- Canada

- /

- Metals and Mining

- /

- TSXV:CTG

TSX Penny Stock Picks: Automotive Finco And 2 Other Promising Investments

Reviewed by Simply Wall St

The Canadian market, like its U.S. counterpart, has been experiencing a period of growth and stability following the decisive outcome of the recent U.S. election, which removed significant uncertainty from investors' minds. As investors navigate this evolving landscape, they often seek out stocks that offer potential for growth while maintaining a strong financial foundation. Penny stocks, despite their somewhat outdated name, continue to present intriguing opportunities for those interested in smaller or newer companies with solid fundamentals and resilience.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.63 | CA$593.2M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.69 | CA$273.57M | ★★★★★☆ |

| Alvopetro Energy (TSXV:ALV) | CA$4.825 | CA$176.46M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.26 | CA$116.54M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.44 | CA$12.46M | ★★★★★☆ |

| Mandalay Resources (TSX:MND) | CA$3.30 | CA$308.29M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.20 | CA$5.34M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.21 | CA$219.69M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$30.36M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.17M | ★★★★★★ |

Click here to see the full list of 964 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Automotive Finco (TSXV:AFCC.H)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Automotive Finco Corp. is a specialty finance company that focuses on the auto retail sector in Canada and internationally, with a market cap of CA$15.06 million.

Operations: The company generates revenue of CA$2.85 million from debt financing and making other investments in the auto retail sector.

