- Canada

- /

- Metals and Mining

- /

- TSXV:HAR

Most Shareholders Will Probably Find That The CEO Compensation For Harfang Exploration Inc. (CVE:HAR) Is Reasonable

Performance at Harfang Exploration Inc. (CVE:HAR) has been reasonably good and CEO Francois Goulet has done a decent job of steering the company in the right direction. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 14 July 2021. We present our case of why we think CEO compensation looks fair.

View our latest analysis for Harfang Exploration

How Does Total Compensation For Francois Goulet Compare With Other Companies In The Industry?

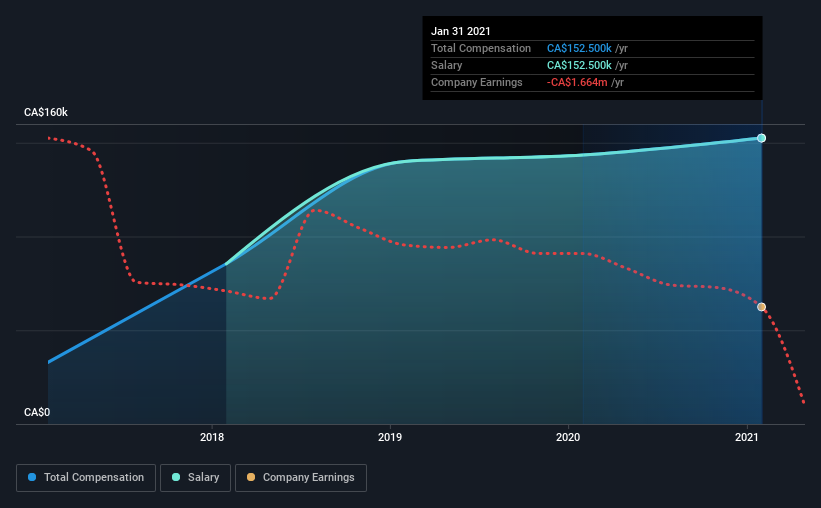

According to our data, Harfang Exploration Inc. has a market capitalization of CA$24m, and paid its CEO total annual compensation worth CA$153k over the year to January 2021. That's a fairly small increase of 6.3% over the previous year. Notably, the salary of CA$153k is the entirety of the CEO compensation.

In comparison with other companies in the industry with market capitalizations under CA$250m, the reported median total CEO compensation was CA$156k. So it looks like Harfang Exploration compensates Francois Goulet in line with the median for the industry. Moreover, Francois Goulet also holds CA$401k worth of Harfang Exploration stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | CA$153k | CA$143k | 100% |

| Other | - | - | - |

| Total Compensation | CA$153k | CA$143k | 100% |

Talking in terms of the industry, salary represented approximately 86% of total compensation out of all the companies we analyzed, while other remuneration made up 14% of the pie. At the company level, Harfang Exploration pays Francois Goulet solely through a salary, preferring to go down a conventional route. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Harfang Exploration Inc.'s Growth

Harfang Exploration Inc.'s earnings per share (EPS) grew 9.7% per year over the last three years. In the last year, the company lost virtually all of its revenue.

We would argue that the lack of revenue growth in the last year is less than ideal, but the modest improvement in EPS is good. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Harfang Exploration Inc. Been A Good Investment?

Most shareholders would probably be pleased with Harfang Exploration Inc. for providing a total return of 47% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Harfang Exploration rewards its CEO solely through a salary, ignoring non-salary benefits completely. The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 5 warning signs for Harfang Exploration (of which 2 are a bit unpleasant!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Harfang Exploration, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Harfang Exploration might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:HAR

Harfang Exploration

An exploration and evaluation stage company, engages in acquiring and exploring mineral properties in Canada.

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026