- Canada

- /

- Metals and Mining

- /

- TSXV:EMX

Discover 3 TSX Penny Stocks With Market Caps Over CA$200M

Reviewed by Simply Wall St

The Canadian market has recently faced some volatility, with political uncertainties and leadership transitions creating a cautious atmosphere for investors. Despite these challenges, the underlying economic growth and easing inflation suggest that opportunities remain for those willing to navigate this landscape. Penny stocks, though an older term, continue to hold potential when supported by strong financials; they offer investors a chance to discover smaller or newer companies with the resilience and growth prospects that larger firms might overlook.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.19 | CA$393.48M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.445 | CA$14.04M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$116.52M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.36 | CA$948.57M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.54 | CA$492.49M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.31 | CA$227.38M | ★★★★★☆ |

| Vox Royalty (TSX:VOXR) | CA$3.31 | CA$167.46M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.25 | CA$33.58M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$1.88 | CA$115.72M | ★★★★☆☆ |

Click here to see the full list of 956 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

EMX Royalty (TSXV:EMX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: EMX Royalty Corporation, along with its subsidiaries, focuses on exploring and generating royalties from metals and minerals properties, with a market cap of CA$276.15 million.

Operations: EMX Royalty's revenue primarily comes from the resource industry, amounting to $26.82 million.

