- Canada

- /

- Metals and Mining

- /

- TSXV:SME

Top TSX Penny Stocks With Market Caps Larger Than CA$8M

Reviewed by Simply Wall St

The Canadian stock market has been buoyed by easing monetary policies and strong performances in financials and materials, contributing to solid returns. In this context, penny stocks—often representing smaller or newer companies—remain a relevant investment area despite the term's vintage feel. These stocks can offer surprising value and growth potential when underpinned by strong financials, making them worth exploring for investors seeking opportunities beyond the mainstream.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.56 | CA$158.19M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.66 | CA$281.86M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.43 | CA$12.32M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.22 | CA$115.5M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.60 | CA$574.88M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.23 | CA$374.78M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.34 | CA$231.56M | ★★★★★☆ |

| Silvercorp Metals (TSX:SVM) | CA$4.51 | CA$994.26M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.10 | CA$30.36M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.16 | CA$5.18M | ★★★★★★ |

Click here to see the full list of 915 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Newport Exploration (TSXV:NWX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Newport Exploration Ltd. is a natural resource company involved in acquiring and exploring resource properties in Canada and Australia, with a market cap of CA$8.45 million.

Operations: No revenue segments are reported for Newport Exploration Ltd.

Market Cap: CA$8.45M

Newport Exploration Ltd., with a market cap of CA$8.45 million, operates as a pre-revenue natural resource company, primarily involved in exploration activities. Despite its lack of significant revenue streams, the company reported net income of CA$1.92 million for the year ended July 31, 2024. Newport's outstanding return on equity at 74.7% and stable weekly volatility suggest financial resilience in a volatile sector. The absence of debt and long-term liabilities further strengthens its balance sheet position, while seasoned board members provide experienced oversight. However, declining earnings growth over recent years remains a concern for potential investors seeking growth opportunities in penny stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of Newport Exploration.

- Gain insights into Newport Exploration's past trends and performance with our report on the company's historical track record.

QC Copper and Gold (TSXV:QCCU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: QC Copper and Gold Inc. is a Canadian company focused on the exploration, development, and production of mineral properties, with a market cap of CA$20.92 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$20.92M

QC Copper and Gold Inc., with a market cap of CA$20.92 million, is currently pre-revenue, focusing on mineral exploration and development. The company recently completed a cost-effective core resampling program at its Thierry Copper Project, potentially enhancing resource estimates without the expense of new drilling. QC Copper's financials show no debt and sufficient cash runway for over three years, though it remains unprofitable with increasing losses over the past five years. Management's average tenure suggests experience in navigating these challenges. Recent acquisitions like the Roger Gold-Copper Project could strategically position QC Copper for future growth within Canada's mining sector.

- Unlock comprehensive insights into our analysis of QC Copper and Gold stock in this financial health report.

- Examine QC Copper and Gold's past performance report to understand how it has performed in prior years.

Sama Resources (TSXV:SME)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sama Resources Inc. is engaged in the exploration and development of mineral properties in West Africa, with a market capitalization of CA$19.81 million.

Operations: Sama Resources Inc. currently does not report any revenue segments, as it is focused on the exploration and development of mineral properties in West Africa.

