- Canada

- /

- Metals and Mining

- /

- TSX:GMX

TSX Penny Stocks Worth Watching In January 2025

Reviewed by Simply Wall St

The Canadian market has been navigating a complex landscape, with recent shifts in bond yields setting the stage for potential opportunities in fixed-income investments. Amidst these broader economic trends, penny stocks continue to capture attention as they represent smaller or less-established companies that can offer value and growth potential. While the term "penny stock" may seem outdated, these investments remain relevant for those seeking to uncover hidden gems with strong financials and promising prospects.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Pulse Seismic (TSX:PSD) | CA$2.39 | CA$116.93M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.32 | CA$913.76M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.94 | CA$368.12M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.53 | CA$12.75M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.54 | CA$501.61M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.41 | CA$231.32M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$33.85M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$179.46M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.89 | CA$113.26M | ★★★★☆☆ |

Click here to see the full list of 949 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Globex Mining Enterprises (TSX:GMX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Globex Mining Enterprises Inc. focuses on the acquisition, exploration, and development of mineral properties in North America, with a market cap of CA$66.16 million.

Operations: The company generates revenue of CA$4.45 million from its Metals & Mining segment, specifically in Gold & Other Precious Metals.

Market Cap: CA$66.16M

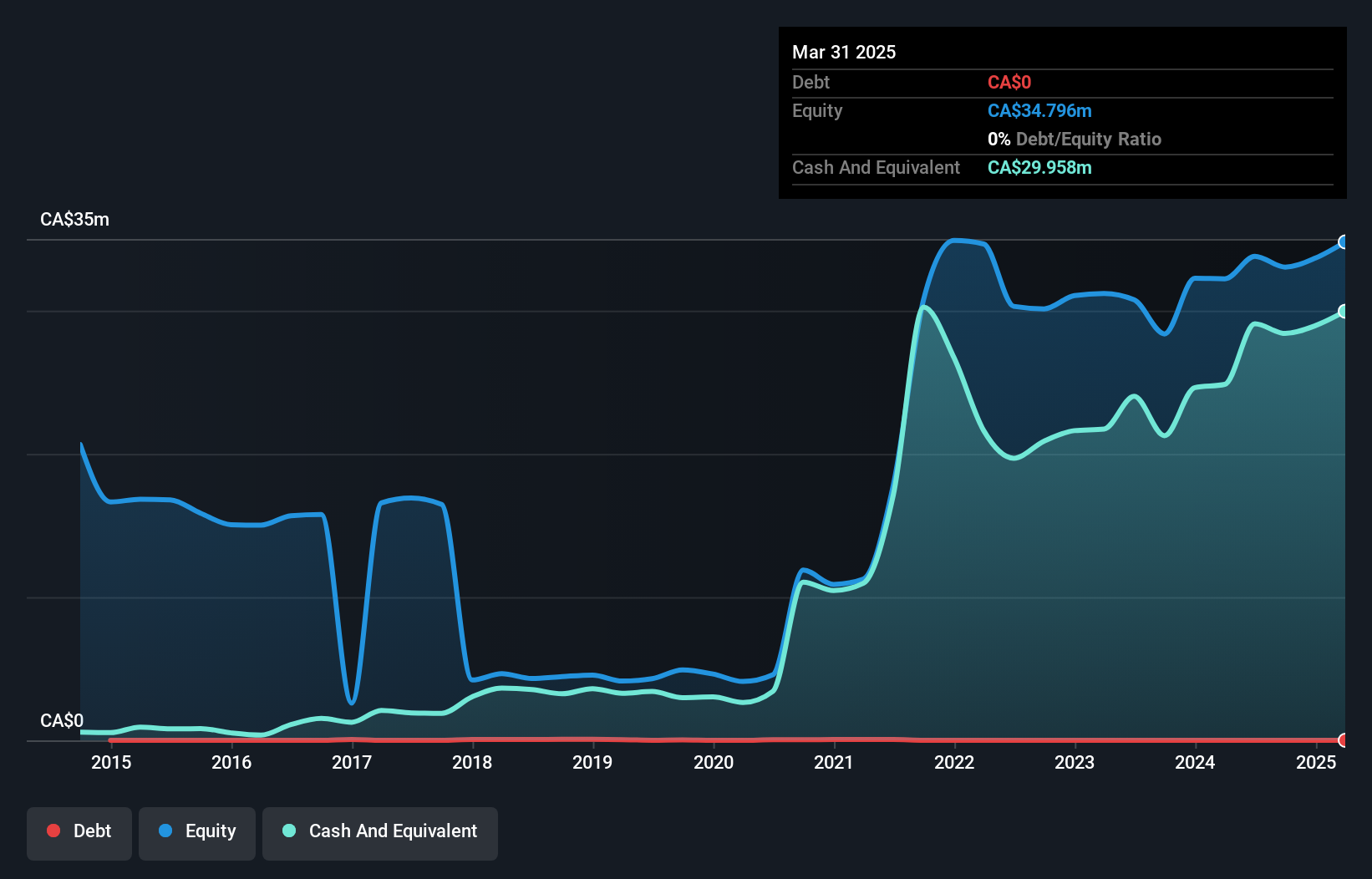

Globex Mining Enterprises Inc. has recently signed an option agreement with Electro Metals and Mining Inc., potentially securing CA$3.5 million in cash payments and shares over four years, alongside a 3% Gross Metal Royalty on its Magusi-Fabie Mines property. The company is advancing its Ironwood Gold Zone project with promising drill results, indicating high-grade gold intersections, which may enhance future mining prospects. Despite being debt-free and having a seasoned board of directors, Globex's revenue remains modest at CA$4 million, highlighting the speculative nature typical of penny stocks in the mining sector.

- Click to explore a detailed breakdown of our findings in Globex Mining Enterprises' financial health report.

- Examine Globex Mining Enterprises' past performance report to understand how it has performed in prior years.

E3 Lithium (TSXV:ETL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: E3 Lithium Limited focuses on the development and extraction of lithium resources in Alberta, with a market cap of CA$67.37 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$67.37M

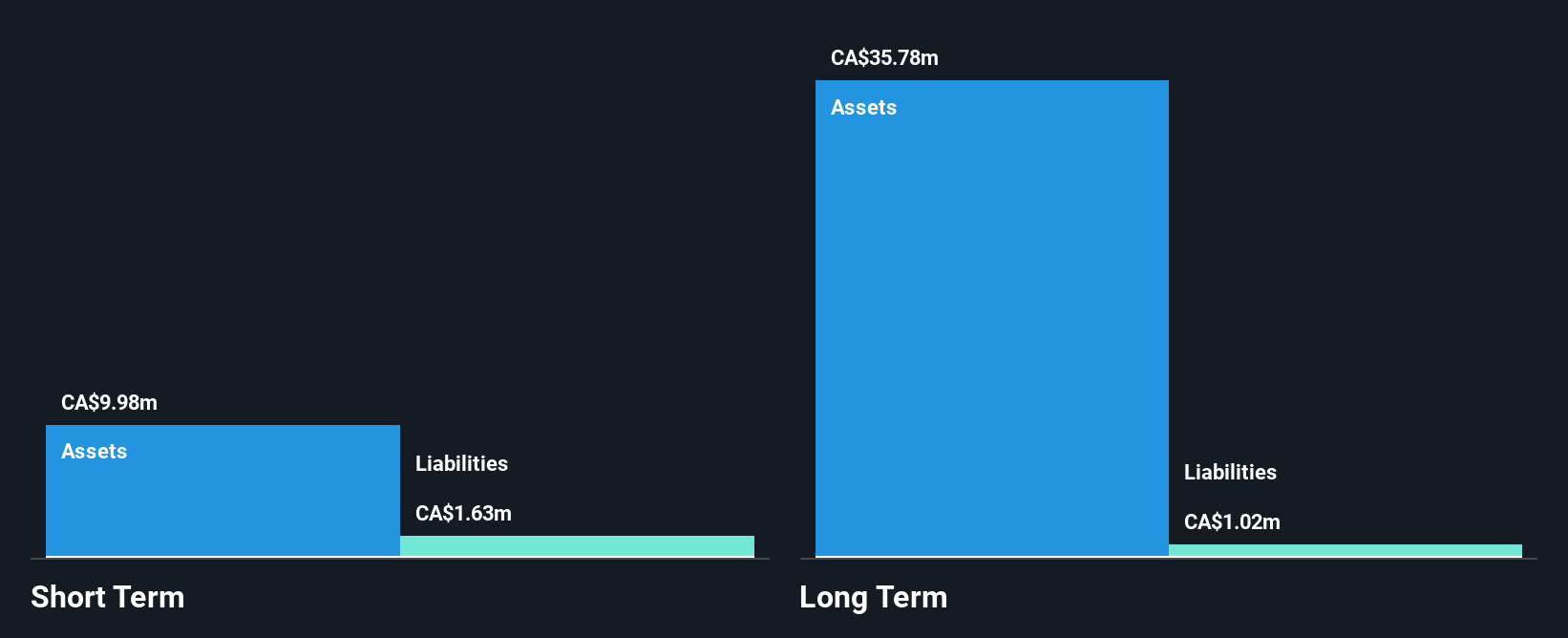

E3 Lithium is pre-revenue, focusing on developing its Demonstration Facility to produce battery-grade lithium carbonate in Alberta. The project, supported by a CA$5 million grant from Emissions Reduction Alberta, aims to validate the commercial viability of its Direct Lithium Extraction technology. Despite a net loss of CA$7.41 million for the first nine months of 2024, E3 maintains a solid financial position with short-term assets exceeding liabilities and no debt. Its management team is experienced, and recent successful pilot operations have confirmed the economic potential of its Clearwater Lithium Project.

- Take a closer look at E3 Lithium's potential here in our financial health report.

- Examine E3 Lithium's earnings growth report to understand how analysts expect it to perform.

Radius Gold (TSXV:RDU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Radius Gold Inc. is involved in the acquisition and exploration of mineral properties, with a market capitalization of CA$7.52 million.

Operations: Radius Gold Inc. does not report any specific revenue segments.

Market Cap: CA$7.52M

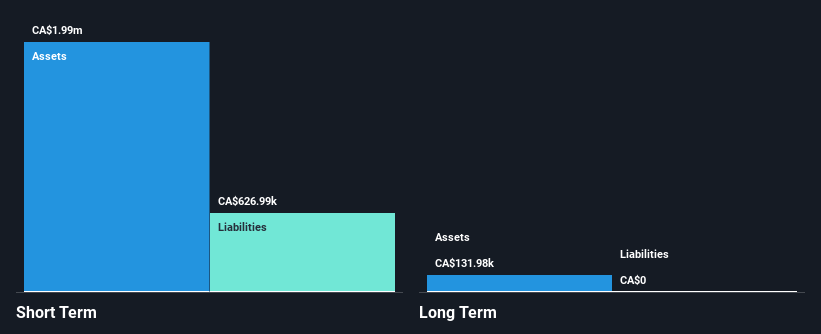

Radius Gold Inc. remains a pre-revenue company, focusing on mineral exploration with a market cap of CA$7.52 million. Despite being unprofitable, it has reduced losses over five years and maintains a debt-free status. Recent strategic moves include expanding its Tierra Roja Project in Peru from 600 to 1,870 hectares and initiating a ground magnetic survey to identify drill targets. The company recently raised CA$580,500 through private placements to support these activities. Radius Gold's seasoned management and board provide stability as they explore the potential of their copper porphyry target within Peru's prolific copper belt.

- Click here and access our complete financial health analysis report to understand the dynamics of Radius Gold.

- Review our historical performance report to gain insights into Radius Gold's track record.

Next Steps

- Explore the 949 names from our TSX Penny Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GMX

Globex Mining Enterprises

Engages in the acquisition, exploration, and development of mineral properties in North America.

Flawless balance sheet low.

Market Insights

Community Narratives