- Canada

- /

- Metals and Mining

- /

- TSXV:GPAC

Companies Like Fosterville South Exploration (CVE:FSX) Are In A Position To Invest In Growth

Just because a business does not make any money, does not mean that the stock will go down. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So should Fosterville South Exploration (CVE:FSX) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

See our latest analysis for Fosterville South Exploration

How Long Is Fosterville South Exploration's Cash Runway?

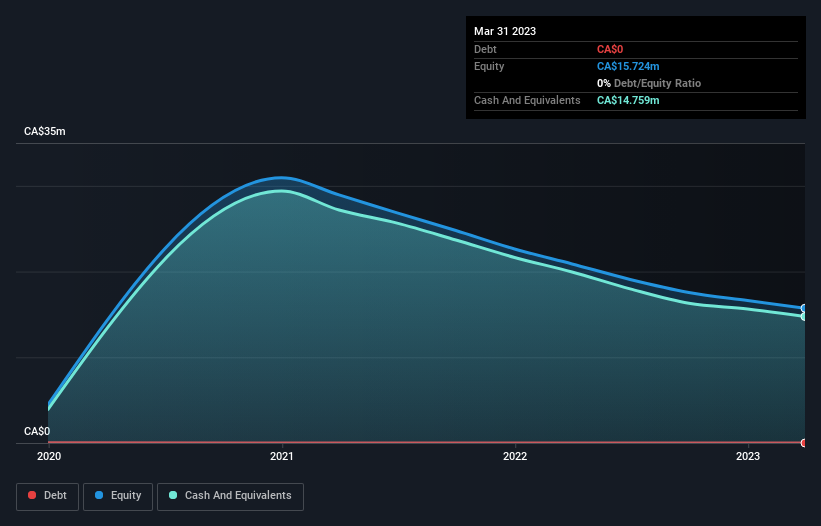

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at March 2023, Fosterville South Exploration had cash of CA$15m and no debt. In the last year, its cash burn was CA$5.3m. Therefore, from March 2023 it had 2.8 years of cash runway. Arguably, that's a prudent and sensible length of runway to have. You can see how its cash balance has changed over time in the image below.

How Is Fosterville South Exploration's Cash Burn Changing Over Time?

Because Fosterville South Exploration isn't currently generating revenue, we consider it an early-stage business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. While it hardly paints a picture of imminent growth, the fact that it has reduced its cash burn by 35% over the last year suggests some degree of prudence. Fosterville South Exploration makes us a little nervous due to its lack of substantial operating revenue. We prefer most of the stocks on this list of stocks that analysts expect to grow.

How Hard Would It Be For Fosterville South Exploration To Raise More Cash For Growth?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Fosterville South Exploration to raise more cash in the future. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of CA$31m, Fosterville South Exploration's CA$5.3m in cash burn equates to about 17% of its market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

Is Fosterville South Exploration's Cash Burn A Worry?

It may already be apparent to you that we're relatively comfortable with the way Fosterville South Exploration is burning through its cash. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. Its weak point is its cash burn relative to its market cap, but even that wasn't too bad! Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. On another note, Fosterville South Exploration has 3 warning signs (and 1 which is concerning) we think you should know about.

Of course Fosterville South Exploration may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:GPAC

Great Pacific Gold

A junior exploration company, engages in the acquisition, exploration, and development of mineral properties in Australia and Papua New Guinea.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026