- Canada

- /

- Metals and Mining

- /

- TSXV:CSO.H

The Corsa Coal (CVE:CSO) Share Price Is Down 89% So Some Shareholders Are Rather Upset

Long term investing works well, but it doesn't always work for each individual stock. We don't wish catastrophic capital loss on anyone. For example, we sympathize with anyone who was caught holding Corsa Coal Corp. (CVE:CSO) during the five years that saw its share price drop a whopping 89%. We also note that the stock has performed poorly over the last year, with the share price down 57%. Furthermore, it's down 26% in about a quarter. That's not much fun for holders. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View our latest analysis for Corsa Coal

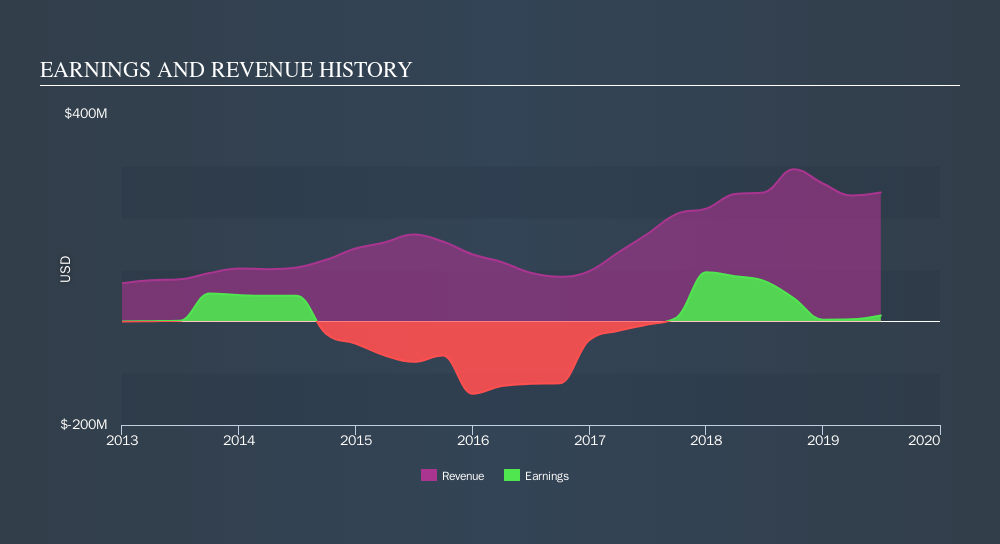

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Corsa Coal became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

Revenue is actually up 19% over the time period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

It is of course excellent to see how Corsa Coal has grown profits over the years, but the future is more important for shareholders. This free interactive report on Corsa Coal's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 3.4% in the last year, Corsa Coal shareholders lost 57%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 36% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

We will like Corsa Coal better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSXV:CSO.H

Corsa Coal

Corsa Coal Corp. mines, processes, and sells metallurgical coal in the Asia, North America, South America, and Europe.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives