- Canada

- /

- Specialty Stores

- /

- TSX:ROOT

3 TSX Penny Stocks To Consider In November 2024

Reviewed by Simply Wall St

As the Canadian economy navigates a cooling labor market and potential interest rate cuts, investors are closely watching how these factors might influence financial markets. Penny stocks, often representing smaller or newer companies, remain an intriguing option for those seeking growth opportunities at lower price points. Despite being considered a somewhat outdated term, penny stocks can still offer significant potential when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.80 | CA$182.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.67 | CA$593.32M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.81 | CA$290.15M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.37 | CA$117.59M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.33 | CA$222.65M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.41 | CA$11.46M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.16 | CA$5.66M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.28 | CA$321.48M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$3.96 | CA$205.39M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.09 | CA$132.27M | ★★★★☆☆ |

Click here to see the full list of 963 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Quarterhill (TSX:QTRH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quarterhill Inc., along with its subsidiaries, operates in the intelligent transportation system sector both in Canada and internationally, with a market cap of CA$186.27 million.

Operations: The company generates revenue of $151.42 million from its intelligent transportation systems segment.

Market Cap: CA$186.27M

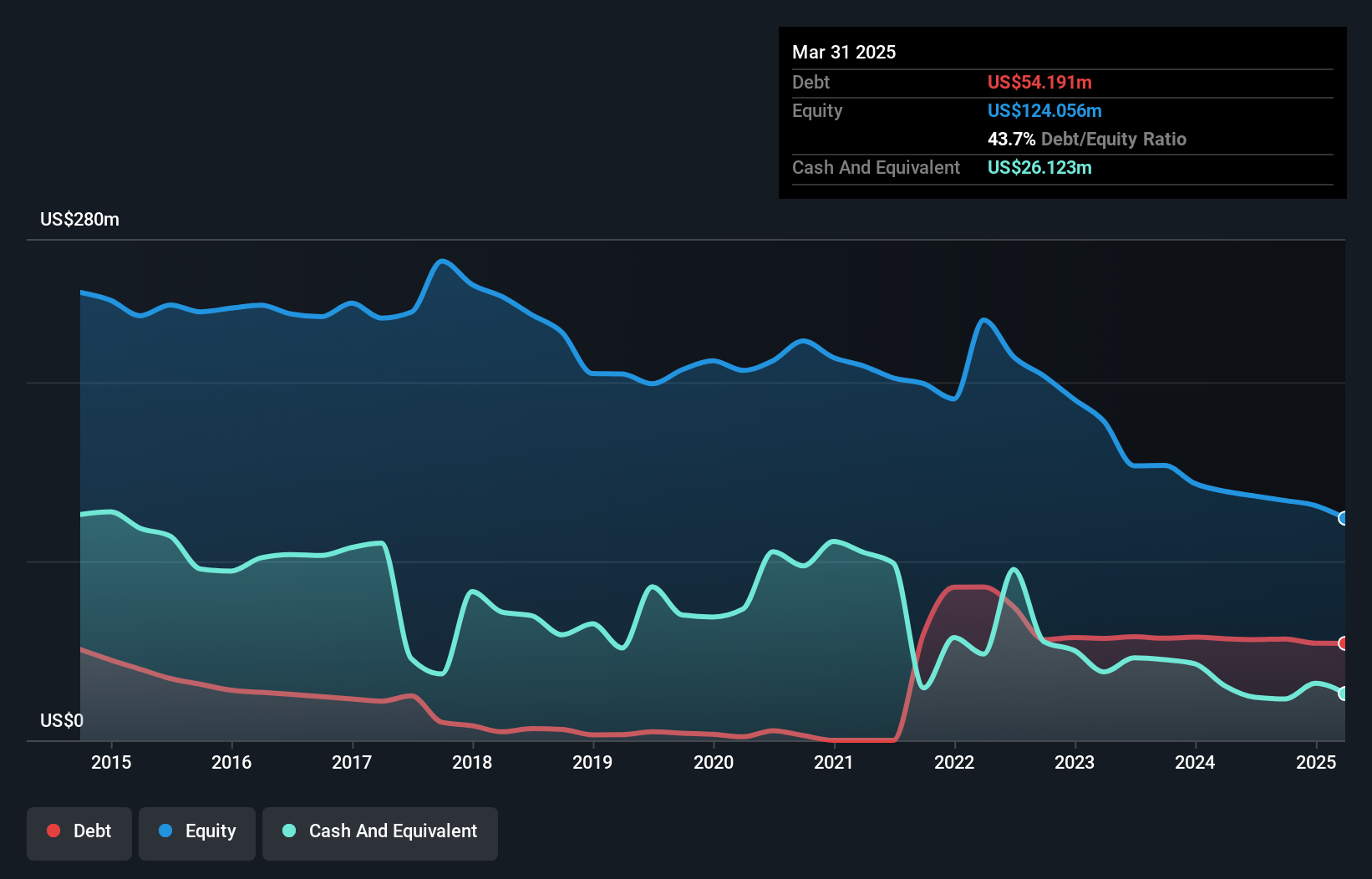

Quarterhill Inc. shows potential in the penny stock arena with a focus on intelligent transportation systems, generating CA$151.42 million in revenue. Despite being unprofitable and not expected to turn profitable soon, its short-term assets cover both short- and long-term liabilities, indicating financial stability. Recent contracts valued at $5.8 million for vehicle enforcement technology highlight growth opportunities, while new advisory appointments aim to enhance its tech roadmap. Although debt levels have risen over five years, they remain satisfactory relative to equity. Analysts expect a significant price increase despite current undervaluation compared to estimated fair value.

- Click to explore a detailed breakdown of our findings in Quarterhill's financial health report.

- Assess Quarterhill's future earnings estimates with our detailed growth reports.

Roots (TSX:ROOT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Roots Corporation, along with its subsidiaries, designs, markets, and sells apparel, leather goods, footwear, and accessories under the Roots brand in Canada and internationally with a market cap of CA$80.90 million.

Operations: The company's revenue is primarily derived from its Direct-To-Consumer segment, which generated CA$217.78 million, supplemented by CA$39.20 million from Partners and Other activities.

Market Cap: CA$80.9M

Roots Corporation, with a market cap of CA$80.90 million, trades significantly below estimated fair value but faces challenges with declining sales and profitability. Recent earnings reports show a net loss of CA$5.24 million for Q2 2024, slightly improved from the previous year. Despite an experienced board and management team, Roots struggles with low return on equity and negative earnings growth over the past year. The company's short-term assets cover immediate liabilities but not long-term ones, indicating financial constraints. A strategic shift in leadership aims to bolster its outdoor and active sectors amid ongoing operational challenges.

- Jump into the full analysis health report here for a deeper understanding of Roots.

- Understand Roots' earnings outlook by examining our growth report.

Emergent Metals (TSXV:EMR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Emergent Metals Corp. is involved in the acquisition and exploration of mineral properties in Canada and the United States, with a market cap of CA$3.37 million.

Operations: No revenue segments have been reported for the company.

Market Cap: CA$3.37M

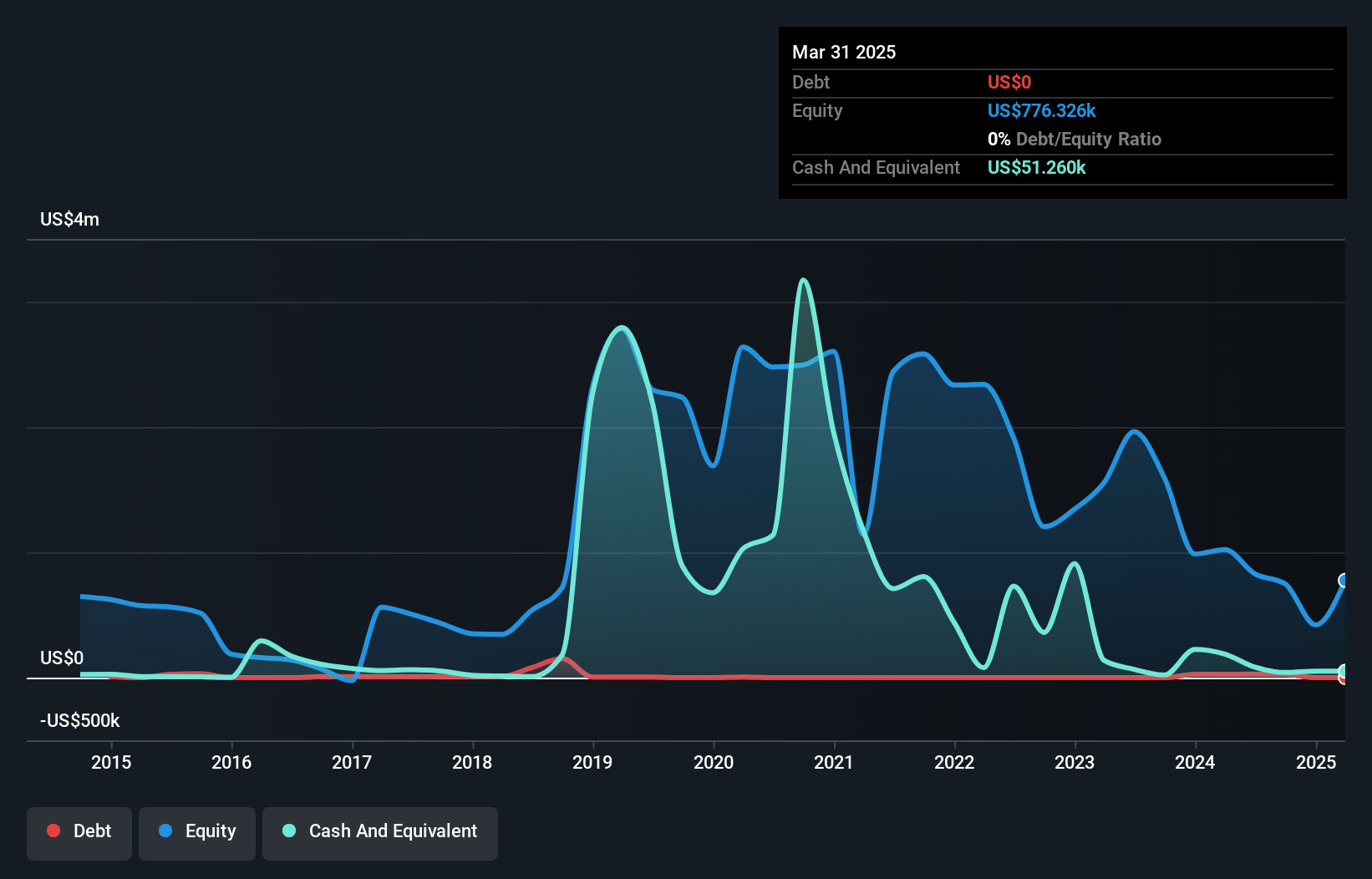

Emergent Metals Corp., with a market cap of CA$3.37 million, is pre-revenue and has experienced significant shareholder dilution over the past year. The company recently announced a private placement to raise up to CA$1 million, which may help address its short-term liabilities that exceed current assets. Despite reducing losses over five years, Emergent remains unprofitable with negative return on equity and high share price volatility. The management and board are seasoned, potentially providing stability amid financial challenges. Emergent's debt levels are manageable due to more cash than total debt but it faces liquidity constraints without further capital influxes.

- Navigate through the intricacies of Emergent Metals with our comprehensive balance sheet health report here.

- Understand Emergent Metals' track record by examining our performance history report.

Taking Advantage

- Gain an insight into the universe of 963 TSX Penny Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ROOT

Roots

Designs, markets, and sells apparel, leather goods, footwear, and accessories under the Roots brand in Canada and internationally.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026