Market Cap: CA$19.81M

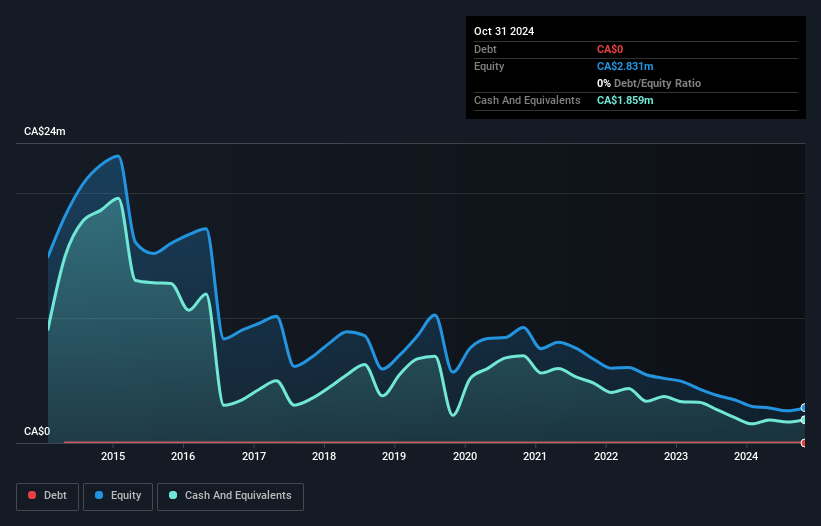

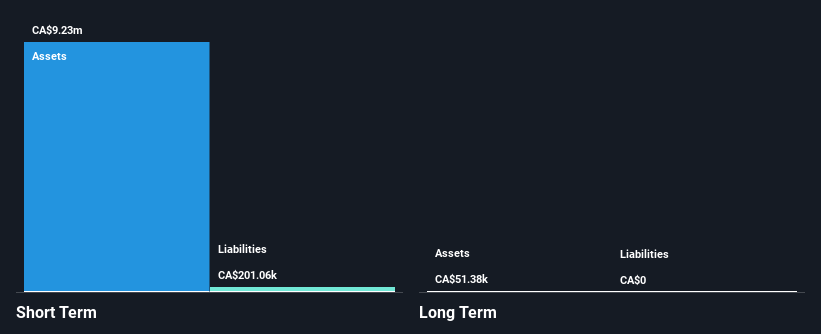

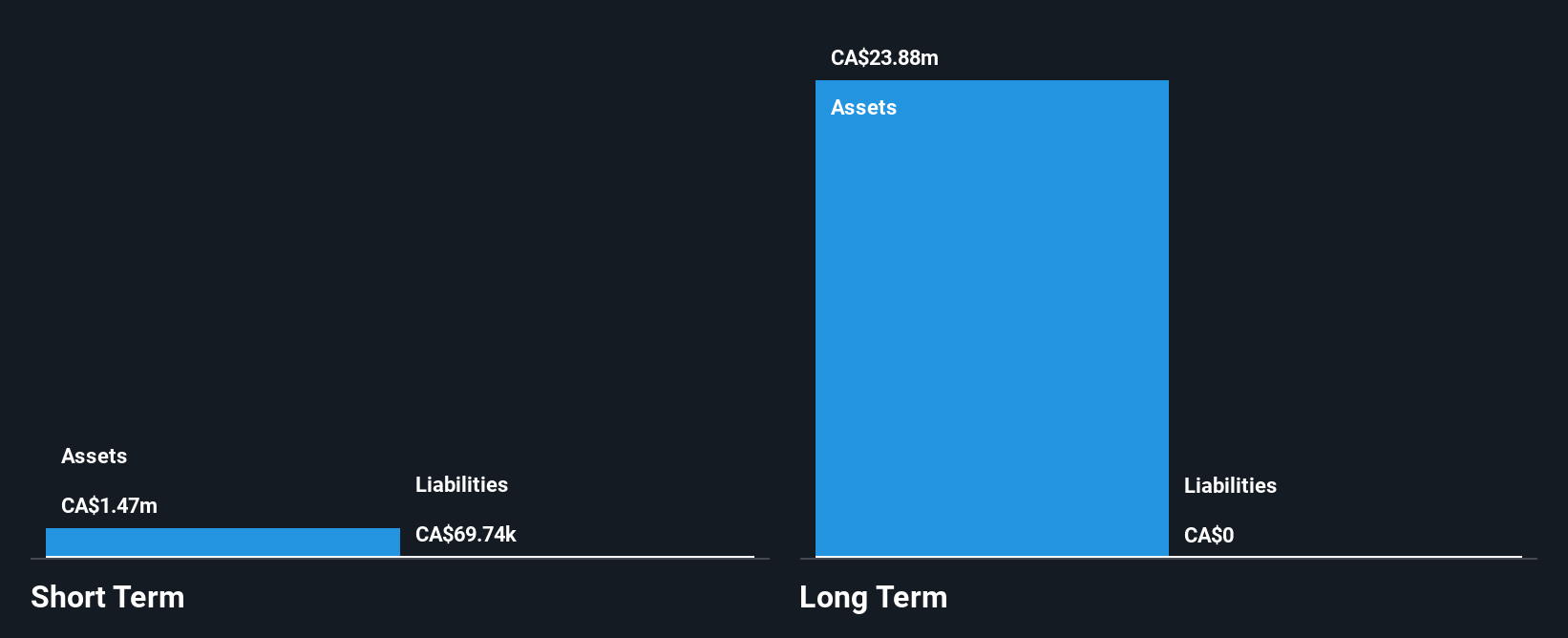

Sama Resources Inc., with a market cap of CA$19.81 million, has transitioned to profitability this year, reporting net income of CA$2.14 million for the third quarter, a significant improvement from the previous year's loss. Despite being pre-revenue and having highly volatile share prices over the past three months, Sama's financial health is bolstered by its debt-free status and strong short-term asset position. The management team and board are experienced, with average tenures exceeding industry norms. The company's low price-to-earnings ratio suggests potential value compared to the broader Canadian market despite high non-cash earnings levels.

- Take a closer look at Sama Resources' potential here in our financial health report.

- Understand Sama Resources' track record by examining our performance history report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 915 TSX Penny Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SME

Flawless balance sheet low.

Market Insights

Community Narratives