- Canada

- /

- Metals and Mining

- /

- TSXV:GSTM

3 Promising TSX Penny Stocks With At Least CA$7M Market Cap

Reviewed by Simply Wall St

As Canada navigates the economic implications of new U.S. policies, including potential tariff changes and energy reforms, the TSX index has shown resilience with gains since Inauguration Day. Amidst this backdrop, investors are exploring opportunities in various market segments, including penny stocks—an area that continues to offer potential despite its somewhat outdated label. These smaller or newer companies can provide significant value when they possess strong financials and growth prospects; we've identified three such penny stocks on the TSX that may present intriguing opportunities for those interested in tapping into emerging market players.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.29 | CA$965.98M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.33 | CA$432.92M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.42 | CA$124.04M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.26 | CA$231.32M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.495 | CA$13.75M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.68 | CA$632.68M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$26.86M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$4.07M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$179.61M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.16 | CA$228.22M | ★★★★☆☆ |

Click here to see the full list of 934 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Questerre Energy (TSX:QEC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Questerre Energy Corporation is an energy technology and innovation company focused on acquiring, exploring, and developing non-conventional oil and gas projects in Canada, with a market cap of CA$98.56 million.

Operations: The company generates CA$33.37 million in revenue from its oil and gas exploration and production activities.

Market Cap: CA$98.56M

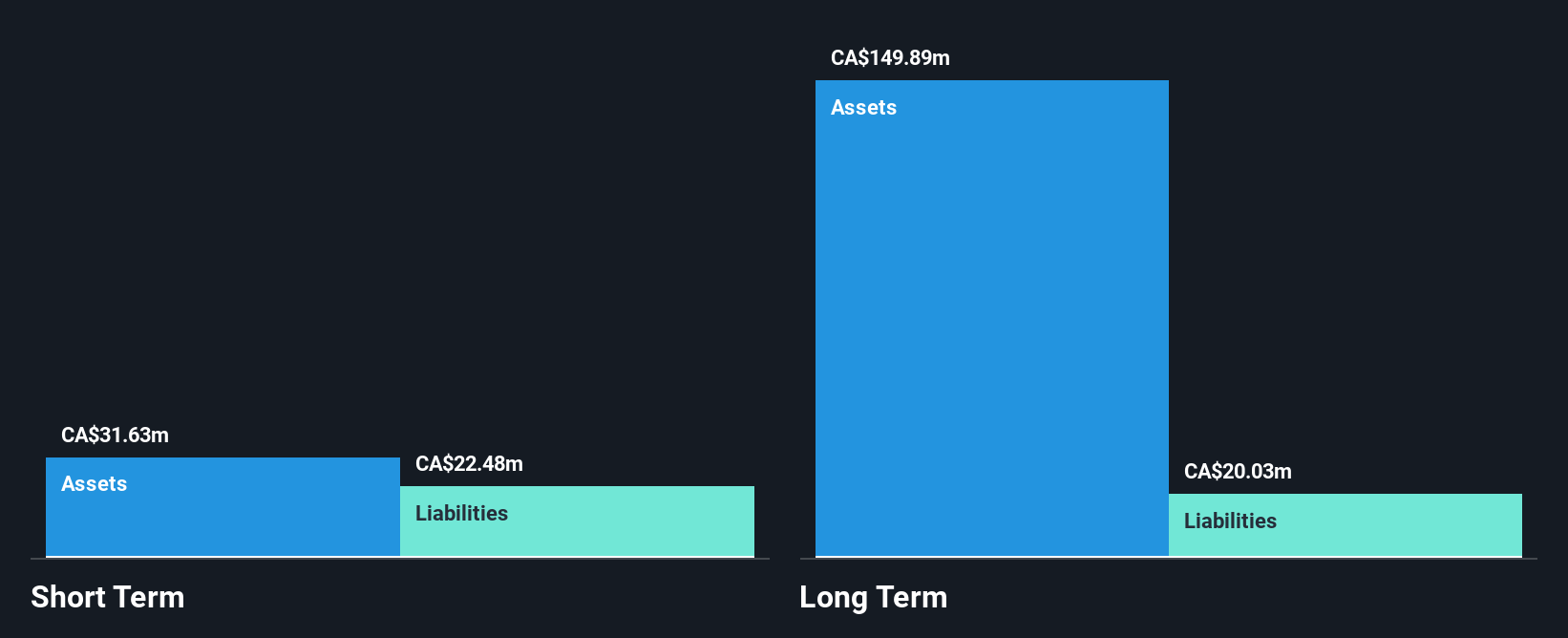

Questerre Energy Corporation, with a market cap of CA$98.56 million, focuses on non-conventional oil and gas projects. Despite being unprofitable, it reported CA$33.37 million in revenue from exploration and production activities. Recent earnings show a decline in quarterly revenue to CA$8.47 million, with a net loss of CA$0.273 million compared to the previous year. The company has strong short-term asset coverage over liabilities and reduced its debt-to-equity ratio significantly over five years. Questerre's management team is experienced with an average tenure of 19.2 years, providing stability amid financial challenges and volatility concerns.

- Click here and access our complete financial health analysis report to understand the dynamics of Questerre Energy.

- Learn about Questerre Energy's historical performance here.

Goldstorm Metals (TSXV:GSTM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Goldstorm Metals Corp. is a junior resource exploration company focused on acquiring, exploring, and developing mineral properties in Canada, with a market cap of CA$7.60 million.

Operations: Goldstorm Metals Corp. has not reported any revenue segments.

Market Cap: CA$7.6M

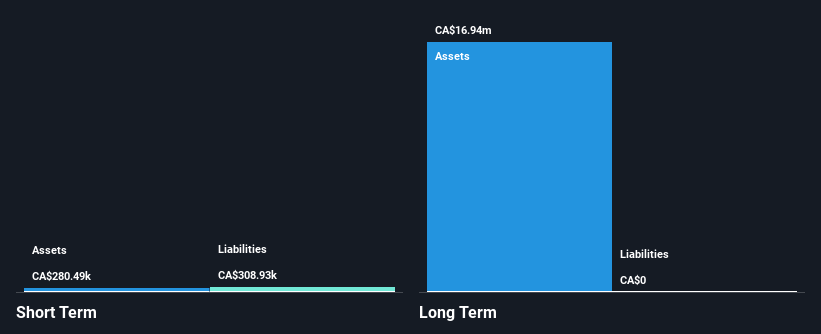

Goldstorm Metals Corp., with a market cap of CA$7.60 million, is a pre-revenue junior exploration company focused on mineral properties in Canada. Recent drilling results from its Electrum gold-silver property in British Columbia showed promising mineralization, but the company remains unprofitable and highly volatile. It has no debt and short-term assets covering liabilities, yet less than one year of cash runway suggests potential liquidity challenges. The management team is relatively inexperienced with an average tenure of one year, which may impact strategic execution as it navigates the complexities of resource exploration and development without significant revenue streams.

- Unlock comprehensive insights into our analysis of Goldstorm Metals stock in this financial health report.

- Examine Goldstorm Metals' past performance report to understand how it has performed in prior years.

Intrepid Metals (TSXV:INTR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Intrepid Metals Corp. is a mineral exploration company focused on acquiring, exploring, and developing mineral properties with a market cap of CA$21.88 million.

Operations: There are no reported revenue segments for this mineral exploration company.

Market Cap: CA$21.88M

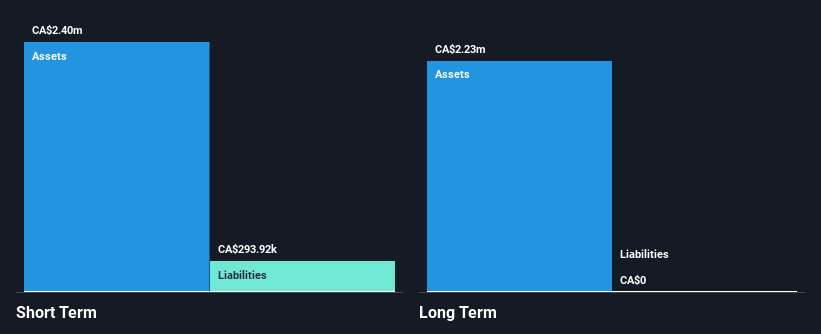

Intrepid Metals Corp., with a market cap of CA$21.88 million, is a pre-revenue mineral exploration company focused on developing its Corral Copper Property in Arizona. Recent drilling revealed substantial high-grade mineralization, bolstering exploration potential and leading to new drill targets. The appointment of Richard Lock to the board brings valuable mining expertise, enhancing leadership amid ongoing strategic initiatives. Despite being unprofitable and having limited cash runway, Intrepid's recent capital raise improves short-term liquidity. The company has no long-term liabilities and maintains more cash than debt, but its relatively inexperienced management team may face challenges in execution.

- Jump into the full analysis health report here for a deeper understanding of Intrepid Metals.

- Assess Intrepid Metals' previous results with our detailed historical performance reports.

Next Steps

- Navigate through the entire inventory of 934 TSX Penny Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:GSTM

Goldstorm Metals

A junior resource exploration company, engages in the acquisition, exploration, and development of mineral properties in Canada.

Moderate risk with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success