- Canada

- /

- Metals and Mining

- /

- TSXV:GER

How Much Does Glen Eagle Resources' (CVE:GER) CEO Make?

This article will reflect on the compensation paid to Jean Labrecque who has served as CEO of Glen Eagle Resources Inc. (CVE:GER) since 2005. This analysis will also assess whether Glen Eagle Resources pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Glen Eagle Resources

Comparing Glen Eagle Resources Inc.'s CEO Compensation With the industry

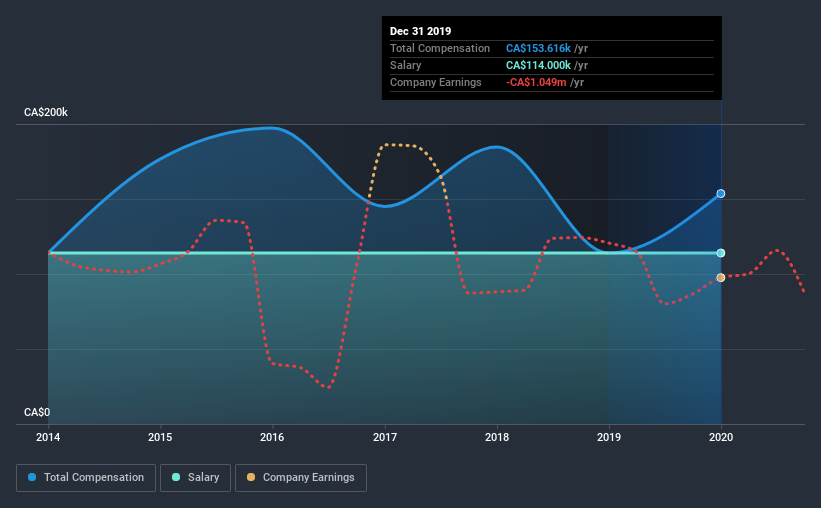

According to our data, Glen Eagle Resources Inc. has a market capitalization of CA$6.6m, and paid its CEO total annual compensation worth CA$154k over the year to December 2019. We note that's an increase of 35% above last year. We note that the salary portion, which stands at CA$114.0k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below CA$257m, we found that the median total CEO compensation was CA$150k. So it looks like Glen Eagle Resources compensates Jean Labrecque in line with the median for the industry. Furthermore, Jean Labrecque directly owns CA$220k worth of shares in the company.

On an industry level, around 93% of total compensation represents salary and 7.0% is other remuneration. In Glen Eagle Resources' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Glen Eagle Resources Inc.'s Growth Numbers

Glen Eagle Resources Inc.'s earnings per share (EPS) grew 1.2% per year over the last three years. It saw its revenue drop 39% over the last year.

We generally like to see a little revenue growth, but it is good to see a modest EPS growth at least. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Glen Eagle Resources Inc. Been A Good Investment?

Given the total shareholder loss of 53% over three years, many shareholders in Glen Eagle Resources Inc. are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

As we noted earlier, Glen Eagle Resources pays its CEO in line with similar-sized companies belonging to the same industry. But with negative shareholder returns and unimpressive EPS growth, shareholders will surely be disturbed. We'd stop short of saying CEO compensation is inappropriate, but without an improvement in performance, it's sure to draw criticism. Shareholders will also not want to see performance improving before agreeing to any raise.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 5 warning signs (and 3 which can't be ignored) in Glen Eagle Resources we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Glen Eagle Resources, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:GER

Glen Eagle Resources

Engages in the acquisition, exploration, development, and evaluation of mining properties in Canada and Honduras.

Medium-low and good value.

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

EU#1 - From German Startup to EU’s Biggest Company

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Amazon - A Fundamental and Historical Valuation

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

The "Sleeping Giant" Stumbles, Then Wakes Up

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Trending Discussion