- Canada

- /

- Metals and Mining

- /

- TSXV:LITH

TSX Penny Stocks With Market Caps Over CA$80M To Watch

Reviewed by Simply Wall St

The Canadian market has shown resilience, with the TSX only 4% off its record high, buoyed by strong performances in sectors like materials. In such a climate, investors may find opportunities in penny stocks—an investment area that remains relevant despite its somewhat outdated name. These smaller or newer companies can offer a compelling mix of affordability and growth potential when backed by solid financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.60 | CA$60.69M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.60 | CA$67.7M | ✅ 4 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.61 | CA$405.83M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.17 | CA$611.96M | ✅ 4 ⚠️ 1 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.74 | CA$285.52M | ✅ 2 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.56 | CA$512.4M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.50 | CA$126.99M | ✅ 1 ⚠️ 2 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.49 | CA$93.89M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.51 | CA$14.61M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.23 | CA$45.42M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 928 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

American Lithium (TSXV:LI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: American Lithium Corp. is an exploration and development stage company focused on acquiring, exploring, and developing mineral properties in North and South America, with a market cap of CA$81.56 million.

Operations: Currently, there are no reported revenue segments for this exploration and development stage company.

Market Cap: CA$81.56M

American Lithium Corp., with a market cap of CA$81.56 million, remains pre-revenue, reflecting its status as an exploration and development stage company. The company's recent update on the Tonopah Lithium Claims project shows a 47% increase in Measured Resources, enhancing resource confidence. Despite having no debt and experienced management, American Lithium faces challenges with less than a year of cash runway and historical losses increasing at 21.3% per year over the past five years. Its short-term assets cover liabilities, but volatility remains high at 13%.

- Click to explore a detailed breakdown of our findings in American Lithium's financial health report.

- Understand American Lithium's track record by examining our performance history report.

Lithium Chile (TSXV:LITH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lithium Chile Inc. focuses on acquiring and developing lithium properties in Chile and Argentina, with a market cap of CA$123.92 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$123.92M

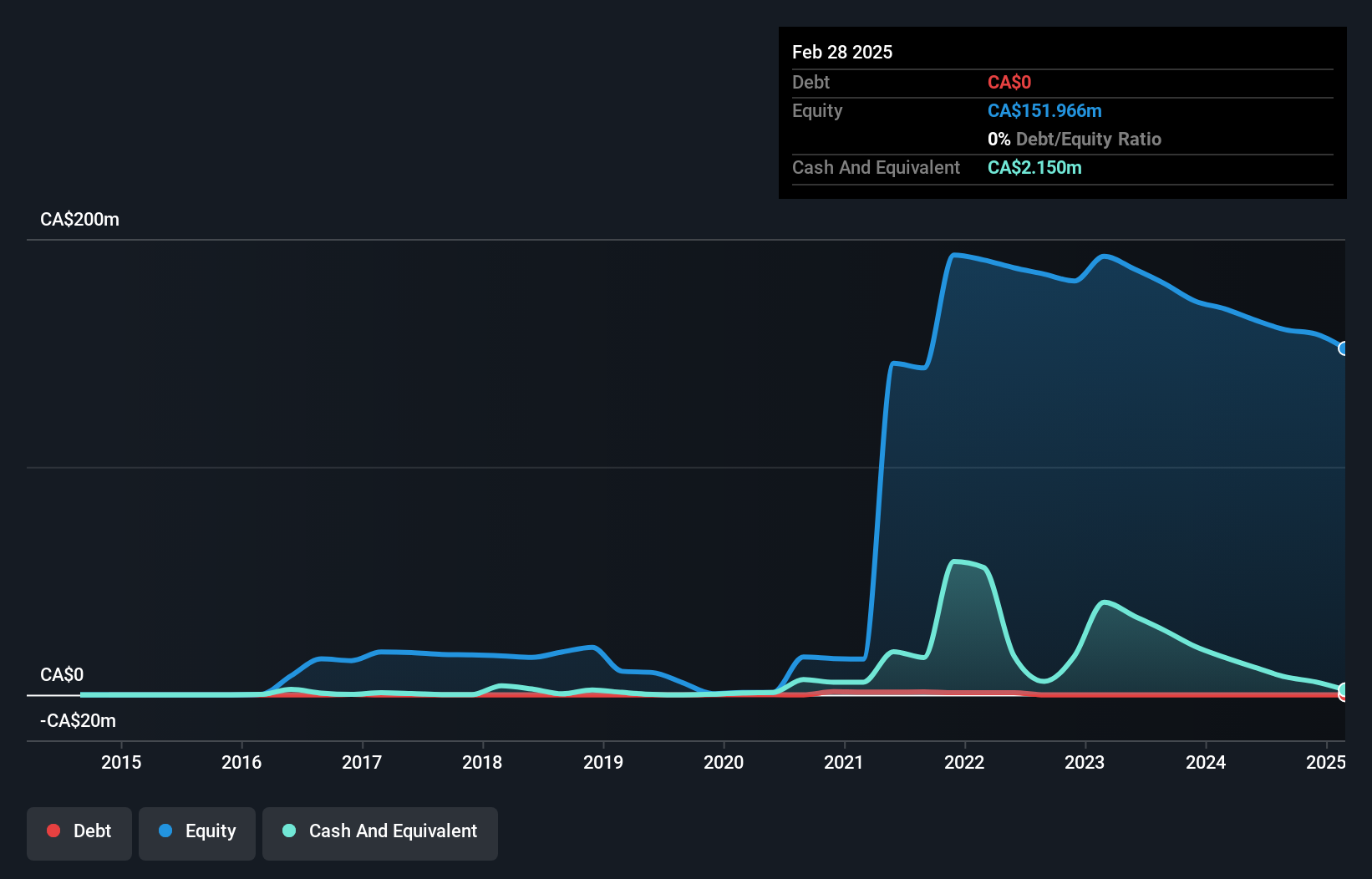

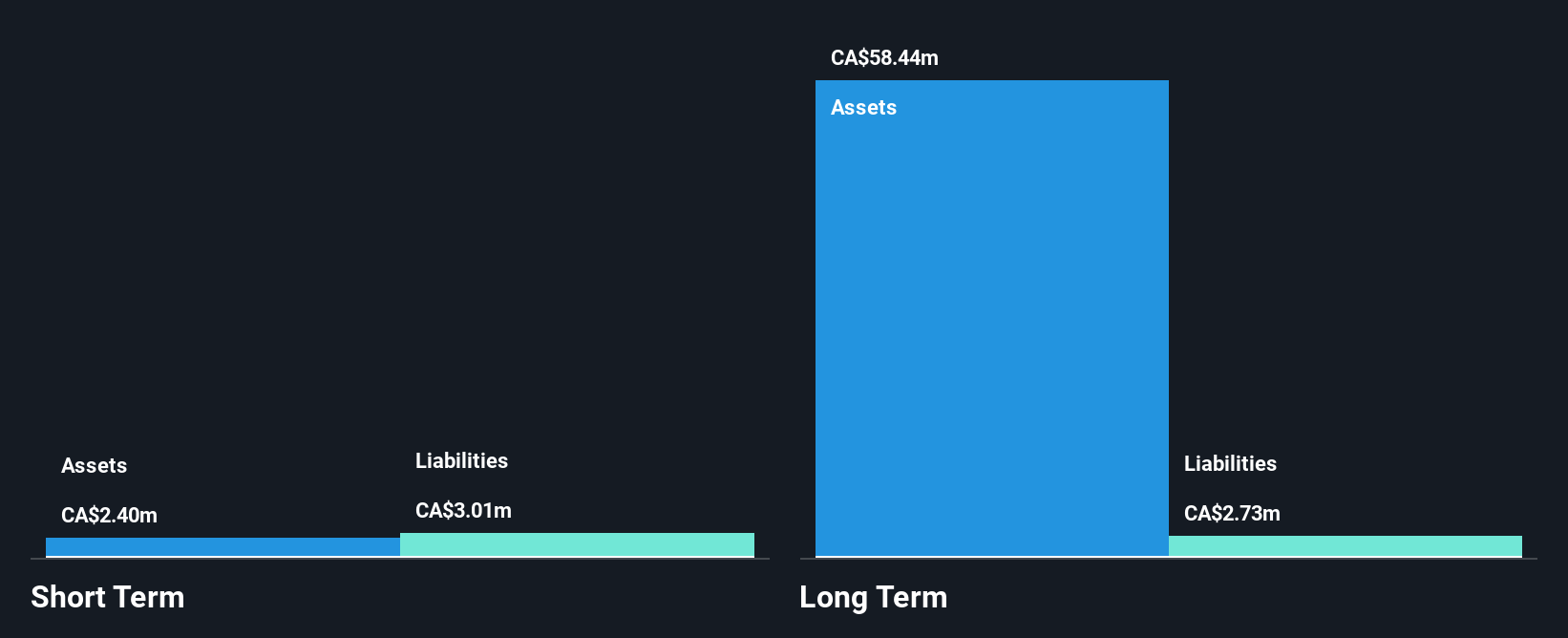

Lithium Chile Inc., with a market cap of CA$123.92 million, is pre-revenue and debt-free, highlighting its exploration focus in the lithium sector. The company recently secured a strategic milestone by being pre-awarded the Mining Tender for CHASCHA SUR in Argentina, enhancing its Arizaro Project's viability. The seasoned management team and experienced board provide stability, while a joint venture with Eramet aims to advance the Molle Verde project. Although profitable over five years with 42% annual earnings growth, Lithium Chile's low return on equity (14.7%) suggests room for improvement despite stable weekly volatility at 9%.

- Get an in-depth perspective on Lithium Chile's performance by reading our balance sheet health report here.

- Learn about Lithium Chile's historical performance here.

Santacruz Silver Mining (TSXV:SCZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Santacruz Silver Mining Ltd. is involved in the acquisition, exploration, development, and operation of mineral properties in Latin America with a market cap of CA$195.72 million.

Operations: The company generates revenue from its mineral operations in Latin America through its Porco ($37.38M), Bolivar ($79.43M), Zimapan ($70.61M), SAN Lucas ($73.13M), and Caballo Blanco Group ($67.09M) segments.

Market Cap: CA$195.72M

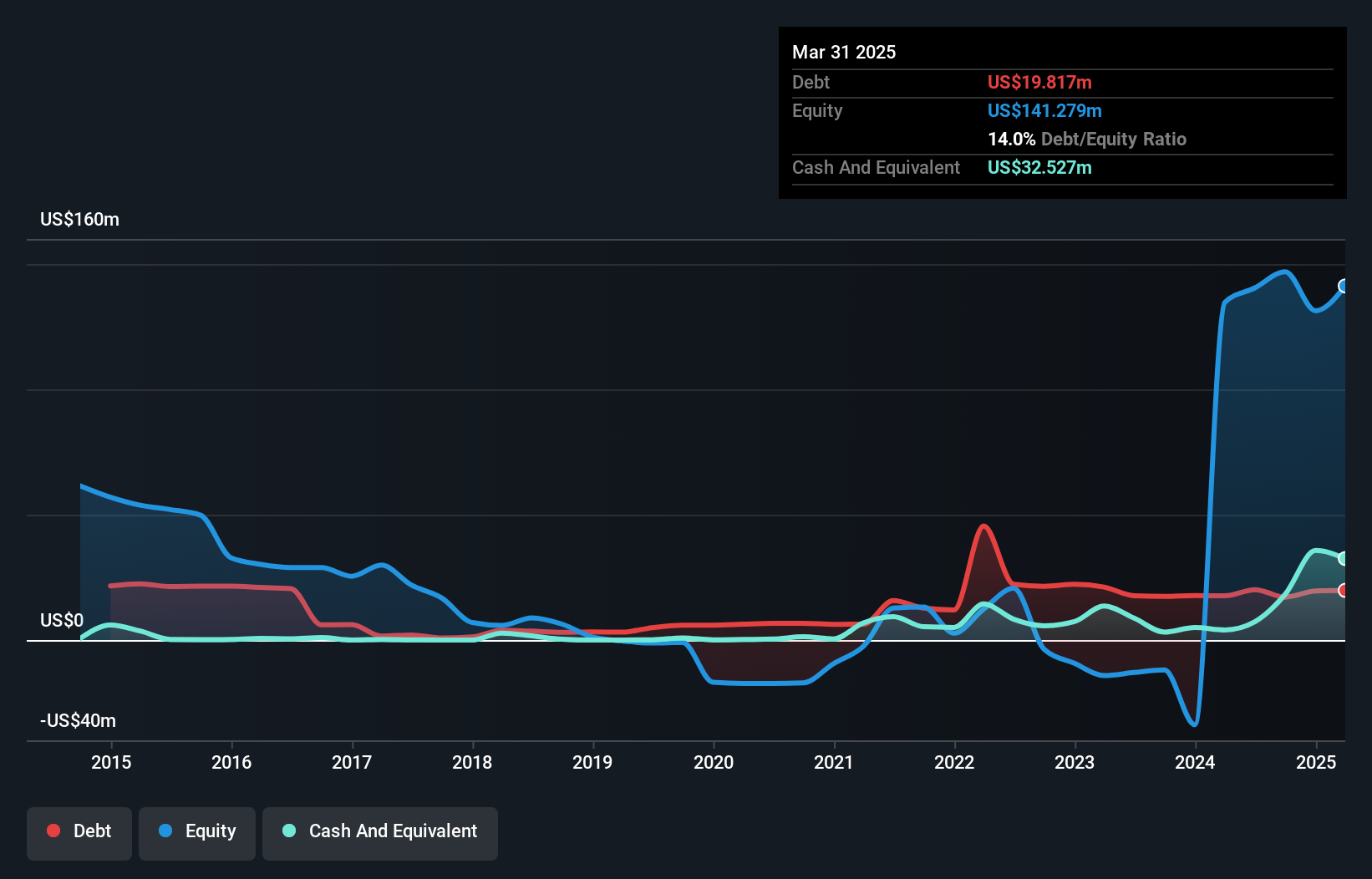

Santacruz Silver Mining Ltd., with a market cap of CA$195.72 million, has shown significant financial improvements, becoming profitable last year and boasting an outstanding return on equity of 102.7%. The company benefits from strong revenue streams across its Latin American operations, including Porco and Bolivar. Recent executive changes, such as appointing Eduardo Torrecillas as COO, are expected to enhance operational efficiency. Despite management's short tenure suggesting inexperience, the board's seasoned leadership provides stability. Santacruz's debt is well-managed with cash flow coverage at 236.8%, underscoring financial resilience amidst ongoing optimization initiatives in its mining operations.

- Jump into the full analysis health report here for a deeper understanding of Santacruz Silver Mining.

- Evaluate Santacruz Silver Mining's prospects by accessing our earnings growth report.

Seize The Opportunity

- Reveal the 928 hidden gems among our TSX Penny Stocks screener with a single click here.

- Ready To Venture Into Other Investment Styles? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LITH

Lithium Chile

Engages in the acquisition and development of lithium properties in Chile and Argentina.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives