- Canada

- /

- Oil and Gas

- /

- TSX:CJ

Exploring Cardinal Energy And 2 Other Promising Small Caps In Canada

Reviewed by Simply Wall St

As Canadian large-cap stocks reach new heights, the market is navigating a landscape marked by persistent inflation and softer economic growth. In this environment, identifying promising small-cap stocks can offer unique opportunities for diversification and potential growth. A good stock in today's market is one that demonstrates resilience amid economic uncertainties and has strong fundamentals to capitalize on shifting market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Total Energy Services | 18.83% | 18.31% | 56.57% | ★★★★★★ |

| TWC Enterprises | 4.02% | 13.46% | 16.81% | ★★★★★★ |

| Yellow Pages | NA | -11.43% | -17.61% | ★★★★★★ |

| Pinetree Capital | 0.20% | 63.68% | 65.79% | ★★★★★★ |

| Itafos | 25.35% | 11.11% | 49.69% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 9.16% | 15.11% | ★★★★★★ |

| Mako Mining | 8.59% | 38.81% | 59.80% | ★★★★★☆ |

| Corby Spirit and Wine | 57.06% | 9.84% | -5.44% | ★★★★☆☆ |

| Genesis Land Development | 48.16% | 31.08% | 55.45% | ★★★★☆☆ |

| Dundee | 2.02% | -35.84% | 57.20% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Cardinal Energy (TSX:CJ)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Cardinal Energy Ltd. is a company focused on the acquisition, exploration, development, optimization, and production of petroleum and natural gas in Alberta, British Columbia, and Saskatchewan with a market cap of CA$988.54 million.

Operations: Cardinal Energy generates revenue primarily from its oil and gas exploration and production segment, totaling CA$502.63 million. The company has a market cap of CA$988.54 million.

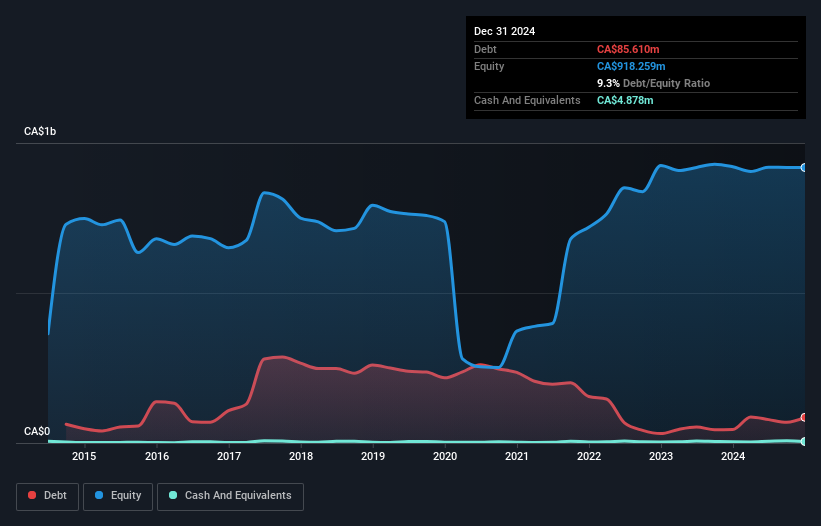

Cardinal Energy, a small player in the Canadian oil and gas sector, has shown resilience with earnings growth of 8.6% over the past year, outpacing the industry average of 2.9%. The company has reduced its debt to equity ratio from 84.6% to a satisfactory 11.8% over five years, and its interest payments are well covered by EBIT at a multiple of 31.3x. Recent earnings for Q1 2025 reported revenue at C$118 million and net income at C$21 million, reflecting solid financial health despite forecasts indicating potential challenges ahead with expected declines in earnings averaging 46.4% annually over three years.

- Click here to discover the nuances of Cardinal Energy with our detailed analytical health report.

Examine Cardinal Energy's past performance report to understand how it has performed in the past.

Valeura Energy (TSX:VLE)

Simply Wall St Value Rating: ★★★★★★

Overview: Valeura Energy Inc. is involved in the exploration, development, and production of petroleum and natural gas in Thailand and Turkey, with a market cap of CA$784.32 million.

Operations: Valeura Energy generates revenue primarily from the exploration, development, and production of petroleum and natural gas. The company's financial performance is influenced by its ability to manage costs associated with these operations.

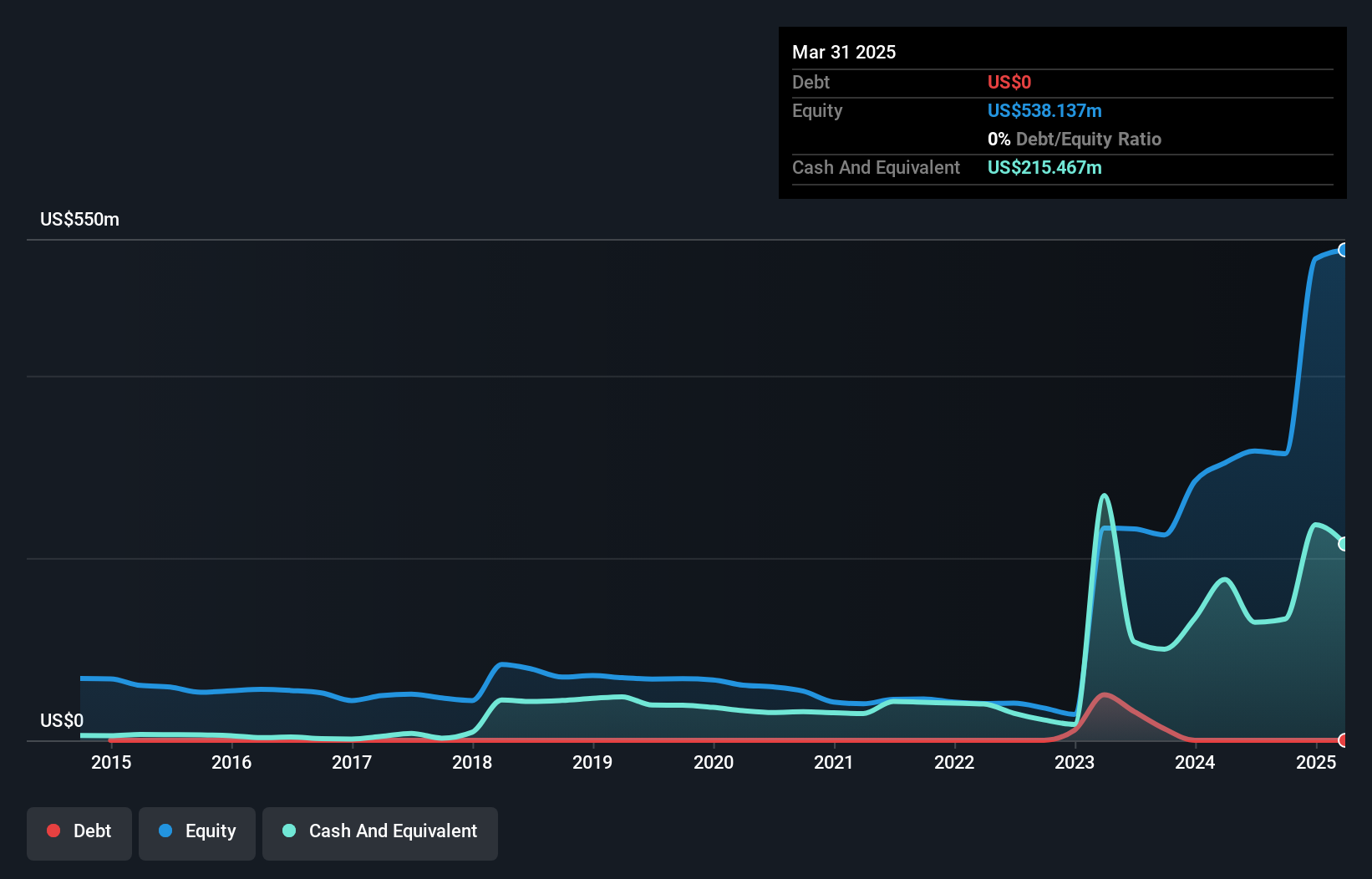

Valeura Energy, a nimble player in the oil and gas sector, has seen its earnings skyrocket by 699% over the past year, outperforming industry averages. The company is debt-free and trades at 66% below its estimated fair value, highlighting an attractive entry point for investors. Recent developments include a strategic focus on M&A to transform company size and the redevelopment of the Wassana field in Thailand. This project alone could add CAD 131 million in incremental value per share, underscoring potential growth despite forecasted earnings declines over the next three years.

Mako Mining (TSXV:MKO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mako Mining Corp. is involved in gold mining and exploration operations in Nicaragua, with a market cap of CA$348.11 million.

Operations: Mako Mining generates revenue primarily from the production of gold, amounting to $92.08 million. The company focuses its financial activities on mining operations and exploration efforts in Nicaragua.

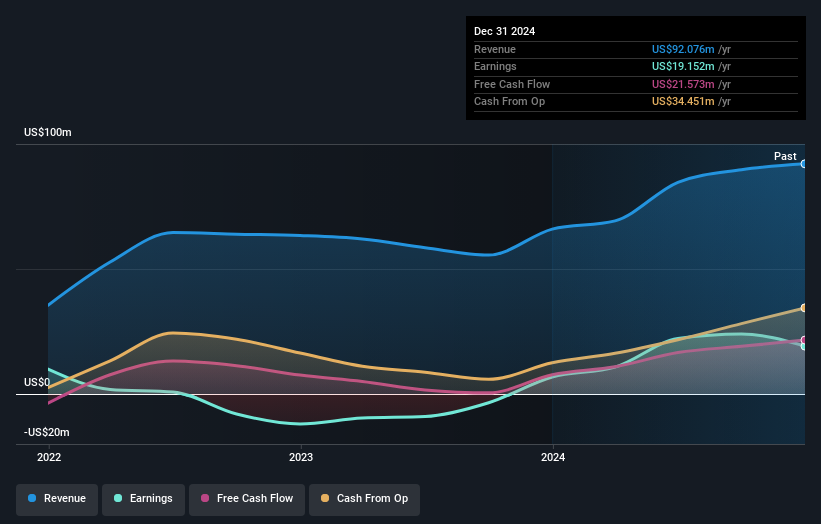

Mako Mining, a nimble player in the gold mining sector, has shown impressive growth with earnings surging by 181.7% over the past year, outpacing industry averages. The company recently reported net income of US$19.15 million for 2024, a substantial increase from US$6.8 million the previous year. Despite recent shareholder dilution, Mako's financial health appears robust with interest payments well covered at 46.7 times by EBIT and more cash than total debt on hand. Recent acquisitions like the Moss gold mine in Arizona further bolster its asset base and operational footprint, supporting future prospects in high-grade gold production areas like San Albino in Nicaragua.

- Dive into the specifics of Mako Mining here with our thorough health report.

Review our historical performance report to gain insights into Mako Mining's's past performance.

Taking Advantage

- Click this link to deep-dive into the 44 companies within our TSX Undiscovered Gems With Strong Fundamentals screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CJ

Cardinal Energy

Engages in the acquisition, exploration, development, optimization, and production of petroleum and natural gas in the provinces of Alberta, British Columbia, and Saskatchewan in Canada.

Good value with proven track record.

Market Insights

Community Narratives