- Canada

- /

- Metals and Mining

- /

- TSXV:LME

Frontier Lithium And 2 Other Promising Penny Stocks On TSX

Reviewed by Simply Wall St

The Canadian market has seen a shift as bond yields have influenced investment strategies, with many investors reconsidering their allocations between cash and bonds. In this context, penny stocks—though an older term—remain relevant for those interested in smaller or newer companies that might offer unique value opportunities. By focusing on financially strong penny stocks, investors can potentially uncover under-the-radar companies poised for long-term success.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.75M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.97 | CA$372.82M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.31 | CA$117.44M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.32 | CA$939.87M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.56 | CA$510.73M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.28 | CA$224.43M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.25 | CA$33.58M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.79 | CA$174.58M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.89 | CA$116.34M | ★★★★☆☆ |

Click here to see the full list of 959 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Frontier Lithium (TSXV:FL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Frontier Lithium Inc. focuses on the acquisition, exploration, and development of mining properties in North America with a market cap of CA$106.98 million.

Operations: Frontier Lithium Inc. does not report any revenue segments as it is primarily engaged in the acquisition, exploration, and development of mining properties in North America.

Market Cap: CA$106.98M

Frontier Lithium Inc., with a market cap of CA$106.98 million, remains pre-revenue as it focuses on developing its mining properties in North America. The company reported a reduced net loss of CA$4.39 million for the second quarter of 2024, down from CA$6.81 million the previous year, indicating some cost management improvements despite ongoing unprofitability. Recent advancements include progress on the PAK Lithium Project's feasibility study and exploration updates at the Ember pegmatite site, highlighting potential resource expansion opportunities. Frontier maintains a stable financial position with sufficient short-term assets to cover liabilities and no debt obligations.

- Dive into the specifics of Frontier Lithium here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Frontier Lithium's future.

Laurion Mineral Exploration (TSXV:LME)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Laurion Mineral Exploration Inc. focuses on the acquisition, exploration, and development of mineral properties in Canada, with a market cap of CA$116.24 million.

Operations: Laurion Mineral Exploration Inc. does not report specific revenue segments, as its primary activities involve acquiring, exploring, and developing mineral properties in Canada.

