In the last week, the Canadian market has stayed flat, but it is up 27% over the past year, with earnings forecast to grow by 16% annually. For those looking to invest in smaller or newer companies, penny stocks—despite their somewhat outdated name—can still offer surprising value. This article highlights three penny stocks that demonstrate financial strength and could potentially provide long-term opportunities for investors willing to explore beyond established names.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.65 | CA$593.37M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.31 | CA$117.59M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.42 | CA$12.03M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.145 | CA$4.56M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.33 | CA$313.02M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.31 | CA$227.75M | ★★★★★☆ |

| Amerigo Resources (TSX:ARG) | CA$1.76 | CA$291.81M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.14 | CA$30.62M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$4.07M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.24 | CA$137.16M | ★★★★☆☆ |

Click here to see the full list of 952 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Charlotte's Web Holdings (TSX:CWEB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Charlotte's Web Holdings, Inc. is engaged in the farming, manufacture, marketing, and sale of hemp-derived cannabidiol (CBD) wellness products with a market cap of CA$31.55 million.

Operations: The company generates revenue from its hemp-based, CBD wellness products, amounting to $54.55 million.

Market Cap: CA$31.55M

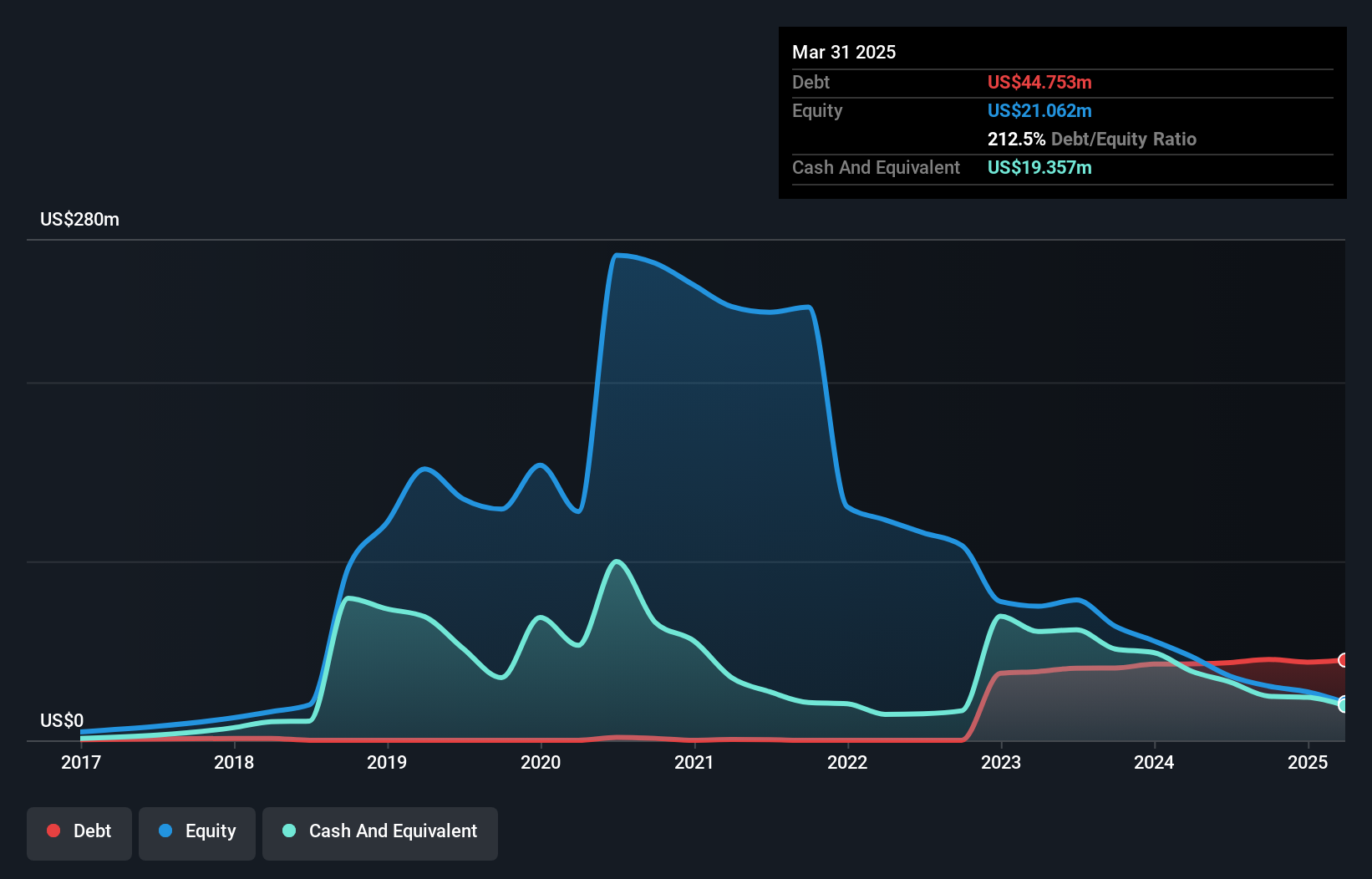

Charlotte's Web Holdings, Inc. faces challenges typical of penny stocks, with a market cap of CA$31.55 million and declining revenue, from US$16.01 million to US$12.29 million year-over-year for Q2 2024. The company remains unprofitable and has seen increased losses over the past five years at an annual rate of 18.8%. Despite having sufficient cash runway for over a year, the company's debt-to-equity ratio has risen significantly to 121.3% in five years, indicating financial strain. Recent changes in auditors may reflect strategic shifts as it navigates its path toward stability amidst industry volatility.

- Take a closer look at Charlotte's Web Holdings' potential here in our financial health report.

- Understand Charlotte's Web Holdings' earnings outlook by examining our growth report.

Century Lithium (TSXV:LCE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Century Lithium Corp. is an exploration and development stage company focused on acquiring, exploring, evaluating, and developing mineral resource properties in the United States with a market cap of CA$56.06 million.

Operations: Currently, there are no reported revenue segments for Century Lithium Corp.

