26.7% annually. It boasts an experienced management team and board, with tenures averaging over 10 years, providing stability in its operations. Regulus has no debt and maintains sufficient cash runway for more than two years based on current free cash flow trends. Short-term assets significantly exceed liabilities, further strengthening its financial position amidst market volatility.

- Unlock comprehensive insights into our analysis of Regulus Resources stock in this financial health report.

- Learn about Regulus Resources' historical performance here.

Zoomd Technologies (TSXV:ZOMD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zoomd Technologies Ltd. operates as a global marketing technology platform focused on user acquisition and engagement, with a market cap of CA$69.12 million.

Operations: The company generates revenue of $46.95 million from its Internet Software & Services segment.

Market Cap: CA$69.12M

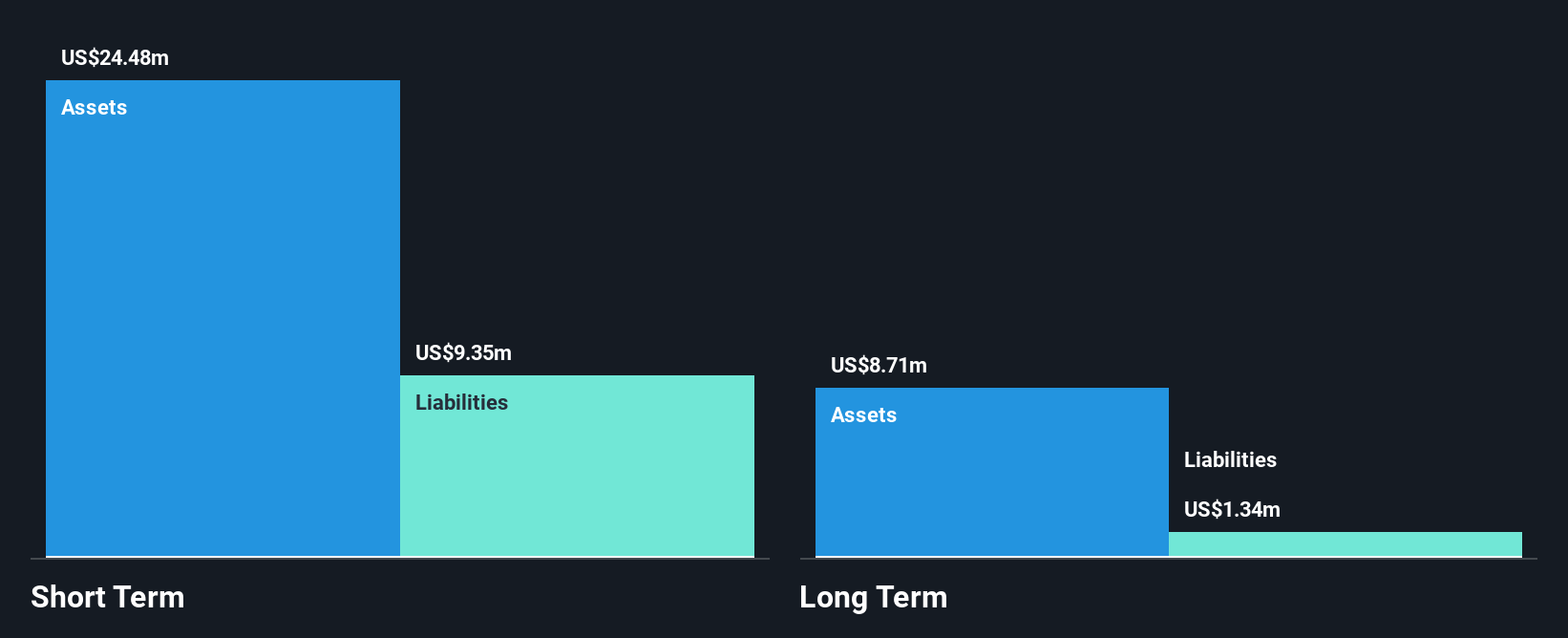

Zoomd Technologies Ltd., with a market cap of CA$69.12 million, has recently achieved profitability, marking a significant milestone. The company reports revenue of $46.95 million from its Internet Software & Services segment and exhibits robust financial health with more cash than total debt and strong operating cash flow covering debt obligations well. Its Return on Equity stands high at 39.8%, indicating efficient management of shareholder funds. Despite increased debt to equity over the past five years, interest payments are well covered by EBIT, suggesting prudent financial management amidst its growth trajectory in the marketing technology sector.

- Take a closer look at Zoomd Technologies' potential here in our financial health report.

- Gain insights into Zoomd Technologies' past trends and performance with our report on the company's historical track record.

Make It Happen

- Investigate our full lineup of 936 TSX Penny Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zoomd Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ZOMD

Zoomd Technologies

Operates as a marketing technology user-acquisition and engagement platform worldwide.

Excellent balance sheet and good value.

Market Insights

Community Narratives