- Canada

- /

- Entertainment

- /

- TSXV:OAM

3 TSX Penny Stocks With Market Caps Under CA$200M To Consider

Reviewed by Simply Wall St

Despite recent volatility, the Canadian stock market has reached all-time highs, with the TSX up roughly 9%, reflecting a resilient economic backdrop. Investing in penny stocks—though an outdated term—continues to offer unique opportunities for growth, especially when these smaller or newer companies are backed by strong financial health. In the current market landscape, identifying penny stocks with robust balance sheets and potential for long-term growth can uncover hidden value for investors.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.72 | CA$67.77M | ✅ 3 ⚠️ 3 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.41 | CA$12.03M | ✅ 2 ⚠️ 4 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.54 | CA$440.75M | ✅ 4 ⚠️ 0 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.74 | CA$505.63M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.94 | CA$18.63M | ✅ 2 ⚠️ 4 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.27 | CA$366.59M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.56 | CA$180.69M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.88 | CA$181.34M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.30 | CA$6.28M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 444 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Hannan Metals (TSXV:HAN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hannan Metals Ltd. is a junior mineral exploration company focused on acquiring and exploring mineral properties in Ireland and Peru, with a market cap of CA$111.24 million.

Operations: Hannan Metals Ltd. has not reported any revenue segments.

Market Cap: CA$111.24M

Hannan Metals Ltd., a pre-revenue junior exploration company, has recently expanded its gold mineralization footprint at the Previsto project in Peru, with high-grade assay results suggesting potential for significant discoveries. Despite being debt-free and having a seasoned management team, Hannan faces financial challenges with less than a year of cash runway and ongoing losses. The company's share price remains highly volatile, reflecting inherent risks associated with early-stage exploration ventures. Recent executive changes and environmental compliance efforts underscore its commitment to responsible development as it progresses its maiden drill program at the Valiente copper-gold project.

- Click here to discover the nuances of Hannan Metals with our detailed analytical financial health report.

- Understand Hannan Metals' track record by examining our performance history report.

OverActive Media (TSXV:OAM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: OverActive Media Corp. is an esports and entertainment company operating in Canada, the United States, and Europe with a market cap of CA$34.63 million.

Operations: The company's revenue is derived from two primary segments: Team Operations, which generated CA$9.67 million, and Business Operations, contributing CA$18.69 million.

