- Canada

- /

- Metals and Mining

- /

- TSXV:LG

Insiders At Lahontan Gold See Good Returns After Buying Stock Worth US$695.9k

Insiders who bought Lahontan Gold Corp. (CVE:LG) stock lover the last 12 months are probably not as affected by last week’s 10.0% loss. After taking the recent loss into consideration, the US$695.9k worth of stock they bought is now worth US$1.95m, indicating that their investment yielded a positive return.

While insider transactions are not the most important thing when it comes to long-term investing, we do think it is perfectly logical to keep tabs on what insiders are doing.

The Last 12 Months Of Insider Transactions At Lahontan Gold

In the last twelve months, the biggest single purchase by an insider was when insider Lawrence Lepard bought CA$429k worth of shares at a price of CA$0.05 per share. Although we like to see insider buying, we note that this large purchase was at significantly below the recent price of CA$0.18. While it does suggest insiders consider the stock undervalued at lower prices, this transaction doesn't tell us much about what they think of current prices.

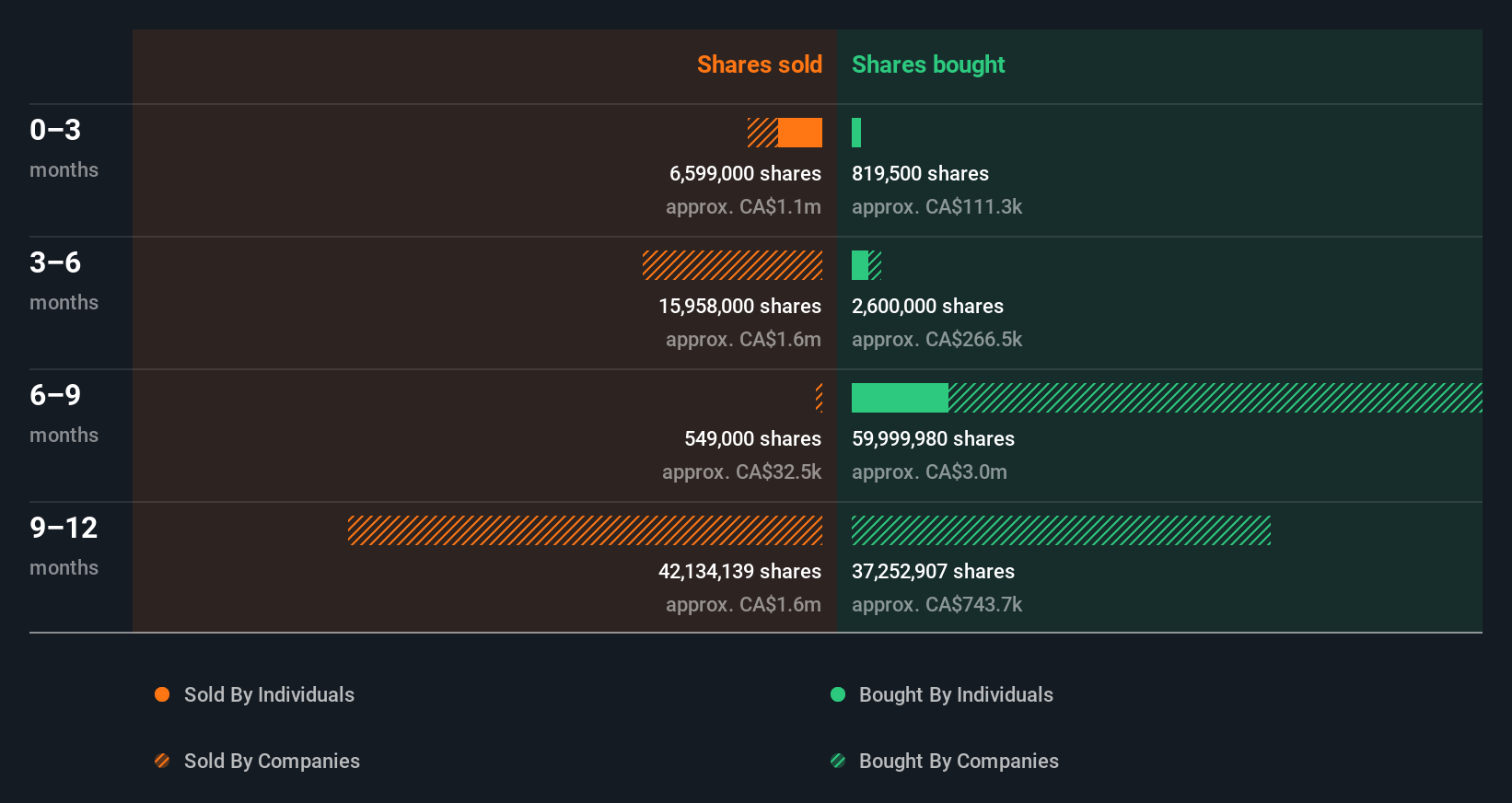

Happily, we note that in the last year insiders paid CA$696k for 10.84m shares. But they sold 3.92m shares for CA$675k. In total, Lahontan Gold insiders bought more than they sold over the last year. The average buy price was around CA$0.064. To my mind it is good that insiders have invested their own money in the company. However, you should keep in mind that they bought when the share price was meaningfully below today's levels. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

Check out our latest analysis for Lahontan Gold

There are always plenty of stocks that insiders are buying. If investing in lesser known companies is your style, you could take a look at this free list of companies. (Hint: insiders have been buying them).

Lahontan Gold Insiders Are Selling The Stock

We've seen more insider selling than insider buying at Lahontan Gold recently. In total, insider Lawrence Lepard sold CA$675k worth of shares in that time. Meanwhile insiders bought CA$112k worth. Since the selling really does outweigh the buying, we'd say that these transactions may suggest that some insiders feel the shares are not cheap.

Insider Ownership Of Lahontan Gold

For a common shareholder, it is worth checking how many shares are held by company insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. From our data, it seems that Lahontan Gold insiders own 7.4% of the company, worth about CA$4.7m. Whilst better than nothing, we're not overly impressed by these holdings.

What Might The Insider Transactions At Lahontan Gold Tell Us?

Unfortunately, there has been more insider selling of Lahontan Gold stock, than buying, in the last three months. On the other hand, the insider transactions over the last year are encouraging. But we'd like it if insiders owned more stock, overall. So overall it's hard to argue insiders are bullish. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Lahontan Gold. For instance, we've identified 5 warning signs for Lahontan Gold (2 don't sit too well with us) you should be aware of.

Of course Lahontan Gold may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:LG

Lahontan Gold

An exploration stage junior mining company, engages in the identification, acquisition, evaluation, and exploration of mineral properties in the United States.

Excellent balance sheet with moderate risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion