- Canada

- /

- Metals and Mining

- /

- TSXV:IPT

The one-year returns have been notable for IMPACT Silver (CVE:IPT) shareholders despite underlying losses increasing

If you want to compound wealth in the stock market, you can do so by buying an index fund. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the IMPACT Silver Corp. (CVE:IPT) share price is 68% higher than it was a year ago, much better than the market return of around 20% (not including dividends) in the same period. So that should have shareholders smiling. Zooming out, the stock is actually down 47% in the last three years.

Since the stock has added CA$20m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for IMPACT Silver

IMPACT Silver isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

IMPACT Silver grew its revenue by 23% last year. We respect that sort of growth, no doubt. While the share price performed well, gaining 68% over twelve months, you could argue the revenue growth warranted it. If the company can maintain the revenue growth, the share price could go higher still. But it's crucial to check profitability and cash flow before forming a view on the future.

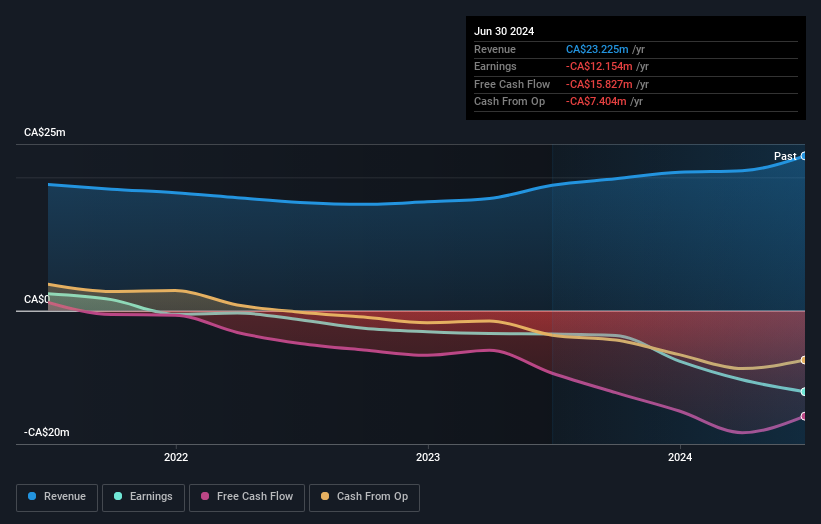

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on IMPACT Silver's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that IMPACT Silver shareholders have received a total shareholder return of 68% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 0.3% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand IMPACT Silver better, we need to consider many other factors. Even so, be aware that IMPACT Silver is showing 5 warning signs in our investment analysis , and 2 of those shouldn't be ignored...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:IPT

IMPACT Silver

Engages in the exploration, development, and mineral processing activities in Mexico.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives