- Canada

- /

- Metals and Mining

- /

- TSXV:UGD

3 TSX Penny Stocks To Consider In February 2025

Reviewed by Simply Wall St

The Canadian market faces potential challenges from escalating tariffs, which could impact economic growth and consumer prices. Despite these uncertainties, diversification remains a key strategy for investors in 2025, offering opportunities to balance risk and reward. Penny stocks, though an older term, still represent smaller or newer companies that can provide surprising value when backed by strong financials; they offer a unique chance for investors to explore promising ventures with potential long-term benefits.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.985 | CA$182.79M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.57 | CA$1.02B | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.73 | CA$441.37M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.45 | CA$124.55M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.41 | CA$235.26M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.51 | CA$14.61M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.70 | CA$647.19M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$26.6M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.86 | CA$397.63M | ★★★★★☆ |

Click here to see the full list of 943 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Electric Metals (USA) (TSXV:EML)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Electric Metals (USA) Limited focuses on acquiring, exploring, and developing mineral properties in the United States, Canada, and Australia with a market cap of CA$18.77 million.

Operations: Electric Metals (USA) Limited does not report any revenue segments.

Market Cap: CA$18.77M

Electric Metals (USA) Limited, with a market cap of CA$18.77 million, is currently pre-revenue and unprofitable, facing challenges typical of early-stage mining ventures. Recent private placements raised CA$583,700 to extend its cash runway beyond the previously limited one month. The company's short-term assets of US$263.6K fall short of covering liabilities totaling US$1.4M, highlighting liquidity concerns despite being debt-free. Share price volatility remains high, with a recent increase in weekly volatility from 23% to 29%. Additionally, the board's average tenure is only 1.4 years, indicating an inexperienced leadership team navigating these financial hurdles.

- Unlock comprehensive insights into our analysis of Electric Metals (USA) stock in this financial health report.

- Explore historical data to track Electric Metals (USA)'s performance over time in our past results report.

MustGrow Biologics (TSXV:MGRO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MustGrow Biologics Corp. is an agricultural biotechnology company that develops and commercializes natural biological technologies and products derived from mustard seeds, with a market cap of CA$68.68 million.

Operations: MustGrow Biologics Corp. currently does not report any revenue segments.

Market Cap: CA$68.68M

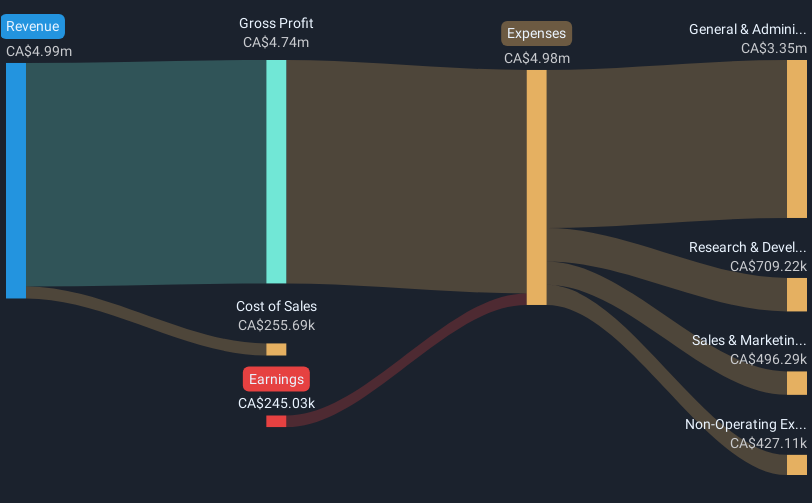

MustGrow Biologics Corp., with a market cap of CA$68.68 million, is pre-revenue, reflecting its early-stage biotech status. Despite this, the company has a strong cash position exceeding both short and long-term liabilities, indicating financial stability for over three years even if free cash flow decreases. Recent private placements raised CA$4.59 million to support operations and potential growth initiatives. The management team and board are experienced, with average tenures of 6.4 and 6.8 years respectively, providing seasoned leadership during this development phase while navigating unprofitability challenges in the near term as earnings are forecasted to decline further over the next three years.

- Click here to discover the nuances of MustGrow Biologics with our detailed analytical financial health report.

