As 2025 draws to a close, the Canadian market is navigating through a landscape marked by easing inflation and stabilizing labor conditions, setting the stage for a potentially constructive outlook in 2026. For investors interested in exploring beyond well-known names, penny stocks—often associated with smaller or newer companies—remain an intriguing area of investment despite their somewhat outdated terminology. These stocks can offer unexpected opportunities when backed by strong financial health, presenting potential for growth and stability amidst evolving market dynamics.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.08 | CA$53.09M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.75 | CA$21.61M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.31 | CA$246.67M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.16 | CA$116.92M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.45 | CA$3.88M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.335 | CA$51.82M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.34 | CA$864.89M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.18 | CA$23.39M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.14 | CA$153.69M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.95 | CA$185.47M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 394 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

EcoSynthetix (TSX:ECO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: EcoSynthetix Inc. is a renewable chemicals company that develops and commercializes bio-based technologies to replace synthetic, petrochemical-based chemicals globally, with a market cap of CA$222.74 million.

Operations: The company generates revenue from its Biopolymer Nanosphere Technology Platform, amounting to $20.31 million.

Market Cap: CA$222.74M

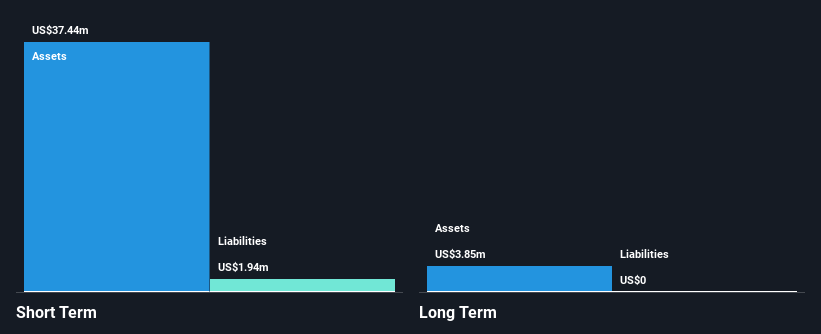

EcoSynthetix Inc. has shown resilience in the penny stock arena with its bio-based technology platform, generating US$20.31 million in revenue. Despite being unprofitable, the company has reduced losses by 14.8% annually over five years and maintains a strong cash position with a runway exceeding three years. Recent earnings revealed sales growth to US$5.83 million for Q3 2025, though net loss was reported at US$0.09 million compared to last year's profit. Strategic moves include share buybacks and new contracts for its SurfLock product in Europe, bolstered by an experienced management team and debt-free status.

- Take a closer look at EcoSynthetix's potential here in our financial health report.

- Gain insights into EcoSynthetix's past trends and performance with our report on the company's historical track record.

Critical Elements Lithium (TSXV:CRE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Critical Elements Lithium Corporation is involved in the acquisition, exploration, evaluation, development, and processing of critical minerals mining properties in Canada with a market cap of CA$83.53 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$83.53M

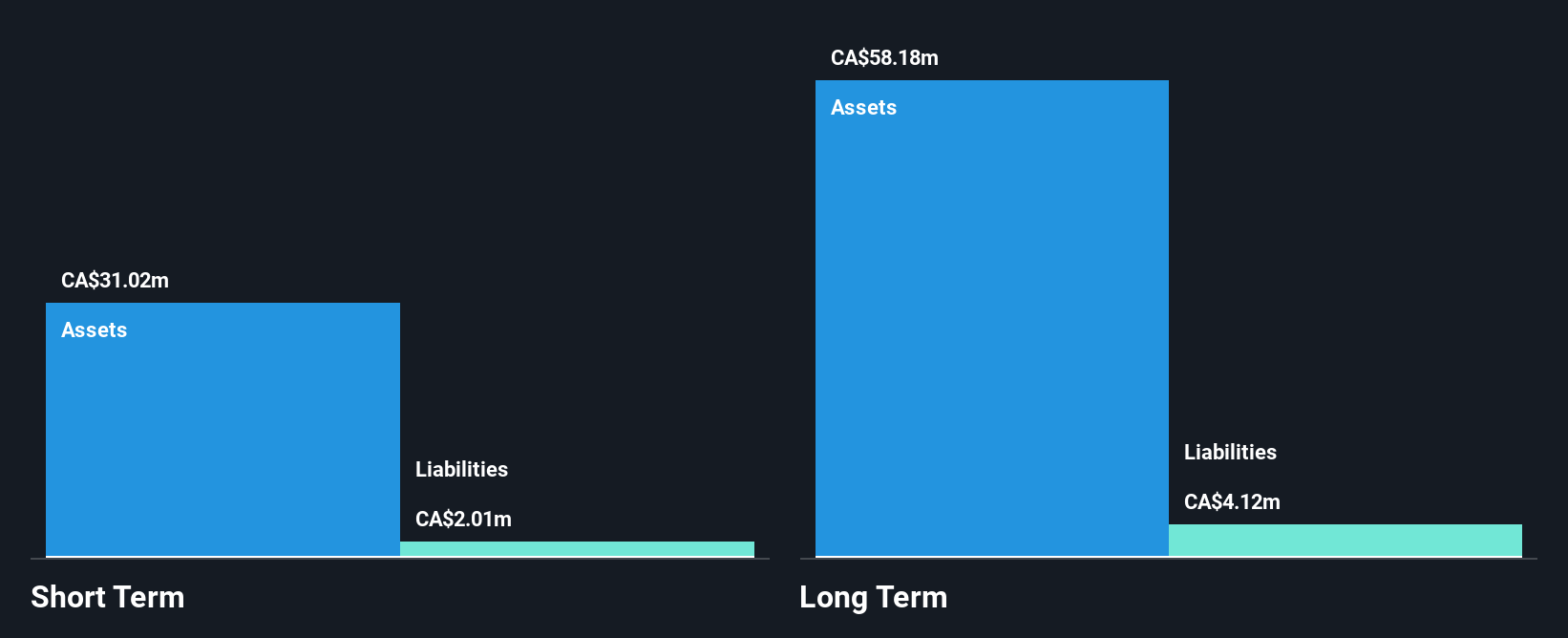

Critical Elements Lithium Corporation, with a market cap of CA$83.53 million, remains pre-revenue but has transitioned to profitability this year. The company recently raised CA$7 million through private placements and maintains a strong balance sheet with short-term assets of CA$27.1 million exceeding liabilities. Despite being dropped from the S&P/TSX Venture Composite Index, it benefits from an experienced management team and board with no debt on its books. Recent exploration efforts in Québec have identified promising mineralized zones for future development, although earnings are forecast to decline significantly over the next three years according to consensus estimates.

- Navigate through the intricacies of Critical Elements Lithium with our comprehensive balance sheet health report here.

- Assess Critical Elements Lithium's future earnings estimates with our detailed growth reports.

Independence Gold (TSXV:IGO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Independence Gold Corp. focuses on acquiring, exploring, and evaluating precious metal properties in North America, with a market cap of CA$20.22 million.

Operations: Currently, there are no reported revenue segments for Independence Gold Corp.

Market Cap: CA$20.22M

Independence Gold Corp., with a market cap of CA$20.22 million, remains pre-revenue and recently secured CA$3.5 million through private placements, enhancing its financial runway. The company has no debt and its short-term assets exceed liabilities, offering some financial stability amidst ongoing exploration efforts at the 3Ts Project in British Columbia. Recent updates to the mineral resource estimate have introduced new vein systems, increasing confidence in potential reserves and highlighting significant expansion opportunities. Despite these advancements, Independence Gold is unprofitable with losses growing over recent years; however, it benefits from a seasoned management team and board of directors.

- Click to explore a detailed breakdown of our findings in Independence Gold's financial health report.

- Review our historical performance report to gain insights into Independence Gold's track record.

Where To Now?

- Click here to access our complete index of 394 TSX Penny Stocks.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EcoSynthetix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ECO

EcoSynthetix

A renewable chemicals company, develops and commercializes bio-based technologies that are used as replacement solutions for synthetic, petrochemical-based chemicals, and other related products in the Americas, Europe, the Middle East, Africa, and Asia Pacific.

Flawless balance sheet with weak fundamentals.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion