- Canada

- /

- Metals and Mining

- /

- TSXV:ICM

TSX Penny Stocks To Watch In December 2025

Reviewed by Simply Wall St

As the Canadian market navigates through policy shifts and global uncertainties, the TSX is on track for its strongest calendar-year return since 2009, rewarding investors who stayed committed during periods of volatility. In this context, understanding what makes a good investment becomes crucial; penny stocks, while an older term, continue to offer intriguing opportunities for growth. These stocks often represent smaller or newer companies that can pair strong financial health with potential long-term gains.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.17 | CA$53.59M | ✅ 3 ⚠️ 3 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.36 | CA$249.69M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.37 | CA$139.1M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.445 | CA$4.01M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.35 | CA$54.82M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.23 | CA$838.27M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.14 | CA$22.79M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.16 | CA$159.88M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.15 | CA$200.61M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.74 | CA$10.64M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 392 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Almadex Minerals (TSXV:DEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Almadex Minerals Ltd. is involved in the acquisition and exploration of mineral resource properties across Canada, the United States, and Mexico, with a market cap of CA$30.59 million.

Operations: The company's revenue is derived entirely from its activities in acquiring and exploring mineral resource properties, totaling CA$0.18 million.

Market Cap: CA$30.59M

Almadex Minerals Ltd., with a market cap of CA$30.59 million, is pre-revenue and focuses on mineral exploration across North America. Recent earnings show an increase in net income to CA$1.39 million for Q3 2025, indicating profitability despite minimal revenue. The company continues its exploratory drilling at the Paradise Project in Nevada and plans further exploration at the New Hope project in Arizona, following challenges with drilling conditions. Almadex has also expanded its portfolio by acquiring the Rattlesnake project in Arizona, highlighting promising preliminary sampling results that suggest potential for significant mineral deposits.

- Click here to discover the nuances of Almadex Minerals with our detailed analytical financial health report.

- Gain insights into Almadex Minerals' past trends and performance with our report on the company's historical track record.

Iconic Minerals (TSXV:ICM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Iconic Minerals Ltd. is a mineral exploration company focused on acquiring and exploring gold and lithium properties in Nevada and Canada, with a market cap of CA$16.33 million.

Operations: Iconic Minerals Ltd. has not reported any revenue segments.

Market Cap: CA$16.33M

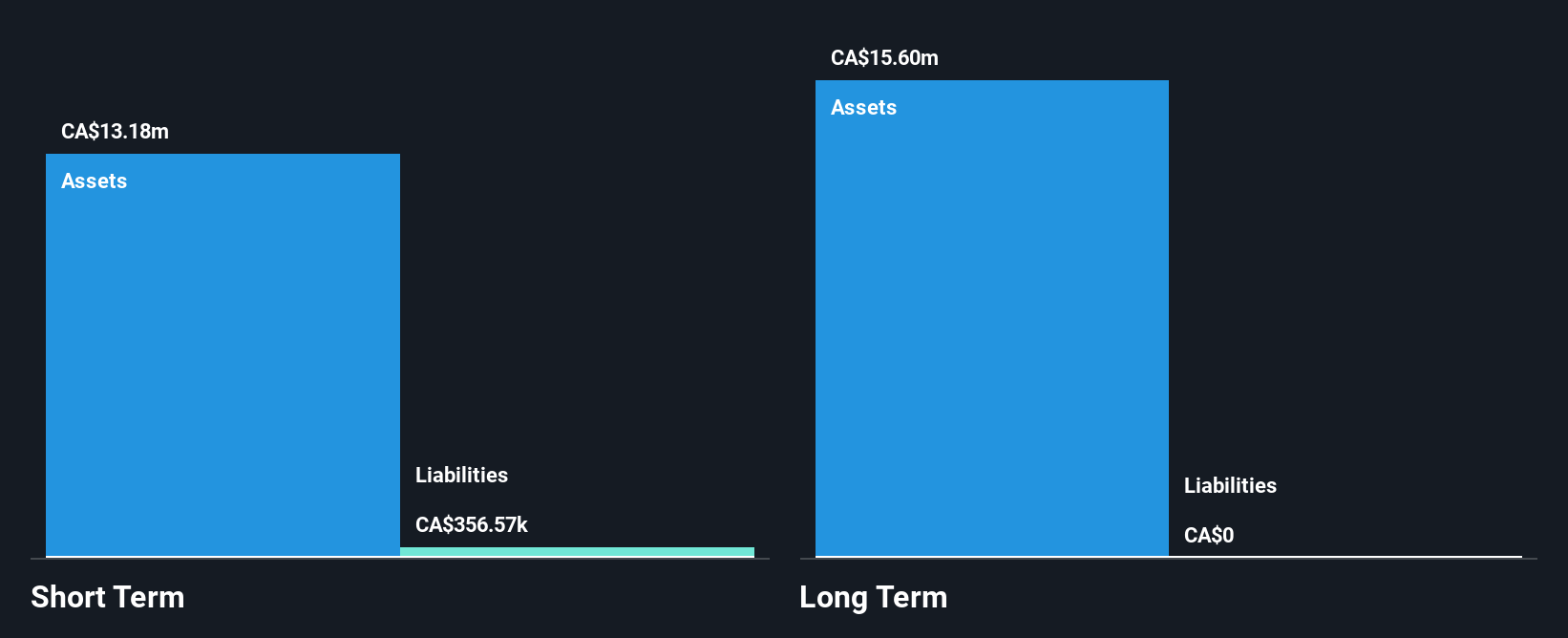

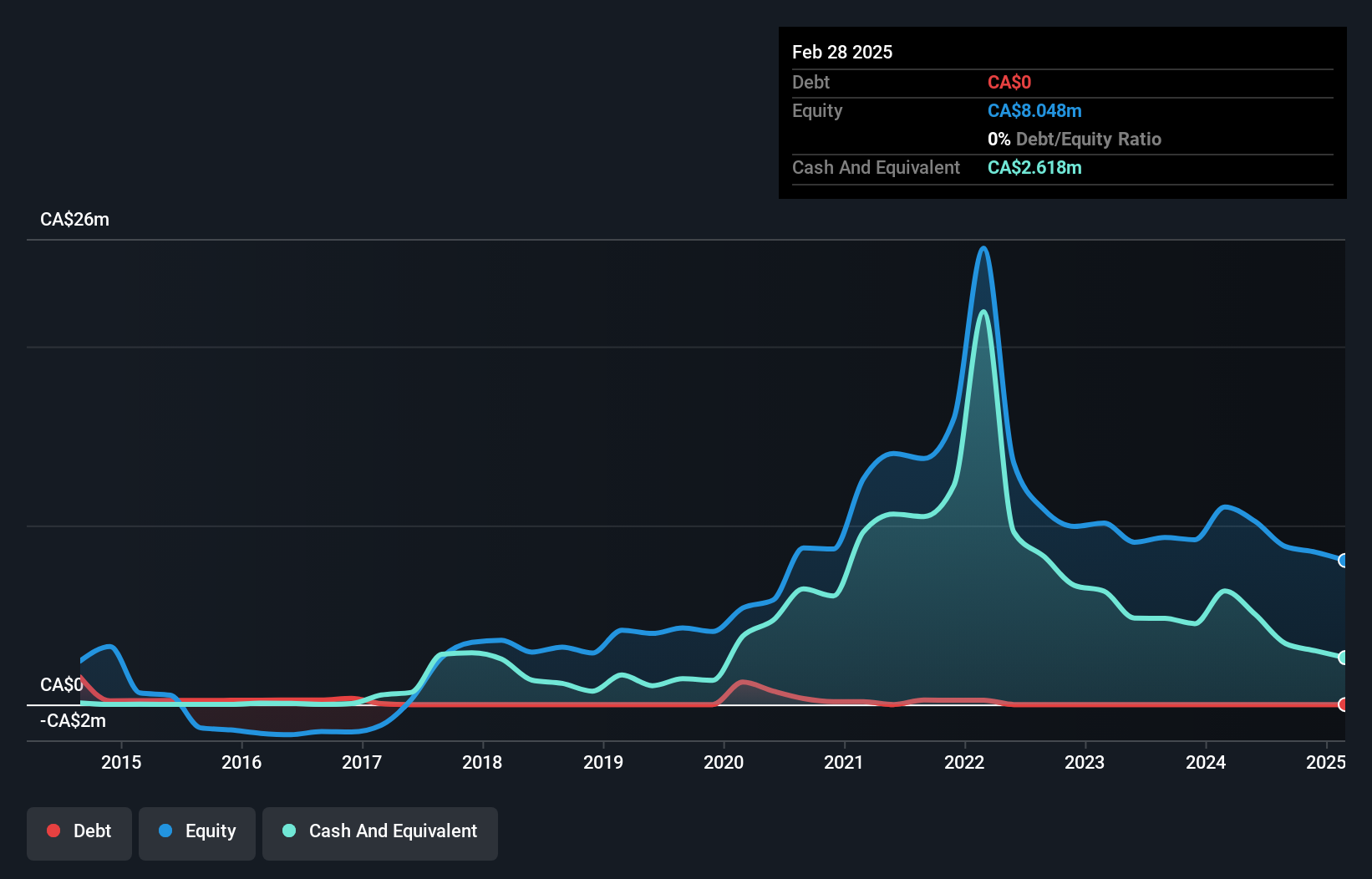

Iconic Minerals Ltd., with a market cap of CA$16.33 million, is currently pre-revenue, focusing on gold and lithium exploration in Nevada and Canada. The company has reduced its net loss significantly from CA$2.28 million to CA$0.29 million over the past year, although it remains unprofitable. Iconic's management team and board are highly experienced, with average tenures of 16.9 years and 14.9 years respectively, providing stability amid high share price volatility over recent months. Despite being debt-free, auditors have expressed concerns about its ability to continue as a going concern following a recent private placement raising CA$2.55 million for further operations.

- Navigate through the intricacies of Iconic Minerals with our comprehensive balance sheet health report here.

- Explore historical data to track Iconic Minerals' performance over time in our past results report.

Noble Mineral Exploration (TSXV:NOB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Noble Mineral Exploration Inc. is a junior exploration company focused on the exploration and evaluation of mineral properties in Canada, with a market cap of CA$18.98 million.

Operations: Noble Mineral Exploration Inc. does not report any specific revenue segments.

Market Cap: CA$18.98M

Noble Mineral Exploration Inc., with a market cap of CA$18.98 million, is a pre-revenue junior exploration company focusing on rare earth elements in Canada. Recent acquisitions include properties in Labrador and Quebec, targeting REE-rich systems with promising historical survey results. The company's financial position is strengthened by recent private placements totaling over CA$2 million, providing a cash runway for more than a year despite ongoing unprofitability and high share price volatility. Noble's experienced management and board are navigating these challenges while remaining debt-free, positioning the company to explore critical mineral opportunities further.

- Click to explore a detailed breakdown of our findings in Noble Mineral Exploration's financial health report.

- Understand Noble Mineral Exploration's track record by examining our performance history report.

Summing It All Up

- Reveal the 392 hidden gems among our TSX Penny Stocks screener with a single click here.

- Ready To Venture Into Other Investment Styles? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ICM

Iconic Minerals

A mineral exploration company, engages in the acquisition and exploration of gold and lithium properties in Nevada and Canada.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026