As we move through 2025, the Canadian market is navigating a complex landscape of persistent inflation and solid corporate earnings, with European equities quietly outperforming amid global uncertainties. In such a climate, identifying stocks with strong fundamentals becomes crucial for investors seeking to capitalize on market opportunities. While the term "penny stock" might seem outdated, these smaller or newer companies can still offer significant growth potential when backed by robust financials. This article highlights three promising penny stocks on the TSX that combine financial strength with potential for outsized gains.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.875 | CA$179.87M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.75 | CA$442.31M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.52 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.70 | CA$638.07M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.19 | CA$31.16M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$4.07M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.90 | CA$416.12M | ★★★★★☆ |

| Copper Road Resources (TSXV:CRD) | CA$0.02 | CA$975.24k | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.86 | CA$177.67M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.15 | CA$224.35M | ★★★★☆☆ |

Click here to see the full list of 935 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Phenom Resources (TSXV:PHNM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Phenom Resources Corp. is involved in the acquisition, exploration, evaluation, and development of natural resource properties in Canada and the United States with a market cap of CA$29.43 million.

Operations: Phenom Resources Corp. does not report any revenue segments, focusing instead on the acquisition, exploration, evaluation, and development of natural resource properties in Canada and the United States.

Market Cap: CA$29.43M

Phenom Resources Corp., with a market cap of CA$29.43 million, is currently pre-revenue and focuses on exploration and development of natural resource properties. Recent soil sampling results have defined a significant Carlin-type gold deposit system, enhancing its exploration potential in Nevada. The company remains debt-free, with short-term assets exceeding liabilities, but it has limited cash runway despite raising CA$1.35 million through a private placement in January 2025. While unprofitable with negative return on equity, Phenom's experienced board may provide strategic guidance as it continues to explore its promising mineral systems without meaningful shareholder dilution over the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of Phenom Resources.

- Evaluate Phenom Resources' historical performance by accessing our past performance report.

Tier One Silver (TSXV:TSLV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tier One Silver Inc. is involved in the acquisition, exploration, and development of mineral properties in Peru, with a market cap of CA$15.39 million.

Operations: Currently, Tier One Silver Inc. does not report any revenue segments.

Market Cap: CA$15.39M

Tier One Silver Inc., with a market cap of CA$15.39 million, is pre-revenue and focused on mineral exploration in Peru. The company has managed to reduce its losses over the past five years, reporting a net loss of CA$0.84 million for Q3 2024, an improvement from the previous year. Despite having highly volatile share prices and limited cash runway, Tier One has raised additional capital recently. It remains debt-free with short-term assets exceeding long-term liabilities but not covering short-term liabilities fully. The experienced board and management team may offer strategic oversight as the company navigates its financial challenges without significant shareholder dilution recently.

- Take a closer look at Tier One Silver's potential here in our financial health report.

- Review our historical performance report to gain insights into Tier One Silver's track record.

Ynvisible Interactive (TSXV:YNV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ynvisible Interactive Inc. develops and sells electrochromic displays in Europe and North America, with a market cap of CA$19.45 million.

Operations: There are no reported revenue segments for Ynvisible Interactive Inc.

Market Cap: CA$19.45M

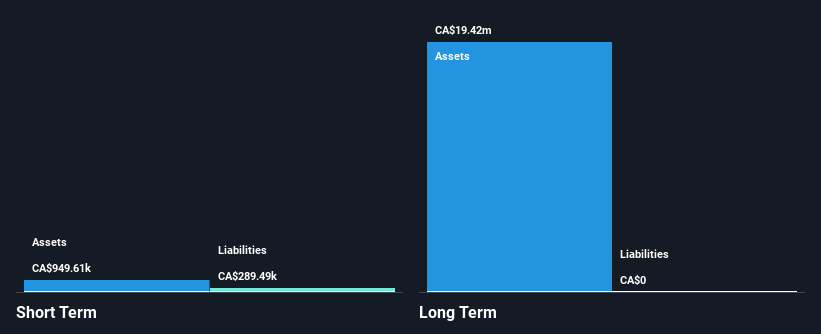

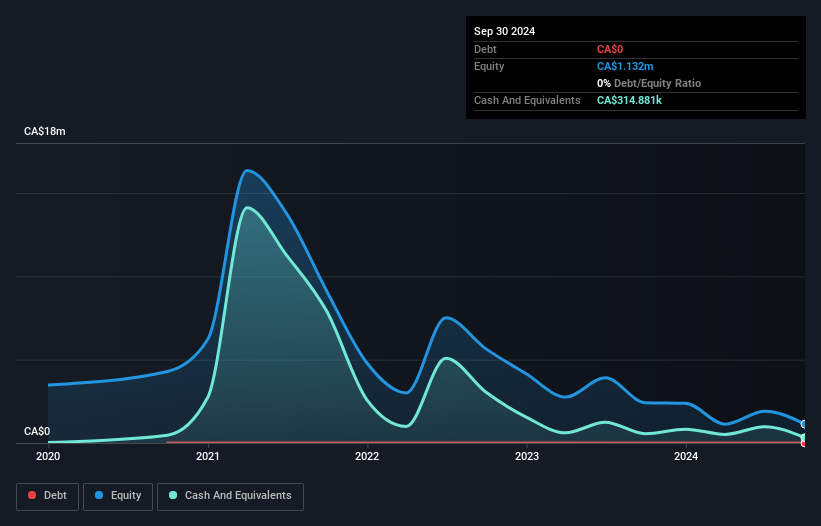

Ynvisible Interactive Inc., with a market cap of CA$19.45 million, is pre-revenue, generating less than US$1 million in sales. Recent collaborations highlight its potential for scalable growth, such as integrating e-paper displays into security and transit systems. Despite being debt-free and having sufficient short-term assets to cover liabilities, Ynvisible remains unprofitable with increasing losses over the past five years. The company has a seasoned management team and board but faces high share price volatility. Its focus on energy-efficient technology positions it well for future opportunities, albeit within the constraints of limited current revenue streams.

- Navigate through the intricacies of Ynvisible Interactive with our comprehensive balance sheet health report here.

- Gain insights into Ynvisible Interactive's historical outcomes by reviewing our past performance report.

Summing It All Up

- Reveal the 935 hidden gems among our TSX Penny Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:YNV

Ynvisible Interactive

Develops and sells electrochromic displays in Europe and North America.

Flawless balance sheet slight.

Market Insights

Community Narratives