- Canada

- /

- Metals and Mining

- /

- TSXV:CGD

TSX Penny Stocks Spotlight: Planet Ventures And Two More Opportunities

Reviewed by Simply Wall St

As the U.S. government shutdown continues, impacting economic data releases and creating uncertainty, the Canadian market remains resilient, buoyed by strong consumer spending and significant investments in artificial intelligence. In this climate, penny stocks—often smaller or newer companies—offer unique opportunities for growth at lower price points. Despite their historical reputation as speculative investments, those with solid financials can present compelling prospects for investors seeking to uncover hidden gems in the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.80 | CA$77.86M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.425 | CA$4.59M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.36 | CA$54.82M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.43 | CA$911.46M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.14 | CA$22.99M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.72 | CA$445.72M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.43 | CA$178.15M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.22 | CA$207.9M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.79 | CA$9.96M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 417 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Planet Ventures (CNSX:PXI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Planet Ventures, Inc. is a venture capital firm that focuses on early-stage investments, with a market cap of CA$12.25 million.

Operations: The company reported revenue of CA$0 million from its unclassified services segment.

Market Cap: CA$12.25M

Planet Ventures Inc. is a venture capital firm with a market cap of CA$12.25 million, operating as a pre-revenue entity with no significant revenue streams reported. Despite negative earnings growth and high volatility in its share price, the company has become profitable over the past five years, showing an annual earnings growth rate of 50.3%. The firm maintains no debt and has initiated a share buyback program to repurchase up to 10,206,333 shares by October 2026, indicating management's belief that the stock is undervalued. However, auditors have expressed concerns about its ability to continue as a going concern.

- Get an in-depth perspective on Planet Ventures' performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Planet Ventures' track record.

Carlin Gold (TSXV:CGD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Carlin Gold Corporation is an exploration stage company focused on identifying, evaluating, acquiring, and exploring mineral properties with a market cap of CA$10.01 million.

Operations: Carlin Gold Corporation does not report any revenue segments, as it is an exploration stage company focused on mineral property activities.

Market Cap: CA$10.01M

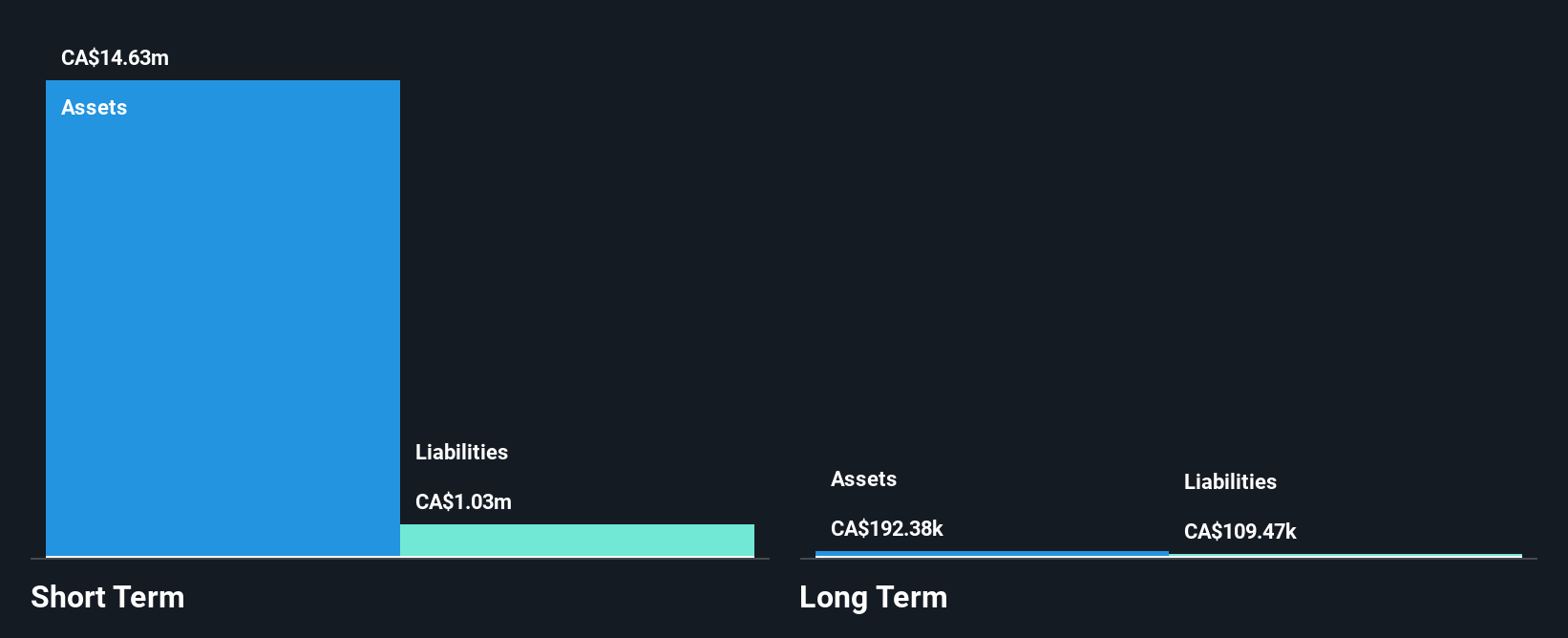

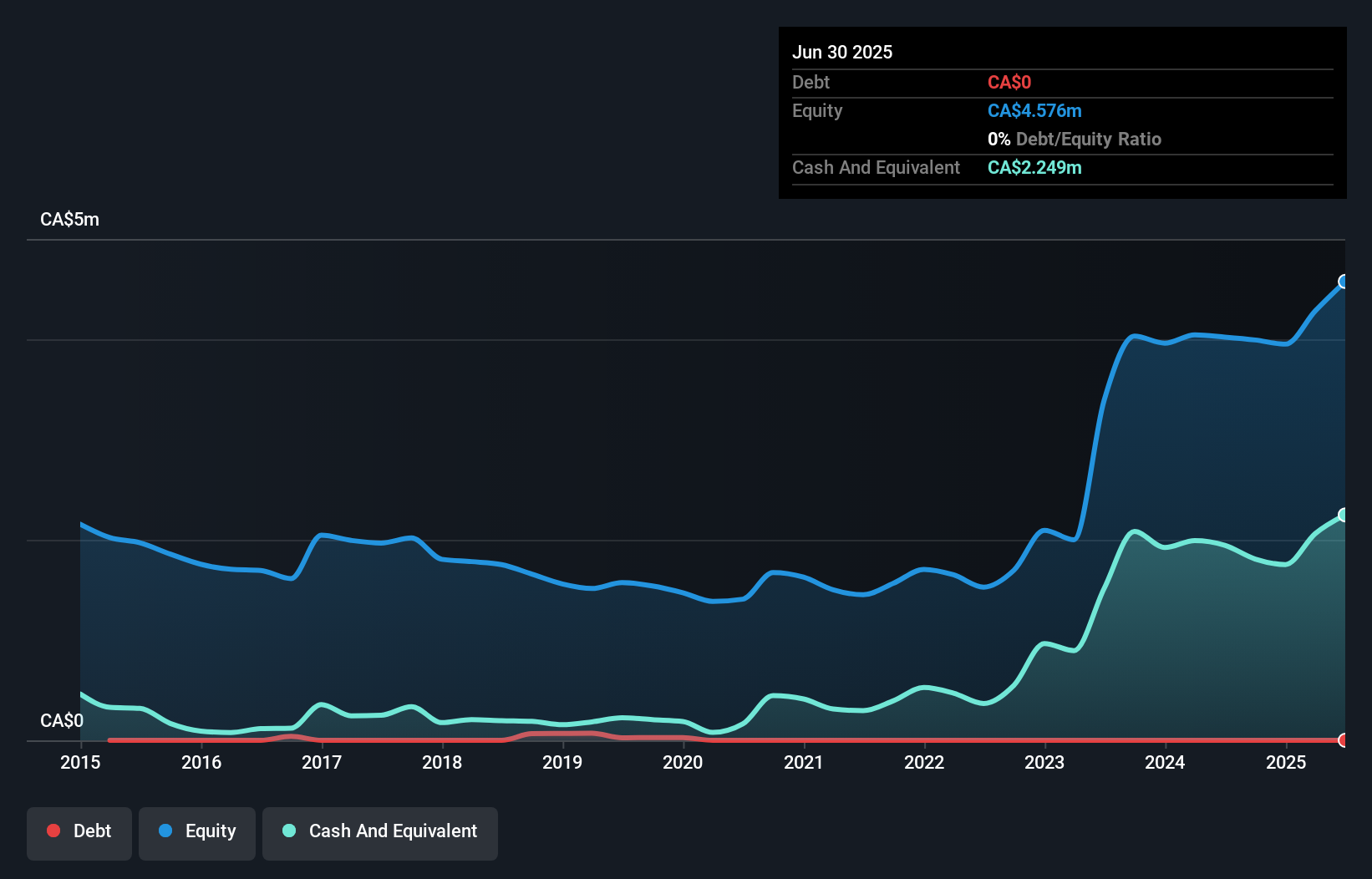

Carlin Gold Corporation, with a CA$10.01 million market cap, operates as a pre-revenue exploration stage company focused on mineral properties. The firm recently announced a non-brokered private placement to raise CA$240,000, enhancing its financial flexibility without incurring debt. Although Carlin's earnings growth of 11.2% over the past year lags behind industry standards, it has achieved profitability over the last five years with an average annual earnings growth of 27.2%. The company benefits from seasoned board leadership and maintains strong short-term asset coverage against liabilities while remaining debt-free.

- Unlock comprehensive insights into our analysis of Carlin Gold stock in this financial health report.

- Understand Carlin Gold's track record by examining our performance history report.

Majestic Gold (TSXV:MJS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Majestic Gold Corp. is a mining company engaged in the exploration, development, and operation of mining properties in China, with a market cap of CA$182.47 million.

Operations: The company's revenue of $80.08 million is derived from its activities in exploring, developing, and operating mining properties.

Market Cap: CA$182.47M

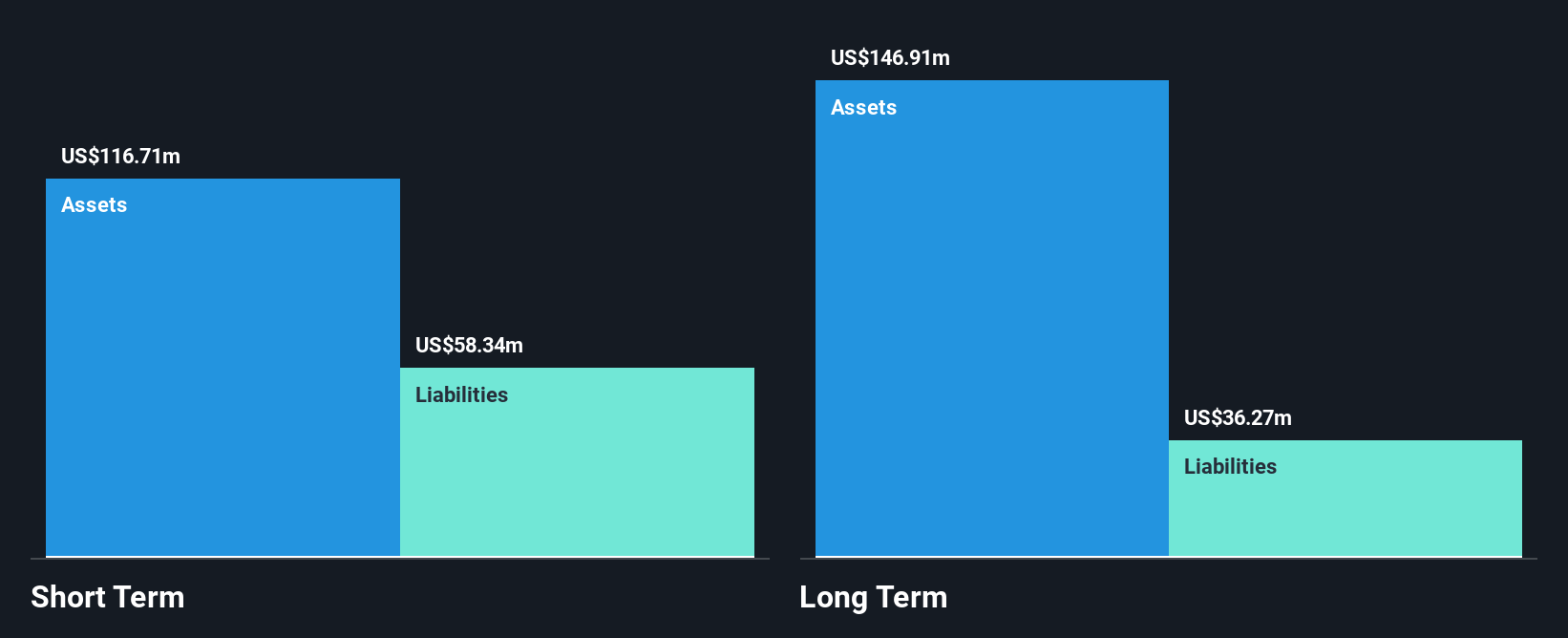

Majestic Gold Corp., with a market cap of CA$182.47 million, has shown consistent earnings growth of 5.2% annually over the past five years but faced a slowdown to 2.5% last year, underperforming the industry average. The company recently resumed operations at its DGZ Mine following regulatory approval after addressing safety concerns from a prior suspension due to an accident. Despite lower net profit margins compared to last year, Majestic maintains strong financial health with more cash than debt and sufficient short-term assets to cover liabilities. A recent dividend declaration underscores its commitment to shareholder returns amidst operational challenges.

- Dive into the specifics of Majestic Gold here with our thorough balance sheet health report.

- Assess Majestic Gold's previous results with our detailed historical performance reports.

Taking Advantage

- Take a closer look at our TSX Penny Stocks list of 417 companies by clicking here.

- Ready To Venture Into Other Investment Styles? The end of cancer? These 28 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CGD

Carlin Gold

An exploration stage company, engages in the identification, evaluation, acquisition, and exploration of mineral properties.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.