Market Cap: CA$34.63M

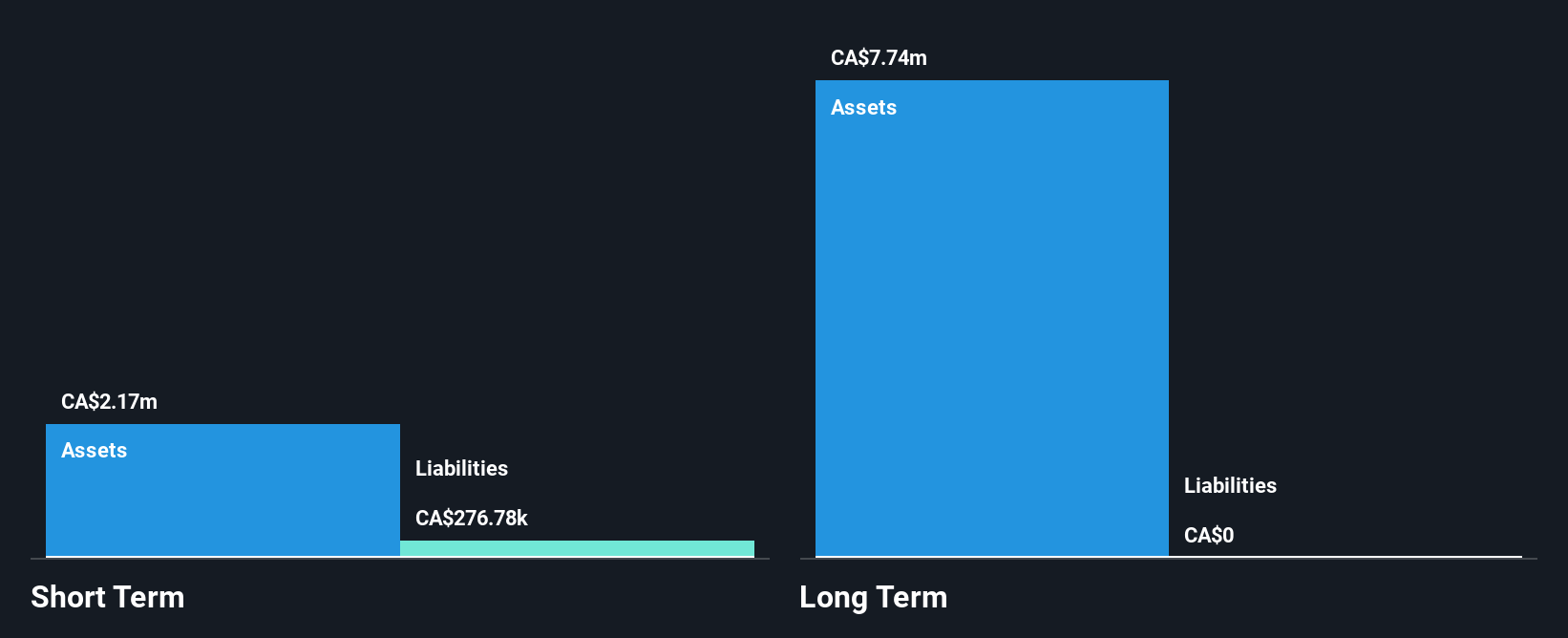

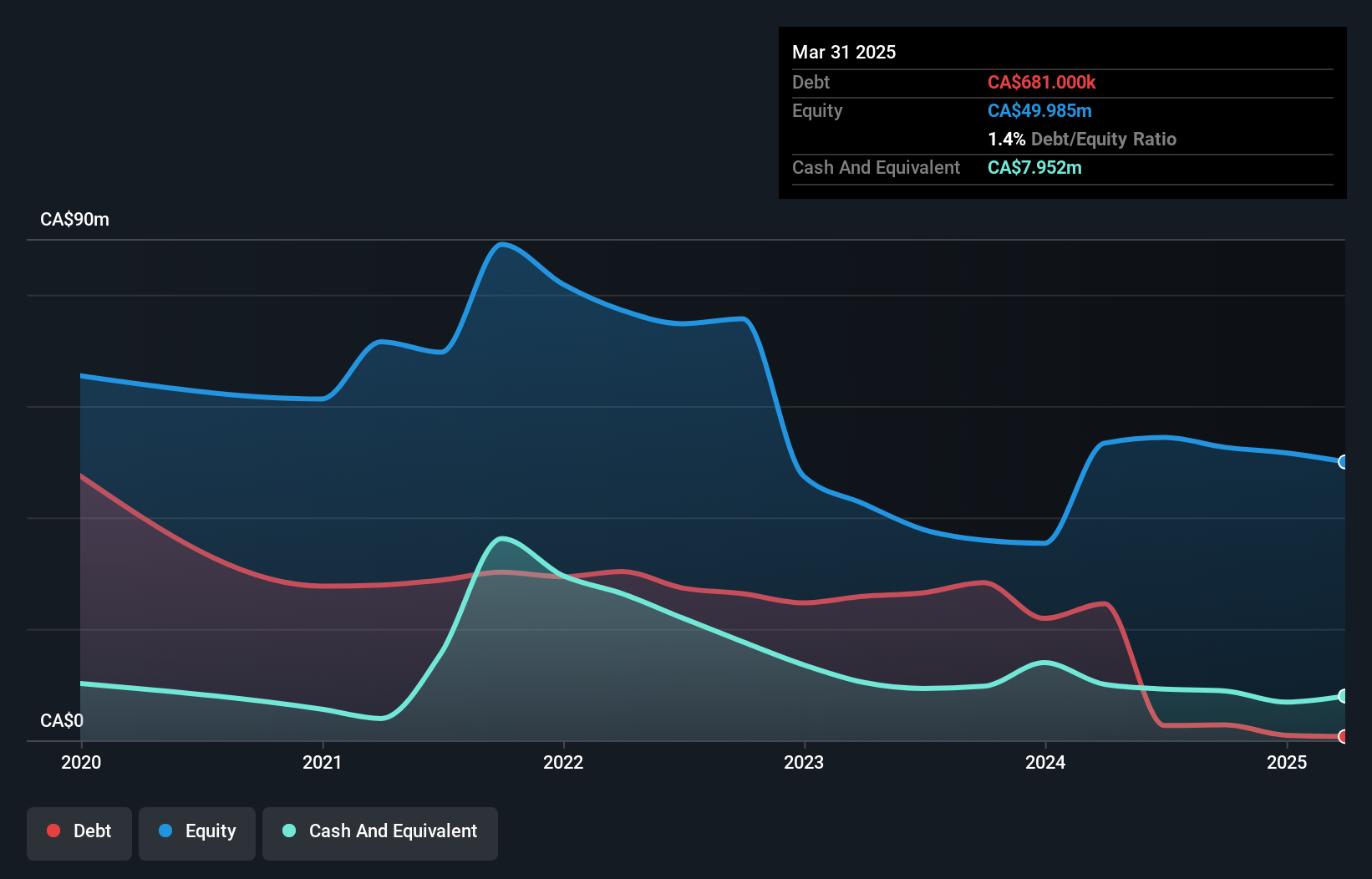

OverActive Media Corp., with a market cap of CA$34.63 million, has shown signs of financial improvement by becoming profitable last year and reducing its debt-to-equity ratio from 67.2% to 1.4% over five years. The company reported Q1 2025 sales of CA$5 million, up from CA$3.66 million the previous year, though it still posted a net loss of CA$3.68 million for the quarter. Despite high volatility and low return on equity at 0.2%, its short-term assets exceed liabilities, indicating some financial stability amidst ongoing challenges in managing operating cash flow and interest coverage issues.

