- Canada

- /

- Metals and Mining

- /

- TSXV:UGD

TSX Penny Stocks Spotlight: Fuerte Metals And 2 More Hidden Gems

Reviewed by Simply Wall St

The Canadian stock market has experienced significant volatility, yet both the S&P 500 and TSX have reached new all-time highs, reflecting a resilient economic backdrop despite ongoing policy uncertainties. In such fluctuating conditions, investors often seek out stocks that combine value with growth potential—qualities sometimes found in smaller or newer companies traditionally known as penny stocks. These stocks may be overlooked but can offer compelling opportunities when supported by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.67 | CA$67.77M | ✅ 3 ⚠️ 3 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$2.01 | CA$104.26M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.025 | CA$2M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.42 | CA$12.32M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.76 | CA$505.63M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.94 | CA$18.63M | ✅ 2 ⚠️ 4 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.27 | CA$364.97M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.56 | CA$173.58M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.90 | CA$177.52M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.10 | CA$6.28M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 444 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Fuerte Metals (TSXV:FMT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Fuerte Metals Corp. is involved in identifying, exploring, and evaluating mineral properties across Chile, Mexico, and the Americas with a market cap of CA$62.39 million.

Operations: Fuerte Metals Corp. has not reported any revenue segments at this time.

Market Cap: CA$62.39M

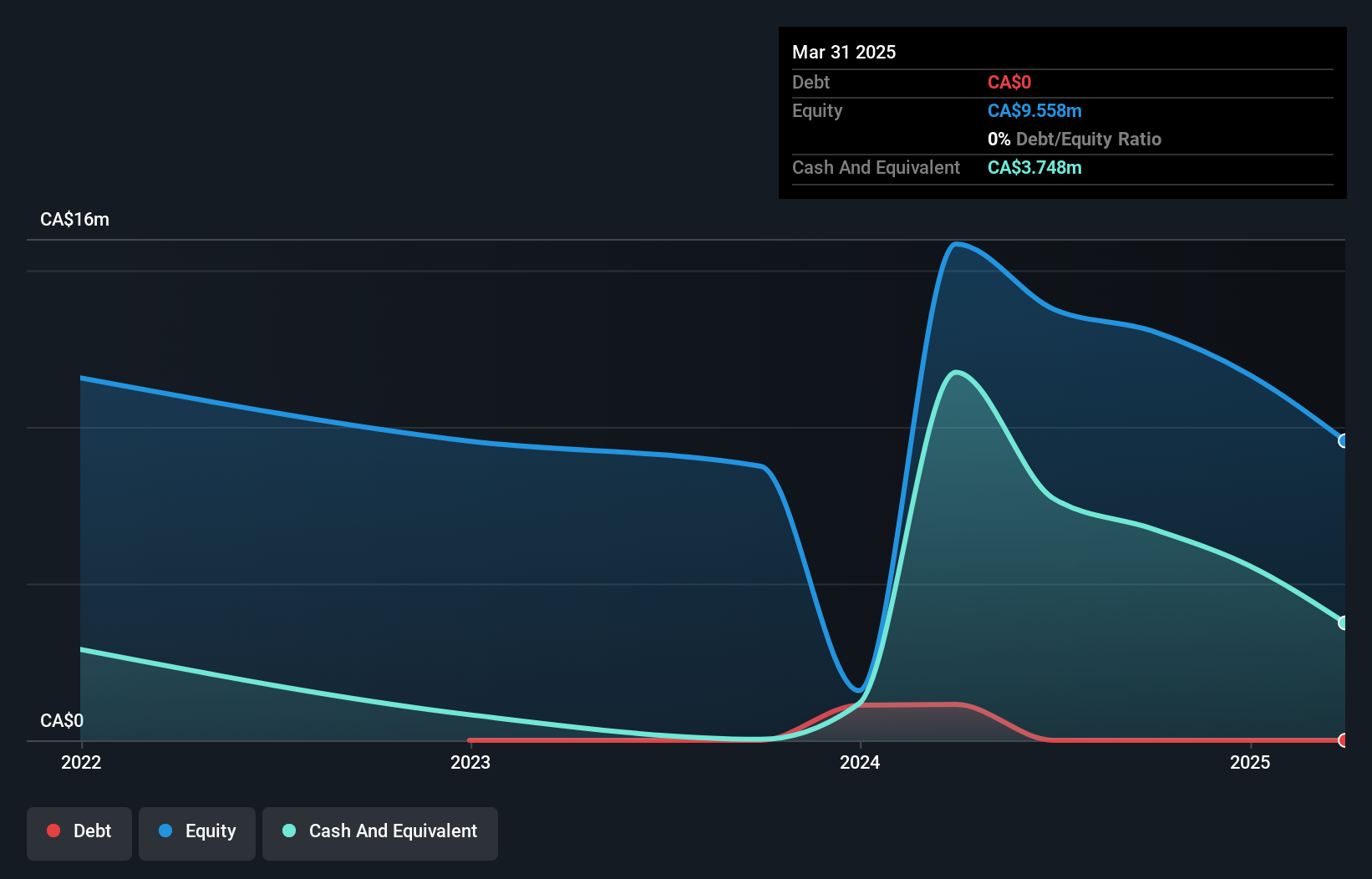

Fuerte Metals Corp., with a market cap of CA$62.39 million, is pre-revenue and focuses on mineral exploration across the Americas. Recent drilling at its Cristina project in Mexico has revealed high-grade gold zones, indicating potential for resource expansion. The company reported a reduced net loss of CA$2.5 million for Q1 2025, down from CA$8.72 million the previous year, reflecting improved financial management despite ongoing unprofitability and less than one year of cash runway remaining. Fuerte Metals remains debt-free but faces challenges due to its inexperienced board and management team tenure data limitations.

- Take a closer look at Fuerte Metals' potential here in our financial health report.

- Understand Fuerte Metals' track record by examining our performance history report.

NervGen Pharma (TSXV:NGEN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NervGen Pharma Corp. is a biotechnology company focused on discovering, developing, and commercializing pharmaceutical treatments for nervous system repair in neurotrauma and neurologic disease settings, with a market cap of CA$258.55 million.

Operations: NervGen Pharma Corp. does not currently report any revenue segments.

Market Cap: CA$258.55M

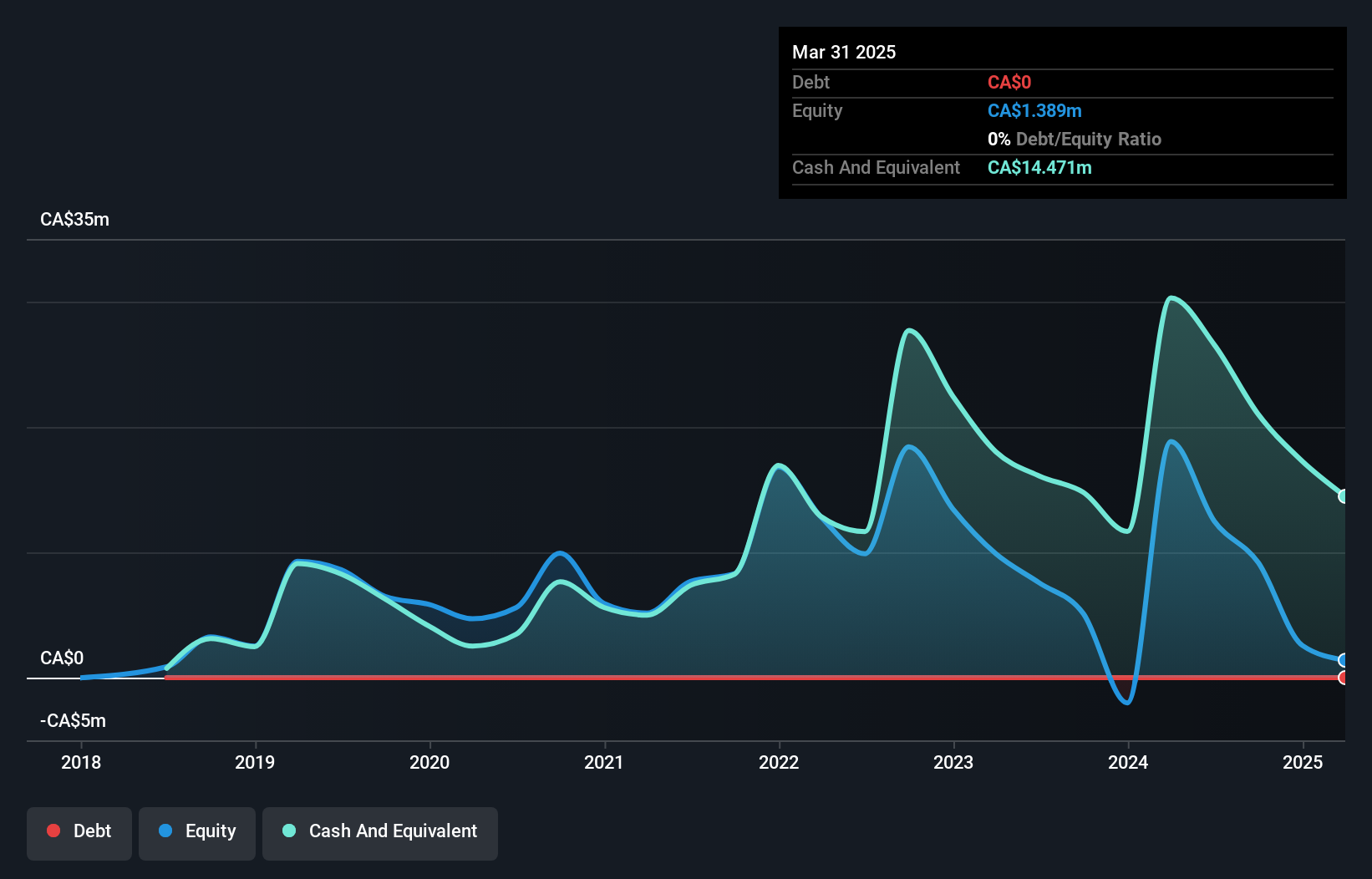

NervGen Pharma Corp., with a market cap of CA$258.55 million, is pre-revenue and focused on developing NVG-291 for spinal cord injury treatment. Recent positive topline results from its Phase 1b/2a trial underscore the potential of NVG-291, which has received Fast Track designation from the FDA. The company remains debt-free but faces financial constraints with less than a year of cash runway and increased losses over five years at 19.9% annually. Management changes include Dr. Adam Rogers as new chair and Randall Kaye expanding his role as Chief Medical Advisor amidst leadership transitions.

- Unlock comprehensive insights into our analysis of NervGen Pharma stock in this financial health report.

- Review our growth performance report to gain insights into NervGen Pharma's future.

Unigold (TSXV:UGD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Unigold Inc. is a junior natural resource company dedicated to exploring and developing gold projects in the Dominican Republic, with a market cap of CA$47.90 million.

Operations: Unigold Inc. currently does not report any revenue segments.

Market Cap: CA$47.9M

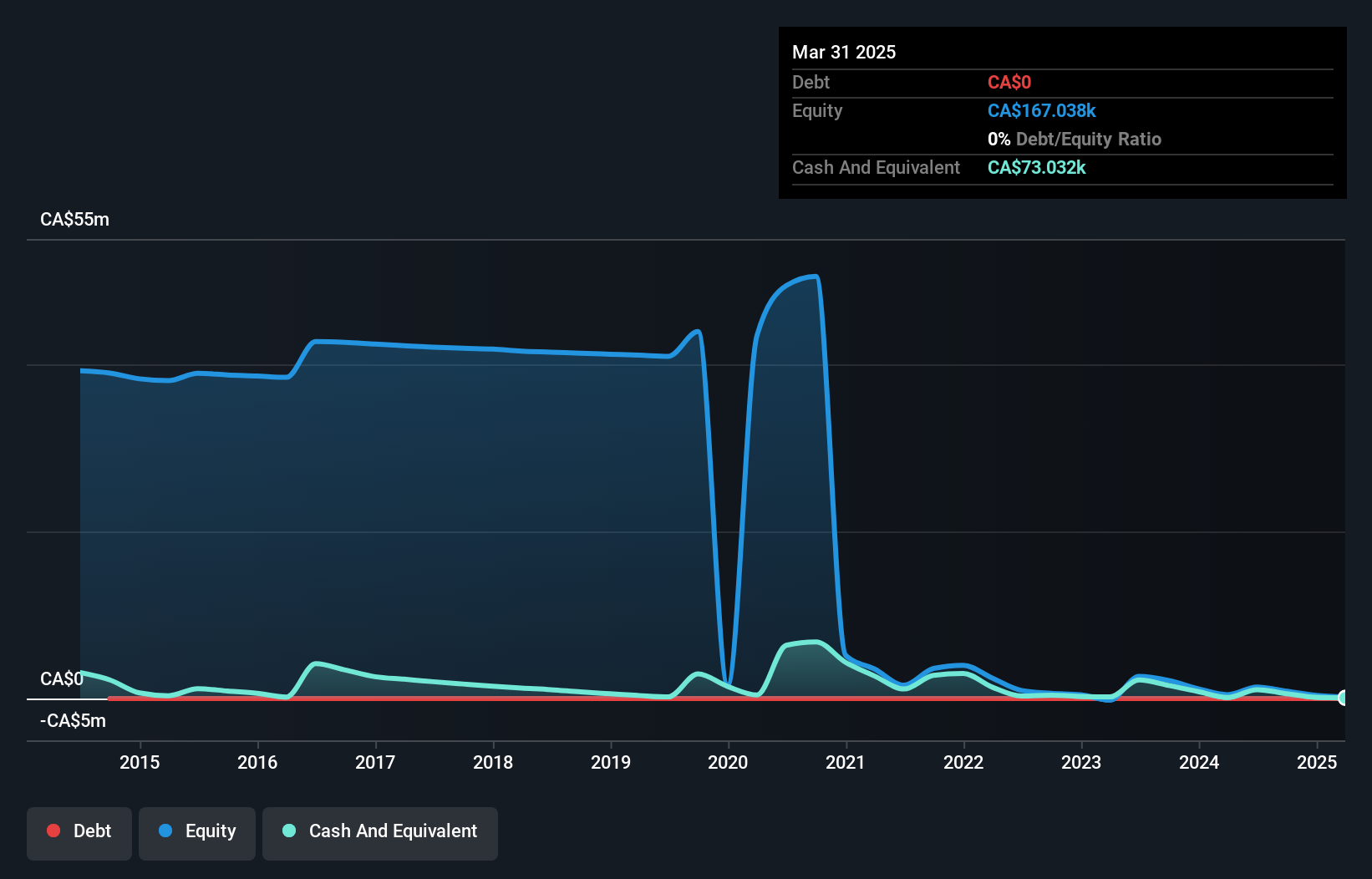

Unigold Inc., with a market cap of CA$47.90 million, is pre-revenue and focused on gold exploration in the Dominican Republic. The company recently completed a private placement raising CA$1.57 million, offering potential future liquidity despite its current cash runway challenges. Unigold remains debt-free but faces doubts about its ability to continue as a going concern, highlighted by an auditor's report. The management team and board are experienced, yet the company's share price has been highly volatile recently. Despite reducing losses over five years at 13.6% annually, Unigold continues to operate unprofitably with negative equity returns.

- Click to explore a detailed breakdown of our findings in Unigold's financial health report.

- Review our historical performance report to gain insights into Unigold's track record.

Make It Happen

- Discover the full array of 444 TSX Penny Stocks right here.

- Contemplating Other Strategies? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:UGD

Unigold

A junior natural resource company, focuses on exploring and developing gold projects in the Dominican Republic.

Excellent balance sheet low.

Market Insights

Community Narratives