- Canada

- /

- Metals and Mining

- /

- CNSX:LEO

Companies Like Quaterra Resources (CVE:QTA) Are In A Position To Invest In Growth

There's no doubt that money can be made by owning shares of unprofitable businesses. Indeed, Quaterra Resources (CVE:QTA) stock is up 117% in the last year, providing strong gains for shareholders. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

Given its strong share price performance, we think it's worthwhile for Quaterra Resources shareholders to consider whether its cash burn is concerning. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Check out our latest analysis for Quaterra Resources

Does Quaterra Resources Have A Long Cash Runway?

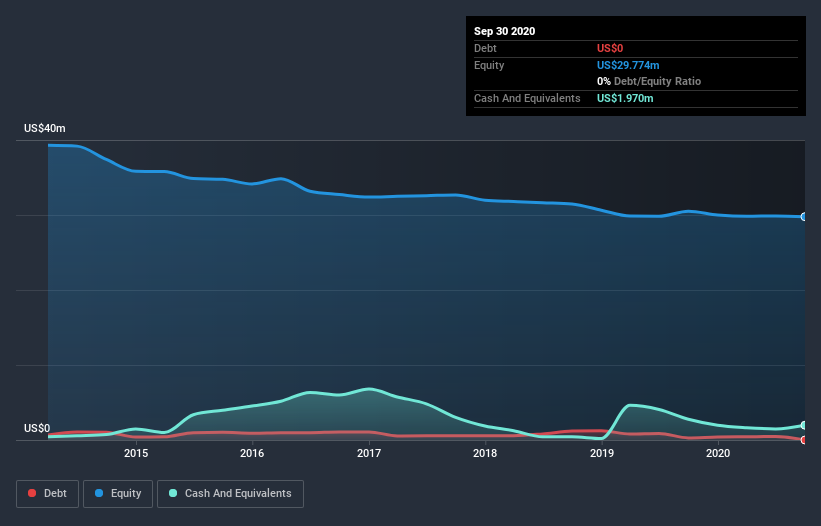

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When Quaterra Resources last reported its balance sheet in September 2020, it had zero debt and cash worth US$2.0m. Looking at the last year, the company burnt through US$903k. That means it had a cash runway of about 2.2 years as of September 2020. That's decent, giving the company a couple years to develop its business. Depicted below, you can see how its cash holdings have changed over time.

Can Quaterra Resources Raise More Cash Easily?

Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Quaterra Resources' cash burn of US$903k is about 4.2% of its US$22m market capitalisation. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

So, Should We Worry About Quaterra Resources' Cash Burn?

Given it's an early stage company, we don't have a lot of data with which to judge Quaterra Resources' cash burn. Certainly, we'd be more confident in the stock if it was generating operating revenue. Having said that, we can say that its cash burn relative to its market cap was a real positive. Overall, we don't think shareholders need to be worried about its cash burn in the near term. On another note, we conducted an in-depth investigation of the company, and identified 3 warning signs for Quaterra Resources (1 doesn't sit too well with us!) that you should be aware of before investing here.

Of course Quaterra Resources may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade Quaterra Resources, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CNSX:LEO

Lion Copper and Gold

A mineral exploration company, engages in the acquisition, exploration, and development of copper projects in the United States.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion