- Canada

- /

- Metals and Mining

- /

- TSXV:CAD

Colonial Coal International And 2 More Promising Penny Stocks On The TSX

Reviewed by Simply Wall St

The Canadian market has experienced significant ups and downs in 2025, with the TSX reaching new all-time highs despite earlier volatility driven by U.S. policy changes and trade tensions. In such a fluctuating landscape, identifying stocks with solid fundamentals becomes crucial for investors seeking potential growth opportunities. Penny stocks, often smaller or newer companies, continue to offer intriguing possibilities for those looking beyond traditional investments; they can provide substantial returns when backed by strong financials and strategic positioning.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.67 | CA$64.74M | ✅ 3 ⚠️ 3 View Analysis > |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.85 | CA$254.04M | ✅ 4 ⚠️ 1 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$2.02 | CA$105.29M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.025 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.43 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.76 | CA$518.93M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.94 | CA$18.43M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.42 | CA$169.01M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.86 | CA$178.37M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.10 | CA$6.28M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 447 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Colonial Coal International (TSXV:CAD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Colonial Coal International Corp. focuses on the acquisition, exploration, and development of coal properties in Canada, with a market cap of CA$239.85 million.

Operations: Colonial Coal International Corp. does not report any revenue segments, as its activities are centered on the acquisition, exploration, and development of coal properties in Canada.

Market Cap: CA$239.85M

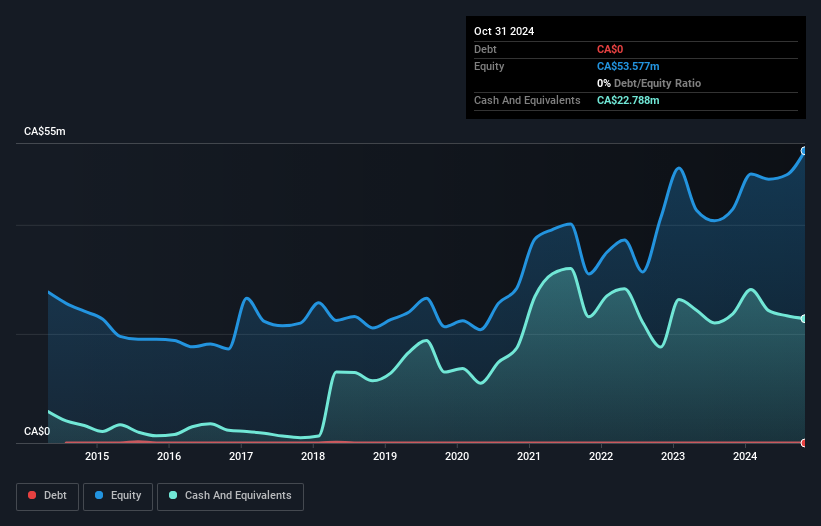

Colonial Coal International, with a market cap of CA$239.85 million, is pre-revenue and focuses on coal property development in Canada. Despite being unprofitable, the company maintains a stable cash runway exceeding three years without debt concerns. Recent earnings show reduced quarterly losses from CA$1.71 million to CA$0.62 million year-over-year, though nine-month losses increased to CA$6.18 million from CA$4.7 million previously reported. The board and management are highly experienced with average tenures over 11 years, though the recent passing of founding director Tony Hammond marks a significant leadership change for the company amidst its ongoing financial challenges.

- Dive into the specifics of Colonial Coal International here with our thorough balance sheet health report.

- Gain insights into Colonial Coal International's historical outcomes by reviewing our past performance report.

Fancamp Exploration (TSXV:FNC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fancamp Exploration Ltd. is involved in the exploration and development of mineral properties, with a market cap of CA$25.45 million.

Operations: Fancamp Exploration Ltd. currently does not report any revenue segments.

Market Cap: CA$25.45M

Fancamp Exploration, with a market cap of CA$25.45 million, is pre-revenue and has recently achieved profitability despite its high volatility. The company benefits from an experienced board and management team, with average tenures of 8.3 and 2.8 years respectively. Its debt-free status alleviates financial strain, while short-term assets significantly cover both short- and long-term liabilities. Recent strategic moves include appointing Kit Spring as CIO to leverage his extensive natural resource sector experience, potentially enhancing investment strategies. A recent legal settlement involving share issuance could impact shareholder value but resolves lingering litigation issues efficiently.

- Get an in-depth perspective on Fancamp Exploration's performance by reading our balance sheet health report here.

- Gain insights into Fancamp Exploration's past trends and performance with our report on the company's historical track record.

Westbridge Renewable Energy (TSXV:WEB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Westbridge Renewable Energy Corp. focuses on acquiring and developing solar photovoltaic projects across Canada, the United States, the United Kingdom, and Italy, with a market cap of CA$64.74 million.

Operations: Currently, there are no reported revenue segments for Westbridge Renewable Energy Corp.

Market Cap: CA$64.74M

Westbridge Renewable Energy Corp., with a market cap of CA$64.74 million, is pre-revenue and trades at an attractive value compared to its peers. Despite negative earnings growth over the past year, it has shown significant profit growth historically, averaging 86.1% annually over five years. The company remains debt-free, with short-term assets comfortably exceeding both short- and long-term liabilities. Recent strategic initiatives include a share buyback program to enhance shareholder value, while management's participation in the Canadian Climate Investor Conference underscores its commitment to advancing sustainable energy solutions within the renewable sector.

- Click here to discover the nuances of Westbridge Renewable Energy with our detailed analytical financial health report.

- Explore Westbridge Renewable Energy's analyst forecasts in our growth report.

Taking Advantage

- Take a closer look at our TSX Penny Stocks list of 447 companies by clicking here.

- Searching for a Fresh Perspective? The end of cancer? These 24 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CAD

Colonial Coal International

Engages in the acquisition, exploration, and development of coal properties in Canada.

Flawless balance sheet very low.

Market Insights

Community Narratives