Market Cap: CA$116.24M

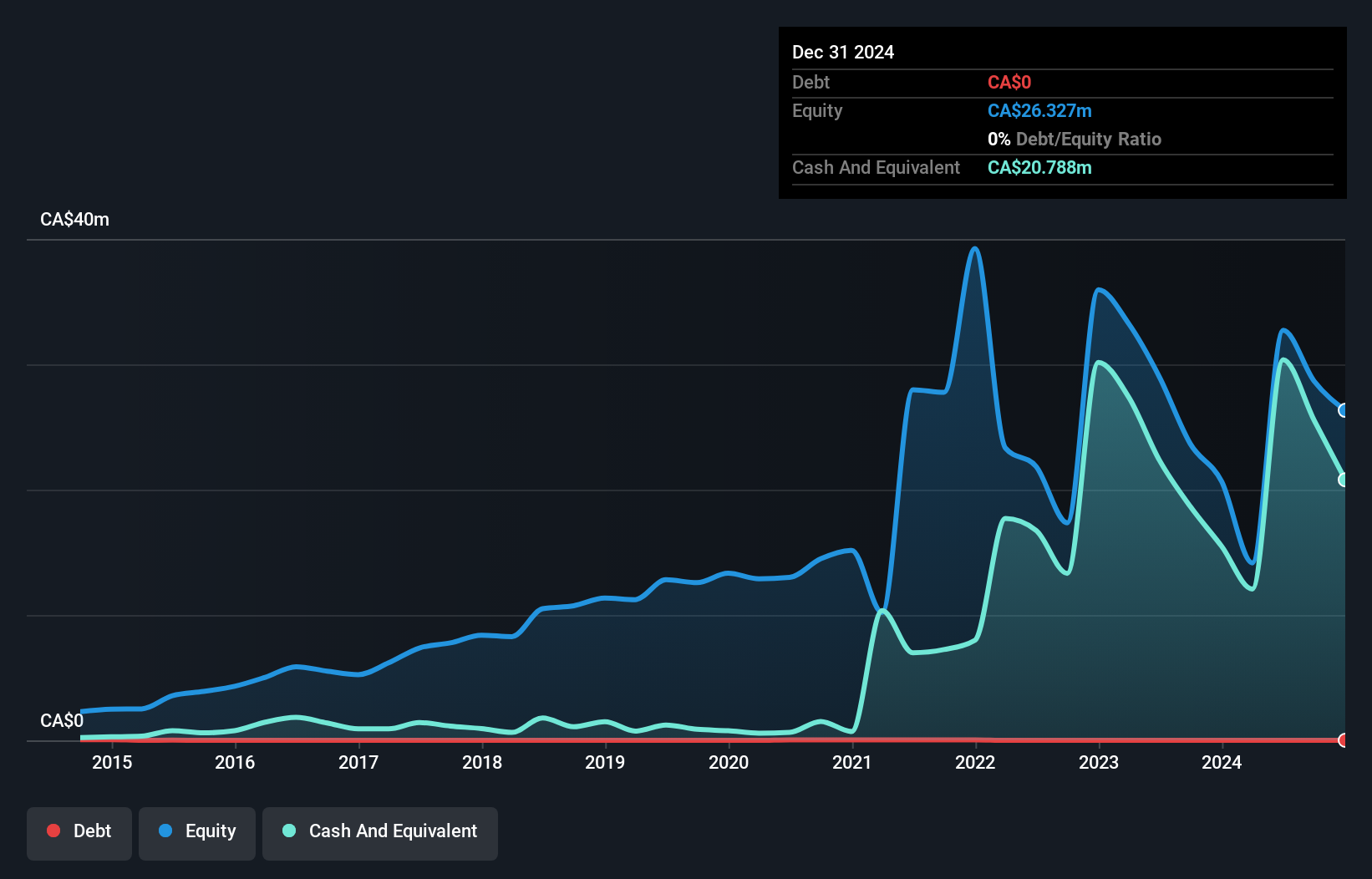

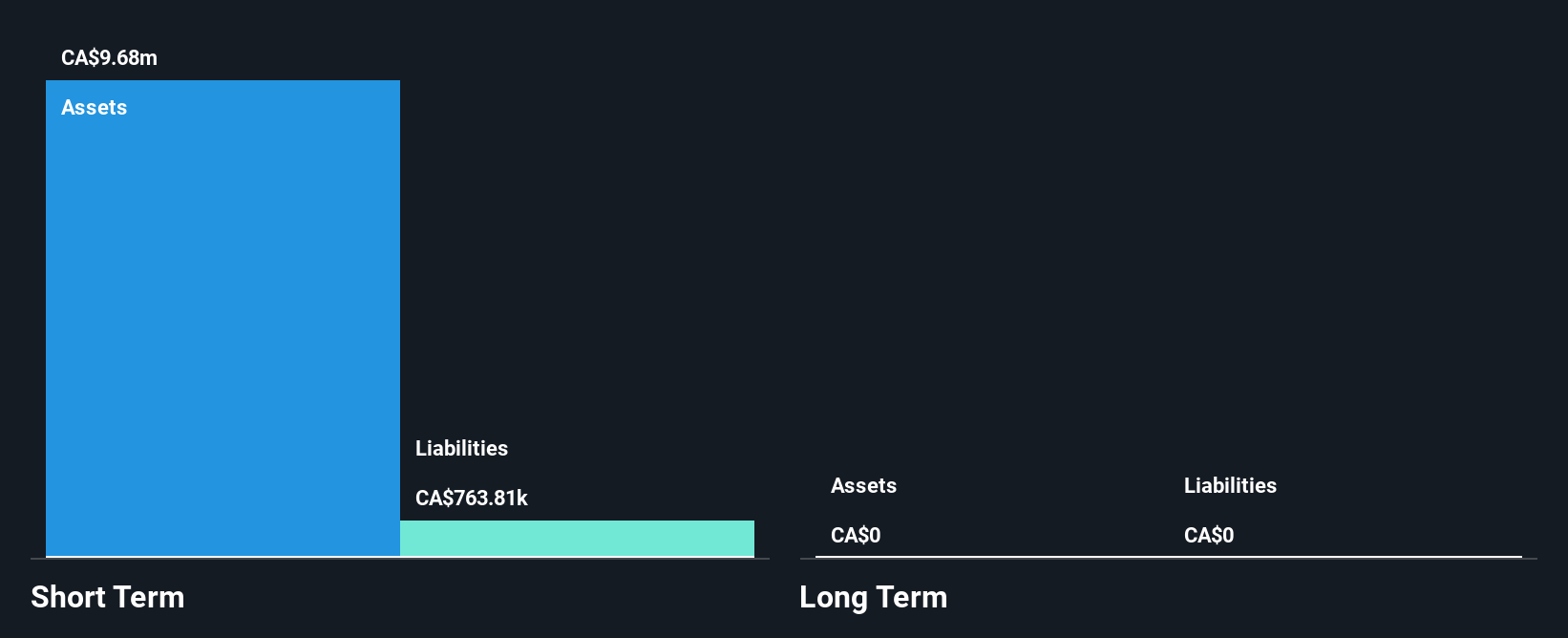

Laurion Mineral Exploration Inc., with a market cap of CA$116.24 million, is pre-revenue as it focuses on mineral exploration in Canada. The company has maintained stable weekly volatility and remains debt-free, with sufficient short-term assets to cover liabilities. Recent drilling at the Ishkõday Project revealed promising high-grade gold intersections, enhancing their understanding of the project's mineral potential and structural framework. Despite shareholder dilution over the past year, Laurion's cash runway suggests financial stability for ongoing exploration efforts. The recent private placement raised CA$2.61 million, supporting continued project development activities.

- Take a closer look at Laurion Mineral Exploration's potential here in our financial health report.

- Evaluate Laurion Mineral Exploration's historical performance by accessing our past performance report.

Neptune Digital Assets (TSXV:NDA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Neptune Digital Assets Corp. builds, owns, and operates infrastructure supporting the digital currency ecosystem in Canada with a market cap of CA$137.13 million.

Operations: The company generates revenue from its data processing operations, amounting to CA$2.41 million.

Market Cap: CA$137.13M

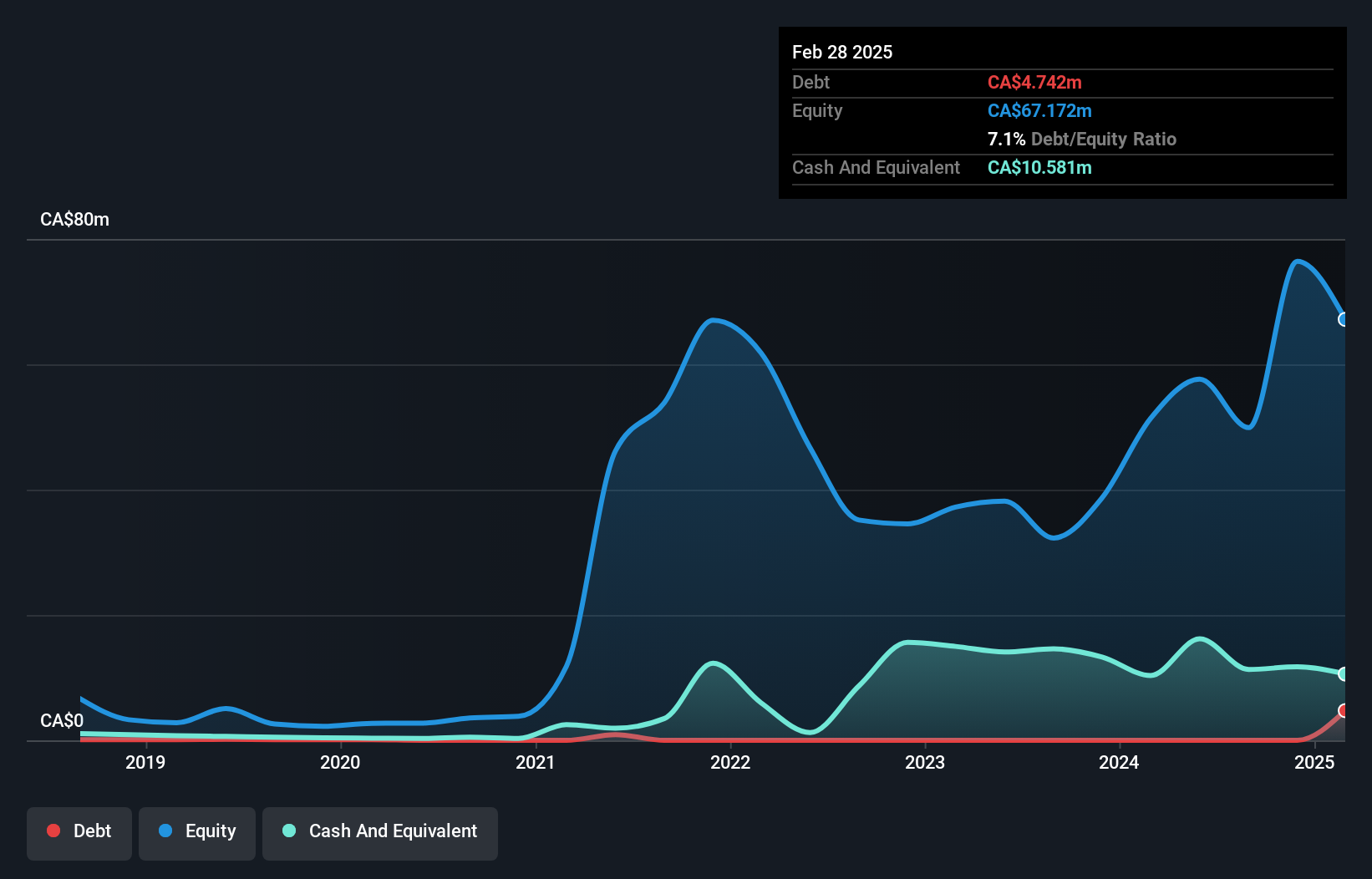

Neptune Digital Assets Corp., with a market cap of CA$137.13 million, has transitioned to profitability, reporting net income of CA$2.43 million for the year ended August 31, 2024. Despite low revenue of CA$2.41 million and high volatility in share price, the company remains debt-free and has strong short-term assets exceeding liabilities. Neptune's strategic expansion into Fantom holdings highlights its innovative approach to leveraging blockchain advancements while utilizing financial strategies like put options to potentially maximize returns. The company's experienced management team further supports its operational stability amidst a rapidly evolving digital currency landscape.

- Click here to discover the nuances of Neptune Digital Assets with our detailed analytical financial health report.

- Explore historical data to track Neptune Digital Assets' performance over time in our past results report.

Summing It All Up

- Reveal the 959 hidden gems among our TSX Penny Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LME

Laurion Mineral Exploration

Engages in the acquisition, exploration, and development of mineral properties in Canada.

Flawless balance sheet low.

Market Insights

Community Narratives