- Canada

- /

- Metals and Mining

- /

- TSXV:NFG

TSX Growth Companies With High Insider Ownership September 2025

Reviewed by Simply Wall St

As the Canadian economy experiences a contraction, contrasting with the U.S.'s solid growth trajectory, market participants are closely watching for potential monetary easing by the Bank of Canada. In this environment, investors may find opportunities in growth companies with high insider ownership on the TSX, as these firms often demonstrate strong alignment between management and shareholder interests—a trait that can be particularly valuable during periods of economic uncertainty.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Zedcor (TSXV:ZDC) | 21.1% | 87.6% |

| Robex Resources (TSXV:RBX) | 24.3% | 99.6% |

| Propel Holdings (TSX:PRL) | 36.7% | 31.8% |

| NTG Clarity Networks (TSXV:NCI) | 39.9% | 29.9% |

| Enterprise Group (TSX:E) | 32.1% | 30.4% |

| Discovery Silver (TSX:DSV) | 13.4% | 57.8% |

| Colliers International Group (TSX:CIGI) | 14.0% | 27.2% |

| CEMATRIX (TSX:CEMX) | 10.5% | 76.6% |

| Aritzia (TSX:ATZ) | 17.2% | 29.6% |

| Allied Gold (TSX:AAUC) | 16% | 86.5% |

Let's review some notable picks from our screened stocks.

First National Financial (TSX:FN)

Simply Wall St Growth Rating: ★★★★★☆

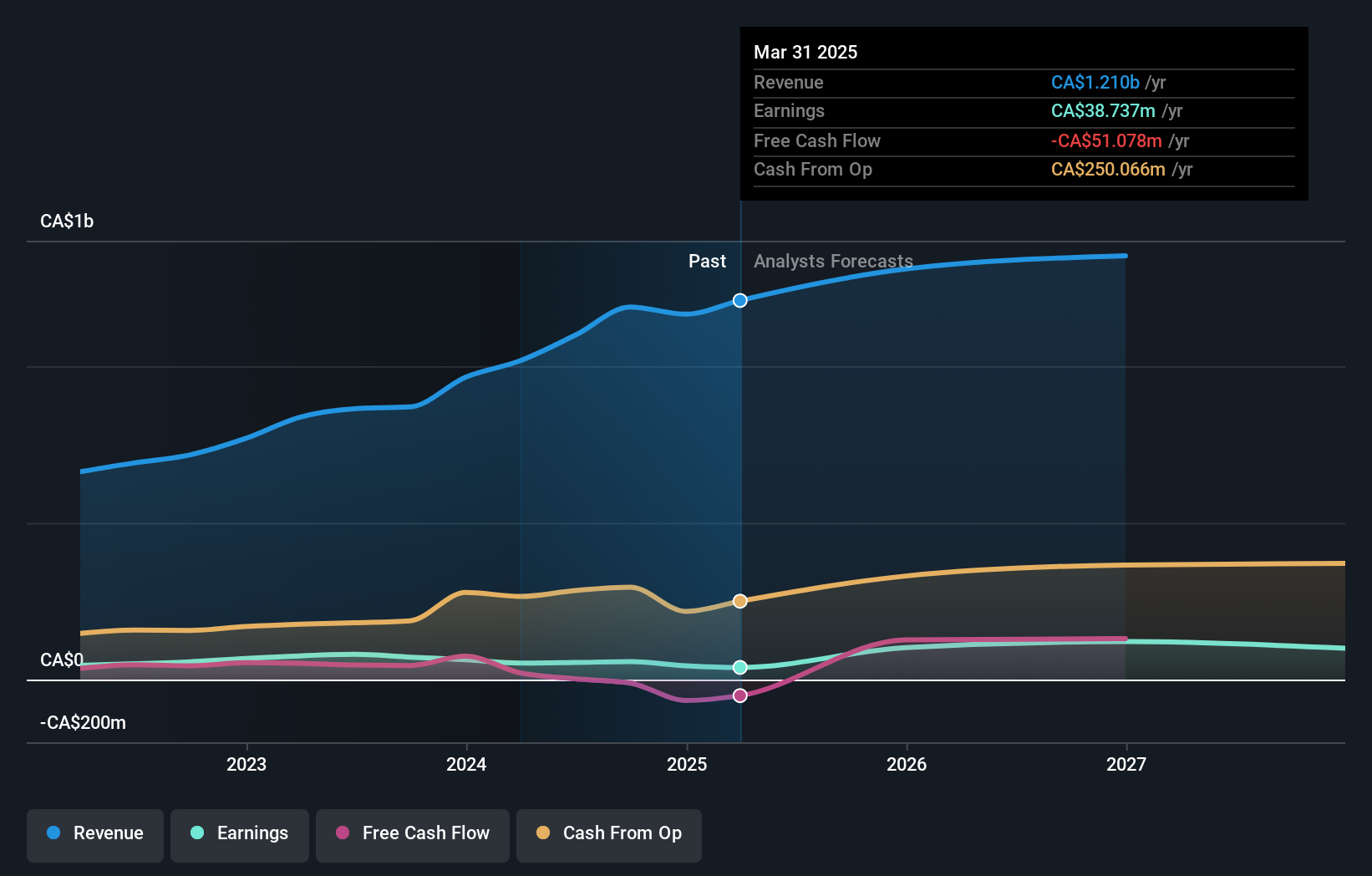

Overview: First National Financial Corporation, with a market cap of CA$2.89 billion, operates in Canada by originating, underwriting, and servicing residential and commercial mortgages through its subsidiaries.

Operations: The company generates revenue from two primary segments: CA$219.15 million from commercial mortgages and CA$478.72 million from residential mortgages in Canada.

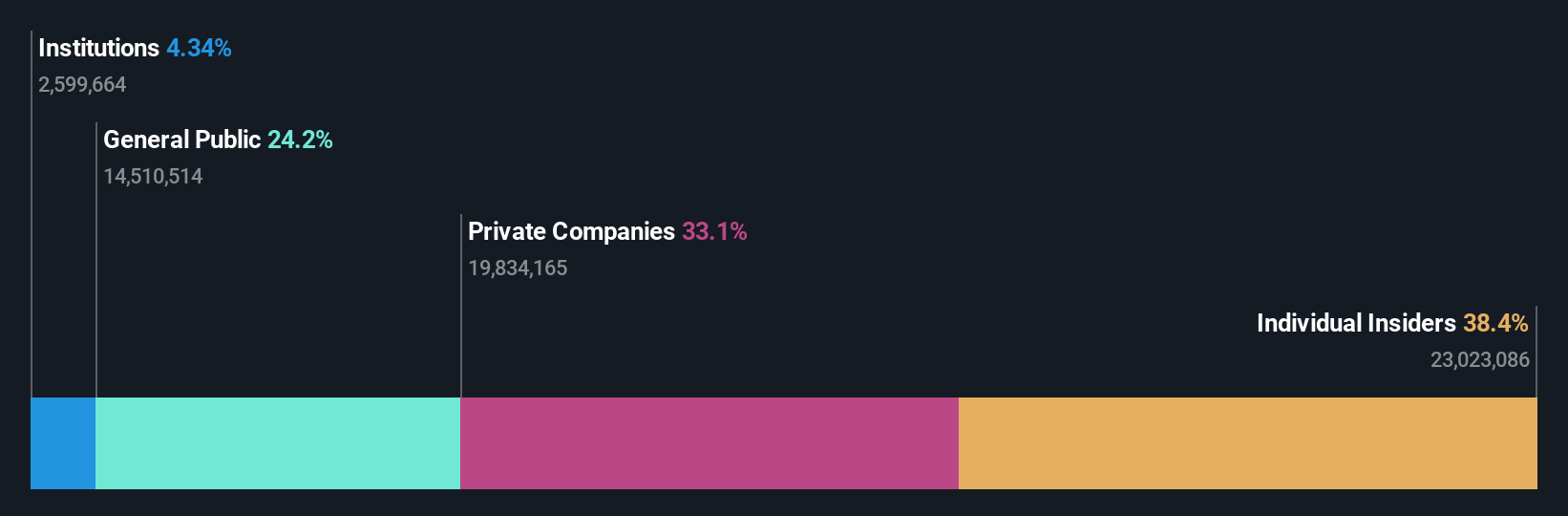

Insider Ownership: 38.4%

First National Financial, with significant insider ownership, is poised for robust earnings growth at 22.1% annually, outpacing the Canadian market. Its Price-To-Earnings ratio of 15.7x suggests good value relative to peers. However, its revenue growth forecast of 19.7% lags behind high-growth benchmarks and debt coverage by operating cash flow is a concern. Recent acquisition news involving Birch Hill and Brookfield could impact insider dynamics but maintains existing leadership stability with CEO Jason Ellis continuing in his role.

- Get an in-depth perspective on First National Financial's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility First National Financial's shares may be trading at a premium.

North American Construction Group (TSX:NOA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: North American Construction Group Ltd. offers mining and heavy civil construction services in the resource development and industrial construction sectors across Australia, Canada, and the United States, with a market cap of CA$550.02 million.

Operations: The company's revenue segments include CA$599.69 million from Heavy Equipment in Canada and CA$635.62 million from Heavy Equipment in Australia.

Insider Ownership: 11%

North American Construction Group exhibits substantial insider buying, indicating confidence in its growth trajectory. Earnings are forecast to grow significantly at 34.9% annually, outpacing the Canadian market. However, recent earnings show a decline in net income and profit margins compared to last year. The company maintains positive revenue guidance for the second half of 2025 despite cost pressures in oil sands operations and has completed a notable share buyback program worth CAD 16.3 million.

- Click here to discover the nuances of North American Construction Group with our detailed analytical future growth report.

- Our expertly prepared valuation report North American Construction Group implies its share price may be too high.

New Found Gold (TSXV:NFG)

Simply Wall St Growth Rating: ★★★★★☆

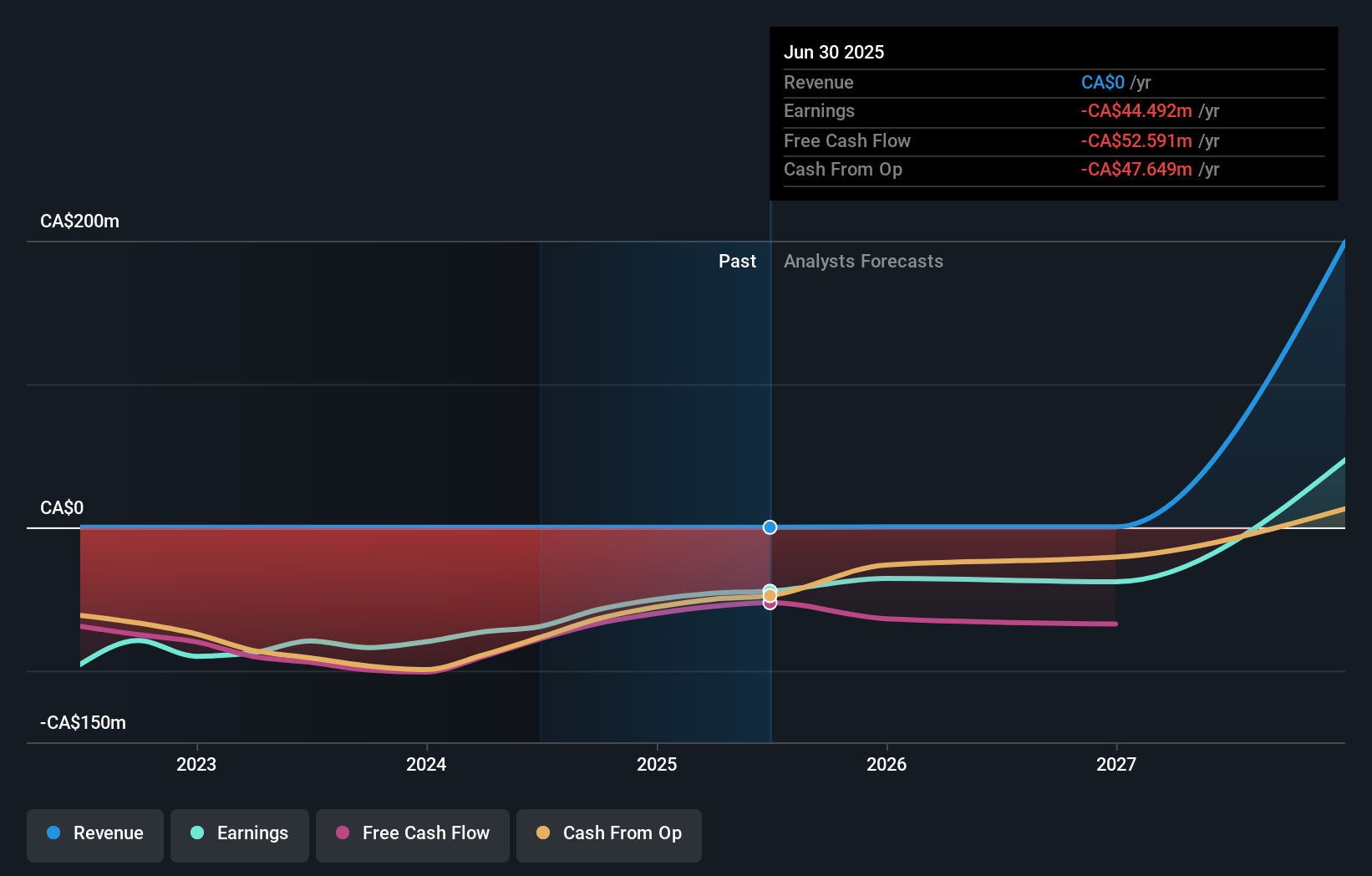

Overview: New Found Gold Corp. is a mineral exploration company focused on identifying, evaluating, acquiring, and exploring mineral properties in Newfoundland and Labrador, Canada, with a market cap of CA$631.82 million.

Operations: New Found Gold Corp. does not currently report any revenue segments, as it is primarily engaged in the exploration and evaluation of mineral properties in Newfoundland and Labrador, Canada.

Insider Ownership: 14.1%

New Found Gold demonstrates strong insider confidence with substantial recent insider buying, notably from Eric Sprott. The company's revenue is projected to grow at a robust 80% annually, significantly outpacing the Canadian market. However, it remains in the early stages of development with minimal current revenue and has faced shareholder dilution recently. Despite reporting net losses, New Found Gold's strategic developments at its Queensway Project suggest potential for future profitability and growth.

- Unlock comprehensive insights into our analysis of New Found Gold stock in this growth report.

- The analysis detailed in our New Found Gold valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Unlock our comprehensive list of 42 Fast Growing TSX Companies With High Insider Ownership by clicking here.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if New Found Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NFG

New Found Gold

A mineral exploration company, engages in the identification, evaluation, acquisition, and exploration of mineral properties in the Provinces of Newfoundland and Labrador, Canada.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives