- Canada

- /

- Basic Materials

- /

- TSXV:FBF

We Ran A Stock Scan For Earnings Growth And Fab-Form Industries (CVE:FBF) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Fab-Form Industries (CVE:FBF), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Fab-Form Industries

How Quickly Is Fab-Form Industries Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. To the delight of shareholders, Fab-Form Industries has achieved impressive annual EPS growth of 52%, compound, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

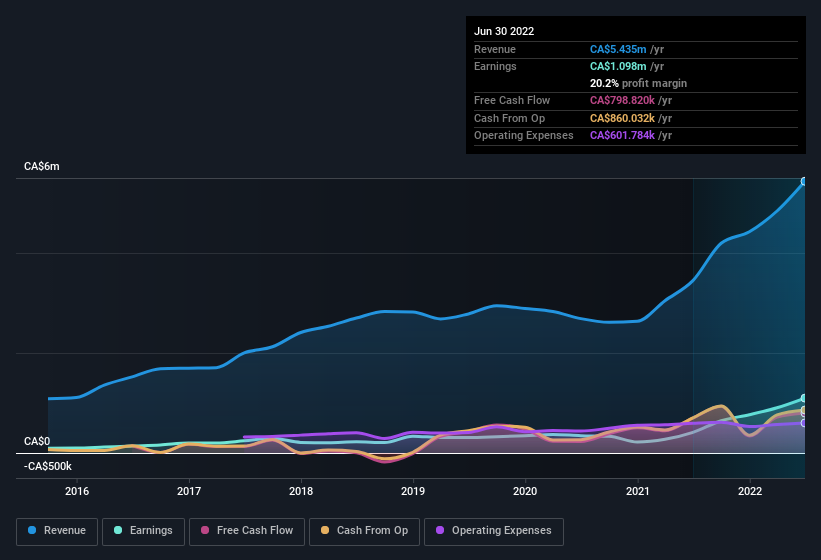

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Fab-Form Industries shareholders is that EBIT margins have grown from 16% to 27% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Fab-Form Industries isn't a huge company, given its market capitalisation of CA$9.6m. That makes it extra important to check on its balance sheet strength.

Are Fab-Form Industries Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Fab-Form Industries insiders own a significant number of shares certainly is appealing. Owning 39% of the company, insiders have plenty riding on the performance of the the share price. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. Valued at only CA$9.6m Fab-Form Industries is really small for a listed company. That means insiders only have CA$3.7m worth of shares, despite the large proportional holding. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, you'd argue that they are indeed. Our analysis has discovered that the median total compensation for the CEOs of companies like Fab-Form Industries with market caps under CA$260m is about CA$240k.

The CEO of Fab-Form Industries only received CA$97k in total compensation for the year ending December 2021. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Fab-Form Industries Deserve A Spot On Your Watchlist?

Fab-Form Industries' earnings have taken off in quite an impressive fashion. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The strong EPS improvement suggests the businesses is humming along. Big growth can make big winners, so the writing on the wall tells us that Fab-Form Industries is worth considering carefully. Before you take the next step you should know about the 5 warning signs for Fab-Form Industries (3 are potentially serious!) that we have uncovered.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:FBF

Fab-Form Industries

Develops, manufactures, and distributes technology to form concrete footings, columns, foundations, and walls for building structures in Canada.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026