- Gain insights into MustGrow Biologics' outlook and expected performance with our report on the company's earnings estimates.

Unigold (TSXV:UGD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Unigold Inc. is a junior natural resource company dedicated to exploring and developing gold projects in the Dominican Republic, with a market cap of CA$19.20 million.

Operations: Unigold Inc. does not report any revenue segments, focusing its efforts on gold exploration and development in the Dominican Republic.

Market Cap: CA$19.2M

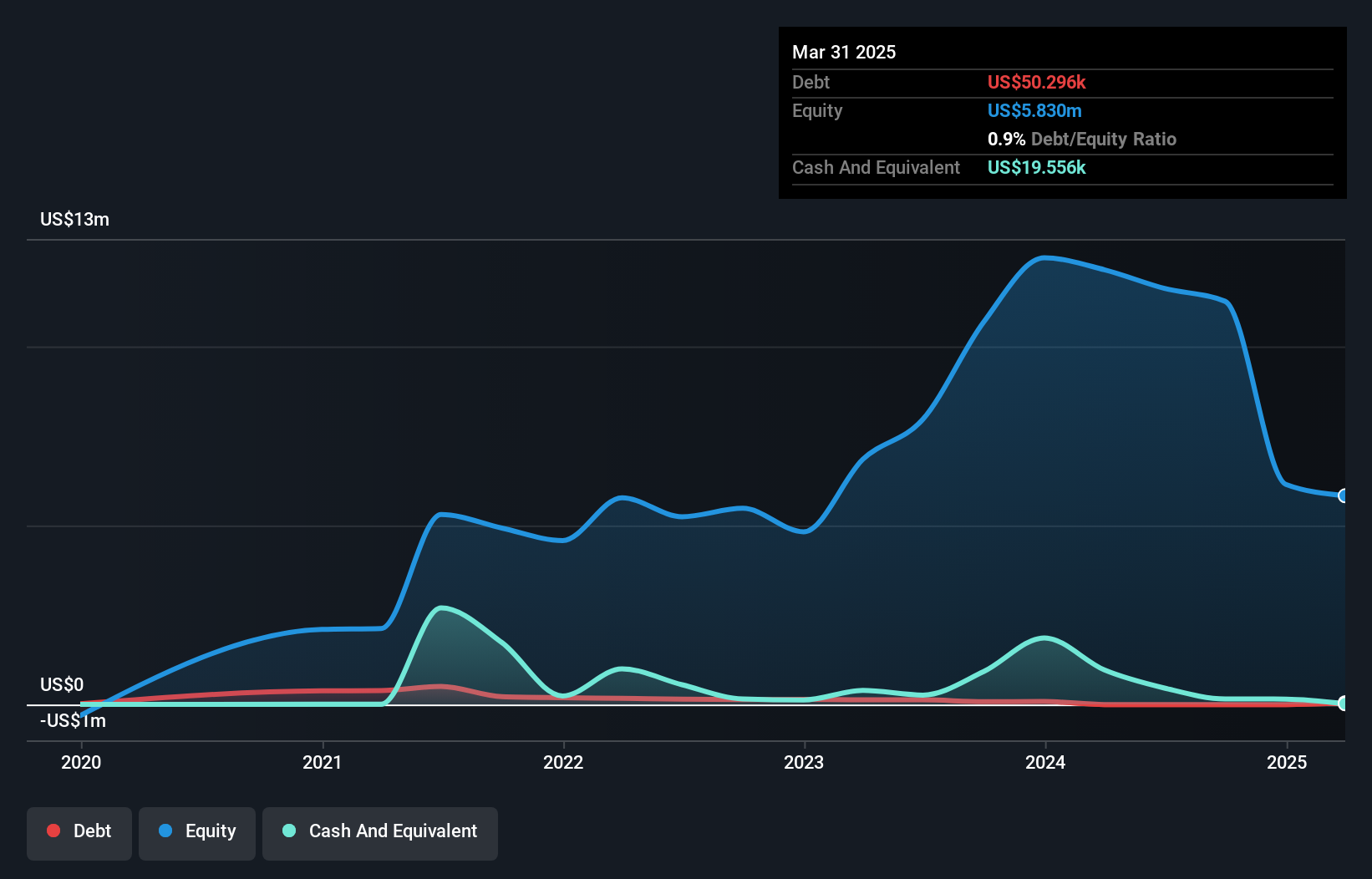

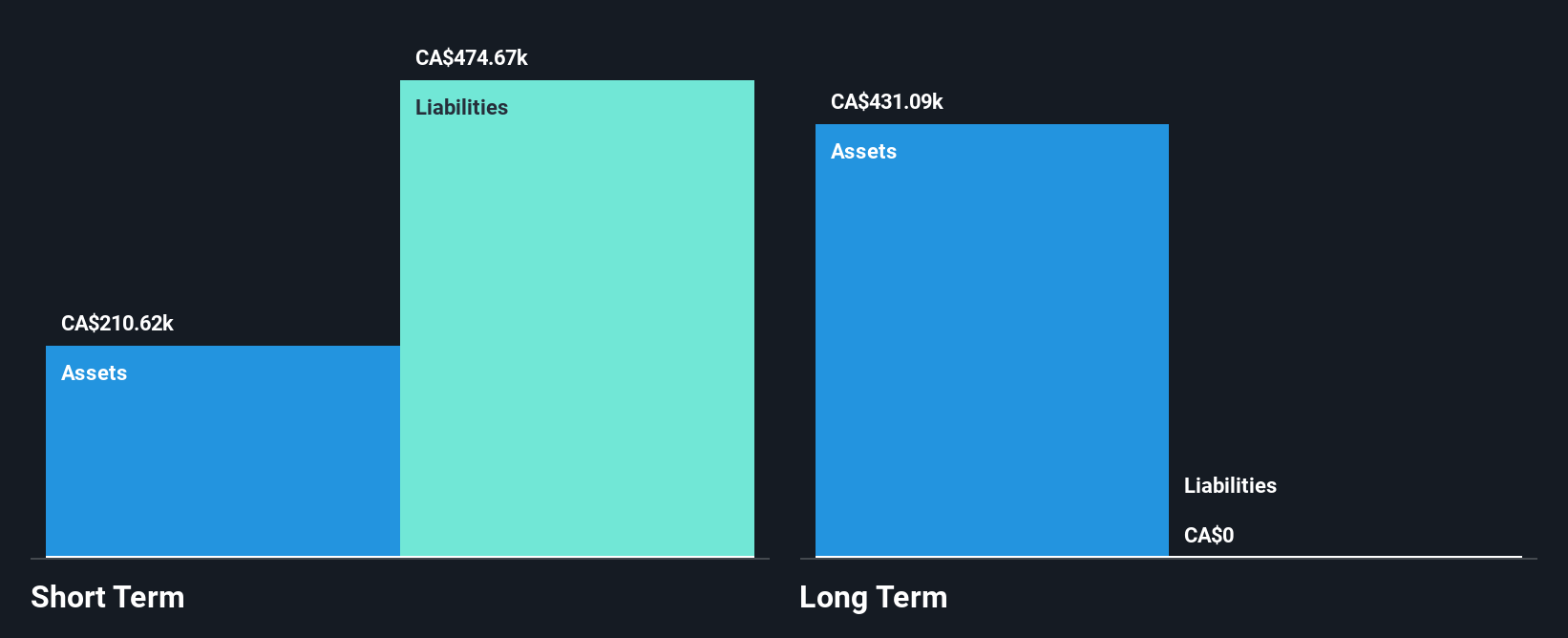

Unigold Inc., with a market cap of CA$19.20 million, is pre-revenue and focused on gold exploration in the Dominican Republic. The company has no debt and its experienced management team averages 4.9 years in tenure, while the board averages 7.1 years. Despite being unprofitable, Unigold has reduced losses over five years by 0.5% annually but faces increased volatility with a weekly rate rising to 26%. Short-term assets (CA$665.1K) exceed liabilities (CA$288.1K), yet cash runway is less than a year if cash flow continues to decline at historical rates of 11.8%.

- Click here and access our complete financial health analysis report to understand the dynamics of Unigold.

- Assess Unigold's previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Get an in-depth perspective on all 943 TSX Penny Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:UGD

Unigold

A junior natural resource company, focuses on exploring and developing gold projects in the Dominican Republic.

Adequate balance sheet slight.

Market Insights

Community Narratives