Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Nouveau Monde Graphite Inc. (CVE:NOU) does use debt in its business. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Nouveau Monde Graphite

What Is Nouveau Monde Graphite's Debt?

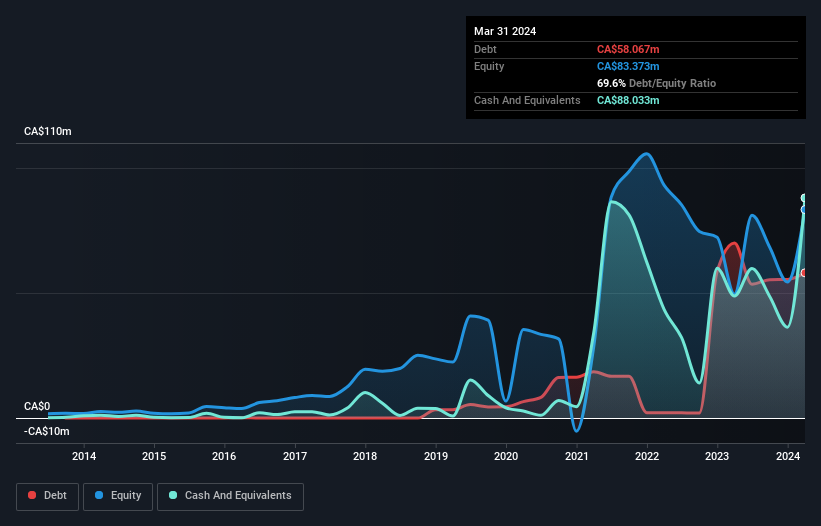

As you can see below, Nouveau Monde Graphite had CA$58.1m of debt at March 2024, down from CA$70.0m a year prior. However, its balance sheet shows it holds CA$88.0m in cash, so it actually has CA$30.0m net cash.

A Look At Nouveau Monde Graphite's Liabilities

The latest balance sheet data shows that Nouveau Monde Graphite had liabilities of CA$89.1m due within a year, and liabilities of CA$3.42m falling due after that. Offsetting this, it had CA$88.0m in cash and CA$4.75m in receivables that were due within 12 months. So these liquid assets roughly match the total liabilities.

This state of affairs indicates that Nouveau Monde Graphite's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the CA$303.9m company is short on cash, but still worth keeping an eye on the balance sheet. Simply put, the fact that Nouveau Monde Graphite has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Nouveau Monde Graphite can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Given its lack of meaningful operating revenue, investors are probably hoping that Nouveau Monde Graphite finds some valuable resources, before it runs out of money.

So How Risky Is Nouveau Monde Graphite?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And the fact is that over the last twelve months Nouveau Monde Graphite lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through CA$58m of cash and made a loss of CA$63m. But at least it has CA$30.0m on the balance sheet to spend on growth, near-term. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 4 warning signs for Nouveau Monde Graphite (3 can't be ignored) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Nouveau Monde Graphite might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NOU

Nouveau Monde Graphite

Engages in the acquisition, exploration, development, and evaluation of mineral properties in Quebec, Canada.

Medium-low risk with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026