Market Cap: CA$15.06M

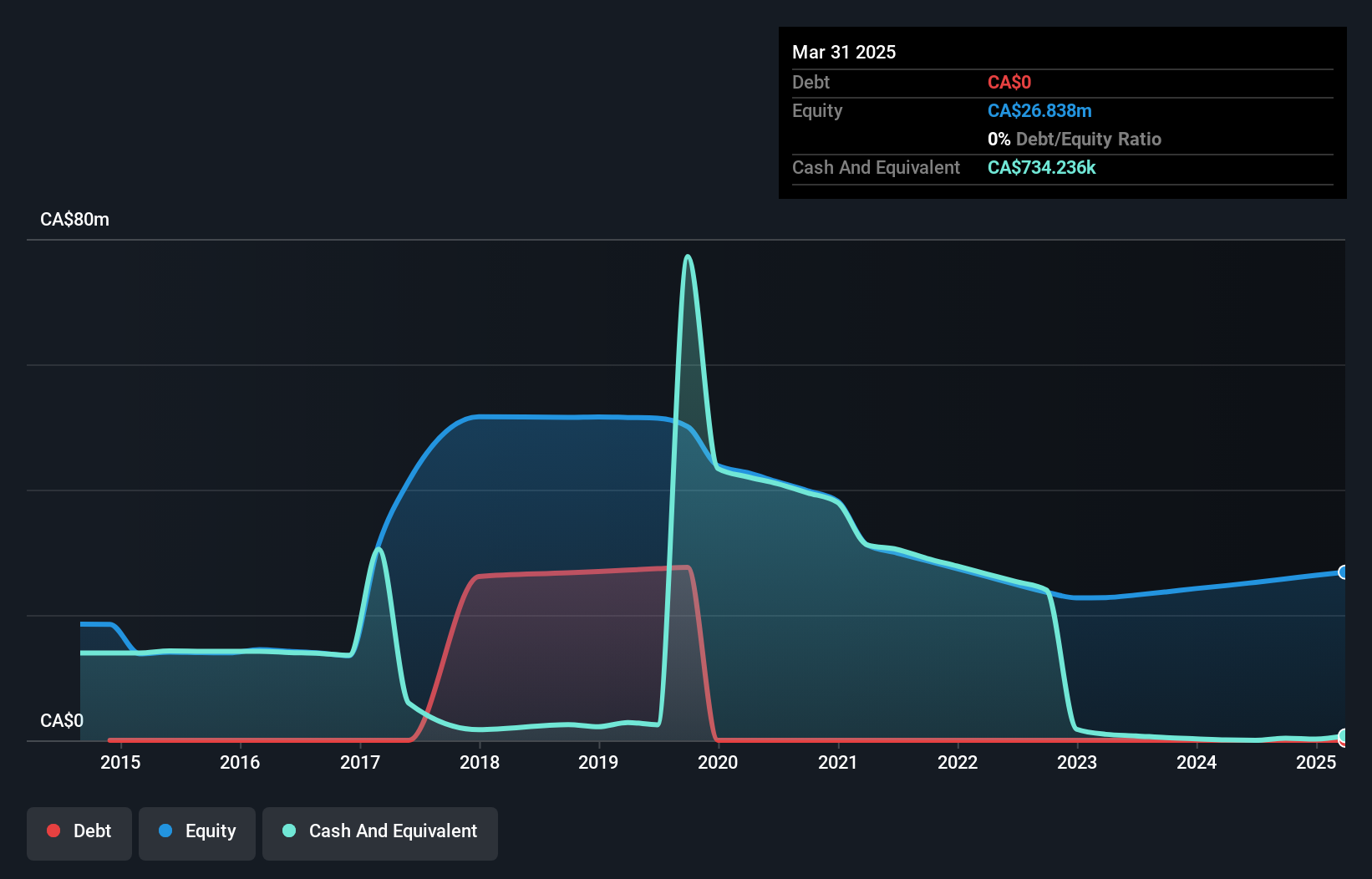

Automotive Finco Corp., with a market cap of CA$15.06 million, operates without debt and showcases a robust net profit margin of 71.3%, up from 43.7% last year. The company has experienced significant earnings growth, increasing by 191.4% over the past year, outpacing the industry average significantly. Despite its low Return on Equity at 8%, it remains undervalued with a Price-To-Earnings ratio of 7.6x compared to the broader Canadian market's 14.6x. Recent earnings reports indicate steady growth in net income and earnings per share from continuing operations over both quarterly and semi-annual periods.

- Click to explore a detailed breakdown of our findings in Automotive Finco's financial health report.

- Gain insights into Automotive Finco's past trends and performance with our report on the company's historical track record.

Centenario Gold (TSXV:CTG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Centenario Gold Corp. focuses on acquiring, exploring, and developing mineral resource projects in Mexico with a market cap of CA$0.84 million.

Operations: Centenario Gold Corp. has not reported any revenue segments.

Market Cap: CA$836.65k

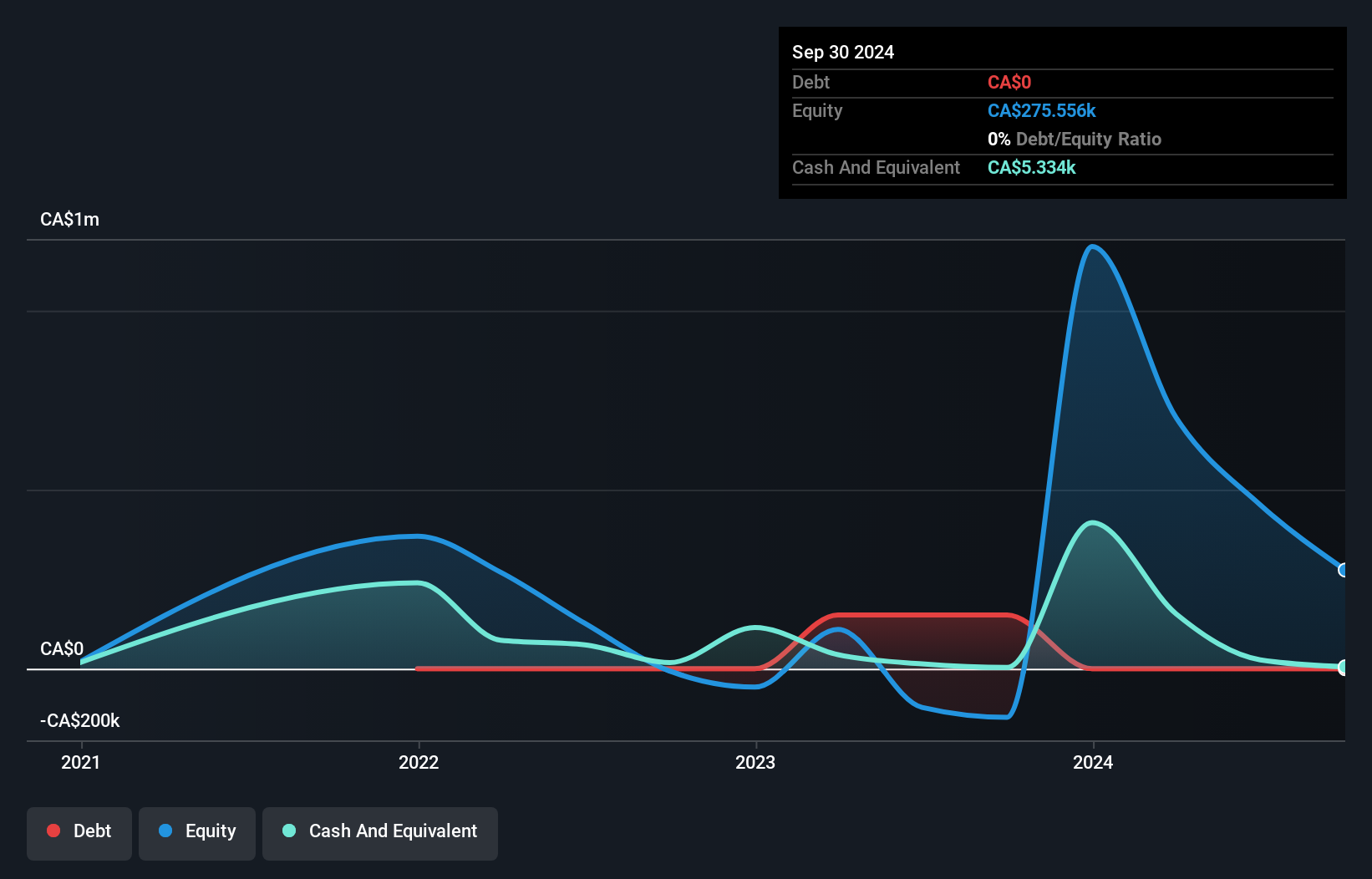

Centenario Gold Corp., with a market cap of CA$0.84 million, is pre-revenue and unprofitable, facing increasing losses over the past five years. Despite having no debt and covering its short-term liabilities with assets of CA$184.4K, it has less than a year of cash runway if current cash flow trends persist. Recent developments include plans to begin a second phase drill program in early 2025 on its Eden property in Mexico, following improved geological insights from earlier drilling phases that identified new targets across the property for further exploration.

