- Canada

- /

- Metals and Mining

- /

- TSXV:CKG

TSX Penny Stocks To Consider In July 2025

Reviewed by Simply Wall St

The first half of 2025 has been a rollercoaster for Canadian markets, with the TSX recovering from early-year declines to reach new all-time highs by June, driven by easing trade tensions and resilient economic data. As investors navigate this complex landscape, identifying stocks that offer both affordability and growth potential becomes crucial. Penny stocks, often representing smaller or newer companies, continue to attract attention for their ability to provide value with strong financial foundations.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.61 | CA$59.68M | ✅ 3 ⚠️ 3 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.69 | CA$631.06M | ✅ 3 ⚠️ 4 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$2.06 | CA$100.61M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.035 | CA$2.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.43 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.76 | CA$518.93M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.96 | CA$19.22M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.47 | CA$159.88M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.86 | CA$177.41M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.10 | CA$5.65M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 444 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Boat Rocker Media (TSX:BRMI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Boat Rocker Media Inc. is an entertainment company that creates, produces, and distributes television and film content in Canada, the United States, and internationally with a market cap of CA$51.19 million.

Operations: The company's revenue is derived from two main segments: Television, generating CA$117.93 million, and Kids and Family, contributing CA$82.04 million.

Market Cap: CA$51.19M

Boat Rocker Media Inc., with a market cap of CA$51.19 million, operates in the entertainment sector, generating significant revenue from its Television (CA$117.93 million) and Kids and Family (CA$82.04 million) segments. Despite being unprofitable with increasing losses over the past five years, the company maintains a strong cash position exceeding its total debt and short-term liabilities coverage by its assets. Recent earnings showed increased sales but also a substantial net loss of CA$135.45 million for Q1 2025 compared to last year. Upcoming shareholder meetings will address strategic changes, including acquisitions and divestitures.

- Click here to discover the nuances of Boat Rocker Media with our detailed analytical financial health report.

- Learn about Boat Rocker Media's future growth trajectory here.

Chesapeake Gold (TSXV:CKG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Chesapeake Gold Corp. is a mineral exploration and evaluation company that concentrates on acquiring, evaluating, and developing precious metal deposits in North and Central America, with a market cap of CA$113.91 million.

Operations: Chesapeake Gold Corp. has not reported any revenue segments, as it is focused on the exploration and evaluation of precious metal deposits in North and Central America.

Market Cap: CA$113.91M

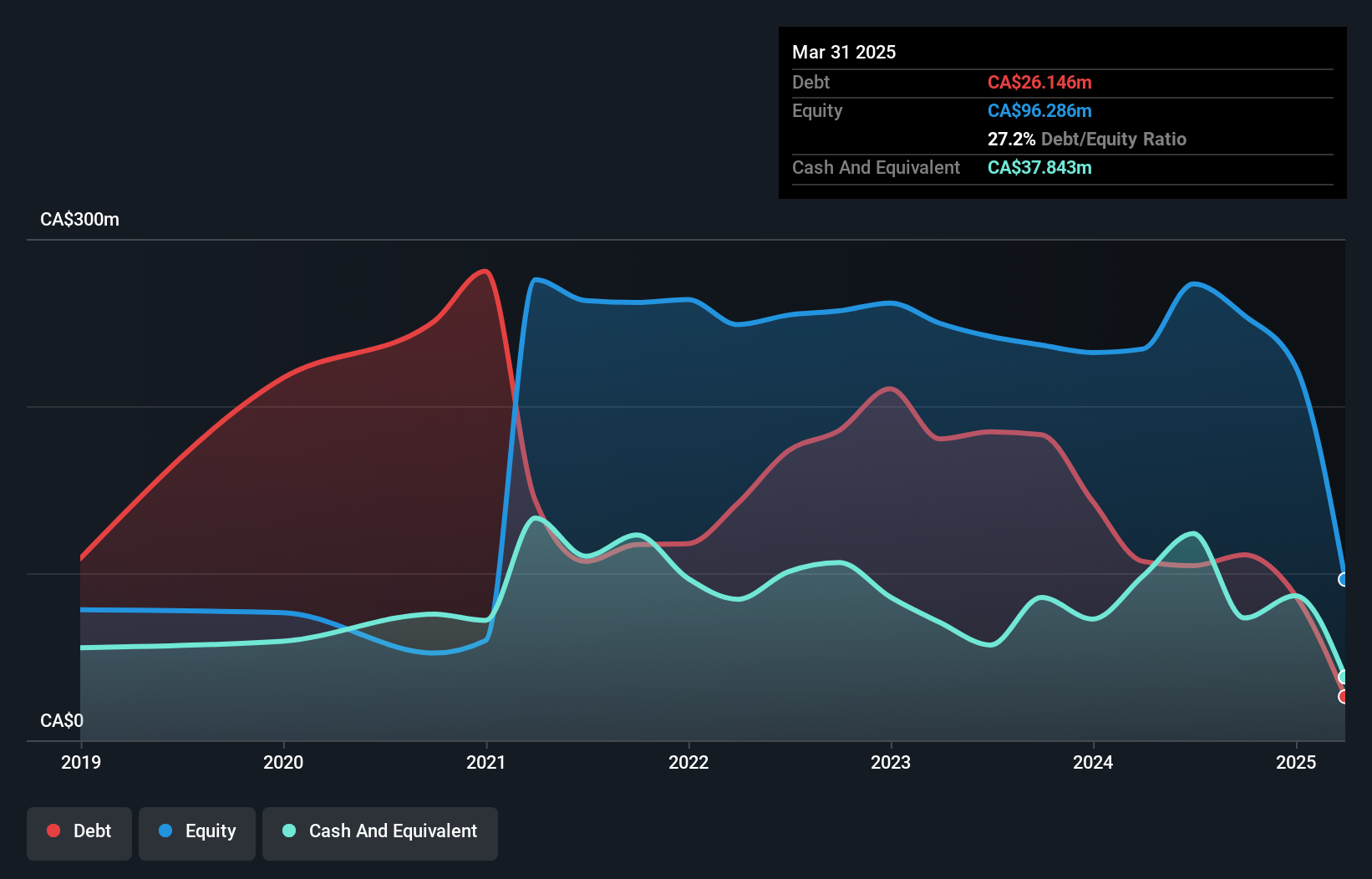

Chesapeake Gold Corp., with a market cap of CA$113.91 million, focuses on precious metal exploration and remains pre-revenue. Recent strategic moves include the election of experienced mining executive Paul West-Sells to the board, enhancing leadership depth. The company recently closed a private placement raising CA$4.44 million, increasing Eric Sprott's stake to 17.9% non-diluted and 19.9% partially diluted, subject to TSXV approval. Chesapeake is debt-free but faces challenges with long-term liabilities exceeding short-term assets by CA$1 million; however, it has extended its cash runway through capital infusion despite ongoing unprofitability and declining earnings over five years.

- Jump into the full analysis health report here for a deeper understanding of Chesapeake Gold.

- Review our historical performance report to gain insights into Chesapeake Gold's track record.

Eskay Mining (TSXV:ESK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eskay Mining Corp. is a natural resource company focused on acquiring and exploring mineral properties in British Columbia, Canada, with a market cap of CA$73.73 million.

Operations: Eskay Mining Corp. does not report any revenue segments, as it is primarily engaged in the acquisition and exploration of mineral properties.

Market Cap: CA$73.73M

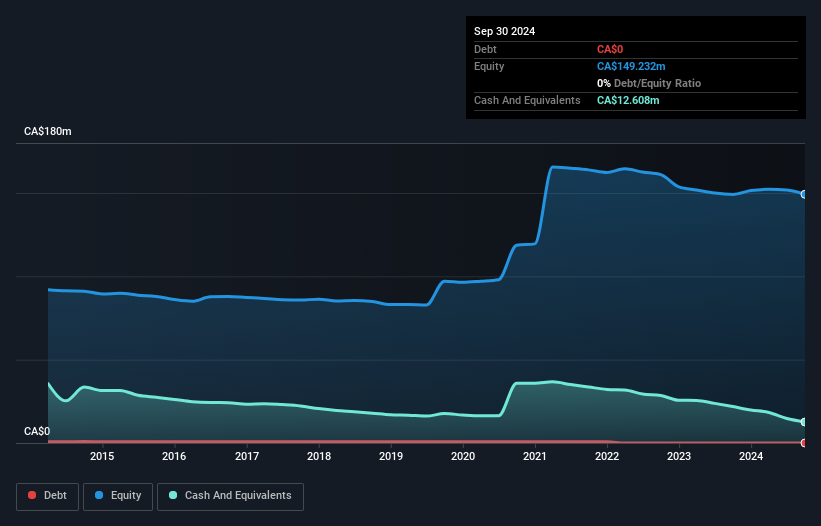

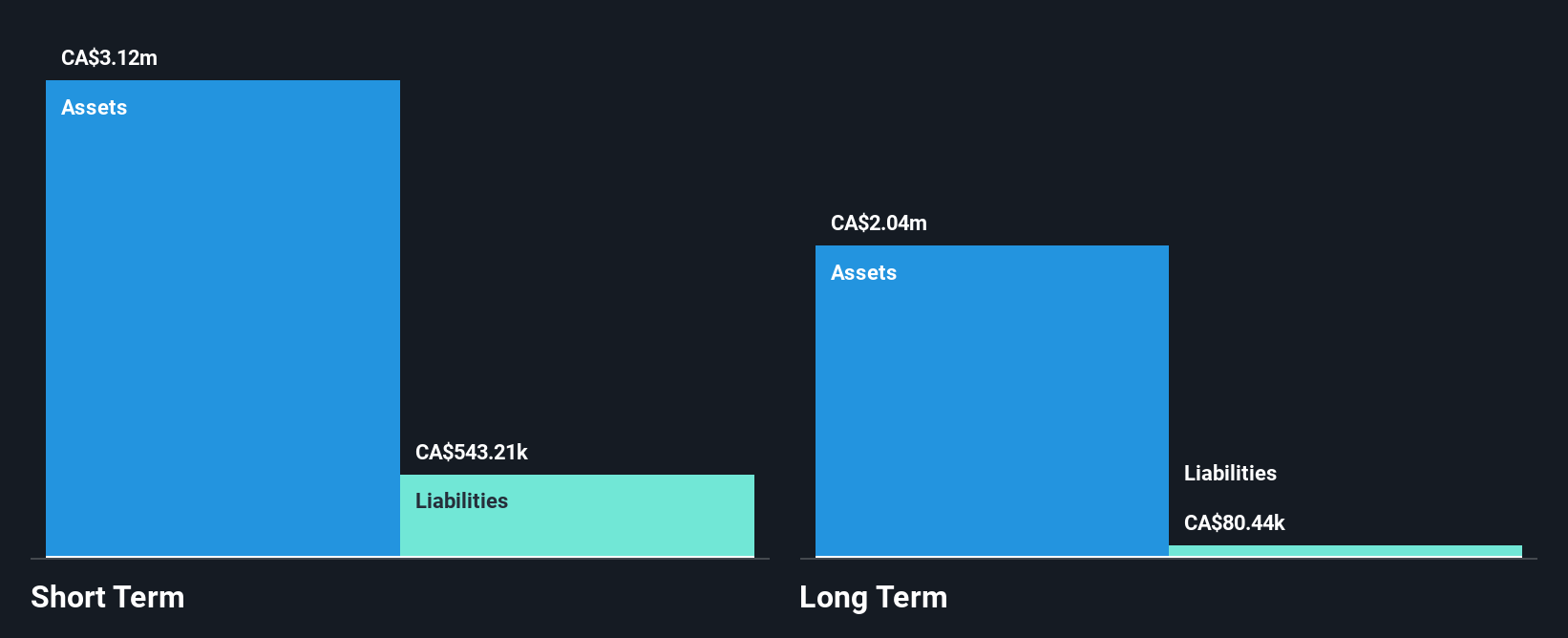

Eskay Mining Corp., with a market cap of CA$73.73 million, is pre-revenue and focuses on mineral exploration in British Columbia. The company has reduced its annual net loss to CA$2.09 million from CA$2.8 million, showing progress despite ongoing unprofitability. Eskay is debt-free, with short-term assets of CA$4.4 million exceeding liabilities, providing financial stability for exploration activities. Its seasoned management and board enhance strategic direction as the company prepares for significant drilling at high-potential sites like Vermillion and Ted Morris zones later this year, aiming to expand its mineralized trends and identify new drill targets for future development efforts.

- Unlock comprehensive insights into our analysis of Eskay Mining stock in this financial health report.

- Evaluate Eskay Mining's historical performance by accessing our past performance report.

Where To Now?

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 441 more companies for you to explore.Click here to unveil our expertly curated list of 444 TSX Penny Stocks.

- Curious About Other Options? We've found 16 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CKG

Chesapeake Gold

A mineral exploration and evaluation company, focuses on acquisition, evaluation, and development of precious metal deposits in North and Central America.

Excellent balance sheet low.

Market Insights

Community Narratives