- Canada

- /

- Metals and Mining

- /

- TSXV:GGA

Goldgroup Mining (TSXV:GGA) Q3 Losses Reinforce Bearish Profitability and Dilution Narratives

Reviewed by Simply Wall St

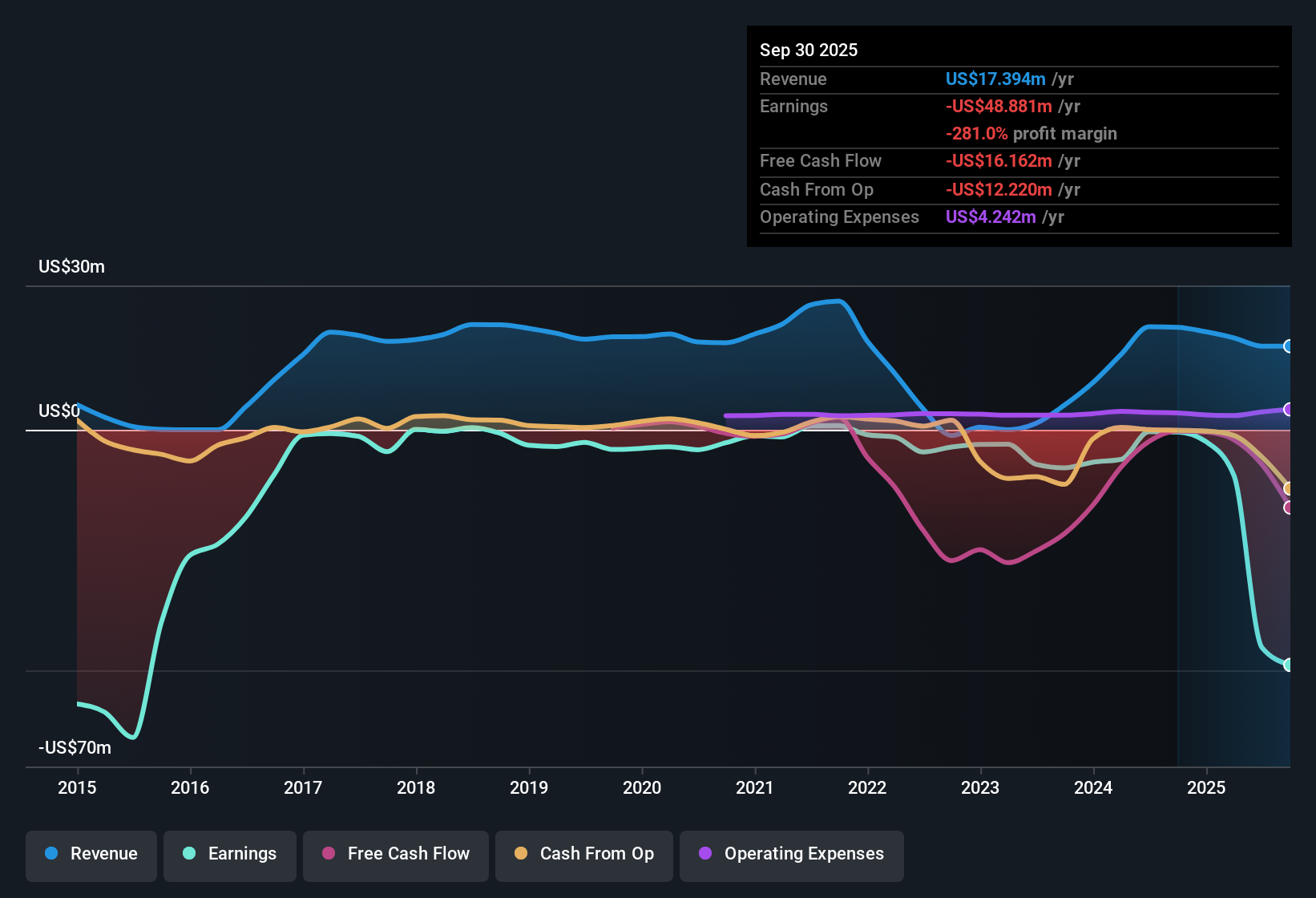

Goldgroup Mining (TSXV:GGA) just posted its Q3 2025 numbers, reporting about $3.7 million in revenue and a basic EPS loss of roughly $0.02, with net income excluding extra items coming in at a loss of around $4.8 million as margins stayed under pressure. Looking back over recent quarters, the company has seen revenue move between about $3.7 million and $7.1 million per quarter while EPS has swung from a small $0.01 profit in Q2 2024 to losses as deep as roughly $0.17 per share in Q2 2025. This latest result is another chapter in a volatile earnings story that keeps investors focused squarely on profitability and cost control.

See our full analysis for Goldgroup Mining.With the latest earnings in hand, the next step is to weigh these numbers against the dominant narratives around Goldgroup Mining to see which stories still hold up and which ones the results start to challenge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Deepen To Nearly $49 million Over The Year

- On a trailing 12 month basis, Goldgroup Mining logged about $17.4 million in revenue but a net loss of roughly $48.9 million, showing that the business is still spending far more than it brings in from operations.

- Critics highlight that five year earnings have been deteriorating at about 67.8% per year, and the latest trailing loss of $48.9 million against only $17.4 million in sales strongly reinforces this bearish view that the company has not yet found a sustainable path toward profitability.

- The pattern of quarterly net income, from a small $0.7 million profit in Q2 2024 to a loss of $35.1 million in Q2 2025, underlines how volatile and increasingly negative the bottom line has become.

- Basic EPS over the last year moved from a small loss of about $0.03 per share in Q4 2024 to a trailing 12 month loss of roughly $0.27 per share by Q3 2025, which bears see as consistent with worsening earnings power.

Short Cash Runway Adds To Dilution Risk

- The risk summary flags that Goldgroup Mining has less than one year of cash runway and has also substantially diluted shareholders over the past year, which together point to a need for more funding to keep operating at the current loss levels.

- Bears argue that this combination of ongoing losses and limited cash makes future dilution more likely, and the data back that up by showing persistent negative net income over the trailing 12 months alongside the explicit note that shareholders have already seen substantial dilution recently.

- The trailing 12 month net loss of about $48.9 million means even a modest extension of the current cost base could quickly eat through remaining cash if operations do not improve.

- Because there are no rewards identified in the trailing data, the balance of a short cash runway and prior dilution stands out as a central bearish concern rather than being offset by clear growth or margin tailwinds.

Rich 13.8x Sales Multiple Despite Losses

- Valuation wise, Goldgroup Mining trades at about 13.8 times trailing sales, versus a peer average of 2.4 times and a Canadian Metals and Mining industry average of 6.2 times, even though the company remains loss making.

- What is striking for a bearish narrative is that such a high sales multiple is attached to a business that generated just $17.4 million in trailing 12 month revenue while losing about $48.9 million over the same period, so skeptics see the current 13.8 times sales valuation as hard to justify without evidence of improving profitability.

- The contrast between a premium price to sales and worsening earnings, including a quarterly net loss of $4.8 million in Q3 2025, makes it difficult for bears to point to traditional value metrics that would support the current share price.

- With the DCF fair value not provided and no identified near term rewards in the data, the only clear reference point is that 13.8 times sales sits well above both peer and industry averages, which bearish investors interpret as valuation risk if performance does not improve.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Goldgroup Mining's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Goldgroup Mining combines steep, widening losses with a short cash runway and substantial shareholder dilution, all while trading at a premium sales multiple.

If you want businesses with stronger cushions instead of mounting losses and dilution risk, use our solid balance sheet and fundamentals stocks screener (1943 results) to quickly focus on companies built on healthier financial foundations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:GGA

Goldgroup Mining

Engages in the acquisition, exploration, and development of gold-bearing mineral properties in Mexico and the Americas.

Mediocre balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026