Market Cap: CA$276.15M

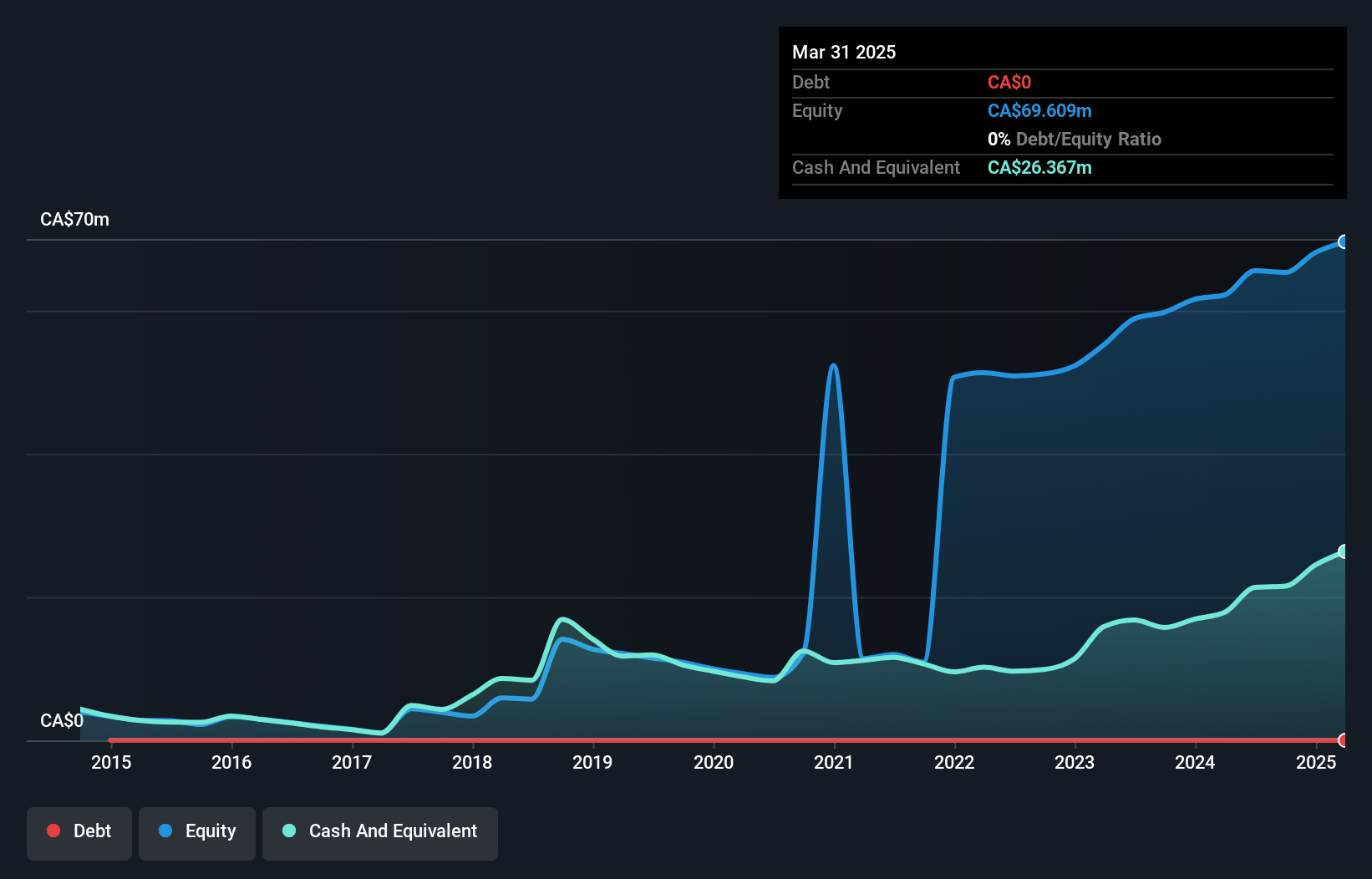

EMX Royalty Corporation, with a market cap of CA$276.15 million, has faced challenges as recent earnings reveal declining sales and net income compared to the previous year. Despite being unprofitable, EMX maintains a satisfactory net debt to equity ratio of 5.5% and boasts sufficient cash runway for over three years due to positive free cash flow growth. The company's strategic royalty interests, such as those in Sweden's Viscaria project with promising exploration results, offer potential upside. Additionally, EMX's seasoned management team and stable weekly volatility provide some stability amidst its financial hurdles.

- Take a closer look at EMX Royalty's potential here in our financial health report.

- Learn about EMX Royalty's future growth trajectory here.

High Tide (TSXV:HITI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: High Tide Inc. operates in the cannabis retail sector across Canada, the United States, and internationally, with a market cap of CA$363.04 million.

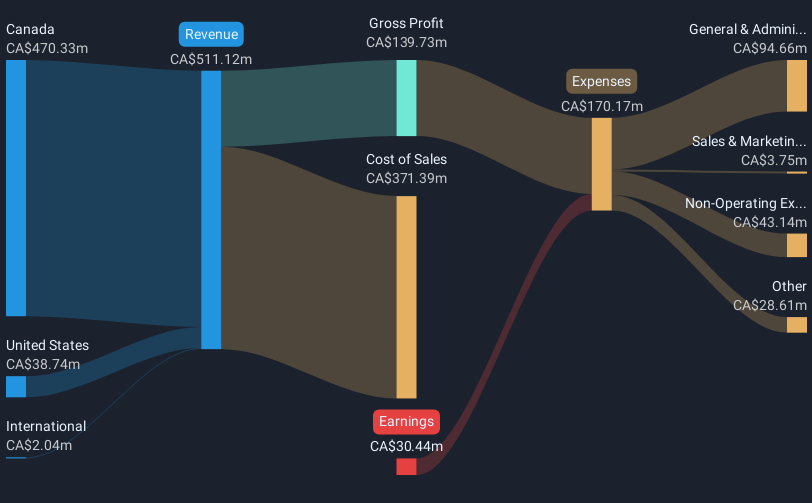

Operations: The company's revenue is primarily derived from CA$470.33 million in Canada, supplemented by CA$38.74 million from the United States and CA$2.04 million internationally.

Market Cap: CA$363.04M

High Tide Inc., with a market cap of CA$363.04 million, continues its expansion in the Canadian cannabis retail sector, recently opening multiple Canna Cabana locations across Ontario and Alberta, bringing its total to 191 stores. While unprofitable with negative return on equity (-20.87%), the company has a stable cash position exceeding debt and maintains a sufficient cash runway for over three years due to positive free cash flow growth. Despite shareholder dilution and insider selling concerns, High Tide trades significantly below estimated fair value, suggesting potential investment interest amid ongoing business development efforts supported by recent debt financing activities.

- Jump into the full analysis health report here for a deeper understanding of High Tide.

- Evaluate High Tide's prospects by accessing our earnings growth report.

Orogen Royalties (TSXV:OGN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Orogen Royalties Inc. is a mineral exploration company active in Canada, the United States, Mexico, Argentina, and Kenya with a market capitalization of approximately CA$276.26 million.

Operations: The company's revenue is derived entirely from its mineral exploration segment, totaling CA$7.33 million.