Market Cap: CA$56.06M

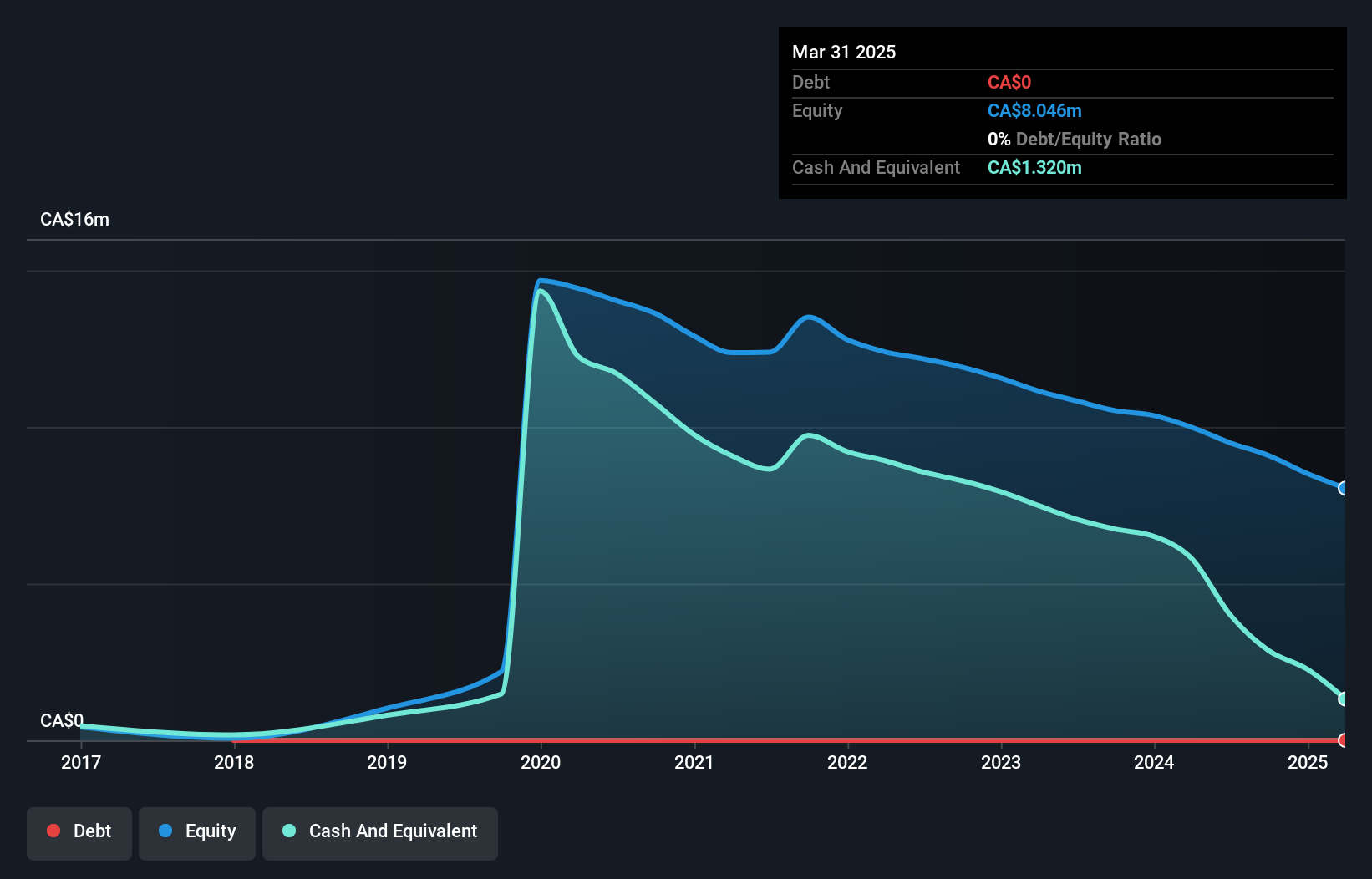

Century Lithium Corp., with a market cap of CA$56.06 million, is pre-revenue and focuses on developing its Angel Island lithium project in Nevada. Recent advancements include the production of battery-grade lithium carbonate with purity levels reaching 99.5% at its pilot plant, underscoring potential for future revenue generation. The company remains debt-free, with short-term assets covering liabilities and a sufficient cash runway exceeding one year. Despite these strengths, Century Lithium is unprofitable and not expected to achieve profitability within three years, highlighting typical risks associated with penny stocks in the exploration stage.

- Navigate through the intricacies of Century Lithium with our comprehensive balance sheet health report here.

- Gain insights into Century Lithium's outlook and expected performance with our report on the company's earnings estimates.

Sun Peak Metals (TSXV:PEAK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sun Peak Metals Corp. is a junior mining company focused on acquiring, exploring, and developing resource properties for precious and base metals in Ethiopia, with a market cap of CA$39.63 million.

Operations: Sun Peak Metals Corp. has not reported any revenue segments.

Market Cap: CA$39.63M

Sun Peak Metals Corp., with a market cap of CA$39.63 million, is pre-revenue and primarily engaged in exploration activities in Ethiopia. The company remains debt-free, with short-term assets significantly exceeding liabilities and no long-term liabilities, providing financial stability. It has a sufficient cash runway for over two years if its free cash flow continues to grow at historical rates. Despite reducing losses over the past five years, Sun Peak Metals remains unprofitable with high share price volatility compared to other Canadian stocks. The experienced management team adds strength amidst typical risks associated with penny stocks in the mining sector.

- Click to explore a detailed breakdown of our findings in Sun Peak Metals' financial health report.

- Understand Sun Peak Metals' track record by examining our performance history report.

Make It Happen

- Click this link to deep-dive into the 952 companies within our TSX Penny Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CWEB

Charlotte's Web Holdings

Engages in the farming, manufacturing, marketing, and sale of hemp-derived cannabidiol (CBD) and other botanical-based wellness products.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives