- Canada

- /

- Metals and Mining

- /

- TSXV:ANOR

Could The Hudson Resources Inc. (CVE:HUD) Ownership Structure Tell Us Something Useful?

The big shareholder groups in Hudson Resources Inc. (CVE:HUD) have power over the company. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. Warren Buffett said that he likes "a business with enduring competitive advantages that is run by able and owner-oriented people." So it's nice to see some insider ownership, because it may suggest that management is owner-oriented.

Hudson Resources is not a large company by global standards. It has a market capitalization of CA$23m, which means it wouldn't have the attention of many institutional investors. In the chart below, we can see that institutional investors have not yet purchased much of the company. Let's delve deeper into each type of owner, to discover more about Hudson Resources.

See our latest analysis for Hudson Resources

What Does The Institutional Ownership Tell Us About Hudson Resources?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

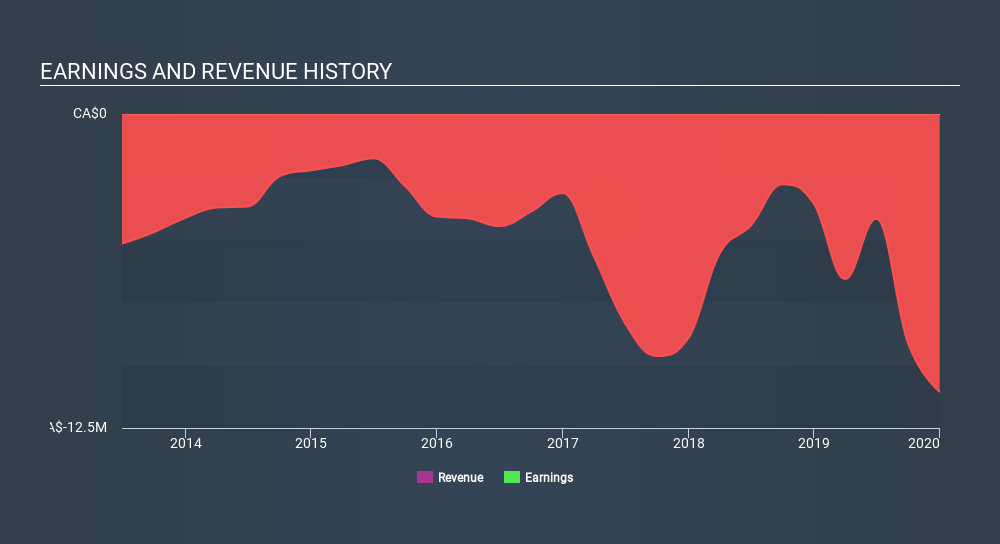

Institutions own less than 5% of Hudson Resources. That indicates that the company is on the radar of some funds, but it isn't particularly popular with professional investors at the moment. If the business gets stronger from here, we could see a situation where more institutions are keen to buy. We sometimes see a rising share price when a few big institutions want to buy a certain stock at the same time. The history of earnings and revenue, which you can see below, could be helpful in considering if more institutional investors will want the stock. Of course, there are plenty of other factors to consider, too.

Hedge funds don't have many shares in Hudson Resources. The company's largest shareholder is Robert Shields, with ownership of 11%, Next, we have Apex Asset Management Corp and Jim Cambon as the second and third largest shareholders, holding 1.4% and 0.8%, of the shares outstanding, respectively. Jim Cambon also happens to hold the title of Member of the Board of Directors.

Our studies suggest that the top 7 shareholders collectively control less than 50% of the company's shares, meaning that the company's shares are widely disseminated and there is no dominant shareholder.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. As far I can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of Hudson Resources

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our most recent data indicates that insiders own a reasonable proportion of Hudson Resources Inc.. It has a market capitalization of just CA$23m, and insiders have CA$2.8m worth of shares in their own names. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership

The general public -- mostly retail investors -- own 87% of Hudson Resources. This level of ownership gives retail investors the power to sway key policy decisions such as board composition, executive compensation, and the dividend payout ratio.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Hudson Resources (at least 2 which are a bit concerning) , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About TSXV:ANOR

AnorTech

Engages in the acquisition, exploration, development, and mining of mineral resources in Canada and Greenland.

Flawless balance sheet with low risk.

Market Insights

Community Narratives