- Canada

- /

- Metals and Mining

- /

- TSXV:NEV

TSX Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

As the U.S. government shutdown unfolds, its impact on economic data releases and market sentiment is being closely watched by investors globally, including those in Canada. Despite this uncertainty, the Canadian market continues to exhibit resilience, buoyed by sectors like artificial intelligence and consumer spending. In such a climate, penny stocks—often smaller or newer companies—remain an intriguing area for investors seeking growth potential through strong financials and promising business models.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.77 | CA$70.78M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.42 | CA$3.55M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.35 | CA$52.57M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.37 | CA$951.38M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.13 | CA$22.59M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.81 | CA$439.26M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.36 | CA$174.09M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.17 | CA$210.75M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.79 | CA$9.83M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 416 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Questerre Energy (TSX:QEC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Questerre Energy Corporation is an energy technology and innovation company focused on the acquisition, exploration, and development of non-conventional oil and gas projects in Canada, with a market cap of CA$154.27 million.

Operations: Questerre Energy generates revenue primarily from its oil and gas exploration and production segment, totaling CA$37.49 million.

Market Cap: CA$154.27M

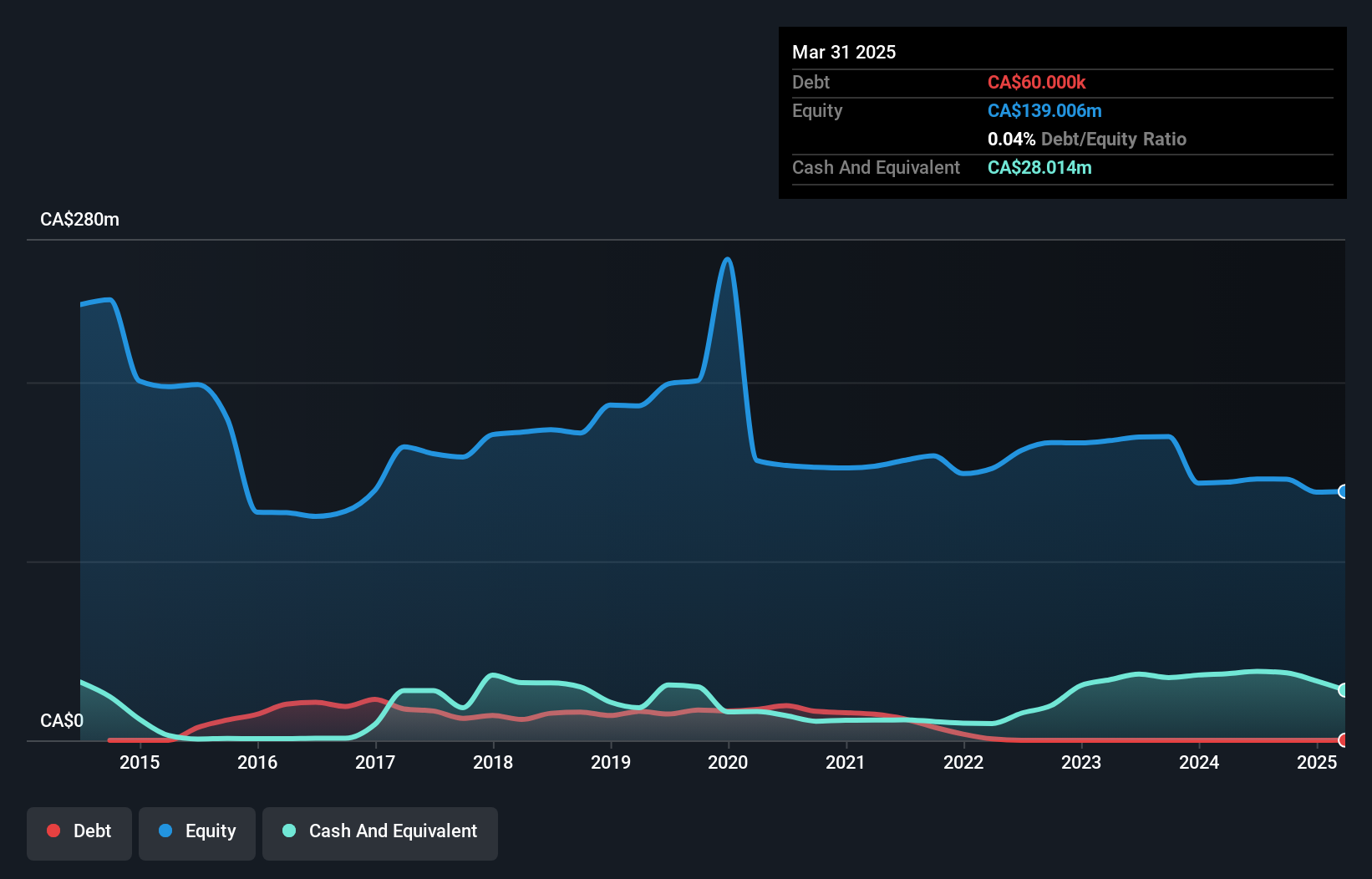

Questerre Energy Corporation, with a market cap of CA$154.27 million, is focused on non-conventional oil and gas projects. Despite being unprofitable with a negative return on equity of -6.57%, it has reduced losses by 30.9% annually over five years and maintains more cash than debt, supporting its financial stability. Recent strategic moves include a joint venture with Nice Capital Holdings to develop PX Energy in Brazil, enhancing growth prospects through international expansion. The management team averages over 20 years of experience, reinforcing leadership stability amidst efforts to secure third-party financing for new ventures.

- Click here and access our complete financial health analysis report to understand the dynamics of Questerre Energy.

- Gain insights into Questerre Energy's past trends and performance with our report on the company's historical track record.

Nevada Sunrise Metals (TSXV:NEV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nevada Sunrise Metals Corporation is a North American exploration company focused on lithium and copper, with a market cap of CA$7.36 million.

Operations: Nevada Sunrise Metals Corporation does not currently report any revenue segments.

Market Cap: CA$7.36M

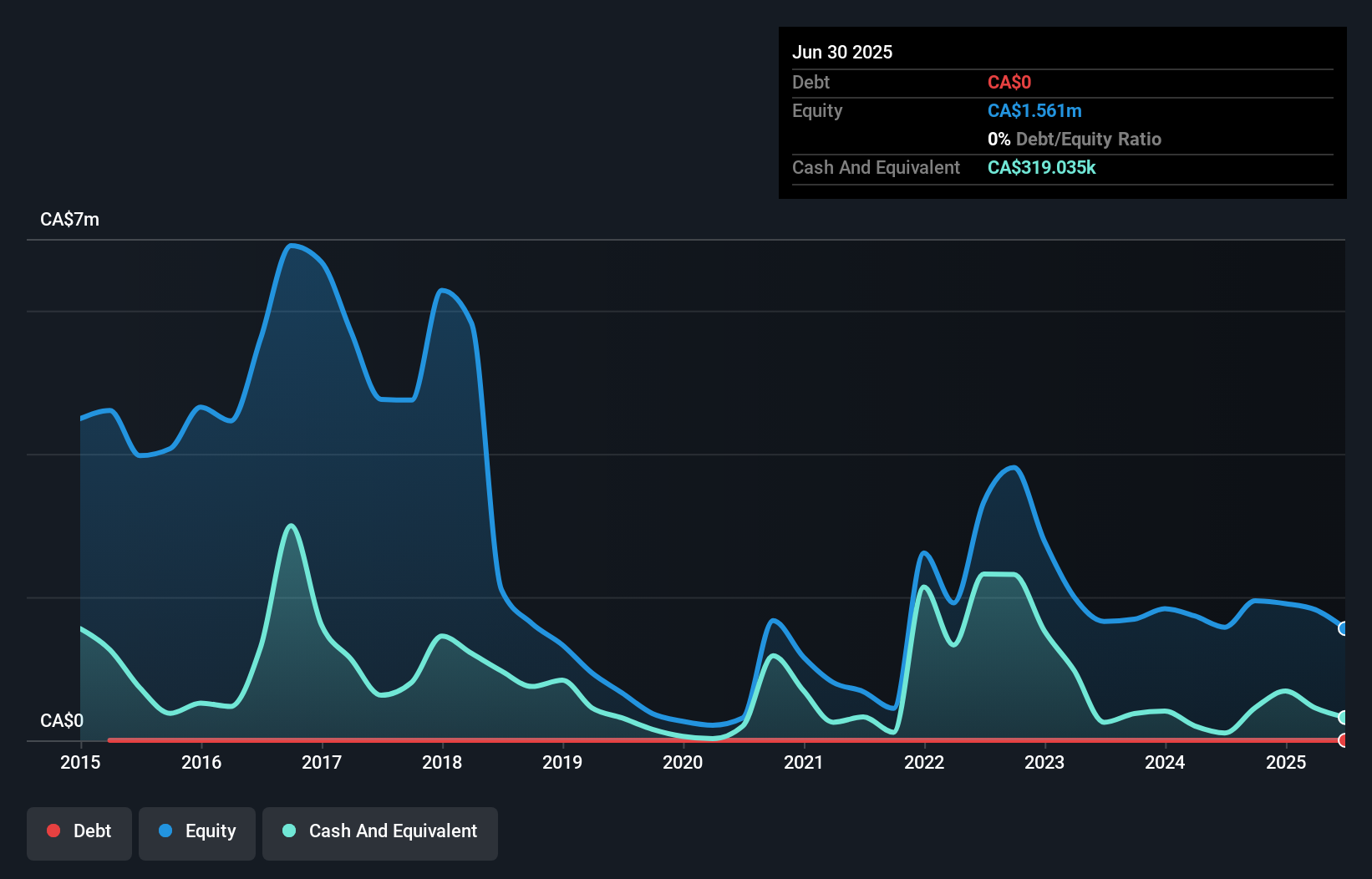

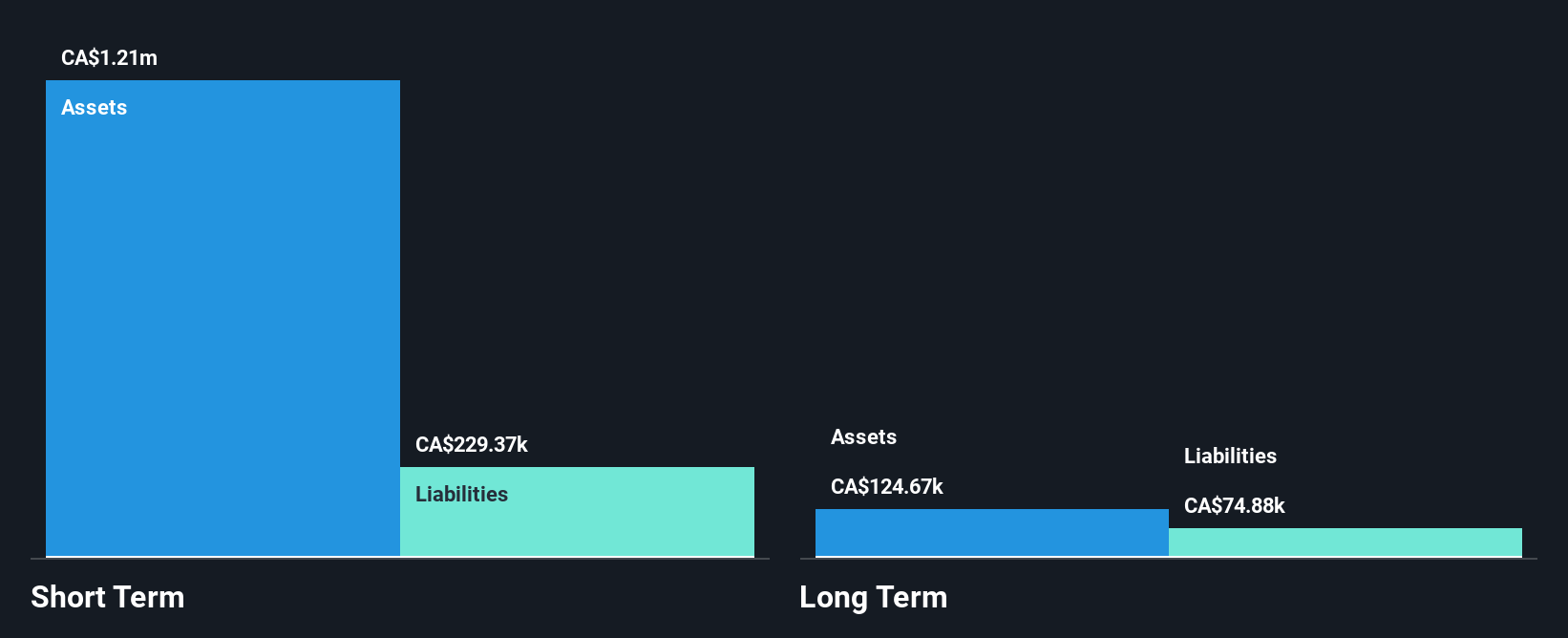

Nevada Sunrise Metals, with a market cap of CA$7.36 million, operates as a pre-revenue exploration company focused on lithium and copper. The company has strategically deepened its partnership with VRIFY Technology to leverage AI for identifying new mineral targets at the Griffon Gold Mine Project in Nevada. While it remains unprofitable, Nevada Sunrise has reduced losses over five years and maintains a debt-free balance sheet. Recent transactions include an option agreement to sell core claims of the Gemini Lithium Project for US$800,000 while retaining royalty interests, providing potential future revenue streams amidst ongoing exploration efforts.

- Click to explore a detailed breakdown of our findings in Nevada Sunrise Metals' financial health report.

- Gain insights into Nevada Sunrise Metals' historical outcomes by reviewing our past performance report.

01 Quantum (TSXV:ONE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 01 Quantum Inc. offers cybersecurity and remote access solutions across the United States, Asia-Pacific, and Canada, with a market cap of CA$53.21 million.

Operations: The company generates revenue of CA$0.42 million from the development and marketing of its communications software.

Market Cap: CA$53.21M

01 Quantum Inc., with a market cap of CA$53.21 million, operates as a pre-revenue company offering cybersecurity and remote access solutions. Despite its unprofitability, the company maintains a debt-free balance sheet and sufficient cash runway for over a year. Recent developments include closing private placements raising CA$2.35 million and forming a strategic alliance with Turnium Technology Group to deliver quantum-safe email encryption solutions globally. This partnership leverages 01's IronCAP X technology, enhancing its market reach in secure communications while integrating seamlessly with enterprise email clients like Microsoft Office Outlook to protect against emerging cyber threats.

- Take a closer look at 01 Quantum's potential here in our financial health report.

- Explore historical data to track 01 Quantum's performance over time in our past results report.

Turning Ideas Into Actions

- Access the full spectrum of 416 TSX Penny Stocks by clicking on this link.

- Searching for a Fresh Perspective? The end of cancer? These 28 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nevada Sunrise Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NEV

Nevada Sunrise Metals

Operates as a lithium and copper exploration company in North America.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives