- Canada

- /

- Metals and Mining

- /

- TSXV:OPHR

TSX Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

The Canadian market has been navigating a period of heightened optimism following the decisive U.S. election outcome, which removed a significant source of uncertainty and contributed to record highs for both the S&P 500 and TSX this year. As investors assess the potential policy implications, including tax cuts and deregulation, attention is shifting towards long-term fundamentals that could shape future opportunities. In this context, penny stocks—often representing smaller or newer companies—continue to offer potential value through their affordability and growth prospects when backed by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.65 | CA$611.45M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.65 | CA$276.89M | ★★★★★☆ |

| Alvopetro Energy (TSXV:ALV) | CA$4.83 | CA$179.38M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$117.05M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.435 | CA$12.18M | ★★★★★☆ |

| Mandalay Resources (TSX:MND) | CA$3.28 | CA$311.11M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.17 | CA$4.87M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.22 | CA$219.69M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.13 | CA$30.36M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.17M | ★★★★★★ |

Click here to see the full list of 962 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

ThreeD Capital (CNSX:IDK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: ThreeD Capital Inc. is a venture capital firm focusing on seed/startup, early venture, and growth capital opportunistic investments, with a market cap of CA$13.60 million.

Operations: The company's revenue is derived entirely from its investing segment, amounting to CA$8.76 million.

Market Cap: CA$13.6M

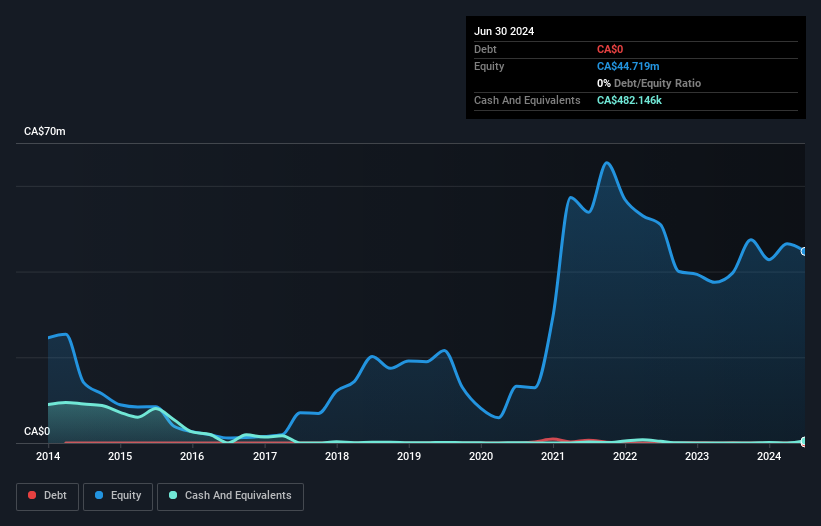

ThreeD Capital Inc., with a market cap of CA$13.60 million, has shown a significant turnaround, reporting CA$8.37 million in revenue and achieving profitability with a net income of CA$4.02 million for the year ended June 30, 2024. The company is debt-free and has completed a share buyback program, repurchasing 4.82% of its shares for CA$0.58 million, indicating confidence in its valuation despite recent shareholder dilution and volatility concerns. While short-term liabilities exceed short-term assets by CA$6.9M, the company maintains high-quality earnings and an experienced board to navigate future challenges effectively.

- Unlock comprehensive insights into our analysis of ThreeD Capital stock in this financial health report.

- Gain insights into ThreeD Capital's past trends and performance with our report on the company's historical track record.

Genius Metals (TSXV:GENI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Genius Metals Inc. is involved in the acquisition, exploration, and development of mineral properties in Canada with a market cap of CA$7.50 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$7.5M

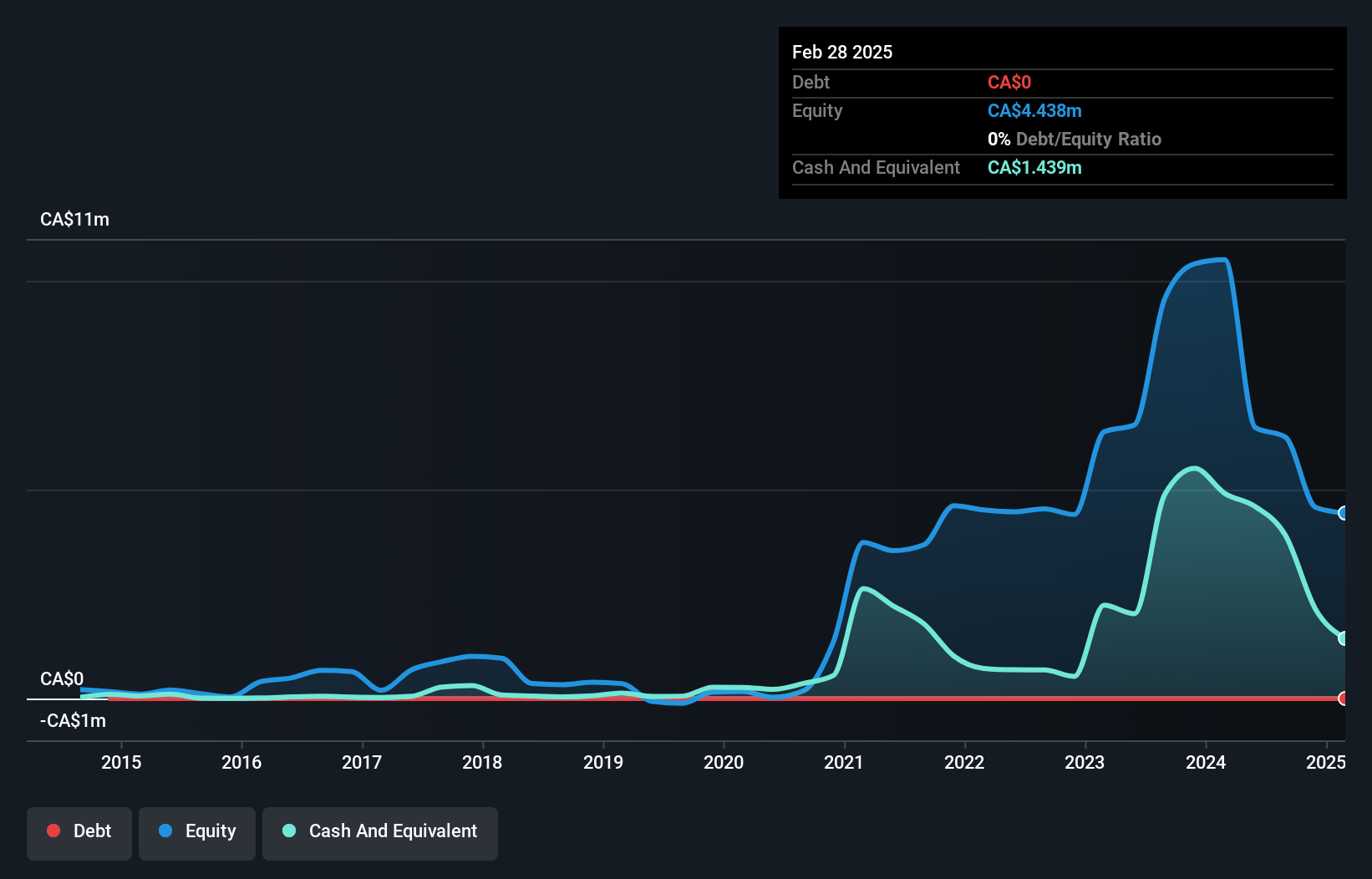

Genius Metals Inc., with a market cap of CA$7.50 million, is pre-revenue and focused on mineral exploration in Canada and Morocco. Recent expansions include the acquisition of options for 100% interest in Moroccan copper projects, Timarighine and Tifernine, highlighting its strategic shift towards high-value copper exploration. Despite being unprofitable, the company has reduced losses over five years by 8.3% annually and remains debt-free with no long-term liabilities. However, shareholders faced dilution last year as shares outstanding increased by 9.7%. The company recently raised capital through a private placement to support its cash runway needs.

- Take a closer look at Genius Metals' potential here in our financial health report.

- Examine Genius Metals' past performance report to understand how it has performed in prior years.

Ophir Metals (TSXV:OPHR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ophir Metals Corp. is involved in the acquisition, exploration, and evaluation of mineral property assets in the United States with a market cap of CA$9.30 million.

Operations: Ophir Metals Corp. has not reported any revenue segments.

Market Cap: CA$9.3M

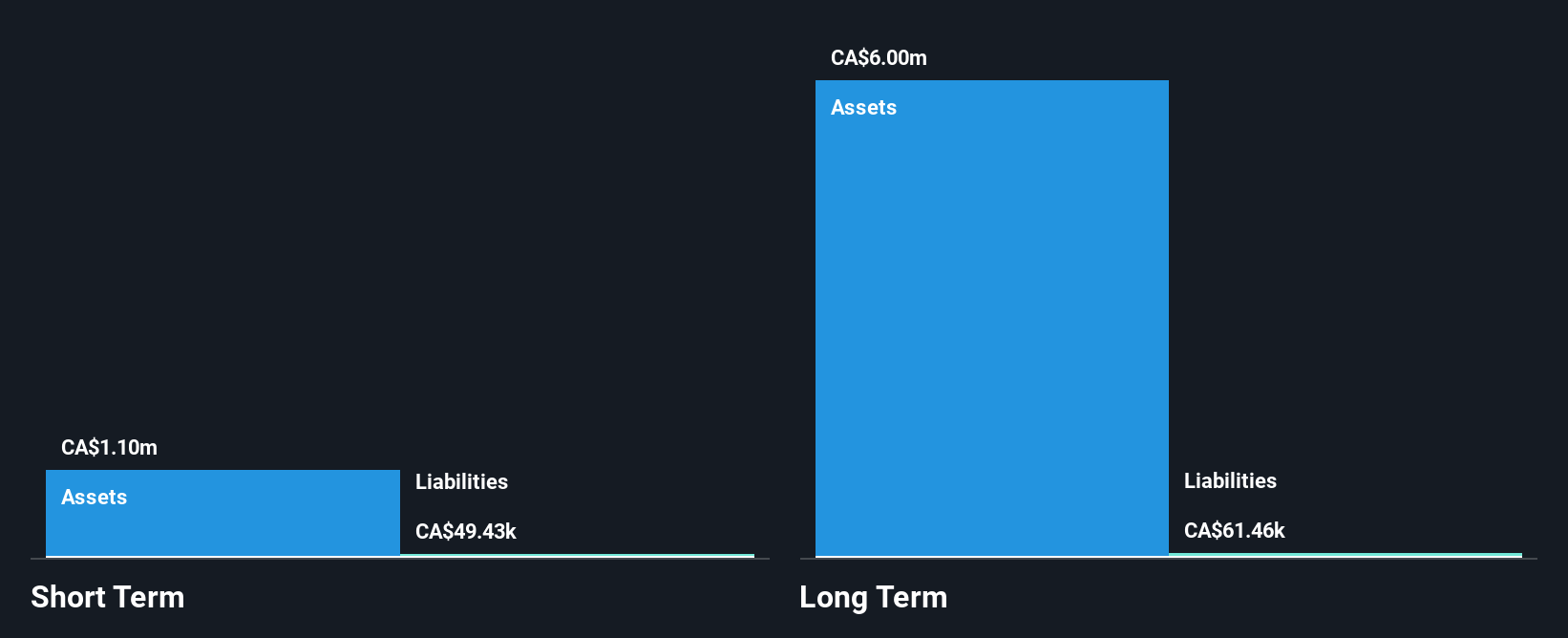

Ophir Metals Corp., with a market cap of CA$9.30 million, is pre-revenue and focuses on mineral property exploration in the U.S. The company remains debt-free, with short-term assets (CA$4.2M) covering its liabilities (CA$1.2M). Ophir's share price has been volatile recently, and shareholders experienced dilution as shares increased by 3.2% over the past year. Despite ongoing losses, recent surface sampling at the Pilipas Lithium Property showed promising results for cesium oxide and gold content, potentially enhancing future prospects if assays from their inaugural drill program confirm these findings.

- Navigate through the intricacies of Ophir Metals with our comprehensive balance sheet health report here.

- Gain insights into Ophir Metals' historical outcomes by reviewing our past performance report.

Next Steps

- Unlock our comprehensive list of 962 TSX Penny Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:OPHR

Ophir Metals

Engages in acquisition, exploration, and development of mineral property assets in the United States and Canada.

Moderate risk with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026