Market Cap: CA$276.26M

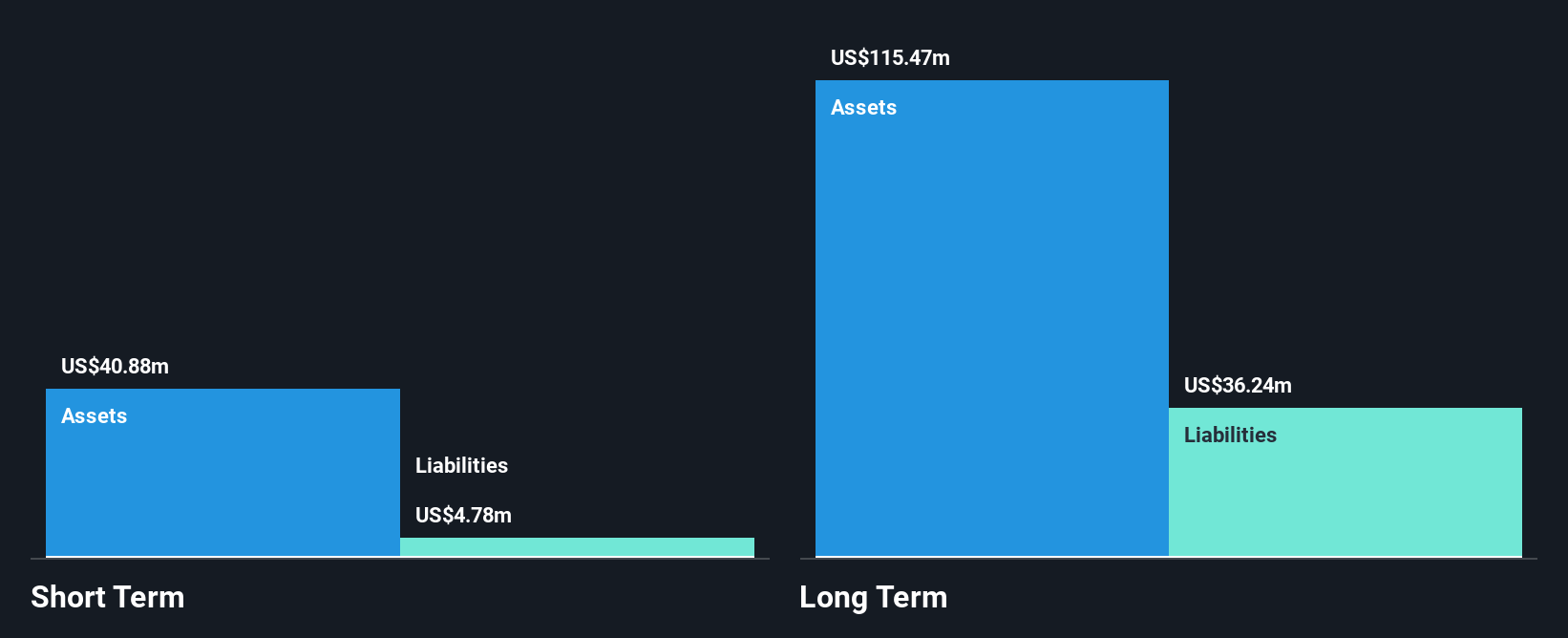

Orogen Royalties Inc., with a market cap of CA$276.26 million, operates debt-free, which alleviates concerns over interest payments. However, the company has experienced negative earnings growth and a decline in profit margins from 47% to 22.4% year-over-year. Its financial results were impacted by a significant one-off loss of CA$623.9K. Despite these challenges, Orogen's short-term assets comfortably cover both its short-term and long-term liabilities, indicating financial stability in the near term. Shareholder dilution occurred over the past year with shares outstanding increasing by 4.2%, while management and board members have seasoned tenures averaging over three years each.

- Navigate through the intricacies of Orogen Royalties with our comprehensive balance sheet health report here.

- Understand Orogen Royalties' earnings outlook by examining our growth report.

Turning Ideas Into Actions

- Investigate our full lineup of 956 TSX Penny Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EMX Royalty might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:EMX

EMX Royalty

Explores for and generates royalties from metals and minerals properties.

Excellent balance sheet and overvalued.