- Canada

- /

- Metals and Mining

- /

- TSXV:EMX

Shareholders Will Probably Hold Off On Increasing EMX Royalty Corporation's (CVE:EMX) CEO Compensation For The Time Being

CEO Dave Cole has done a decent job of delivering relatively good performance at EMX Royalty Corporation (CVE:EMX) recently. As shareholders go into the upcoming AGM on 30 June 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

Check out our latest analysis for EMX Royalty

How Does Total Compensation For Dave Cole Compare With Other Companies In The Industry?

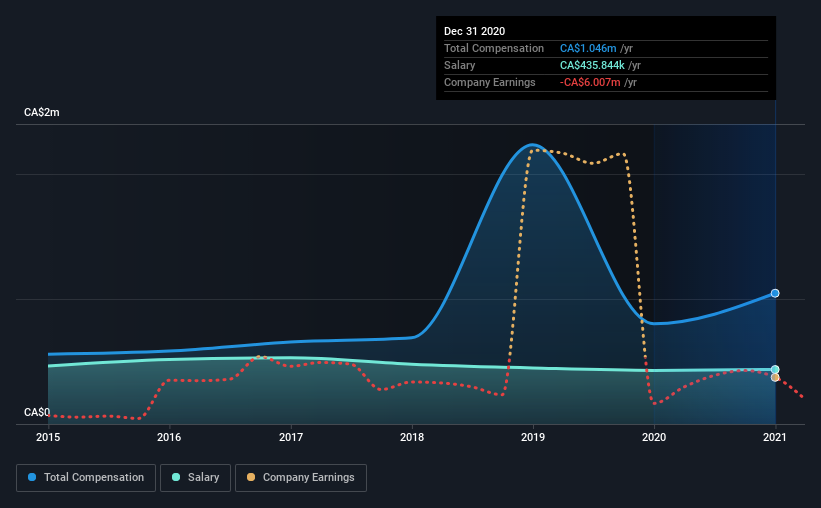

Our data indicates that EMX Royalty Corporation has a market capitalization of CA$317m, and total annual CEO compensation was reported as CA$1.0m for the year to December 2020. We note that's an increase of 31% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CA$436k.

In comparison with other companies in the industry with market capitalizations ranging from CA$123m to CA$492m, the reported median CEO total compensation was CA$490k. Accordingly, our analysis reveals that EMX Royalty Corporation pays Dave Cole north of the industry median. Moreover, Dave Cole also holds CA$8.6m worth of EMX Royalty stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$436k | CA$429k | 42% |

| Other | CA$610k | CA$373k | 58% |

| Total Compensation | CA$1.0m | CA$802k | 100% |

Talking in terms of the industry, salary represented approximately 92% of total compensation out of all the companies we analyzed, while other remuneration made up 8% of the pie. EMX Royalty pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

EMX Royalty Corporation's Growth

Over the last three years, EMX Royalty Corporation has shrunk its earnings per share by 35% per year. It achieved revenue growth of 75% over the last year.

Investors would be a bit wary of companies that have lower EPS But on the other hand, revenue growth is strong, suggesting a brighter future. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has EMX Royalty Corporation Been A Good Investment?

Most shareholders would probably be pleased with EMX Royalty Corporation for providing a total return of 171% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

The overall company performance has been commendable, however there are still areas for improvement. We still think that some shareholders will be hesitant of increasing CEO pay until EPS growth improves, since they are already paid higher than the industry.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 2 warning signs for EMX Royalty that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EMX Royalty might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:EMX

EMX Royalty

As of November 13, 2025, EMX Royalty Corporation was acquired by Elemental Altus Royalties Corp.

Adequate balance sheet with limited growth.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026