- Canada

- /

- Metals and Mining

- /

- TSXV:IVS

Eskay Mining Leads The Pack Of 3 TSX Penny Stocks To Consider

Reviewed by Simply Wall St

As the Canadian market navigates through a period of economic resilience and gradual interest rate adjustments, investors are keenly observing opportunities that align with these conditions. Penny stocks, though an older term, continue to capture attention by representing smaller or emerging companies with potential for growth. By identifying those with solid financial foundations, investors can explore promising prospects within this niche investment area.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.55 | CA$169.52M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.72 | CA$286.83M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.35 | CA$117.03M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.17 | CA$5.03M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.47 | CA$317.65M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.65 | CA$574.88M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.455 | CA$12.89M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.10 | CA$207.81M | ★★★★★☆ |

| Silvercorp Metals (TSX:SVM) | CA$4.71 | CA$1.08B | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.07 | CA$29.28M | ★★★★★★ |

Click here to see the full list of 967 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Eskay Mining (TSXV:ESK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eskay Mining Corp. is a natural resource company focused on acquiring and exploring mineral properties in British Columbia, Canada, with a market cap of CA$29.41 million.

Operations: Eskay Mining Corp. does not report any revenue segments.

Market Cap: CA$29.41M

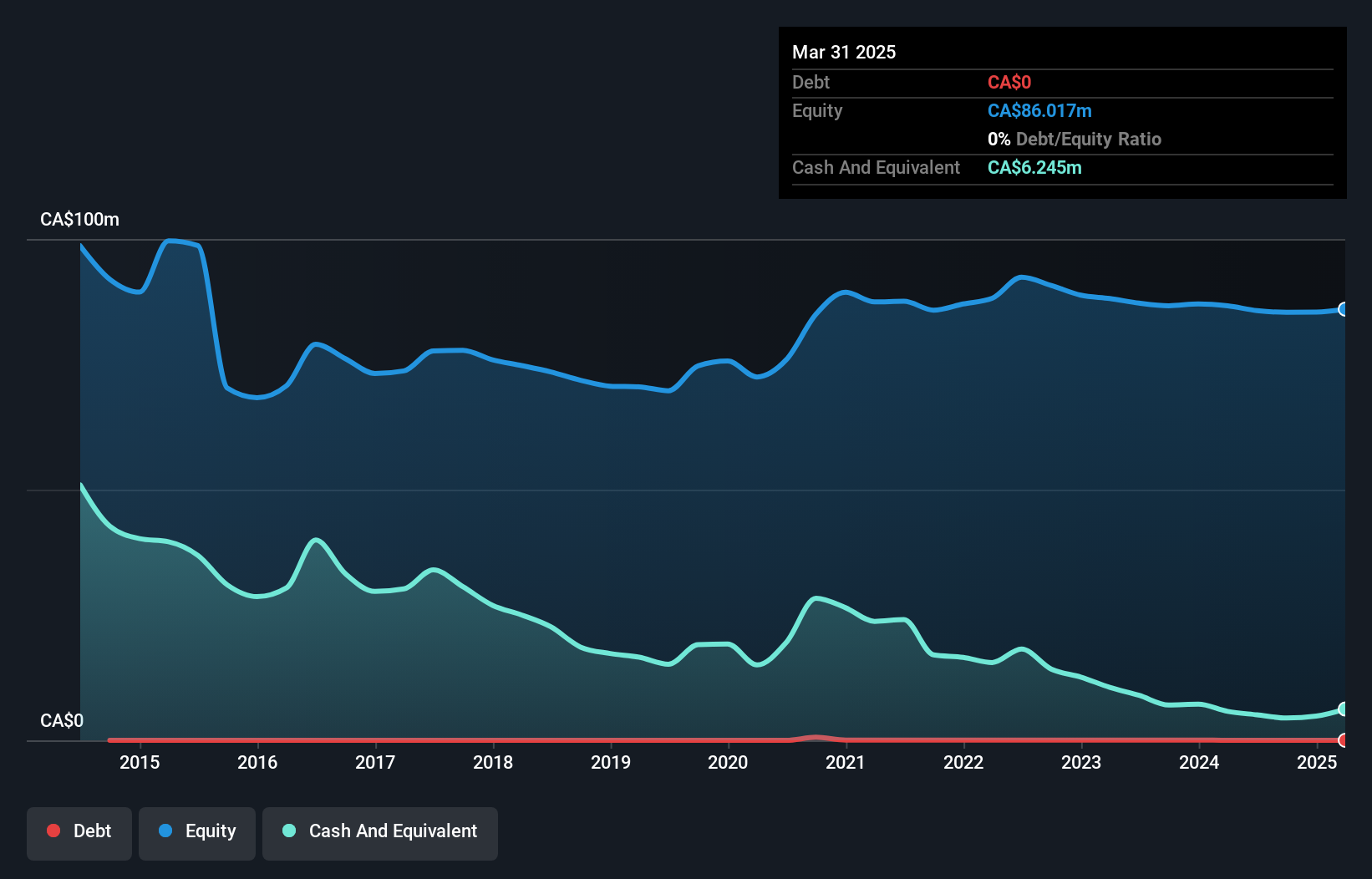

Eskay Mining Corp., with a market cap of CA$29.41 million, is a pre-revenue company focused on exploring mineral properties in British Columbia. Despite being debt-free and having sufficient cash runway for over three years, Eskay remains unprofitable with increasing losses over the past five years. Recent exploration efforts have identified high-grade gold veins at its Consolidated Eskay property, suggesting potential mineral wealth, although previous drill tests were inconclusive. The management team and board are experienced, which may aid in navigating future exploration challenges and opportunities as the company continues to focus on its promising gold anomalies.

- Click to explore a detailed breakdown of our findings in Eskay Mining's financial health report.

- Gain insights into Eskay Mining's historical outcomes by reviewing our past performance report.

Inventus Mining (TSXV:IVS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Inventus Mining Corp. is involved in the acquisition, exploration, and development of mineral properties in Canada with a market cap of CA$10.98 million.

Operations: Inventus Mining Corp. does not report any specific revenue segments.

Market Cap: CA$10.98M

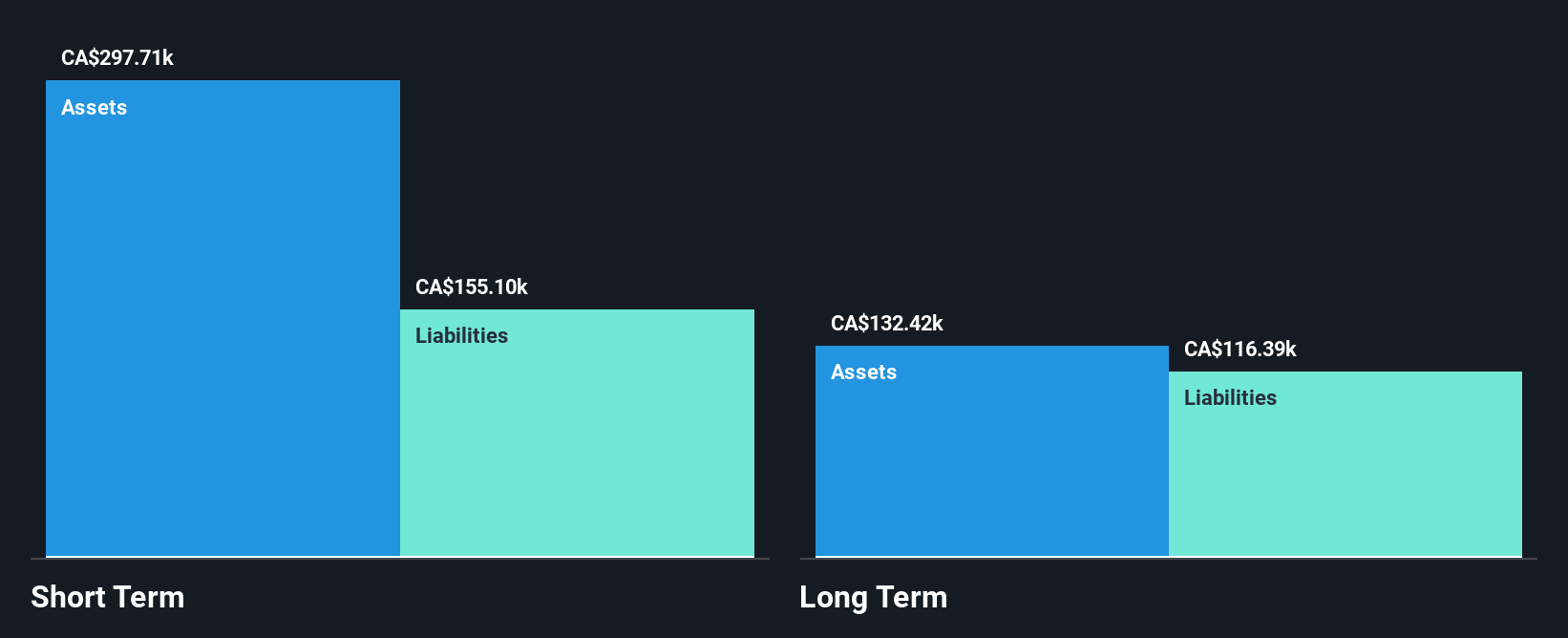

Inventus Mining Corp., with a market cap of CA$10.98 million, is pre-revenue and focuses on mineral exploration in Canada. The company has experienced increased volatility with shareholders being diluted by 8.9% over the past year. Despite this, Inventus remains debt-free and has sufficient cash runway for more than a year based on current free cash flow estimates, bolstered by recent capital raises through private placements. The company is advancing its Pardo gold project with an upcoming drill program aimed at supporting future resource estimates, potentially enhancing its asset base amidst management changes that bring extensive industry expertise to the team.

- Dive into the specifics of Inventus Mining here with our thorough balance sheet health report.

- Assess Inventus Mining's previous results with our detailed historical performance reports.

Strategic Metals (TSXV:SMD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Strategic Metals Ltd. acquires, explores, and evaluates mineral properties in Canada with a market cap of CA$16.64 million.

Operations: Strategic Metals Ltd. has not reported any revenue segments.

Market Cap: CA$16.64M

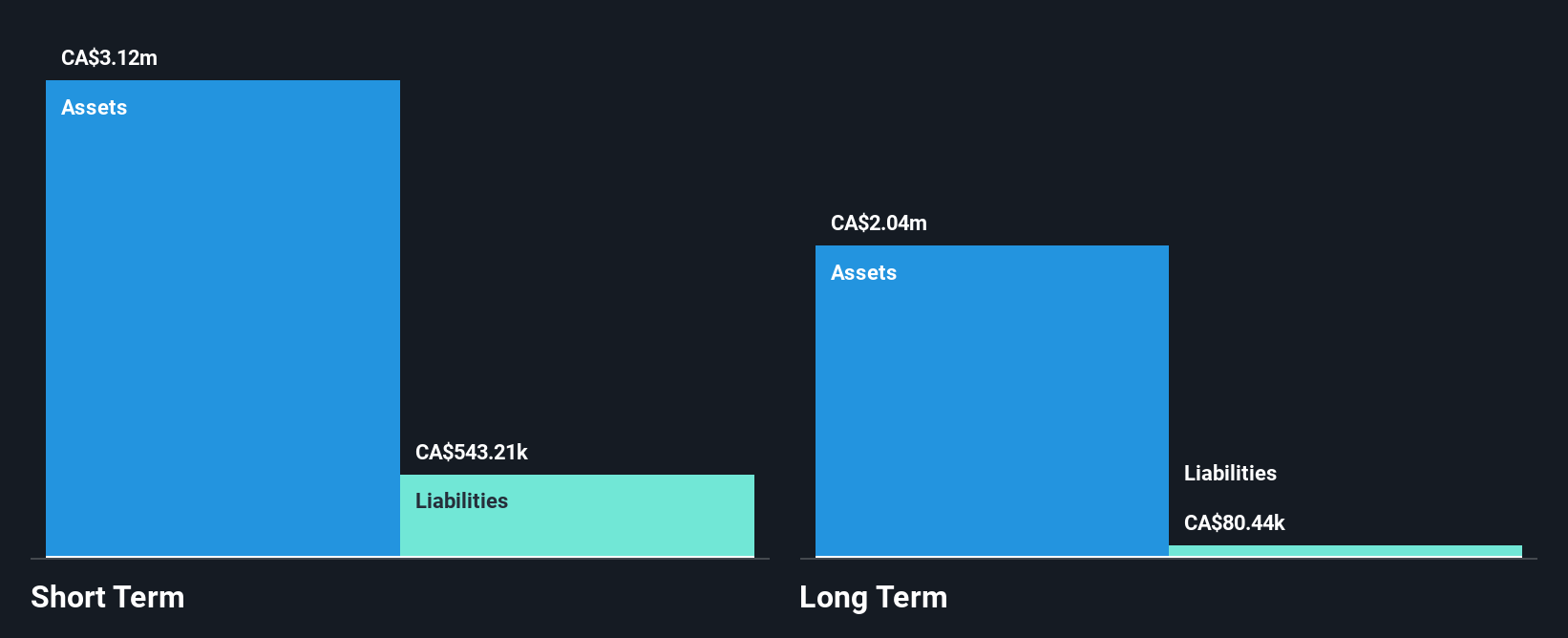

Strategic Metals Ltd., with a market cap of CA$16.64 million, is pre-revenue and focuses on mineral exploration in Canada. The company remains debt-free and has maintained shareholder value without dilution over the past year. It possesses sufficient cash runway for more than three years, ensuring operational stability despite ongoing losses which have increased by 14% annually over five years. Strategic Metals' seasoned board and management team bring substantial industry experience, although short-term assets slightly fall short of covering long-term liabilities. Recent activities include a shareholders meeting to address director elections and stock option plan renewals.

- Unlock comprehensive insights into our analysis of Strategic Metals stock in this financial health report.

- Evaluate Strategic Metals' historical performance by accessing our past performance report.

Make It Happen

- Click through to start exploring the rest of the 964 TSX Penny Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:IVS

Inventus Mining

Engages in the acquisition, exploration, and development of mineral properties in Canada.

Flawless balance sheet slight.

Market Insights

Community Narratives