- Get an in-depth perspective on OverActive Media's performance by reading our balance sheet health report here.

- Gain insights into OverActive Media's past trends and performance with our report on the company's historical track record.

Scottie Resources (TSXV:SCOT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Scottie Resources Corp. focuses on the identification, acquisition, exploration, and development of mineral properties in British Columbia, Canada, with a market cap of CA$43.97 million.

Operations: Scottie Resources Corp. currently does not report any revenue segments, focusing instead on its activities in mineral property exploration and development in British Columbia, Canada.

Market Cap: CA$43.97M

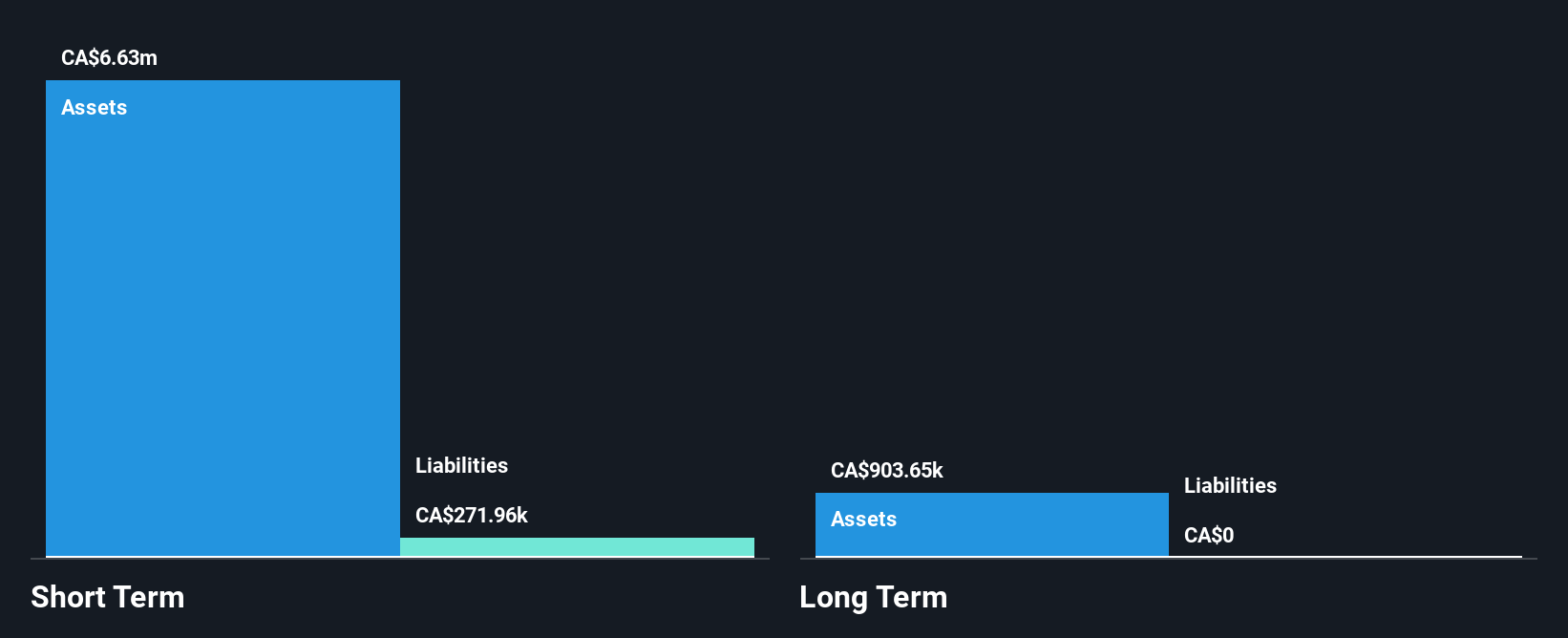

Scottie Resources Corp., with a market cap of CA$43.97 million, is pre-revenue and focuses on mineral exploration in British Columbia. The company recently announced a maiden Inferred Mineral Resource Estimate for its Scottie Gold Mine Project, featuring 703,000 ounces of gold at an average grade of 6.1 g/t. This includes both underground and shallow pit resources designed to optimize early cash flows and minimize initial capital outlay. Scottie's financial position is supported by a debt-free structure and sufficient cash runway exceeding three years, though it remains unprofitable with increasing losses over the past five years despite positive free cash flow trends.

- Navigate through the intricacies of Scottie Resources with our comprehensive balance sheet health report here.

- Examine Scottie Resources' past performance report to understand how it has performed in prior years.

Summing It All Up

- Discover the full array of 444 TSX Penny Stocks right here.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:OAM

OverActive Media

Operates as an esports and entertainment company in Canada, the United States, and Europe.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives