- Canada

- /

- Metals and Mining

- /

- TSXV:CNRI

Irving Resources And 2 Other Promising Penny Stocks On TSX

Reviewed by Simply Wall St

The Canadian market is experiencing strong momentum as it heads into 2025, supported by resilient consumer spending and rising corporate profits, though investors are advised to remain cautious of potential curveballs. For those interested in exploring smaller or newer companies, penny stocks—despite the term's outdated connotation—can still offer intriguing opportunities. This article highlights three such stocks that combine financial strength with the potential for long-term growth, presenting a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.36 | CA$158.19M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.73 | CA$283.52M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.37 | CA$121.61M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.45 | CA$13.32M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.66 | CA$324.12M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.65 | CA$574.88M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$3.76 | CA$188.71M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.15 | CA$208.8M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.155 | CA$4.71M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.89 | CA$181.41M | ★★★★★☆ |

Click here to see the full list of 953 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Irving Resources (CNSX:IRV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Irving Resources Inc. is a junior exploration stage company focused on acquiring and exploring mineral properties in Canada and Japan, with a market cap of CA$24.92 million.

Operations: Irving Resources Inc. does not report any revenue segments as it is in the exploration stage.

Market Cap: CA$24.92M

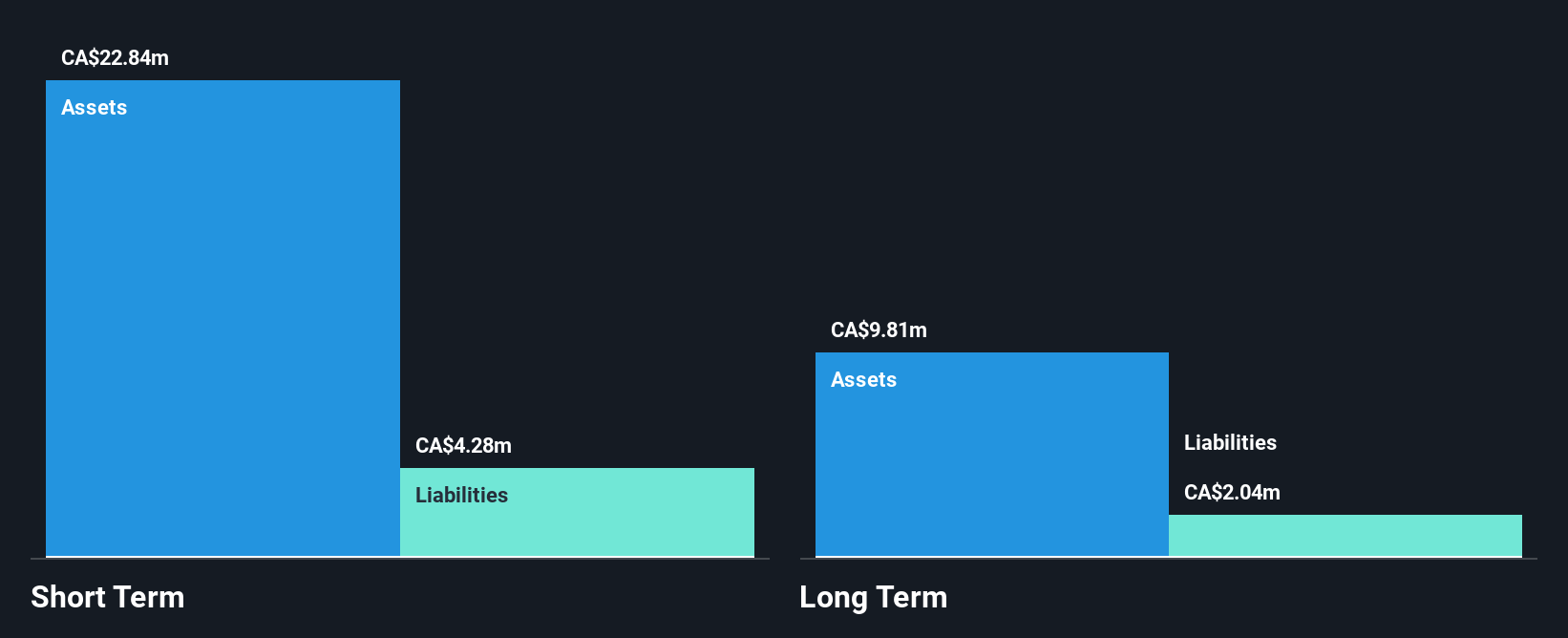

Irving Resources, a pre-revenue junior exploration company, has recently formed a joint venture with Newmont Overseas Exploration and Sumitomo Corporation, holding a 27.5% interest in the Yamagano and Noto properties. Despite its unprofitability, Irving has shown progress by reducing losses over the past five years at an annual rate of 18%. The company's short-term assets of CA$3.8 million comfortably cover both short-term and long-term liabilities. However, it faces challenges with less than a year of cash runway if current cash flow trends continue. Shareholders experienced dilution last year as shares outstanding increased by 3.7%.

- Dive into the specifics of Irving Resources here with our thorough balance sheet health report.

- Examine Irving Resources' past performance report to understand how it has performed in prior years.

Canadian North Resources (TSXV:CNRI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Canadian North Resources Inc. focuses on the exploration and development of mineral properties in Canada, with a market cap of CA$107.66 million.

Operations: There are no reported revenue segments for Canadian North Resources Inc.

Market Cap: CA$107.66M

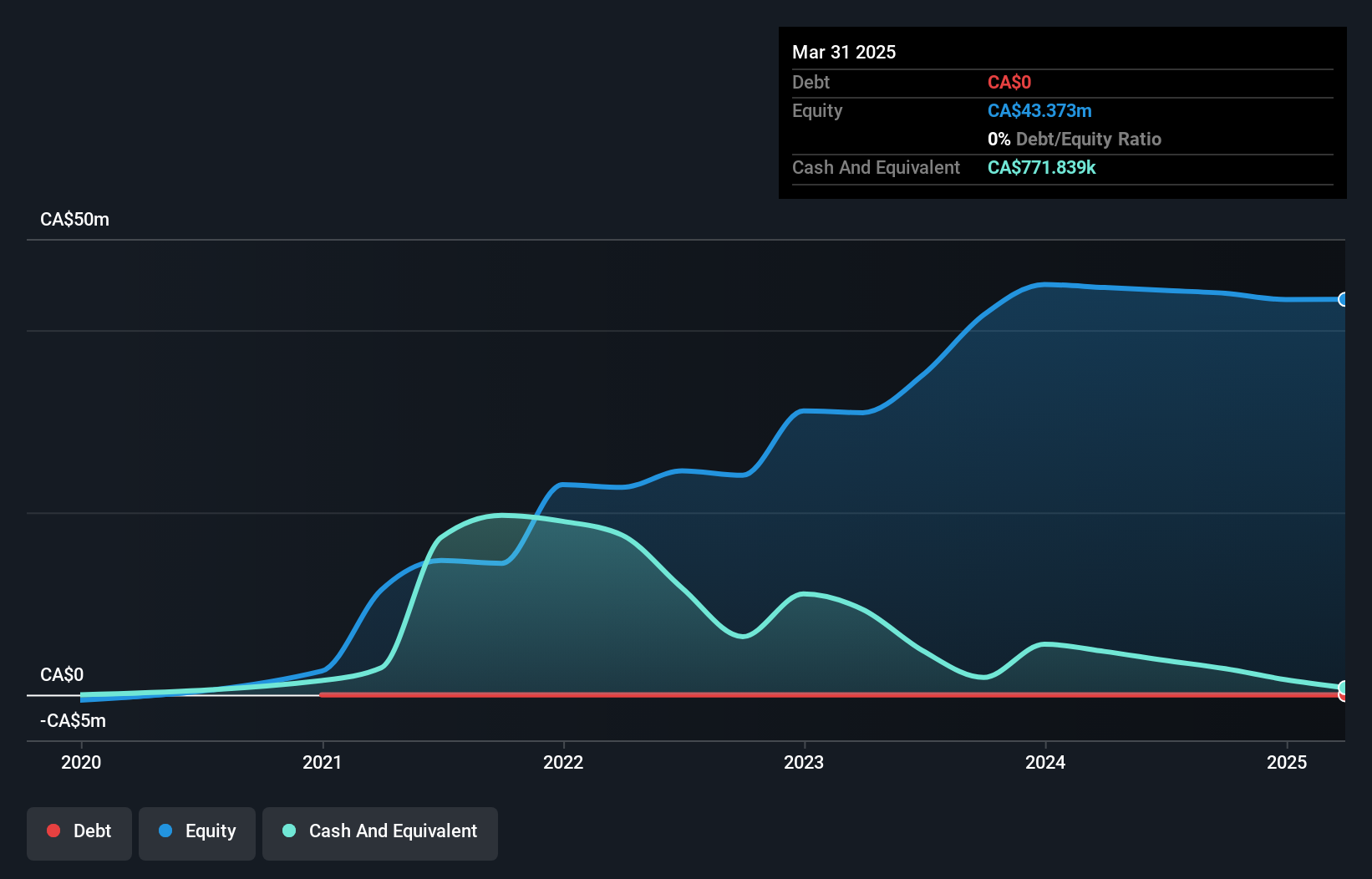

Canadian North Resources Inc., a pre-revenue exploration company, focuses on advancing its Ferguson Lake project. Recent bioleaching tests have shown promising results for extracting metals like nickel and cobalt, potentially reducing costs and environmental impact. The company's financial position is challenging with less than a year of cash runway and increasing losses over the past five years at 49.5% annually. Despite being debt-free, shareholders faced dilution with shares outstanding rising by 3.3%. Recent board changes include the appointment of Henderson Tse, bringing valuable financial expertise to support strategic development efforts amidst volatile share prices.

- Navigate through the intricacies of Canadian North Resources with our comprehensive balance sheet health report here.

- Assess Canadian North Resources' previous results with our detailed historical performance reports.

Frontier Lithium (TSXV:FL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Frontier Lithium Inc. focuses on acquiring, exploring, and developing mining properties in North America with a market cap of CA$116.09 million.

Operations: Frontier Lithium Inc. has not reported any revenue segments.

Market Cap: CA$116.09M

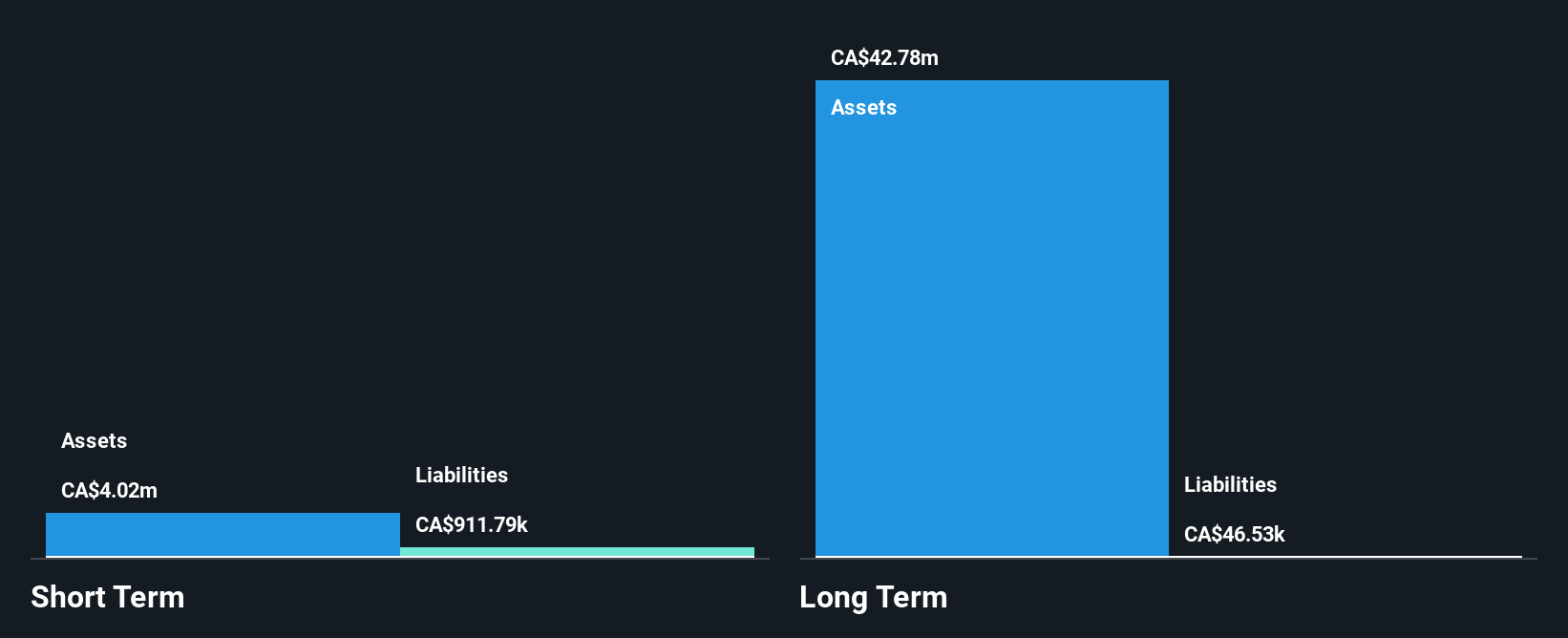

Frontier Lithium Inc., a pre-revenue entity with a market cap of CA$116.09 million, focuses on lithium exploration and development. Despite being unprofitable, the company has reduced its net loss from CA$6.81 million to CA$4.39 million year-over-year for the second quarter of 2024. Frontier is debt-free and maintains sufficient cash runway exceeding one year, supported by short-term assets covering its liabilities effectively. Recent advancements include progress on the PAK Lithium Project's definitive feasibility study and exploration updates at Ember LCT pegmatite, which could bolster future prospects despite current financial challenges and high volatility in share prices.

- Get an in-depth perspective on Frontier Lithium's performance by reading our balance sheet health report here.

- Assess Frontier Lithium's future earnings estimates with our detailed growth reports.

Where To Now?

- Click this link to deep-dive into the 953 companies within our TSX Penny Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CNRI

Canadian North Resources

Engages in the exploration and development of mineral properties in Canada.

Moderate with mediocre balance sheet.

Market Insights

Community Narratives