- Take a closer look at Centenario Gold's potential here in our financial health report.

- Examine Centenario Gold's past performance report to understand how it has performed in prior years.

Nubian Resources (TSXV:NBR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nubian Resources Ltd. is involved in the exploration and evaluation of mineral properties across Australia, Peru, and the United States, with a market cap of CA$4.06 million.

Operations: Nubian Resources Ltd. does not report any revenue segments.

Market Cap: CA$4.06M

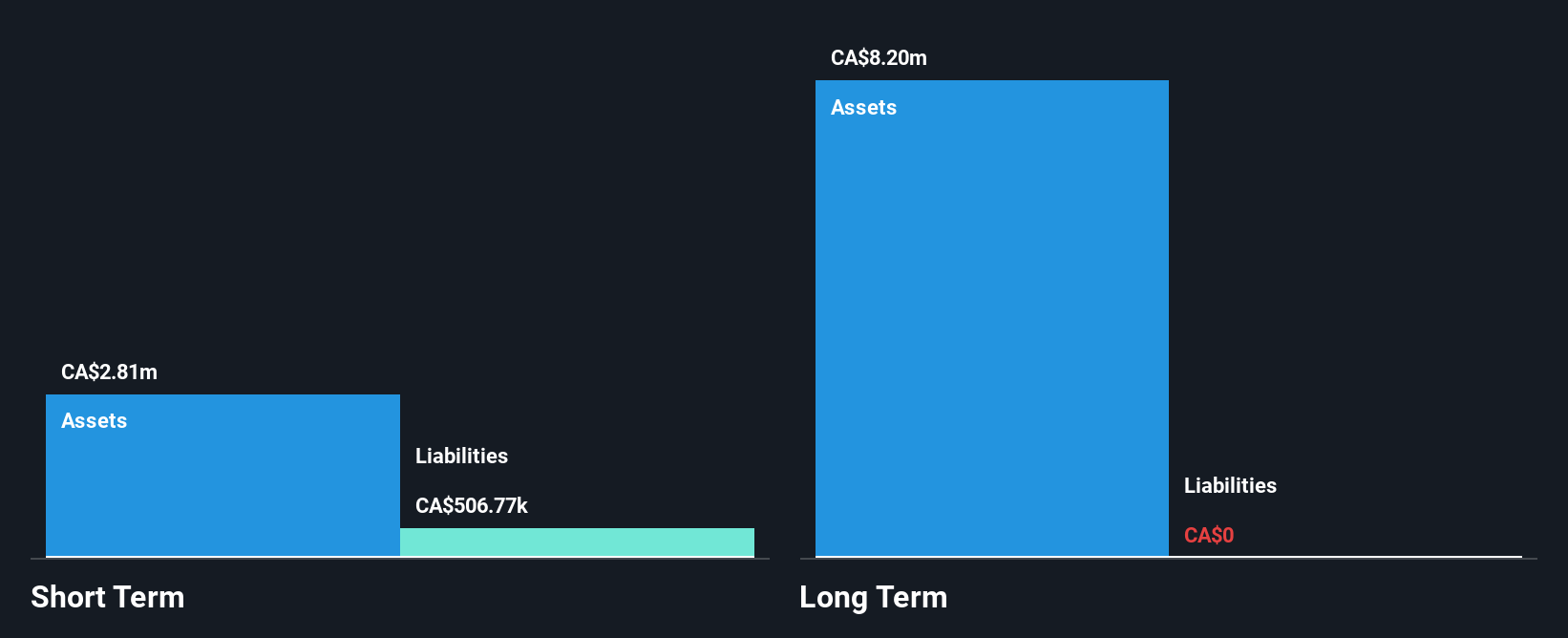

Nubian Resources Ltd., with a market cap of CA$4.06 million, is pre-revenue and unprofitable, but it has no debt and sufficient cash runway for over three years. The company's short-term assets of CA$2.9 million comfortably cover its short-term liabilities of CA$224.6K, indicating solid liquidity in the near term. Despite shareholder dilution by 7% over the past year and high volatility in its share price, Nubian has managed to reduce losses at a rate of 21% annually over five years. Both its board and management team are experienced, which may support strategic decision-making moving forward.

- Get an in-depth perspective on Nubian Resources' performance by reading our balance sheet health report here.

- Evaluate Nubian Resources' historical performance by accessing our past performance report.

Next Steps

- Take a closer look at our TSX Penny Stocks list of 964 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CTG

Centenario Gold

Engages in the acquisition and exploration of mineral resources in Mexico.

Slight with mediocre balance sheet.

Market Insights

Community Narratives