- Canada

- /

- Metals and Mining

- /

- TSXV:THX

Lavras Gold Leads The Charge On TSX With 2 Other Prominent Penny Stocks

Reviewed by Simply Wall St

The Canadian market has shown robust performance, increasing by 1.0% over the last week and up 27% over the past year, with earnings projected to grow by 16% annually. For investors interested in smaller or newer companies, penny stocks—despite their somewhat outdated name—can still offer surprising value when backed by solid financial foundations. This article explores several penny stocks that stand out for their financial strength and potential long-term growth prospects.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.68 | CA$620.88M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.41 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.165 | CA$4.4M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.24 | CA$297.04M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$119.71M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.80 | CA$303.41M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$221.84M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.17M | ★★★★★★ |

| Newport Exploration (TSXV:NWX) | CA$0.115 | CA$12.14M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$30.89M | ★★★★★★ |

Click here to see the full list of 947 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Lavras Gold (TSXV:LGC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lavras Gold Corp. is involved in the exploration and development of mineral resource properties in Brazil, with a market cap of CA$135.60 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$135.6M

Lavras Gold Corp., with a market cap of CA$135.60 million, is pre-revenue and debt-free, though it faces financial challenges with less than a year of cash runway at current burn rates. Recent drilling results at its Fazenda do Posto Gold Target in Brazil revealed promising gold mineralization, suggesting potential resource expansion. Despite these prospects, the company remains unprofitable with increasing losses over the past five years. The management team is experienced, but the board lacks tenure depth. Lavras Gold has filed for a CA$50 million shelf registration to support future operations and exploration activities.

- Get an in-depth perspective on Lavras Gold's performance by reading our balance sheet health report here.

- Examine Lavras Gold's past performance report to understand how it has performed in prior years.

MustGrow Biologics (TSXV:MGRO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MustGrow Biologics Corp. is an agricultural biotechnology company that develops and commercializes natural biological technologies and products derived from mustard seeds, with a market cap of CA$76.94 million.

Operations: MustGrow Biologics Corp. has not reported any revenue segments.

Market Cap: CA$76.94M

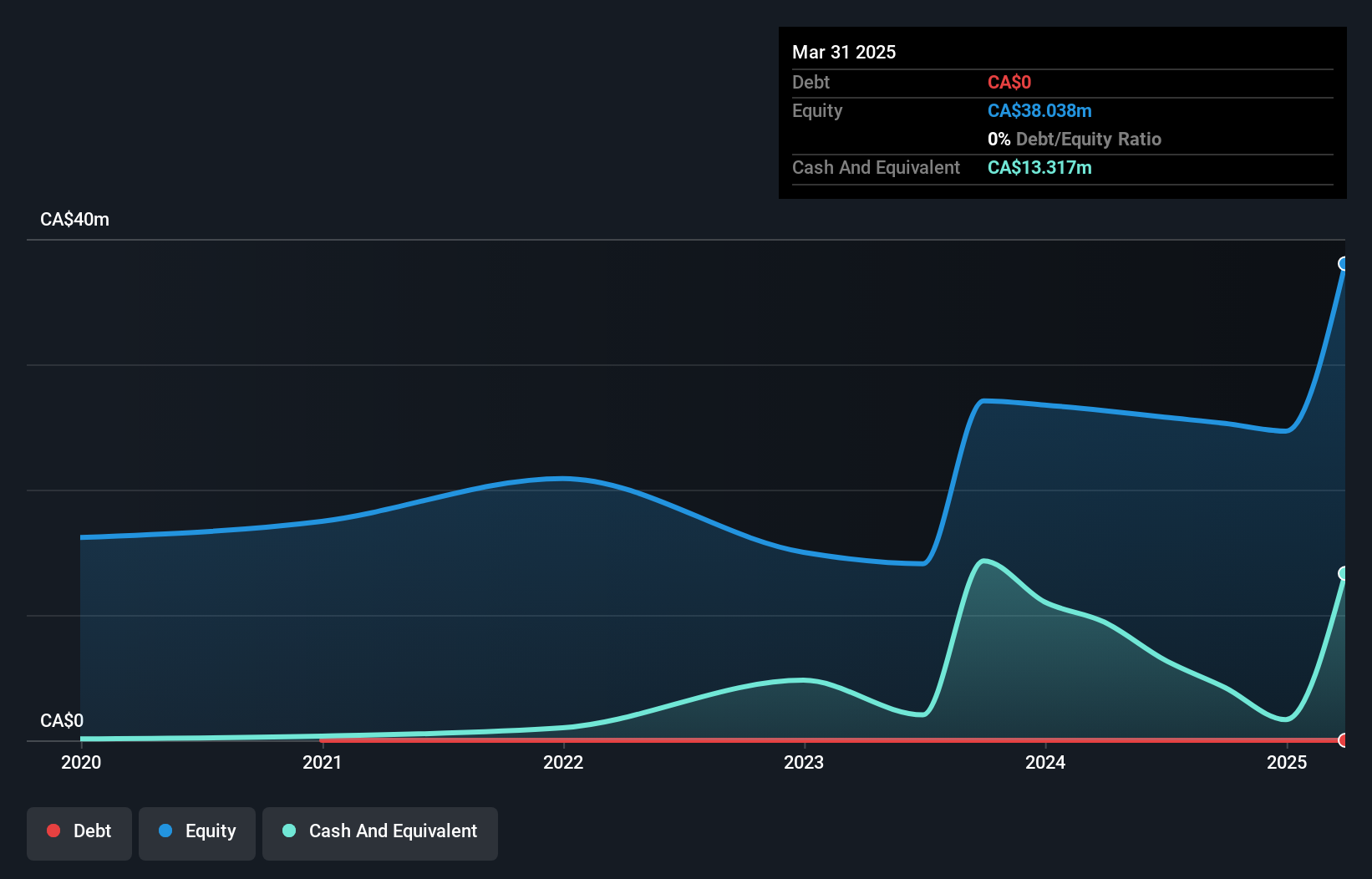

MustGrow Biologics Corp., with a market cap of CA$76.94 million, is pre-revenue and unprofitable, focusing on natural agricultural products derived from mustard seeds. The company has secured funding from Agriculture and Agri-Food Canada to explore new applications in human and animal health. Despite its financial challenges, including shareholder dilution over the past year, MustGrow maintains a strong cash position relative to debt and has sufficient short-term assets to cover liabilities. Its management team is experienced, supporting ongoing collaborations with global partners like Bayer for product development in biofertility solutions such as TerraSanteTM.

- Click to explore a detailed breakdown of our findings in MustGrow Biologics' financial health report.

- Understand MustGrow Biologics' track record by examining our performance history report.

Thor Explorations (TSXV:THX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Thor Explorations Ltd., along with its subsidiaries, operates as a gold producer and explorer with a market cap of CA$183.70 million.

Operations: The company's revenue is primarily derived from the Segilola Mine Project, which generated $146.78 million.

Market Cap: CA$183.7M

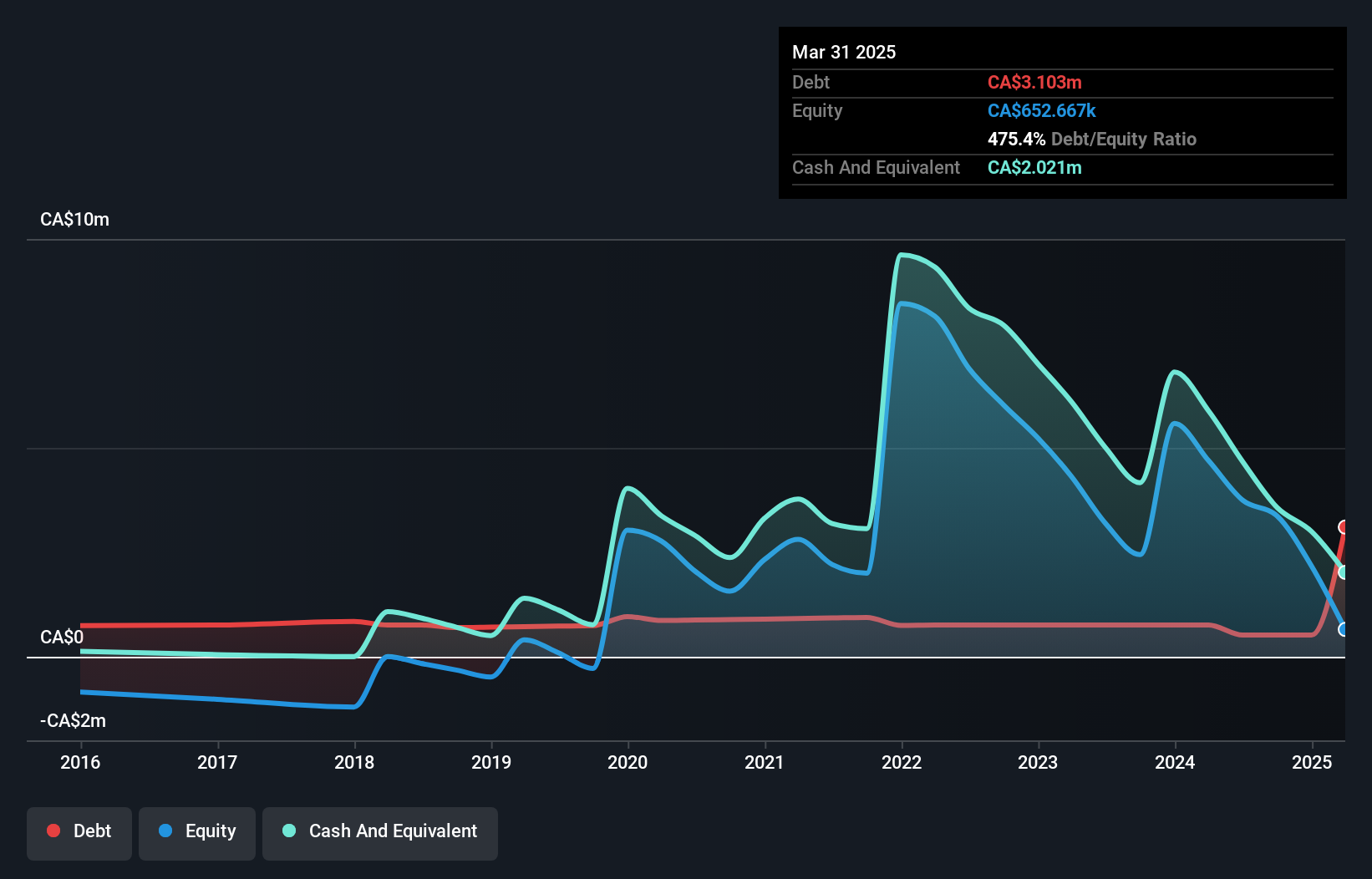

Thor Explorations Ltd., with a market cap of CA$183.70 million, is navigating challenges in the gold mining sector. The company recently adjusted its 2024 production guidance to 85,000 oz due to operational delays and weather impacts at the Segilola Mine Project, which generated $146.78 million in revenue. Despite these setbacks, Thor's financials show strength; it has high-quality earnings and a satisfactory net debt to equity ratio of 1.8%. However, short-term liabilities exceed assets by $52.7M (US$), highlighting potential liquidity concerns despite well-covered interest payments and good cash flow coverage on debt.

- Take a closer look at Thor Explorations' potential here in our financial health report.

- Review our growth performance report to gain insights into Thor Explorations' future.

Taking Advantage

- Access the full spectrum of 947 TSX Penny Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thor Explorations might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:THX

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives