- Canada

- /

- Metals and Mining

- /

- TSXV:ICM

TSX Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

The Canadian market has shown resilience, with favorable factors such as potential interest rate cuts and positive corporate earnings growth supporting a stable outlook despite uncertainties around trade and credit concerns. In this context, penny stocks—often representing smaller or newer companies—remain relevant for investors seeking growth opportunities at lower price points. When these stocks are backed by strong financials and solid fundamentals, they can offer an appealing mix of value and potential upside in the current market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.52 | CA$63.71M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.39 | CA$3.26M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.355 | CA$53.32M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.26 | CA$838.27M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.09 | CA$21.6M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.70 | CA$436.03M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.34 | CA$169.52M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.07 | CA$196.51M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.79 | CA$9.83M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 413 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Iconic Minerals (TSXV:ICM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Iconic Minerals Ltd. is a mineral exploration company focused on acquiring and exploring gold and lithium properties in Nevada and Canada, with a market cap of CA$12.33 million.

Operations: The company has not reported any revenue segments.

Market Cap: CA$12.33M

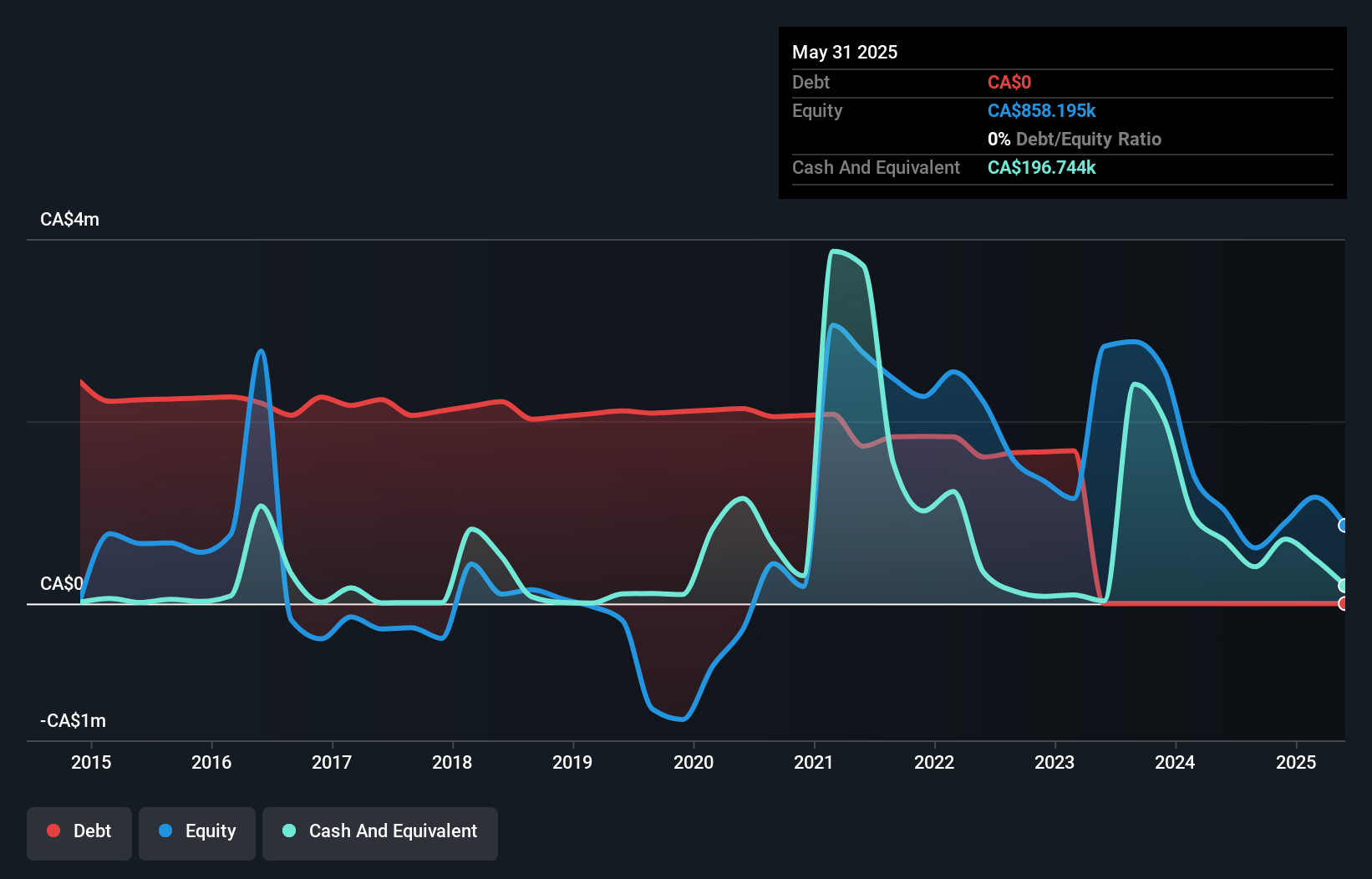

Iconic Minerals Ltd., a pre-revenue company with a market cap of CA$12.33 million, focuses on gold and lithium exploration in Nevada and Canada. Despite its unprofitability, the company has reduced losses over the past five years. Its experienced management and board members bring stability, although share price volatility remains high compared to most Canadian stocks. Recently, Iconic announced a private placement to raise CA$2.55 million by issuing units at CAD 0.085 each, potentially providing capital for future exploration activities. The company's short-term assets exceed long-term liabilities but fall short of covering short-term obligations fully.

- Click here and access our complete financial health analysis report to understand the dynamics of Iconic Minerals.

- Explore historical data to track Iconic Minerals' performance over time in our past results report.

Plata Latina Minerals (TSXV:PLA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Plata Latina Minerals Corporation, with a market cap of CA$13.83 million, is involved in the exploration and evaluation of mineral resource properties in Mexico through its subsidiaries.

Operations: Plata Latina Minerals Corporation does not report any revenue segments as it is focused on the exploration and evaluation of mineral resource properties in Mexico.

Market Cap: CA$13.83M

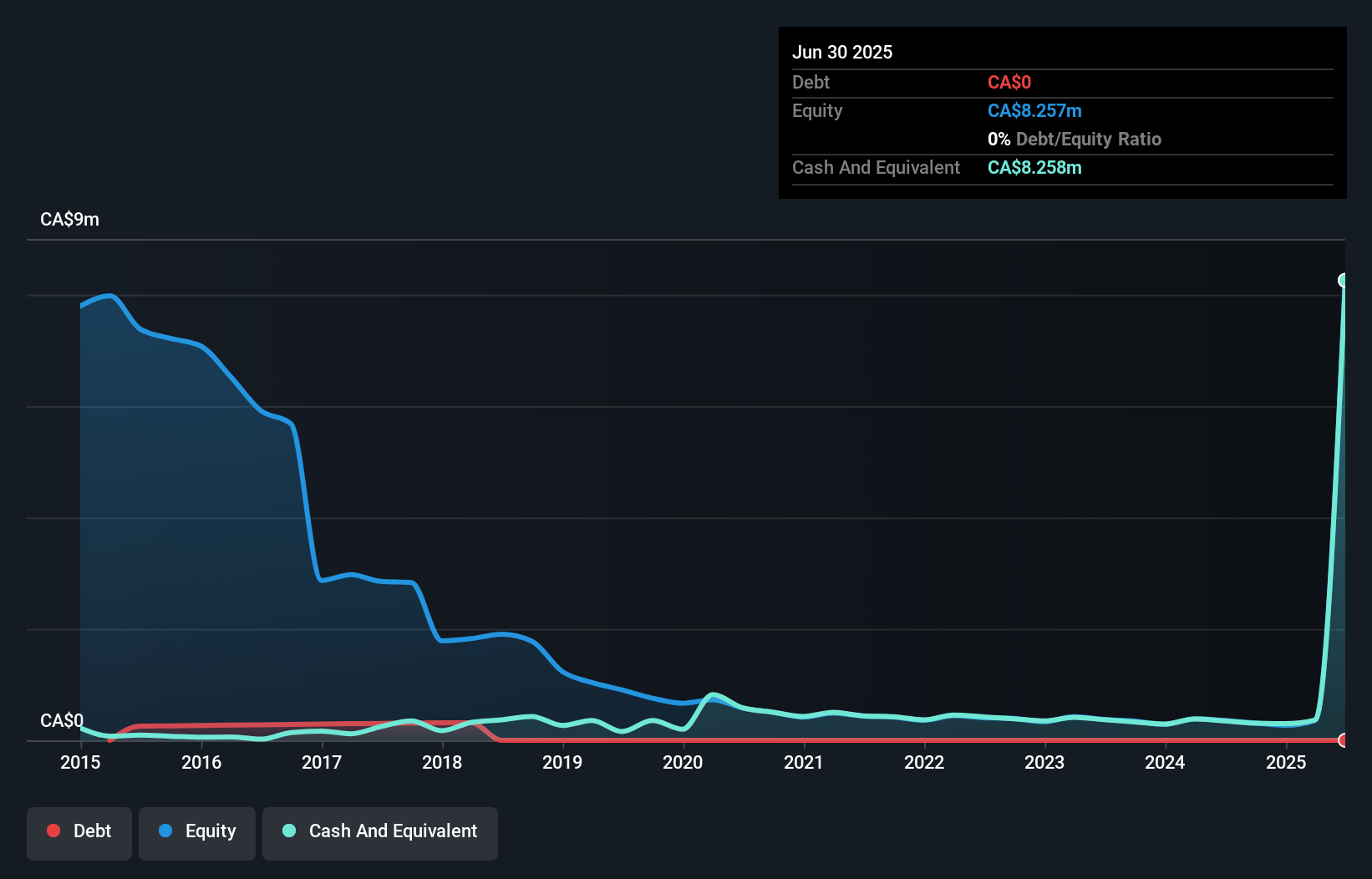

Plata Latina Minerals Corporation, with a market cap of CA$13.83 million, remains pre-revenue while focusing on mineral exploration in Mexico. The company recently became profitable, reporting net income of CA$7.58 million for the second quarter of 2025 due to a large one-off gain. Its financial stability is underscored by no debt and short-term assets exceeding liabilities. However, its share price has been highly volatile over the past three months. Recent strategic moves include private placements raising up to CA$20 million and board changes aimed at strengthening governance as it navigates growth opportunities in the mining sector.

- Dive into the specifics of Plata Latina Minerals here with our thorough balance sheet health report.

- Assess Plata Latina Minerals' previous results with our detailed historical performance reports.

Auxly Cannabis Group (TSX:XLY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Auxly Cannabis Group Inc. is a consumer packaged goods company specializing in cannabis products within the Canadian market, with a market cap of CA$182.04 million.

Operations: The company generates revenue through its Venture Capital segment, which amounted to CA$139.38 million.

Market Cap: CA$182.04M

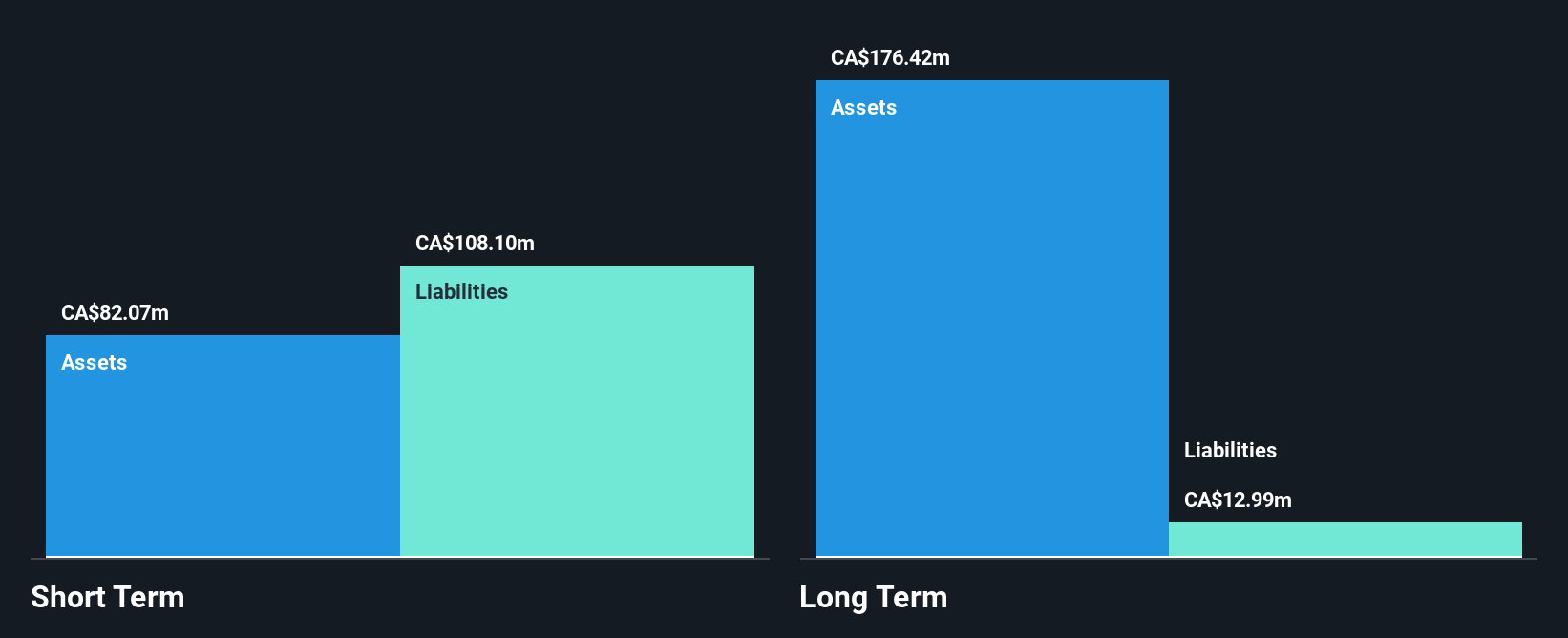

Auxly Cannabis Group Inc., with a market cap of CA$182.04 million, has recently shown financial improvement by reporting a net income of CA$20.42 million for the first half of 2025, compared to a previous net loss. The company has not diluted shareholders significantly in the past year and maintains satisfactory debt levels with its debt well covered by operating cash flow. Despite short-term liabilities exceeding assets, long-term liabilities are adequately covered. Auxly's high return on equity and reduced volatility signal potential stability within the volatile cannabis sector, while experienced management may aid in navigating future growth challenges.

- Navigate through the intricacies of Auxly Cannabis Group with our comprehensive balance sheet health report here.

- Understand Auxly Cannabis Group's track record by examining our performance history report.

Turning Ideas Into Actions

- Investigate our full lineup of 413 TSX Penny Stocks right here.

- Curious About Other Options? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ICM

Iconic Minerals

A mineral exploration company, engages in the acquisition and exploration of gold and lithium properties in Nevada and Canada.

Excellent balance sheet with low risk.

Market Insights

Community Narratives