It is not uncommon to see companies perform well in the years after insiders buy shares. Unfortunately, there are also plenty of examples of share prices declining precipitously after insiders have sold shares. So shareholders might well want to know whether insiders have been buying or selling shares in Robex Resources Inc. (CVE:RBX).

Do Insider Transactions Matter?

Most investors know that it is quite permissible for company leaders, such as directors of the board, to buy and sell stock in the company. However, rules govern insider transactions, and certain disclosures are required.

We don't think shareholders should simply follow insider transactions. But it is perfectly logical to keep tabs on what insiders are doing. As Peter Lynch said, 'insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise'.

View our latest analysis for Robex Resources

Robex Resources Insider Transactions Over The Last Year

While no particular insider transaction stood out, we can still look at the overall trading.

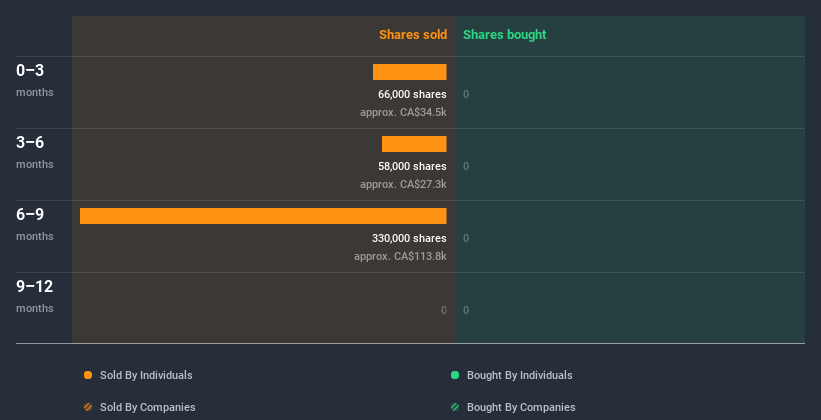

Insiders in Robex Resources didn't buy any shares in the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Insiders at Robex Resources Have Sold Stock Recently

Over the last three months, we've seen a bit of insider selling at Robex Resources. Independent Director Christian Marti divested only CA$34k worth of shares in that time. It's not great to see insider selling, nor the lack of recent buyers. But the amount sold isn't enough for us to put any weight on it.

Insider Ownership of Robex Resources

Many investors like to check how much of a company is owned by insiders. We usually like to see fairly high levels of insider ownership. It's great to see that Robex Resources insiders own 68% of the company, worth about CA$207m. I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

What Might The Insider Transactions At Robex Resources Tell Us?

We did not see any insider buying in the last three months, but we did see selling. But given the selling was modest, we're not worried. It's heartening that insiders own plenty of stock, but we'd like to see more insider buying, since the last year of Robex Resources insider transactions don't fill us with confidence. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. In terms of investment risks, we've identified 1 warning sign with Robex Resources and understanding this should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading Robex Resources or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:RBX

Robex Resources

Engages in the exploration, development, and production of gold in West Africa.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion