- Canada

- /

- Metals and Mining

- /

- TSXV:GMA

Spotlight On 3 TSX Penny Stocks Under CA$20M Market Cap

Reviewed by Simply Wall St

Amidst a landscape of shifting political regimes and economic uncertainties, Canadian markets continue to navigate the complexities of rising government bond yields and their impact on stock valuations. In this context, penny stocks—though an older term—remain relevant as they represent smaller or newer companies that can offer unique growth opportunities. When these stocks are backed by solid financial health, they present potential for significant returns, making them intriguing options for investors seeking hidden value in quality companies.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.02 | CA$392.54M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.43 | CA$125.06M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.22 | CA$948.57M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.49 | CA$13.18M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$629.3M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.32 | CA$225.41M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$29.82M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$4.07M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$180.43M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$0.95 | CA$133.43M | ★★★★★☆ |

Click here to see the full list of 928 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Free Battery Metal (CNSX:FREE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Free Battery Metal Limited focuses on the acquisition, exploration, and development of mineral properties in Canada with a market cap of CA$1.05 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$1.05M

Free Battery Metal Limited is a pre-revenue company with a market cap of CA$1.05 million, focusing on mineral exploration in Canada. Despite having no long-term liabilities and sufficient short-term assets to cover its liabilities, the company faces challenges with high share price volatility and limited cash runway if current cash flow trends continue. Recent earnings reports show reduced net losses compared to last year, but the firm remains unprofitable with negative return on equity. The management team and board are relatively inexperienced, which may impact strategic decision-making as the company progresses in its development phase.

- Jump into the full analysis health report here for a deeper understanding of Free Battery Metal.

- Gain insights into Free Battery Metal's historical outcomes by reviewing our past performance report.

CMC Metals (TSXV:CMB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CMC Metals Ltd. is involved in the acquisition and exploration of mineral properties in Canada and the United States, with a market cap of CA$3.94 million.

Operations: Currently, there are no reported revenue segments for CMC Metals Ltd.

Market Cap: CA$3.94M

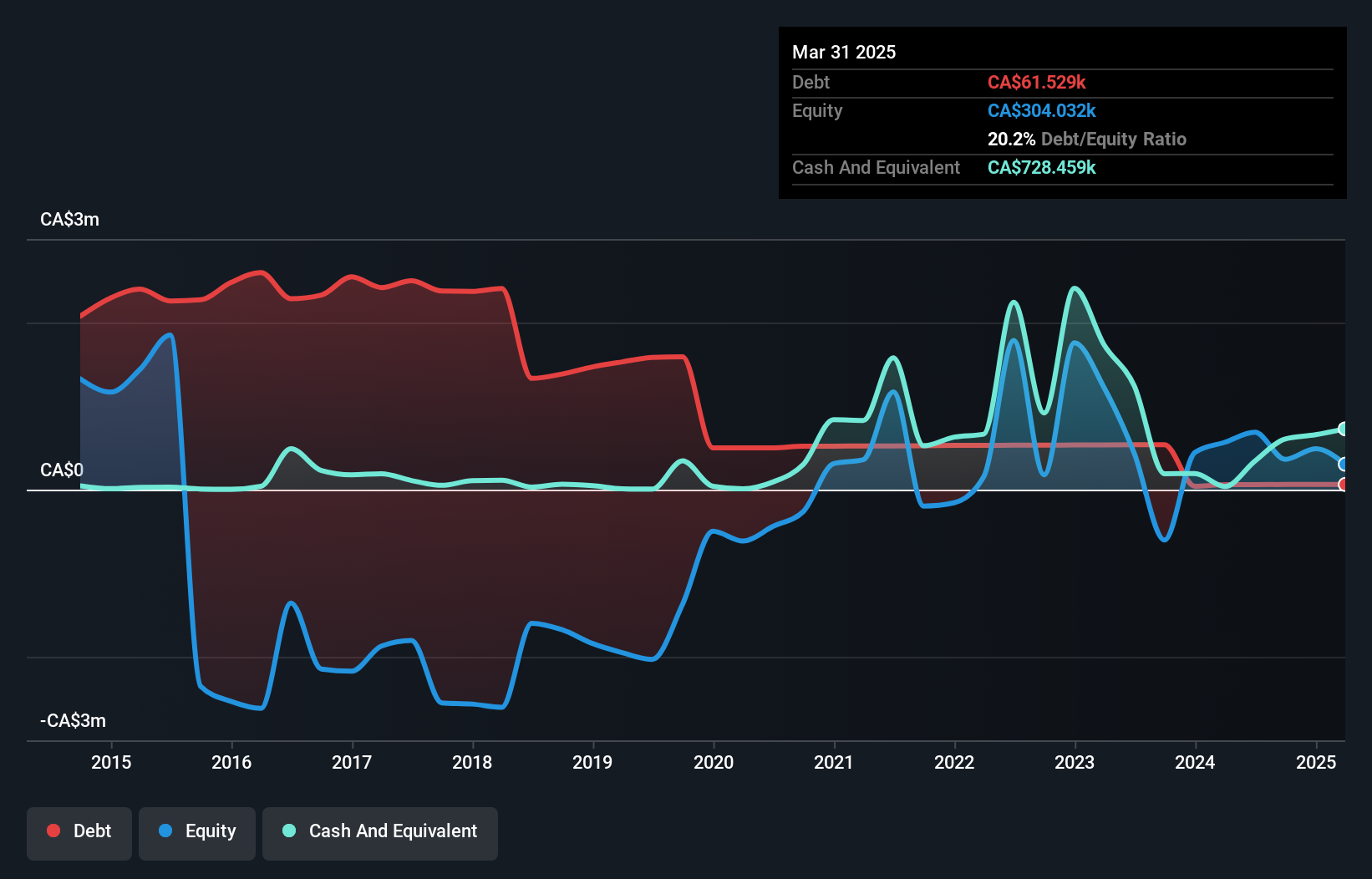

CMC Metals Ltd., with a market cap of CA$3.94 million, is a pre-revenue company engaged in mineral exploration. Recent announcements include a new Mineral Resource Estimate for its Silver Hart Project, highlighting an inferred resource of 8.82 Moz silver equivalent and potential expansion opportunities. Additionally, high-grade samples from the Amy Property suggest significant exploration potential. However, CMC faces challenges such as limited cash runway and shareholder dilution over the past year. The management team shows experience with an average tenure of 4.3 years, but the board is relatively new, which could influence strategic decisions moving forward.

- Dive into the specifics of CMC Metals here with our thorough balance sheet health report.

- Examine CMC Metals' past performance report to understand how it has performed in prior years.

Geomega Resources (TSXV:GMA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Geomega Resources Inc. is involved in the acquisition, evaluation, and exploration of mining properties in Canada with a market cap of CA$15.06 million.

Operations: No revenue segments have been reported.

Market Cap: CA$15.06M

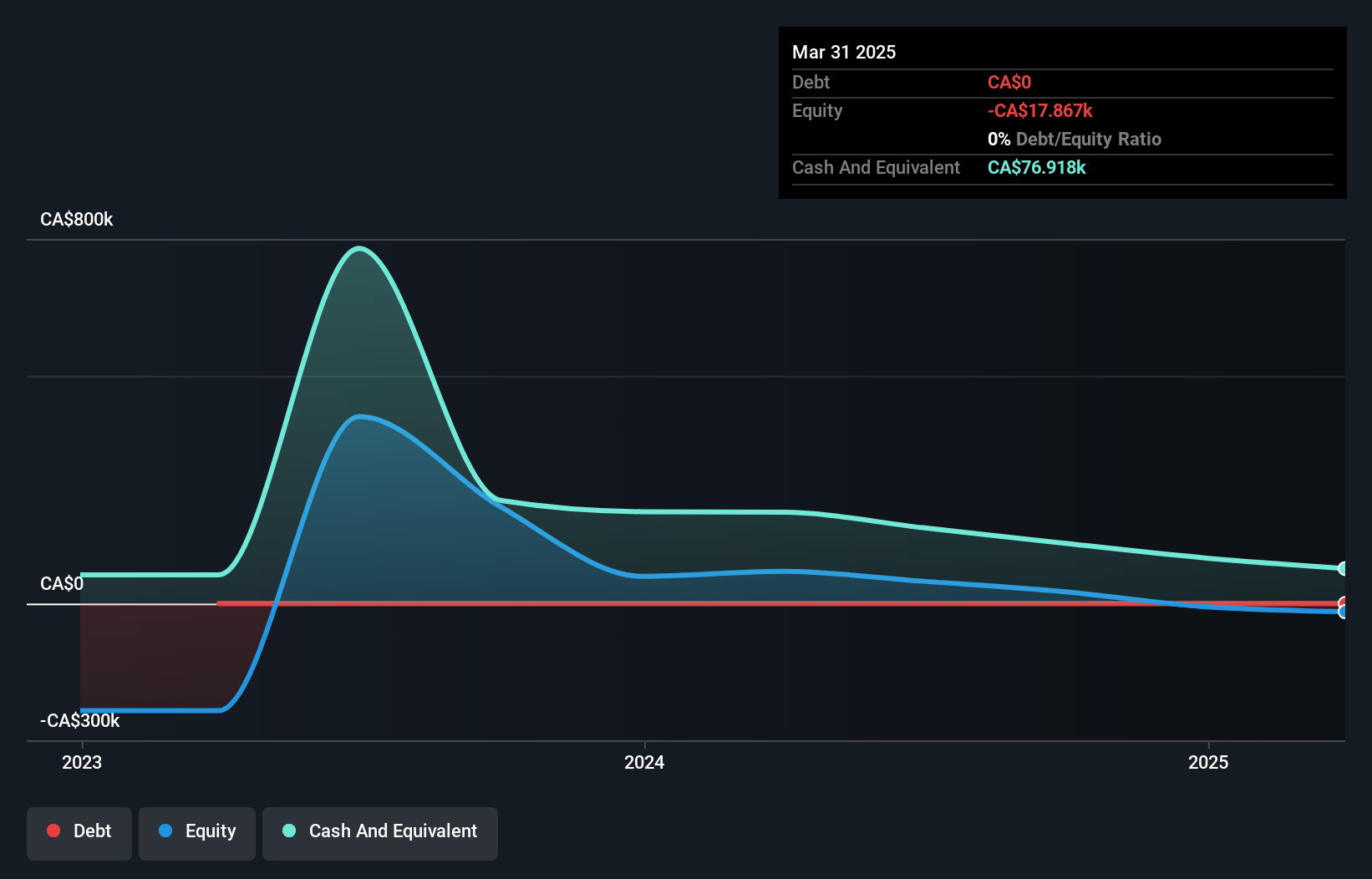

Geomega Resources Inc., with a market cap of CA$15.06 million, is a pre-revenue company focused on mining exploration and rare earth magnets recycling. Recent updates indicate significant progress in its demonstration plant, with over 90% of long lead items ordered and civil engineering work underway. Despite being debt-free and having short-term assets exceeding liabilities, Geomega faces challenges such as high volatility in share price and less than a year of cash runway if current free cash flow trends persist. The seasoned management team averages 9.3 years tenure, providing stability amidst financial constraints.

- Get an in-depth perspective on Geomega Resources' performance by reading our balance sheet health report here.

- Assess Geomega Resources' previous results with our detailed historical performance reports.

Make It Happen

- Click here to access our complete index of 928 TSX Penny Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Geomega Resources, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:GMA

Geomega Resources

Engages in the acquisition, evaluation, and exploration of mining properties in Canada.

Flawless balance sheet slight.

Market Insights

Community Narratives